Efficient monetary administration equips you to take advantage of your nonprofit’s restricted sources. To provide significant stories that can assist you do that, you could monitor all monetary exercise and ideally examine it to your price range, or your monetary illustration of what you assume you’ll pursue throughout the yr.

There are 4 core stories, referred to as monetary statements, that nonprofits ought to create to evaluation monetary information and actions. Let’s take a better take a look at every of those paperwork and the way your nonprofit can compile them.

4 Foremost Monetary Statements for Nonprofits

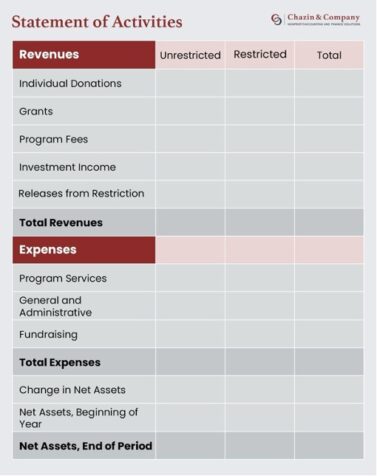

1. Assertion of Actions

The Assertion of Actions, just like the for-profit earnings assertion, particulars a nonprofit’s income sources and bills. This doc subtracts whole bills from whole income to let you already know in case your group is bringing in extra money than it’s spending.

Whereas the particular particulars you file right here rely in your nonprofit’s distinctive monetary state of affairs, this report is often damaged down into the next sections:

- Income, together with your numerous funding sources, reminiscent of financial donations, in-kind items, and grants

- Bills in accordance with the mission-centric perform they serve, together with program, administrative, and fundraising prices

- Change in internet belongings, which is identical factor as internet earnings or loss in for-profit terminology

The road gadgets in your Assertion of Actions ought to replicate your group’s working price range for the fiscal yr. This lets you examine your deliberate versus precise monetary actions and consider how intently your group was in a position to stick with its price range.

2. Assertion of Monetary Place

The change in internet belongings calculated within the earlier doc needs to be listed in additional element in your Assertion of Monetary Place. This report, just like the for-profit steadiness sheet, lists all of your belongings and liabilities, reminiscent of:

- Property: Money and money equivalents, contributions receivable, pay as you go bills, and property and gear

- Liabilities: Accounts payable and accrued bills

When calculating internet belongings for the Assertion of Monetary Place, you’ll must separate restricted internet belongings from unrestricted internet belongings. This implies distinctly separating internet belongings with donor restrictions, reminiscent of grant funding, from these with out donor restrictions to raised perceive the liquidity of your sources.

3. Assertion of Money Stream

The Assertion of Money Stream particulars the influx and outflow of money, revealing how a lot money is accessible to cowl your nonprofit’s bills. This assertion categorizes money flows in accordance with their sources. For instance, it would checklist money flows from:

- Working bills, which encompasses money acquired and paid

- Investing actions, reminiscent of gear purchases

- Financing actions, like mortgage funds or establishing endowment funds

Whereas the Assertion of Actions and Assertion of Monetary Place are primarily based on information from a whole fiscal yr, the Assertion of Money Stream covers transactions regularly, that means it may be created month-to-month.

4. Assertion of Useful Bills

The Assertion of Useful Bills stories intimately in your nonprofit’s expenditures. This doc is a requirement for annual audits and categorizes your nonprofit’s prices primarily based on their perform in accordance with your mission.

There are usually three classes these bills may fall below:

- Program (or cause-related) bills, reminiscent of the prices an animal shelter incurs whereas administering medical remedy to rescued animals

- Administration, which incorporates your day-to-day prices, like salaries and paying for workplace provides

- Fundraising prices, like the price of shopping for fundraising software program or advertising and marketing a particular marketing campaign

In case your nonprofit is required to file the complete Kind 990 annually or when you’ve got an audit requirement, you’ll must create a Assertion of Useful Bills.

Tips on how to Create Nonprofit Monetary Statements

When the time involves compile your monetary information into organized stories, there are just a few steps you could comply with:

1. Collect Monetary Knowledge

Accumulate all of your nonprofit’s important monetary data, together with:

- Revenue

- Bills

- Property

- Liabilities

- Particulars on restrictions

This information ought to ideally already be saved and available in your accounting software program. Your bookkeeping practices all through the fiscal yr matter. An organized record-keeping system ensures your nonprofit can simply entry key monetary information when the time involves compile your monetary statements.

2. Compile Knowledge in a Monetary Assertion Template

After compiling your information, set up it into the correct monetary statements utilizing the reason of every assertion mentioned on this information. If you’re utilizing fund accounting software program constructed for nonprofits, these stories will likely be native in your system. You possibly can run them with just some clicks, and simply add columns for price range to precise, balances, and exercise year-over-year.

In case your accounting software program doesn’t embrace these stories, there are templates out there that can assist you create them, such because the Assertion of Actions template within the Chazin & Firm’s nonprofit accounting information.

Remember the fact that even with a template, your nonprofit might want to customise its monetary statements to match your distinctive information. For instance, you’ll want so as to add line gadgets to the above template to account to your nonprofit’s distinctive income sources.

3. Seek the advice of a Skilled Accountant

Gathering information and correctly categorizing it in every monetary assertion may be time-consuming, particularly for those who’ve by no means performed it earlier than. As a result of staffing is a typical challenge for nonprofits, and plenty of don’t have in-house accountants, outsourcing the duty can streamline the method and guarantee your monetary statements are correct.

Take into account hiring knowledgeable accountant to assist your staff set up its information or relieve your nonprofit of the duty altogether. When researching accountants, search for one with:

- Nonprofit-specific experience: You’ll want an accountant who is aware of the ins and outs of nonprofit funds, reminiscent of donor-restricted funds and grant reporting.

- Familiarity with compliance necessities: Knowledgeable who is aware of the related compliance necessities will hold these laws in thoughts whereas creating compliant monetary stories.

- Ample expertise: Years of expertise in nonprofit accounting alerts knowledgeable’s familiarity with the method. Hiring an accountant with loads of expertise means they’ll be geared up to streamline the method and deal with any hiccups your group could face.

Whereas a nonprofit accountant may be useful for monetary assertion preparation, they will additionally assist your monetary exercise on an ongoing foundation. From price range help to audit preparation to grant monitoring, knowledgeable can take over lots of the complicated duties related along with your nonprofit’s funds to alleviate the burden out of your employees and make sure you preserve compliance.

Your nonprofit’s monetary statements are solely as correct because the monetary information you enter. To provide efficient monetary statements, reconcile your accounts and evaluation your information all through the fiscal yr to catch errors earlier than compiling stories. Put within the effort to prepare your monetary information and enhance your nonprofit’s method to accounting now to make monetary statements a breeze when it’s time to create them.

Having the correct fund accounting software program with sub-fund capabilities makes creating these stories easy and straightforward. Try the Blackbaud Monetary Edge NXT on-demand product tour to be taught extra.