Saving cash is essential – everyone knows that. However generally everybody wants some assist in arising with methods to economize. I’ll break down the precise methods that I exploit to save extra money every month. If me, I am fairly lazy with regards to these items. However these methods and hacks are easy, and so they save some huge cash.

Going again to my frugality equation, all time spent on these saving methods earns me tons of financial savings.

Everyone knows the fundamentals – spend lower than you earn. However how do you actually spend much less? You first must have the proper mindset to avoid wasting, after which you need to benefit from each trick doable to spice up that financial savings. This already assumes you are monitoring your cash every month. In case you’re not, check out our picks of the perfect budgeting apps.

After that, it is mindset. And your mindset should be this: Every month begin with a spending funds at $0. It is simpler to only purchase nothing than to purchase one thing, and cease budgeting. Each buy must be considered very intensely. Solely spend when you need to.

Lastly, it is about leveraging methods that will help you. Listed below are our high 15 methods to economize. This record will prevent over $590 every month when you comply with it diligently and use all of those methods. Which means you might save over $7,000 per 12 months!

1. Use A Money Again Reward Credit score Card For All Spending

The primary trick, and one of the essential ones, is to make use of a money again rewards bank card for all spending that you simply do. I am speaking the whole lot.

One of the best rewards bank cards pay 2% money again as a baseline. Some playing cards provide as much as 5% on particular classes of spending as effectively. You’ll find the perfect high money again rewards playing cards right here.

By placing the whole lot on a rewards bank card, you are saving not less than 2% on the whole lot you spend every month. In case your common spending is $1,000 per 30 days, this tactic can prevent $20 per 30 days.

The issue is, folks do not spend the whole lot on the identical card. Even I mess up generally. For instance, I not too long ago found that my automotive insurance coverage may have been paid for on a bank card. I have been having it instantly debited from my checking and incomes no rewards. Contemplating the my invoice is about $100 per 30 days, I may have been saving $2 per 30 days for actually doing nothing. I switched it over, and now I am saving cash!

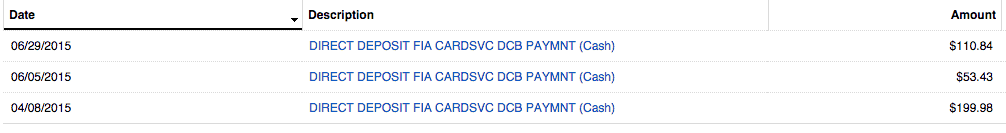

To show you will get nice financial savings with this trick, right here is my financial savings thus far for six months of the 12 months:

As you possibly can see, for six months, this technique has saved me $424.81. That breaks right down to $70.80 per 30 days in financial savings.

Complete Month-to-month Financial savings: $70.80

2. Use Spending Tips To Enhance Financial savings

There are spending methods that you need to use to spice up your financial savings when making a purchase order. I am not an skilled on this space, however there are a whole lot of blogs which are. The issue with many of those methods is that it could take a whole lot of effort and time to seek out the perfect methods to benefit from bank card offers. And like I stated earlier, I hate spending effort and time if I can not get the reward simply.

Nevertheless, there are easy methods that you are able to do proper now to spice up your financial savings. The best manner to do that is to easily benefit from bank cards that pay extra for sure classes of spending.

For instance, American Categorical is providing a Blue CashBack On a regular basis Credit score Card, which pays 3% money again at supermarkets.

The beauty of grocery shops is that almost all of them promote reward playing cards to different retailers and outlets. One other reward perk that I benefit from is on groceries and fuel.

I usually spend about $500 per 30 days on groceries, so getting 3% money again equates to $15 per 30 days. Now, I additionally spend about $400 per 30 days in fuel. If I purchase a fuel reward card at my grocery retailer, I am truly spending one other $400 on the grocery story – getting that very same 3% money again. That is one other financial savings of $12 per 30 days.

Complete Month-to-month Financial savings: $27

3. Use On-line Saving Tips For Stuff You Already Do

Do you search the Web for stuff? I am speaking random searches, like “What Time Does The Inventory Market Open“? In case you do, you might be incomes extra cash simply to your regular on-line habits.

For instance, Melanie highlights how she made $5 in two weeks utilizing Swagbucks for her regular searches. I signed up for each Swagbucks and InboxDollars and earned $5 immediately only for signing up.

Each Swagbucks and InboxDollars are nonetheless providing their $5 join promotion. You possibly can join right here:

In case you signup for every, you’d get $10 the primary month. Ongoing, it is a solution to save $10 per 30 days by simply doing all of your regular exercise.

