It appears each lodge model has a bank card (or six, within the case of Marriott). So, it may be troublesome to select which one to get.

Out of the 33 bank cards presently in my pockets, 1 / 4 of them are from lodge manufacturers. And one in every of my high selections is the World of Hyatt Credit score Card, which is the non-public bank card from Chase and my favourite lodge loyalty program, World of Hyatt.

Listed here are 5 causes I bought the cardboard — and plan to maintain it for the long run.

Annual price that pays for itself

The World of Hyatt card‘s $95 annual price is common for a mid-tier cobranded lodge card. And it is offset by greater than only one profit — making it a no brainer to maintain in your pockets 12 months after 12 months.

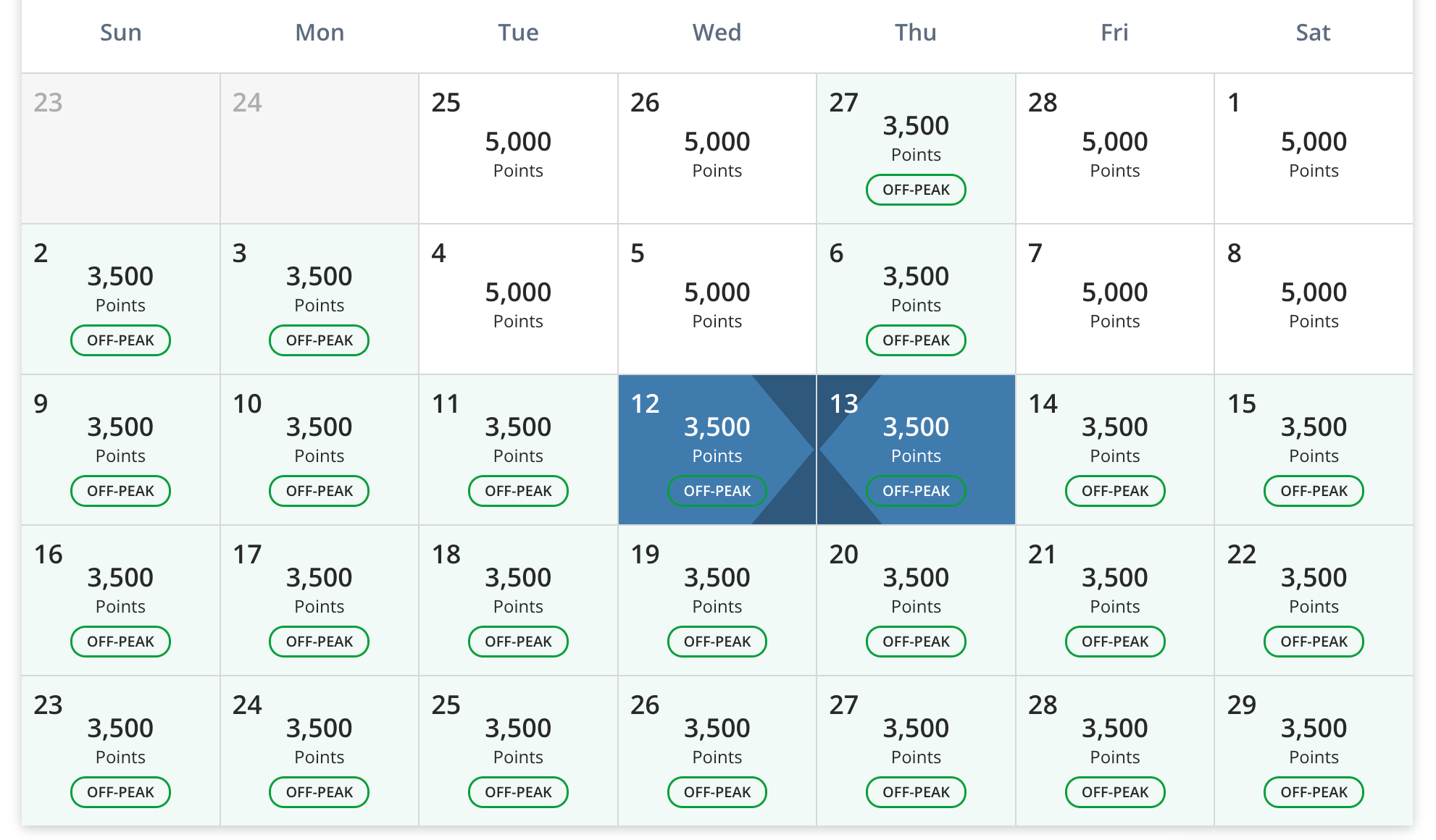

This card gives an annual free night time certificates at a Class 1-4 property, legitimate for peak, customary and off-peak dates. Which means you possibly can redeem it for an evening costing between 3,500 and 18,000 factors, with a choice for the upper finish to get most worth out of the certificates.

