I first learn The Millionaire Subsequent Door a 12 months or so into my first job.

I didn’t know a factor about what it takes to get rich so the ebook was eye-opening for me as a 20-something attempting to determine my profession and funds.

The overall thesis of the ebook is that the prototypical millionaire is just not what you assume.

They dwell beneath their means, prioritize saving over spending, don’t spend frivolously on luxuries, price range their cash, assume long-term and save/make investments one thing like 20% of their earnings. The millionaires subsequent door are disciplined with their cash, usually tend to drive a Ford than a Bentley and keep away from standing symbols.

Half of them lived in the identical home for greater than 20 years and 80% of them had been first era prosperous.

The one factor that actually caught out to me on the time was that almost all millionaires are self-employed or personal a enterprise. In actual fact, self-employed individuals make up lower than 20% of the employees in America however account for practically two-thirds of the millionaires.1

And it’s not flashy, high-tech firms. The 2-comma membership largely owns and operates unglamorous but regular, worthwhile companies.

The ebook was initially revealed again in 1996.

Is it nonetheless true at present?

With regards to enterprise possession, sure.

The Wall Road Journal has a profile of the stealthy rich (aka the millionaire subsequent door):

The most important supply of earnings for the 1% highest earners within the U.S. isn’t being a companion at an funding financial institution or launching a one-in-a-million tech startup. It’s proudly owning a medium-size regional enterprise. Lots of them are distinctly boring and very profitable, like auto dealerships, beverage distributors, grocery shops, dental practices and legislation companies, based on Zidar and Zwick.

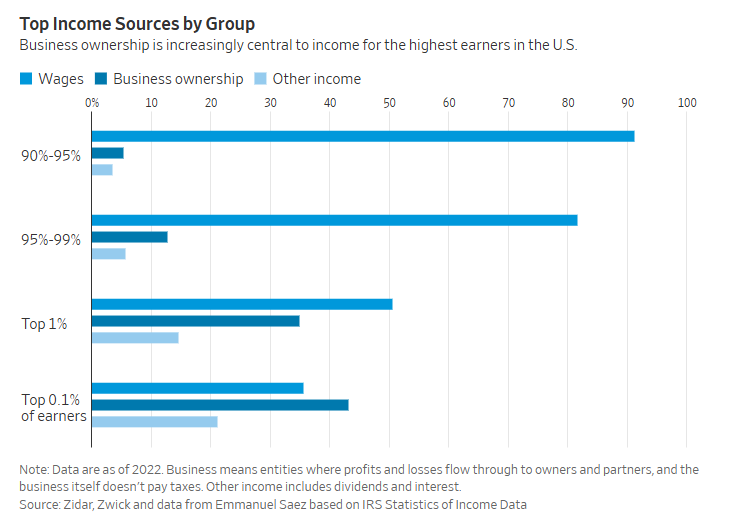

Right here’s the breakdown among the many prime 10%:

This group can also be rising:

Their evaluation of anonymized tax knowledge from 2000 by 2022 suggests the significance of such enterprise possession to the U.S. financial system has grown. The share of earnings that possession generates has elevated to 34.9% in 2022 from 30.3% in 2014 for the highest 1% earners.

The variety of such enterprise house owners price $10 million or extra, adjusted for inflation, has greater than doubled since 2001, to 1.6 million as of 2022.

This may occasionally seem to be a pipe dream to lots of people. Beginning a enterprise is difficult. It’s dangerous. There aren’t any ensures it’s going to work.

The easiest way to supercharge your wealth is to personal fairness. In the event you accomplish that in a enterprise you personal or work at, that actually helps. The subsequent smartest thing is to personal fairness in publicly traded shares.

The excellent news is that it’s by no means been simpler to put money into the inventory market. When The Millionaire Subsequent Door was initially launched, the authors famous that fewer than 25% of households owned shares or mutual funds. Right this moment, it’s extra like 60%. That’s progress.

Within the ebook, Thomas Stanley and William Danko lay out seven widespread denominators amongst individuals who efficiently construct wealth:

The world appears to be like a lot completely different than when this ebook was first launched. Individuals most likely spend extra money than they used to, even the millionaire subsequent door varieties. However constructing wealth nonetheless takes self-discipline, sacrifice and laborious work.

I don’t see these attributes ever altering.

Additional Studying:

Your Family CFO

1One other stat I highlighted is that millionaires tended to dwell in neighborhoods comprised largely of non-millionaires, who outnumbered them 3-to-1.

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here can be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.