Complete Month-to-month Financial savings: $10

4. Get Rebates For All On-line Procuring

My subsequent secret to saving cash is to make use of Rakuten or TopCashBack for all of your on-line procuring. The good factor is which you could combo this with bank card money again rewards and hacking to avoid wasting much more cash.

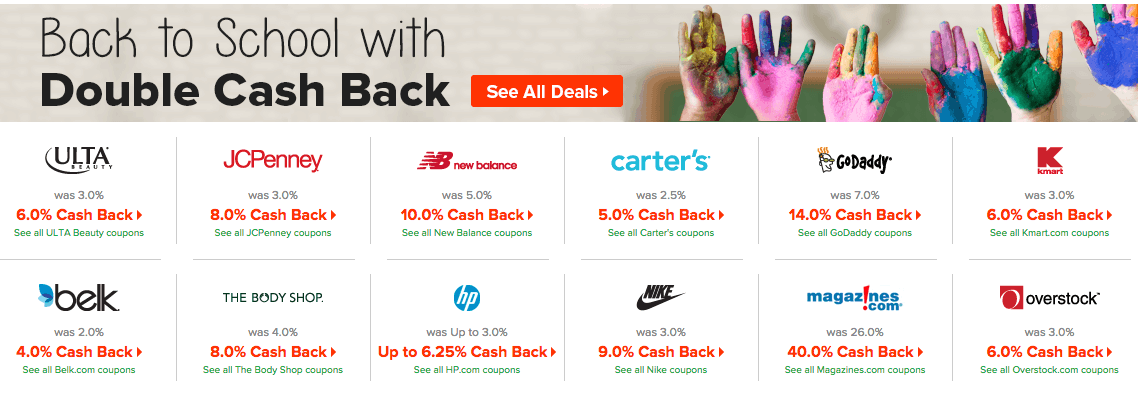

Rakuten is a rebates website the place you get a rebate only for procuring by their web site. They provide completely different percentages for various shops which you could store at. This is a few of their present money again offers:

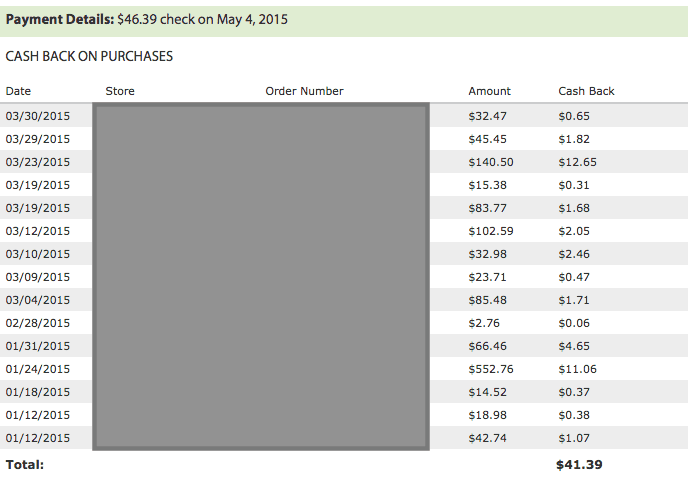

As you possibly can see, you possibly can earn cash simply to your regular again to highschool procuring. This is a snapshot of my regular procuring on-line, and the way it earned me $46.39 for 3 months of on-line procuring:

As you possibly can see, I spent a complete of $1,260.55 on-line over the primary three months of the 12 months. That earned me a verify of $46.39 – the $41.39 you see within the screenshot, plus a $5 bonus for spending at a sure retailer that month.

That equates to a 3.7% rebate on all on-line procuring I did for the quarter. Bear in mind, when it got here time to pay, I additionally used a rewards bank card that earned me 2% money again – successfully saving me 5.7% on all my on-line procuring.

One of the best trick for utilizing Rakuten and TopCashBack is to attend for a sale on the positioning – generally they provide 10% or more money again to your common procuring. That is when it may be very worthwhile to make use of their service.

Complete Month-to-month Financial savings: $13.80

5. Drop The Fitness center Membership

The typical gymnasium membership prices round $50 per 30 days. Even when you go together with a “low-cost” gymnasium, you are still taking a look at paying round $20 per 30 days. Plus, many gyms have activation charges or signup charges that may increase the annual price huge time.

