In 2022, it was a nasty 12 months for the markets.

On the time I wrote about the way it was perhaps one of many worst years ever when you think about bonds had a bear market similtaneously shares.

Final 12 months I wrote about how 2023 was a good 12 months which was good as a result of typically unhealthy years are adopted by unhealthy years.

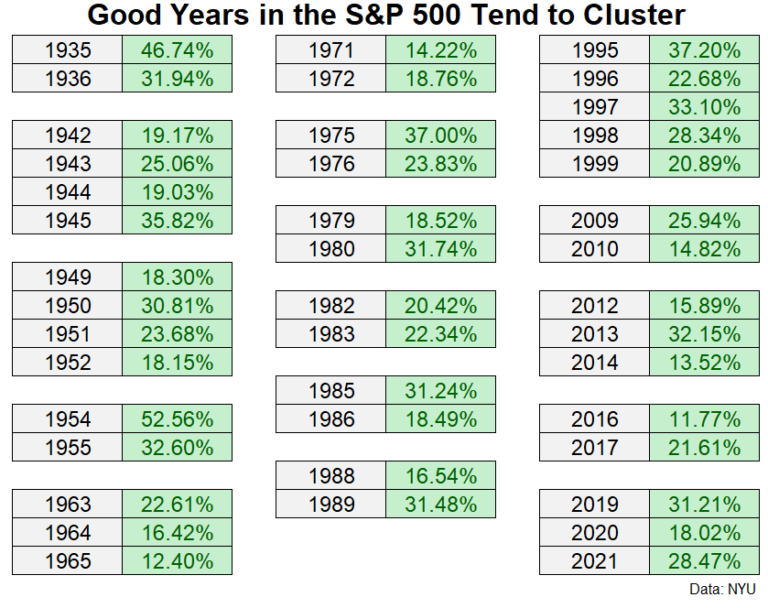

I adopted that up writing about how good years within the markets are inclined to cluster:

Effectively, the S&P 500 was up 25% in 2024. It occurred once more.

I’m not taking a victory lap right here. I wasn’t making a prediction that 2024 can be one other nice 12 months. I used to be merely utilizing historical past as a information to indicate how momentum tends to work within the inventory market.

So now we’re taking a look at back-to-back years of 25%+ positive factors for the S&P 500 (+26% in 2023 and +25% in 2024).

A couple of weeks in the past I famous how uncommon that is:

Since 1928 there have solely been three different cases of 25%+ returns in back-to-back years:

-

- 1935 (+47%) and 1936 (+32%)

- 1954 (+53%) and 1955 (+33%)

- 1997 (+33%) and 1998 (+28%)

So what occurred subsequent?

One thing for everybody:

-

- 1937: -35%

- 1956: +7%

- 1999: +21%

Horrible, first rate and nice. Not useful.

I suppose we could possibly be organising for an additional late-Nineteen Nineties growth time the place 20% positive factors yearly have been the norm however we’ve already been on a implausible run within the U.S. inventory market.

Not so for the fastened revenue facet of the ledger. The Bloomberg Mixture Bond Index was up somewhat greater than 1% in 2024.1 That might imply a U.S.-centric 60/40 portfolio was up somewhat greater than 15% final 12 months.

Some would say this exhibits diversification is useless or doesn’t work anymore. I might say this proves diversification works as meant. Bonds have carried out poorly lately however the inventory market has picked up the slack. That’s how diversification is meant to work.

There’ll come a time within the years forward when the inventory market struggles and bonds do the heavy lifting.