I redeemed my free night time certificates on the Andaz Mexico Metropolis Condesa (a Class 4 property) final 12 months, and on the Hyatt Home Manchester (Class 2) the 12 months earlier than. Given money charges for these properties begin at $250 and $170, respectively, I bought my annual price’s price — after which some.

You can even mix your factors and free night time certificates on the identical keep; I often use my certificates for the primary night time after which add nights booked with factors.

Useful lodge factors

In response to TPG’s February 2025 valuations, World of Hyatt factors are among the many Most worthy lodge factors, price at the very least double the worth of Hilton Honors, IHG One Rewards and Marriott Bonvoy factors.

A part of the reason being that World of Hyatt is the one one in every of these 4 main loyalty packages that also sticks to an award chart (for essentially the most half). Commonplace room redemptions at most Hyatt-affiliated properties value between 3,500 and 45,000 factors.

Each day E-newsletter

Reward your inbox with the TPG Each day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Whereas some folks intention for luxurious lodge stays at manufacturers like Park Hyatt, I choose to squeeze essentially the most nights out of my Hyatt factors by utilizing them at high-value Class 1 and a pair of properties. For instance, I just lately stayed on the glorious Alila Bangsar Kuala Lumpur for under 5,000 factors an evening (the property will increase to eight,000 factors an evening March 25).

It is necessary to do the mathematics to resolve whether or not utilizing factors or money to e book a lodge keep is healthier. Once I use money, I earn 4 factors per greenback spent with Hyatt — together with on meals and spa companies — which is equal to an virtually 7% return on my spending, in line with our February 2025 valuations.

High up with Chase and Bilt factors

I direct most of my basic journey and eating spending to my Chase Sapphire Reserve®, which earns 3 factors per greenback spent. And since Hyatt is one in every of Chase’s 14 switch companions, I can switch my factors at a 1:1 ratio to high up my account.

You can even switch Bilt Rewards Factors to Hyatt at a 1:1 ratio.

Transfers are usually on the spot, however over the previous six months, I’ve had two situations of Chase factors taking three to seven days to look in my Hyatt account.

Computerized elite standing

It is secure to say I’ve boarded the Hyatt standing practice. This card offers me my ticket, granting me complimentary Discoverist standing only for having it in my pockets.

Whereas this entry-level standing does not give me many perks, the notable ones embody:

- A ten% factors bonus on Hyatt stays

- Upgrades to most popular rooms (topic to availability)

- 2 p.m. late checkout (topic to availability)

Quick monitor to larger standing

My intention final 12 months was to get to mid-tier Explorist standing, which requires 30 nights in a 12 months. I reached this standing tier due to the 5 elite night time standing credit this card grants me and staying 25 nights at Hyatt motels.

Whereas not a perk particular to the cardboard, I admire this system’s Milestone Rewards, which granted me 2,000 bonus factors once I reached 20 nights, and a free night time certificates and two membership entry awards once I reached 30 nights.

This 12 months, I intention to succeed in top-tier Globalist standing, which requires 60 nights. Because of this card’s 5 elite nights, some latest stays and upcoming ones, I am on monitor to get midway there by the center of the 12 months.

This card will give me a lift within the second half of the 12 months, granting me two elite night time credit for each $5,000 spent on it. By 12 months’s finish, I plan to place my virtually $10,000 property tax invoice on this card, plus one other $5,000 or so basically spending, totaling $15,000.

That is the candy spot to intention for, because it is not going to solely give me six elite night time credit towards my 60-night goal but additionally an extra free night time certificates to redeem at a Class 1-4 property.

Backside line

In case you ask TPG veterans and consultants on factors and miles which lodge program they’re most loyal to, the most typical reply is Hyatt. So, if you wish to intention for top-tier lodge standing and revel in some Milestone Rewards alongside the way in which, the World of Hyatt card is a superb alternative.

Given the high-value redemptions and free night time certificates, it is also a no brainer for these seeking to reduce the money value of lodge stays.

In case you do not significantly care about standing however have a card that earns Chase Final Rewards factors, the Hyatt card is a superb alternative, too. Its annual price simply pays for itself annually.

To be taught extra, learn our full overview of the World of Hyatt Credit score Card.

Apply right here: World of Hyatt Credit score Card

Associated: My high 3 picks for the very best cobranded lodge bank card