This is the worst half – in line with Stephen Dubner and Steven Levitt, the authors of Freakonomics, the typical particular person overestimates how a lot they will use the gymnasium by upwards of 70%. Primarily they’re solely getting 30% of their cash’s price.

So what’s an individual to do? Search for methods to work out with out having to go to the gymnasium, together with operating, biking, taking part in an outside sport, and extra.

Complete Month-to-month Financial savings: $20

6. Get Organized

Many individuals, together with myself, neglect in regards to the worth of group and the way it can actually translate into month-to-month cash financial savings. I’ve written earlier than about the ability of getting organized, but it surely by no means ceases to amaze me how a lot I may doubtlessly spend after I’m disorganized.

To get organized, take a couple of ideas from our household. First, we maintain all of our toiletries in a single spot within the corridor closet in order that we all know if we’re out of one thing. Second, we maintain the pantry organized by sort of meals as effectively, in order that we do not skip over one thing. Lastly, we maintain an inventory of the whole lot we have to get on the retailer every week.

This may occasionally appear easy, but it surely prevents doubling up on shopping for issues that we do not want. For instance, the opposite day I assumed we have been out of cleaning soap – I will admit I used to be lazy and did not look within the closet. I added it to the procuring record, however my spouse rapidly found that it was within the corridor closet. Provided that cleaning soap prices about $5, that is a financial savings proper there.

Now, it is not so much, however it could add up when you’re not organized.

Take a look at this record of the perfect budgeting apps if you’d like some assist.

Complete Month-to-month Financial savings: $10

7. Purchase Used And Promote Used

The subsequent technique I exploit so much is to purchase used, and in addition promote used. What do I imply by this?

At any time when I am taking a look at buying one thing – like a family good, electronics, or perhaps a automotive – I look a shopping for it used or refurbished. There is a ton of financial savings available when you purchase issues refurbished.