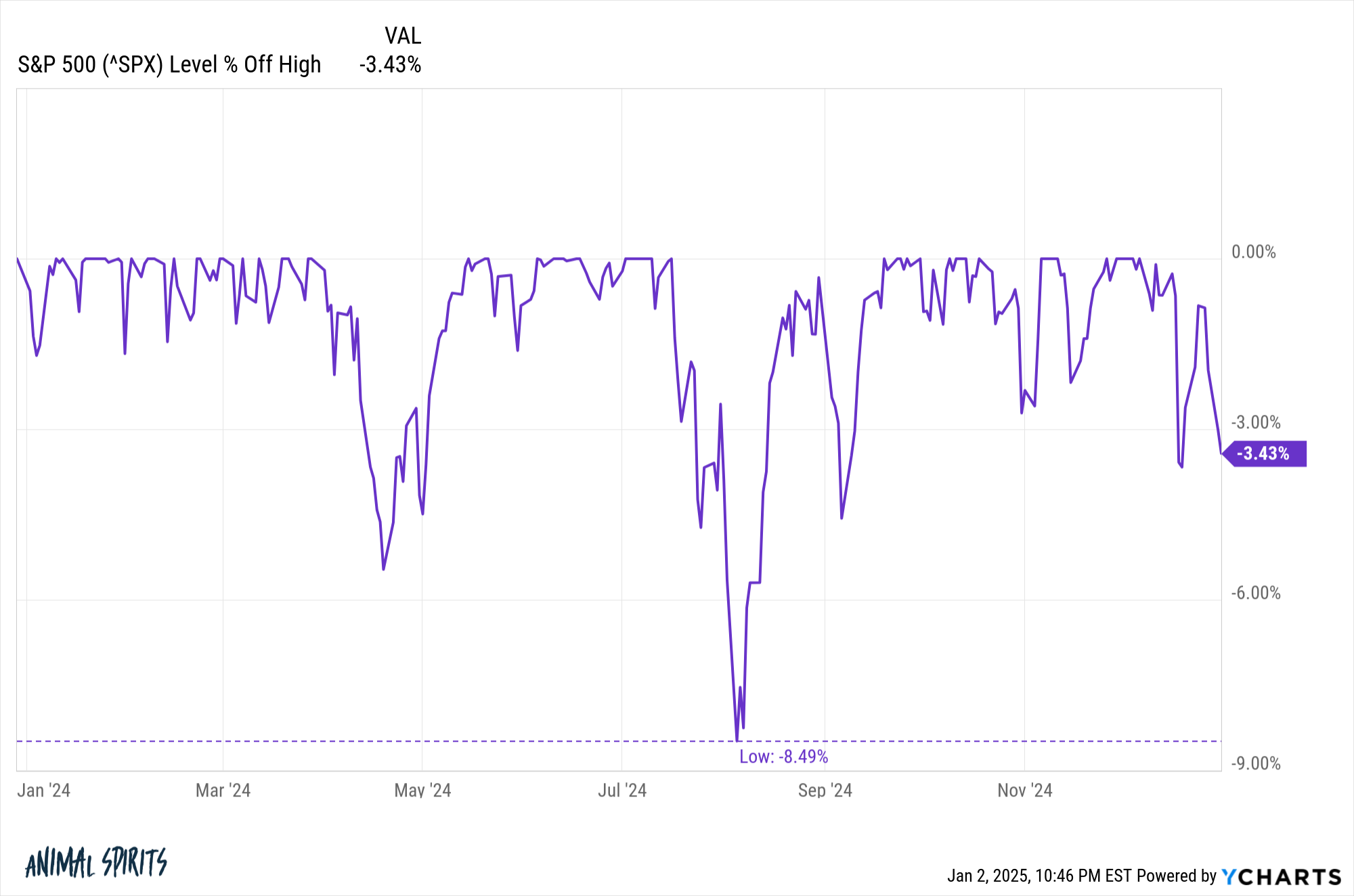

The inventory market additionally made it via the 12 months with out triggering a double-digit correction, one thing that has occurred in two-thirds of all years going again to the late-Twenties:

One of many causes it was a superb 12 months for the inventory market is as a result of it was a superb 12 months for the economic system.

The U.S. inflation price averaged 3% for the 12 months. The unemployment price got here in at a median of 4% in 2024. Actual GDP progress was roughly 3% annualized within the 2nd and third quarters.

2024 was a beautiful 12 months for shares and the economic system.

It gained’t at all times be like this however it’s good to understand the nice instances whereas they’re right here.

One of many causes we get to take pleasure in good instances out there is as a result of they’re invariably adopted by unhealthy instances.

The excellent news is the nice instances greater than make up for the unhealthy instances.

Micheal and I talked concerning the 12 months that was within the inventory market and extra on the most recent Animal Spirits this week (sorry no video due to the vacations):

Additional Studying:

30% Up Years within the Inventory Market

Now right here’s what I’ve been studying recently:

Books:

1The saving grace this 12 months was increased yields. The worth returns have been really adverse.

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here shall be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.