Commercial

QQA, RSPA, and EFAA intention to supply constant month-to-month revenue and progress potential. |

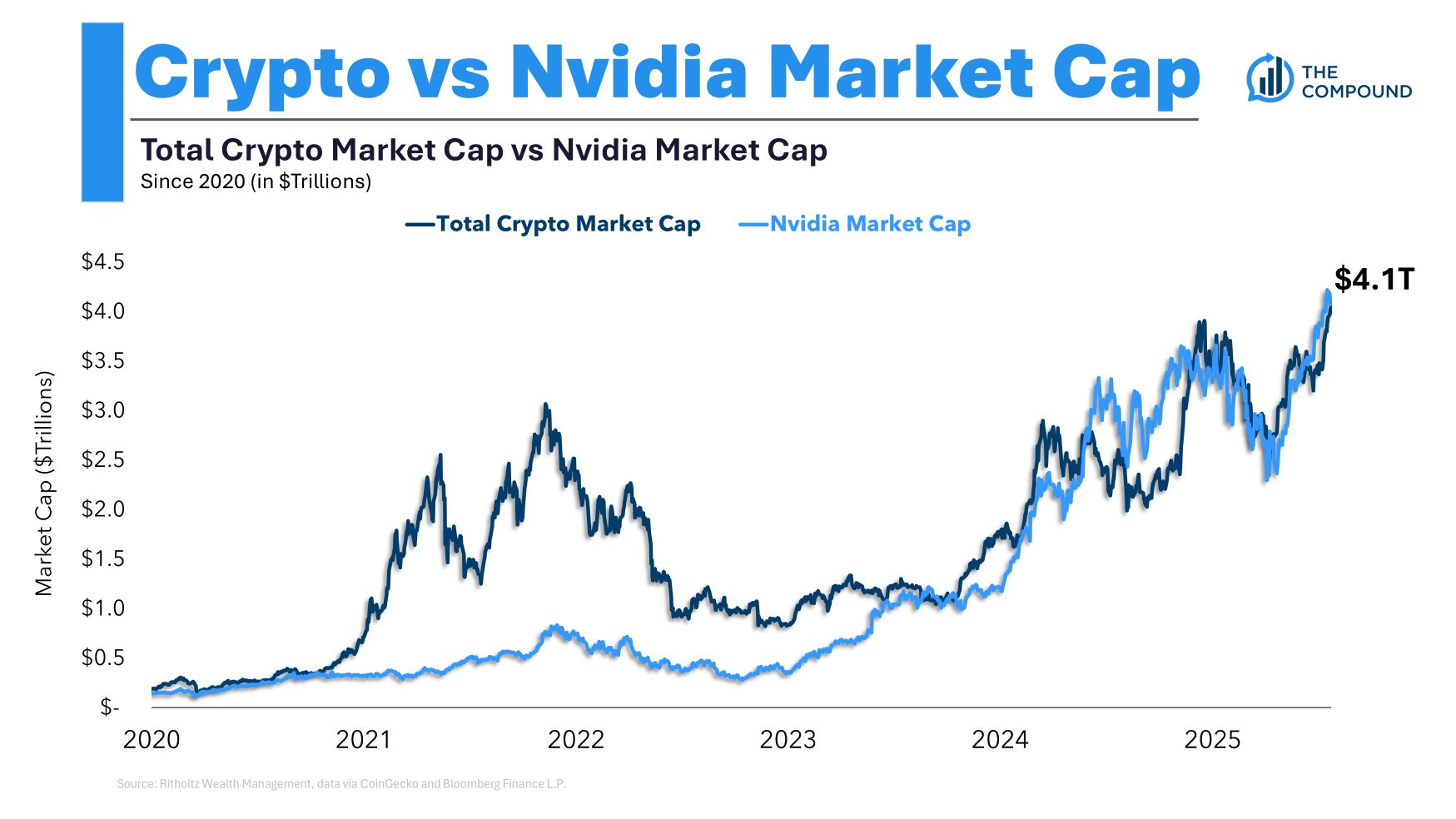

$4 trillion. That’s the dimensions of the crypto market. It’s an astounding quantity of {dollars}, and but, when considered by way of a sure lens, it’s actually not that a lot.

When you’re a skeptic, you’ll dismiss this as delusional nonsense. I get it. However for those who’re a believer, at the very least in quantity go up, like I’m, you may assume otherwise about how massive this asset class can get.

I used to be aghast when JC made the remark final week that “It’s a rounding error. That’s actually what it’s.”

JC was making the purpose that it might go to zero, and it wouldn’t have any systemic implications. Right here’s the clip, if you wish to hear it from his mouth.

I used to be like, “WHAT ARE YOU TALKING ABOUT??? IT’S AS BIG AS NVIDIA!”

Besides it isn’t as massive as Nvidia. Nvidia has a market capitalization. Its value occasions its variety of shares excellent.

If “all people” went to promote Nvidia, it might hit some kind of ground that’s manner increased than zero. Let’s not get slowed down within the “all people” half, as a result of for each purchaser there’s a vendor and so on and so on, that is only a psychological train.

My level is, at some quantity on its manner down, a purchaser would take the corporate personal and feast off of its gushing money flows. And if Nvidia determined it needed to promote 100% of the corporate, there could be a purchaser or a consortium of patrons that might be completely satisfied to take it off its palms. That’s what we imply by a market capitalization.

With Bitcoin, we took one thing from conventional finance and skeuomorphed it onto these tokens in order that we might all make sense of its dimension. Besides it isn’t a market cap in any respect. As a result of there isn’t any single purchaser or group of patrons that might take all of crypto off sellers’ palms. And if “everybody” went to promote, then there are not any basic explanation why it couldn’t fall to $10.

And so once I say that $4 trillion isn’t rather a lot, or $2 trillion within the case of Bitcoin, it actually isn’t. As a result of that quantity isn’t actual.

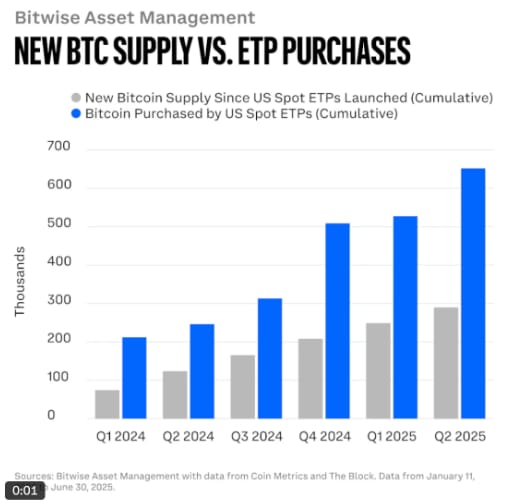

However again to actuality and never theoretical arguments. Proper now, there’s a race to purchase Bitcoin. This chart from Bitwise reveals that for the reason that launch of ETPs, buyers have bought twice as many Bitcoins as Bitcoin which have been mined. Demand is outpacing provide by greater than a bit of.

And that is company adoption. Once more, there are far more patrons than sellers.

Who is aware of how lengthy this dynamic lasts? Sooner or later it is going to attain an equilibrium. And definitely, in some unspecified time in the future, these dynamics will reverse and costs will come manner down. I imply, duh.

I don’t understand how excessive Bitcoin can go, or if I’ll look again on this submit with disgrace, but it surely’s solely attainable that the ceiling is rather a lot increased than individuals assume, particularly for those who’re excited about the market cap.