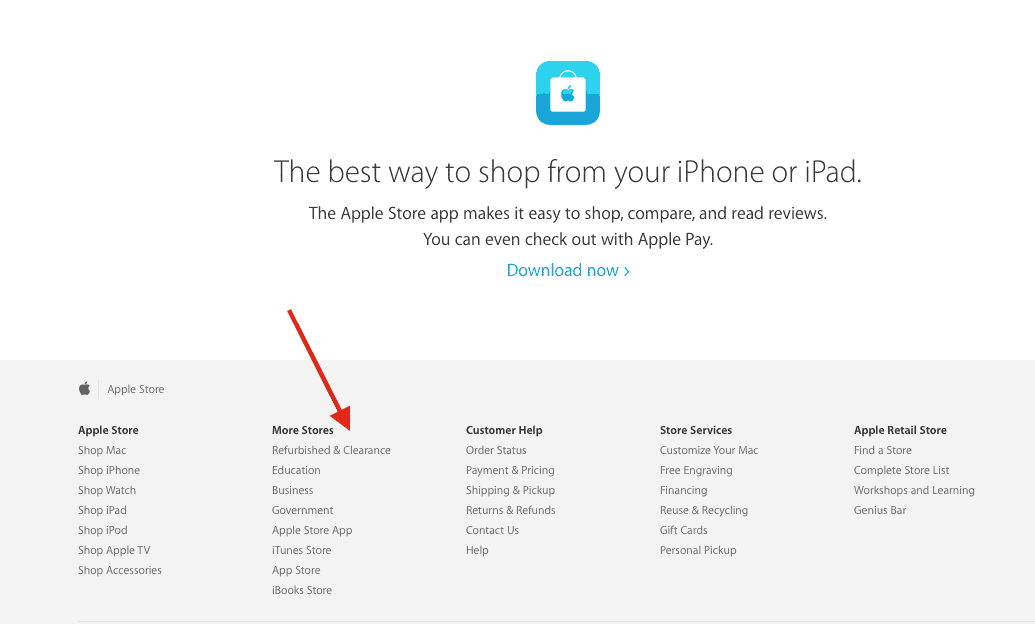

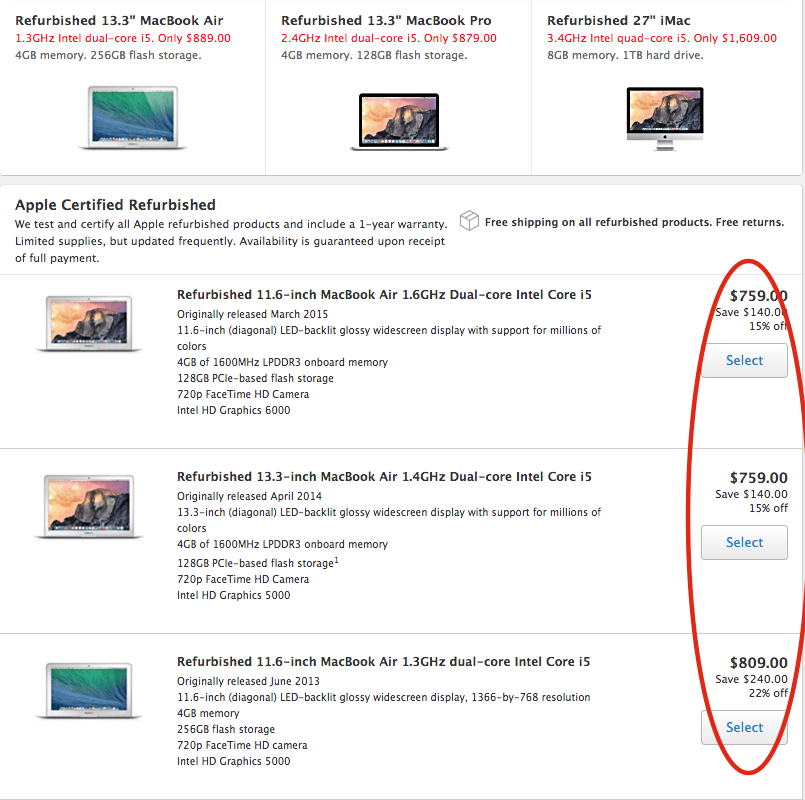

For instance, after I was not too long ago seeking to improve my laptop computer, I went to the refurbished retailer within the Apple Store:

Contained in the Apple Refurbished and Clearance retailer, you will discover financial savings of 15% or extra on virtually each product that Apple carries. Plus, all of these things have the identical guarantee as another new product bought from Apple.

Half 2 of the equation is to promote used.

At any time when we improve to one thing new, we do not simply let the outdated stuff sit round – we promote it. For instance, I used to be changing an outdated iMac. It wasn’t price a lot, however I used to be in a position to promote my outdated iMac for $450. Apple has an incredible program the place you possibly can promote your merchandise again to them for an Apple Reward card, which you need to use for something from Apple. You possibly can study extra on the Apple Recycling Program.

Nevertheless, if I did not have an Apple product, I’d look on promoting my merchandise on Amazon.com or eBay.

So, not solely am I getting a financial savings on the brand new laptop, however I am promoting the outdated laptop to offset the worth. There’s huge financial savings available right here. In my instance, I saved $240 on my new MacBook, and offered my outdated iMac for $450 – a complete financial savings of $690.

Whereas that is not one thing that occurs month-to-month, I’d say that I get such a financial savings yearly. So, we are able to divide this financial savings out per 30 days.

Complete Month-to-month Financial savings: $57.50

8. Examine Costs On Every part

Even when you do not need to purchase issues used, it is best to nonetheless verify and evaluate costs. I do that on a regular basis – particularly when simply shopping for the common stuff I have to buy every month.

If I am in a retailer, I all the time pull out my smartphone and use my Amazon app to match costs on the whole lot. I do not essentially purchase it on Amazon, but it surely offers me an excellent sense of the perfect value.

If I do find yourself shopping for the merchandise on-line versus in-store, I all the time benefit from Ebates to combo the financial savings. So, not solely am I getting the perfect value, I am getting rebates and bank card rewards.

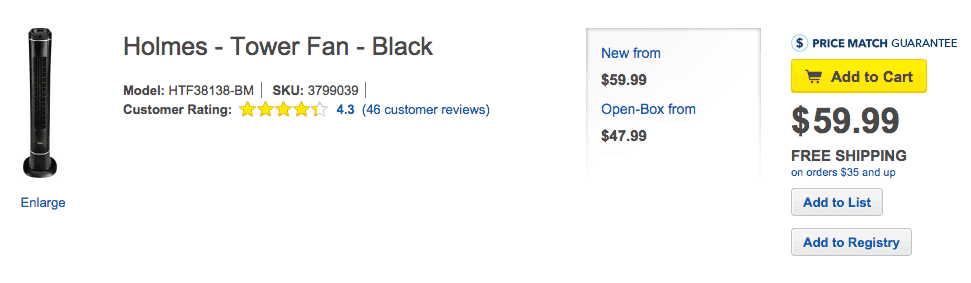

For instance, it has been sizzling and I have been looking to buy a fan. I used to be strolling by a Greatest Purchase, and determined to go in and look. I discovered a fan I appreciated and was on the point of purchase it:

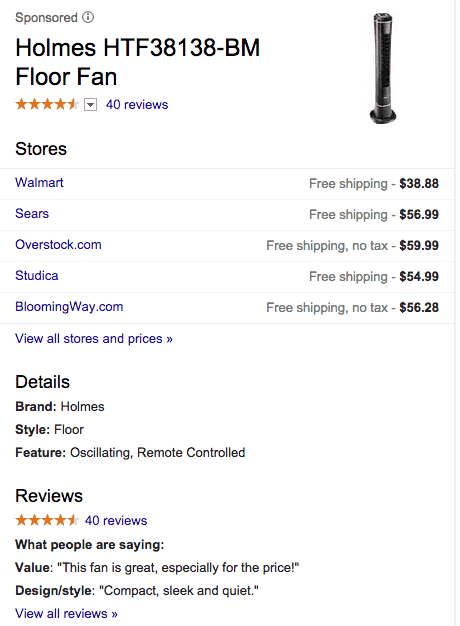

Nevertheless, earlier than pulling the set off at Greatest Purchase, I pulled out my telephone and Google’d the Mannequin Quantity:

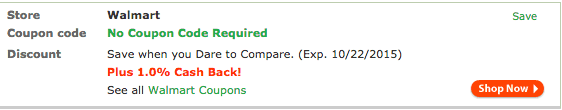

As you possibly can see, Walmart had a less expensive value on the fan. And sure, Greatest Purchase does have a value match assure coverage, however even their value match assure would not embody Rakuten. As you possibly can see, Rakuten presents an extra 1% money again for procuring at Walmart:

I do that on virtually each buy now and discover financial savings virtually each time. For simply evaluating costs, we are able to see the financial savings of $21.11.

Complete Month-to-month Financial savings: $21.11

9. Get Value Changes On Previous Purchases

Once you buy one thing, that you must maintain on to your entire receipts. I recommend having a file the place you retailer your entire receipts for not less than a 12 months – longer for giant purchases like home equipment.

You’ll be shocked by the financial savings you will discover every month by getting changes in your previous purchases. Virtually each retail retailer has a value adjustment coverage, however I’d enterprise that 98% of customers by no means benefit from them.

For instance:

- Macy’s: Provides a value adjustment inside 14 days of buy.

- Walmart: Provides a value adjustment inside 7 days of buy

- Hole: Provides a value adjustment inside 14 days of buy

Nevertheless, some corporations will do changes so long as they carry the merchandise at full value. I bought a pair of footwear at Nordstrom earlier within the 12 months, and it not too long ago went on sale throughout their Anniversary Sale.

Though it has been about 6 months since I bought the footwear, Nordstrom honored the worth adjustment. And as you possibly can see, it was a hefty quantity – $83.05. If you will get that financial savings twice a 12 months, it is worthwhile.

Complete Month-to-month Financial savings: $13.84

10. Minimize Your Cable

The subsequent huge price reducing expense is to easy reduce your cable. With all the exhibits you possibly can watch without spending a dime on-line, there is no such thing as a motive to pay for cable anymore.

In response to a report compiled by BI Intelligence, cable corporations reported the bottom quantity of cable subscribers in years, however rising broadband web subscribers.

Cable TV is pricey, and whereas Web remains to be pricy every month, the financial savings by not having cable is large.

We not too long ago reduce our cable, and it has saved us $100 per 30 days. Even on the bottom cable plan provided by our cable firm, it could have been an additional $100 per 30 days to have fundamental cable channels and the field to get it.

As an alternative of cable, we opted to purchase Apple TV together with Netflix. The Apple TV prices nothing every month, and Netflix runs us an extra $7.99. We additionally bought a digital antenna to get the native channels, which truly works surprisingly effectively and we are able to watch the information and a number of other sports activities packages.

It is humorous as a result of previous to reducing cable, we may have by no means fathomed not having it. Now, with out it, life is simply less complicated and cheaper.

Complete Month-to-month Financial savings: $92.01

11. Save On Utilities Every Month

One of many greatest bills that almost all households have every month are utilities. These are the necessities – energy and water – that everybody usually pays for. These “necessary” bills can add up when you’re not cautious.

However there are a number of methods which you could save on utilities every month. First, for energy, change each lightbulb in your own home to LED Lightbulbs. This may present substantial financial savings in your own home – they use 90%+ much less vitality than commonplace lightbulbs.

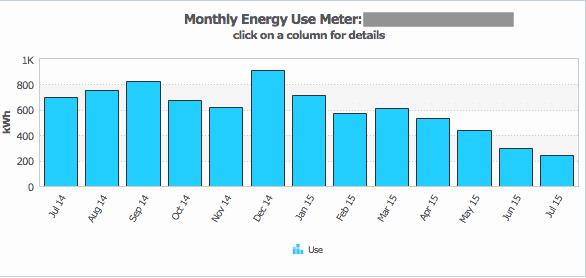

We not too long ago change all of our lightbulbs in our home to LEDs, and noticed our energy invoice lowered over 50% – nothing else modified. This is a screenshot of our vitality utilization displaying the drop in energy utilization since switching bulbs to start with of June:

For comparability, in July we used 676 kW of energy, and in July the next 12 months we used 288 kW. That translated right into a $100 per 30 days financial savings!

Nevertheless, LED lightbulbs are costly. They price about $7 or extra per bulb, when you discover them on sale. Nevertheless, many of the energy corporations throughout america are at present providing rebates on bulbs. You possibly can go to the Vitality Star Rebate Finder and choose “Mild Bulbs” and see if you will get a rebate in your bulbs. Many corporations are providing rebates of round $4 per bulb. That lowers the worth considerably and makes it much more worthwhile.

One other solution to save on energy is to make use of a free software like OhmConnect that lets you get rebates for reducing again your energy throughout sure instances. It is not a ton of cash, but it surely offers you somewhat further in your pocket every month.

Subsequent up is water. Water is a tricky one, as a result of it is arduous to seek out methods to avoid wasting. In California, although, it is much more essential to avoid wasting water due to the drought – and water corporations are elevating charges and including penalties in consequence.

Nevertheless, identical to energy corporations are providing rebates to preserve, water utilities are additionally providing rebates to preserve. In California, the water corporations are providing rebates on shopping for excessive effectivity garments washers, excessive effectivity bathrooms, weather-based sprinkler controllers, excessive effectivity sprinklers, and extra. I not too long ago was in a position to buy a brand new sprinkler controller and all new sprinklers for FREE after the rebate, and it decreased our water utilization by about 10% – or a $20 financial savings.

Complete Month-to-month Financial savings: $120

12. Enhance Your 401k Contribution

Automating your financial savings is among the greatest methods to spice up your general financial savings. In case you work and are provided a 401k or 403b, among the best methods to avoid wasting extra money every month is to easily increase your 401k contribution.

These contributions are pre-tax, so when you increase it by simply 1%, you will barely even discover a change in your take-home pay. It is as near a painless solution to save as doable.

Take the instance of creating $35,000 per 12 months. In case you increase your 401k contribution by simply 1%, it should contribute an additional $29.17 per paycheck (when you’re paid bi-weekly). That will increase your annual financial savings by $758.42, which is large!

Need to do extra than simply 1%. Take a look at this nice calculator and see all kinds of completely different situations.

Complete Month-to-month Financial savings: $58.34

13. Decrease Your Insurance coverage Invoice

Insurance coverage is a type of areas that is usually set and neglect for many households. You join insurance coverage when you need to (whenever you purchase a automotive, or whenever you transfer), however in any other case you doubtless by no means have a look at it.

As an alternative, you have to be checking your insurance coverage insurance policies not less than yearly. You would be shocked how a lot it can save you by checking easy adjustments – just like the mileage you drive or the worth of your property.

For instance, I not too long ago checked the mileage that was on my automotive insurance coverage coverage. Once I signed up, I chosen 15,000 miles yearly on common. Nevertheless, based mostly on my final 12 months of service information, I might solely pushed 10,000 miles. By going surfing to USAA and altering this one reality, it lowered my invoice by $5 per 30 days.

Take a look at my software for discovering the perfect automotive insurance coverage charges.

Complete Month-to-month Financial savings: $5

14. Minimize Your Funding Bills

This one is a tricky one as a result of funding bills are usually “ghosts” – which means you do not actually know they’re there, however they’re taking cash away from you every month. Funding bills are commissions and annual charges that you simply pay to speculate.

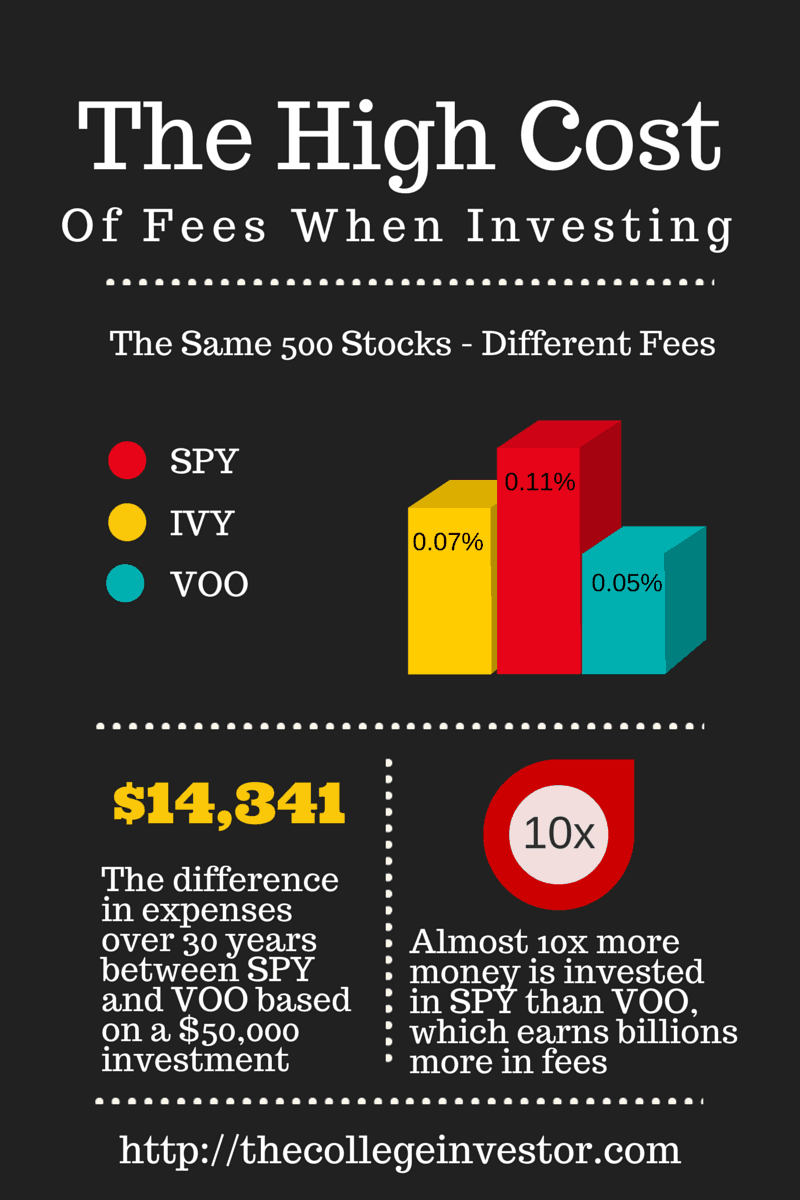

Bear in mind this chart from our article about Paying Extra To Make investments In The Similar Firm:

Investing in the identical actual shares can price you $14,341 over 30 years. That breaks down right into a month-to-month expense of $39.84. Why are you giving up $39.84 to put money into an dearer ETF that invests in the identical 500 shares?

The difficulty is that these charges are hidden. You do not know they’re there. Whereas the federal government has tried to make charges extra clear, they’re nonetheless misplaced on most particular person traders.

Fortunately, there are two instruments that may assist. The primary is Empower. I like to recommend Empower as a free software to easily arrange your monetary accounts (which you have to be doing already). What you most likely did not know is that additionally they have a Retirement Payment Analyzer that may let you know how a lot you are spending in charges yearly.

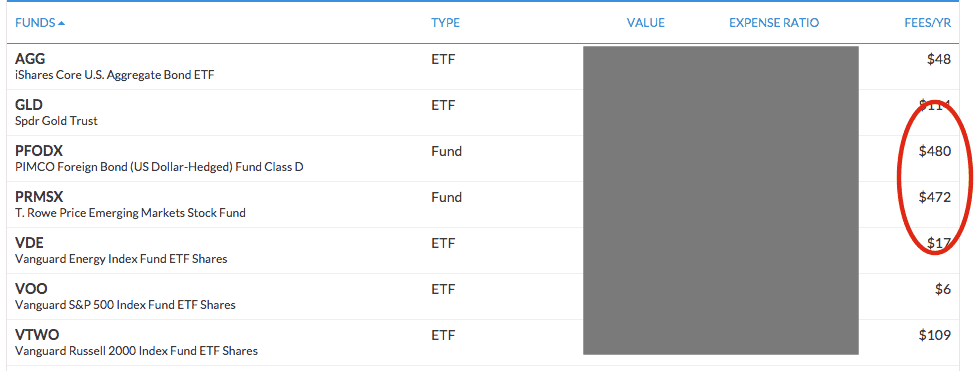

This is a sneak peek at my portfolio and it discovered two funds which have considerably increased charges than they need to:

By discovering these two funds, and switching them out for decrease price funds, I used to be in a position to save roughly $800 per 12 months – or $66.67 per 30 days.

You possibly can see, it estimates that I will save roughly $400 per 30 days as effectively, and even highlights a possible ETF that I may purchase that matches my funding targets.

Complete Month-to-month Financial savings: $66.67

15. Get rid of Financial institution Charges

Lastly, do you’ve got actually free checking? I am speaking $0 charges.

In response to the Bankrate Checking Account Payment Survey:

- Solely 38% of checking accounts are actually free

- 97% of checking accounts may be free if prospects meet sure necessities

- The typical out-of-network ATM transaction prices $4.35

Even “good” banks and credit score unions, like Navy Federal Financial savings Financial institution, have began charging prospects random charges – like account minimal charges and inactivity charges. In case you do not keep sufficient in your accounts, you possibly can rapidly see your steadiness eroded by charges.

That not too long ago occurred to me – I maintained a small account at Navy Federal and abruptly noticed a $3 payment for inactivity. Sorry, however I do not use my financial savings account – that is why it is a financial savings account. Both manner, I moved away from there and setup at USAA.

USAA presents actually free checking, with no minimums or charges, and even ATM reimbursement – so you do not have to pay that nasty $4.35 per transaction.

In case you’re not having fun with actually free checking, you are not saving sufficient with regards to banking.

Take a look at our record of the Greatest Credit score Unions or Greatest Free Checking Accounts.

Complete Month-to-month Financial savings: $5

Including Up The Time And Financial savings

It is all the time essential to recollect the time it takes to economize – that is an enormous a part of the frugality equation. You do not need to save $1 if it takes you 5 hours of labor. That simply would not make sense.

In case you add up all the financial savings from these duties, you will save $591.07 per 30 days. That provides as much as over $7,000 in financial savings per 12 months.

However let’s discuss time. This is my estimated breakdown of how a lot time every activity takes on a month-to-month foundation. Sure, some duties could have an startup time-cost, however that is the continuing time price:

- Credit score Card Rewards: 0 further time (you’ll be procuring anyway)

- Credit score Card Hacking: 10 minutes per 30 days (time to seek out high offers)

- On-line Financial savings: 0 further time (you’ll be looking on-line anyway)

- On-line Rebates: half-hour per 30 days (time to seek out the highest offers)

- Drop The Fitness center: 0 further time (you’ll work out anyway)

- Group: 1 hour per 30 days (time to arrange)

- Purchase Used/Promote Used: 0 further time to purchase, half-hour further to promote (you’ll be shopping for anyway, however promoting is a brand new activity)

- Examine Costs: half-hour per 30 days (to spend time evaluating completely different web sites)

- Value Changes: 10 minutes per 30 days (to verify outdated receipts and get changes)

- Minimize Your Cable: 0 further time (as soon as you’ve got acquired your system setup, there is no such thing as a ongoing time dedication)

- Save On Utilities: 0 further time (as soon as you’ve got modified your gear, there is no such thing as a ongoing time dedication)

- Enhance Your 401k: 0 further time (as soon as you modify your withholding, there is no such thing as a ongoing time dedication)

- Decrease Your Insurance coverage: 0 further time (as soon as you’ve got made the change, nothing is ongoing)

- Decrease Your Funding Bills: 0 further time (as soon as you’ve got made the change, nothing is ongoing)

- Get rid of Financial institution Charges: 0 further time (as soon as you’ve got made the change, nothing is ongoing)

So, as you possibly can see, this whole record of extras perhaps provides as much as an additional 2 hours and 20 minutes over the course of a whole month. To save lots of $590, that works out to roughly $246 per hour of labor in financial savings!

Bear in mind, saving cash is just half the equation. You must also deal with incomes extra money as effectively! That is the true secret to constructing wealth. Take a look at our sources on 50+ methods to earn extra cash in school, and methods to setup a passive earnings stream.

Extra Tales: