Mortgage Q&A: “What’s a lender credit score?”

Should you’ve been buying mortgage charges, whether or not for a brand new residence buy or a refinance, you’ve probably come throughout the time period “lender credit score.”

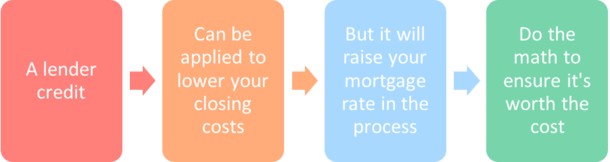

These non-compulsory credit can be utilized to offset your closing prices. However they may bump up your rate of interest within the course of.

Let’s study extra about how they work and if it is smart to make the most of them.

Bounce to lender credit score matters:

– How a Lender Credit score Works

– Lender Credit score vs. Paying Factors

– What Can a Lender Credit score Be Used For?

– Lender Credit score Limitations

– Lender Credit score Instance

– A Lender Credit score Will Elevate Your Mortgage Charge

– Does a Lender Credit score Must Be Paid Again?

– The way to See If You’re Getting a Lender Credit score

– Is a Lender Credit score a Good Deal?

– Lender Credit score Professionals and Cons

How a Lender Credit score Works

- Mortgage lenders know you don’t need to pay any charges to get a house mortgage

- So they provide “credit” that offset the customary closing prices related to a mortgage

- Credit could be utilized to issues like title insurance coverage, appraisal charges, and so forth

- You don’t pay these prices out-of-pocket, however wind up with a better mortgage fee

Everybody desires one thing without spending a dime, whether or not it’s a sandwich or a mortgage.

Sadly, each require manpower and price cash, and a technique or one other you’re going to must pay the worth as the patron.

While you take out a mortgage, there are many prices concerned. You must pay for issues like title insurance coverage, escrow charges, appraisal charges, credit score experiences, taxes, insurance coverage, and so forth.

There are plenty of individuals concerned and so they all must be compensated for his or her effort and time.

Sadly, debtors are sometimes stretched fairly skinny by the point they get to the closing desk, what with the down cost, transferring prices, and so forth.

Lenders perceive this, which is why they provide credit to cowl many of those prices. This will cut back your money burden and makes their provide seem much more enticing.

Nonetheless, when you choose a mortgage that provides a credit score, your rate of interest might be greater to soak up these compulsory prices.

Merely put, you pay much less cash upfront to get your mortgage, however extra over time by way of a better fee/month-to-month cost.

Lender Credit score vs. Paying Factors

| Mortgage Charge | Credit score/Factors | Closing Prices | Good For… |

| 6.5% | 1.00 | $5,000 + lender and third get together charges | Somebody who desires the bottom fee and cost |

| 6.75% | 0.0 | $0 + lender and third get together charges | Somebody who’s pleased with the market fee |

| 7% | -.50 | -$2,500 (can be utilized to offset charges) | Somebody who doesn’t need to pay something out of pocket at closing |

Let’s fake you’ve bought a $500,000 mortgage quantity and also you’ve been quoted a mortgage fee of 6.75%.

You will need to pay closing prices, reminiscent of title insurance coverage, appraisal, and lender charges, however no factors are due.

The lender additionally provides you two different choices. Pay one mortgage level ($5,000) and so they’ll offer you a decrease mortgage fee of 6.5%.

Or they’ll offer you a credit score of $2,500 if you happen to elect to take a barely greater fee of seven%. Should you agree, that cash can offset your closing prices so that you don’t pay something when your mortgage funds.

As an alternative, you pay a bit of further every month due to the upper rate of interest.

Conversely, the borrower who takes the 6.5% fee should pay $5,000 at closing, however pays much less every month due to their decrease rate of interest.

Nonetheless, it’s going to take them a number of years to recoup these upfront prices by way of the decrease month-to-month funds.

What Can a Lender Credit score Be Used For?

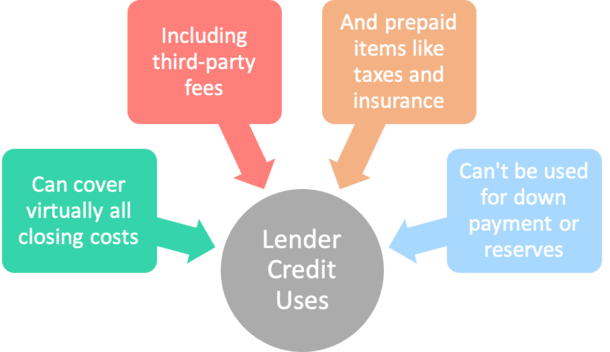

- You should utilize a lender credit score to pay nearly all closing prices

- Together with third-party charges reminiscent of title insurance coverage and escrow charges

- Together with pay as you go objects like property taxes and householders insurance coverage

- It could can help you get a mortgage with no out-of-pocket bills

While you buy a house or refinance an present mortgage, plenty of fingers contact your mortgage. As such, you’ll be hit with this payment and that payment.

You should pay title insurance coverage corporations, escrow corporations, couriers, notaries, appraisers, and on and on.

In actual fact, closing prices alone, not together with down cost, may quantity to tens of hundreds of {dollars} or extra.

To remove all or a few of these charges, a lender credit score can be utilized to cowl frequent third-party charges reminiscent of a house appraisal and title insurance coverage.

It may also be used to pay pay as you go objects together with house owner’s insurance coverage and property taxes. And even for actual property agent fee.

However keep in mind, whilst you don’t must pay these charges at closing, they’re nonetheless paid by you. Simply over time versus at closing out-of-pocket.

Lender Credit score Limitations

- A lender credit score can’t be used towards down cost on a house buy

- Nor can it’s used for reserves or minimal borrower contribution

- However the credit score could cut back the whole money to shut

- Making it simpler to provide you with funds wanted for down cost

Whereas a lender credit score can tremendously cut back or remove your entire closing prices when refinancing, the identical will not be true when it entails a house buy.

Why? As a result of a lender credit score can’t be used for the down cost. Nor can it’s used for reserves or to fulfill minimal borrower contribution necessities.

So if you happen to’re shopping for a house, you’ll nonetheless want to offer the down cost with your personal funds or by way of present funds if acceptable.

The excellent news is the lender credit score ought to nonetheless cut back your complete closing prices.

Should you owed $10,000 in closing prices plus a $25,000 down cost, you’d perhaps solely have to provide you with $25,000 complete, versus $35,000.

Not directly, the lender credit score could make it simpler to provide you with the down cost since it will probably cowl all these third-party charges and pay as you go objects like taxes and insurance coverage.

This frees up the money for the down cost that may in any other case go elsewhere.

It will possibly additionally make issues a bit of extra manageable when you’ve got extra money in your pocket as you juggle two housing funds, pay movers, purchase furnishings, and so forth.

Lastly, word that if the lender credit score exceeds closing prices. Any extra could also be left on the desk.

So select an acceptable lender credit score quantity that doesn’t improve your rate of interest unnecessarily.

If cash is left over, it might be doable to make use of it to decrease the excellent mortgage steadiness by way of a principal curtailment.

An Instance of a Lender Credit score

Mortgage sort: 30-year fastened

Par fee: 3.5% (the place you pay all closing prices out of pocket)

Charge with lender-paid compensation: 3.75%

Charge with lender-paid compensation and a lender credit score: 4%

Let’s fake the mortgage quantity is $500,000 and the par fee is 3.5% with $11,500 in closing prices.

You don’t need to pay all that cash at closing, who does? Happily, you’re introduced with two different choices, together with a fee of three.75% and a fee of 4%.

The month-to-month principal and curiosity cost (and shutting prices) appear like the next primarily based on the varied rates of interest introduced:

- $2,245.22 at 3.5% ($11,500 in closing prices)

- $2,315.58 at 3.75% ($4,000 in closing prices)

- $2,387.08 at 4% ($0 in closing prices)

As you possibly can see, by electing to pay nothing at closing, you’ll pay extra every month you maintain the mortgage as a result of your mortgage fee might be greater.

A borrower who selects the 4% rate of interest with the lender credit score can pay $2,387.08 per thirty days and pay no closing prices.

That’s about $72 extra per thirty days than the borrower with the three.75% fee who pays $4,000 in closing prices.

And roughly $142 greater than the borrower who takes the three.5% fee and pays $11,500 at closing.

So the longer you retain the mortgage, the extra you pay with the upper fee. Over time, you can wind up paying greater than you’ll have had you simply paid these prices upfront.

However if you happen to solely hold the mortgage for a brief time frame, it may truly be advantageous to take the upper rate of interest and lender credit score.

Alternatively, you can store round till you discover the most effective of each worlds, a low rate of interest and restricted/no charges.

A Lender Credit score Will Elevate Your Mortgage Charge

- Whereas a lender credit score could be useful if you happen to’re money poor

- By lowering or eliminating all out-of-pocket closing prices

- It would improve your mortgage rate of interest in consequence

- You continue to pay these prices, simply not directly over the lifetime of the mortgage versus upfront

Within the situation above, the borrower qualifies for a par mortgage fee of three.5%.

Nonetheless, they’re supplied a fee of 4%, which permits the mortgage originator to receives a commission for his or her work on the mortgage. It additionally gives the borrower with a credit score towards their closing prices.

The mortgage originator’s lender-paid compensation could have pushed the rate of interest as much as 3.75%, however there are nonetheless closing prices to think about.

If the borrower elects to make use of a lender credit score to cowl these prices, it might bump the rate of interest up one other quarter % to 4%. However this permits them to refinance for “free.” It’s generally known as a no closing price mortgage.

In different phrases, the lender will increase the rate of interest twice. As soon as to pay out a fee, and a second time to cowl closing prices.

Whereas the rate of interest is greater, the borrower doesn’t have to fret about paying the lender for taking out the mortgage. Nor do they should half with any cash for issues just like the appraisal, title insurance coverage, and so forth.

Does a Lender Credit score Must Be Paid Again?

- The straightforward reply is not any, it doesn’t must be paid again

- As a result of it’s not free to start with (it raises your mortgage fee!)

- Your lender isn’t giving something away, they’re merely saving you cash upfront on closing prices

- However that interprets into a better month-to-month cost for so long as you maintain the mortgage

No. Because the title implies, it’s a credit score that you simply’re given in trade for a barely greater mortgage fee.

So to that finish, it’s not truly free to start with and also you don’t owe the lender something. You do in actual fact pay for it, simply over time versus upfront.

Bear in mind, you’ll wind up with a bigger mortgage cost that have to be paid every month you maintain your mortgage.

As proven within the instance above, the credit score permits a borrower to avoid wasting on closing prices at the moment, however their month-to-month cost is greater in consequence.

That is the way it’s paid again, although if you happen to don’t maintain your mortgage for very lengthy, maybe resulting from a fast refinance or sale, you received’t pay again a lot of the credit score by way of the upper curiosity expense.

Conversely, somebody who takes a credit score and retains their mortgage for a decade or longer could pay greater than what they initially saved on the closing desk.

Both method, you not directly pay for any credit score taken as a result of your mortgage fee might be greater. This implies the lender isn’t actually doing you any favors, or offering a free lunch.

They’re merely structuring the mortgage the place extra is paid over time versus at closing, which could be advantageous, particularly for a cash-strapped borrower.

Test Your Mortgage Estimate Type for a Lender Credit score

- Analyze your LE type when buying your property mortgage

- Pay attention to the whole closing prices concerned

- Ask if a lender credit score is being utilized to your mortgage

- If that’s the case, decide how a lot it reduces your out-of-pocket bills to see if it’s price it

On the Mortgage Estimate (LE), you need to see a line detailing the lender credit score that claims, “this credit score reduces your settlement costs.”

It’s a disgrace it doesn’t additionally say that it “will increase your fee.” However what are you able to do…

Test the greenback quantity of the credit score to find out how a lot it’s doing to offset your mortgage prices.

You may ask your mortgage officer or dealer what the mortgage fee would appear like with out the credit score in place to check. Or examine varied totally different credit score quantities.

As famous, the clear profit is to keep away from out-of-pocket bills. That is vital if a borrower doesn’t have a number of further money readily available, or just doesn’t need to spend it on refinancing their mortgage.

It additionally is smart if the rate of interest is fairly just like one the place the borrower should pay each the closing prices and fee.

As an illustration, there could also be a scenario the place the mortgage fee is 3.5% with the borrower paying all closing prices and fee. And three.75% with all charges paid due to the lender credit score.

That’s a comparatively small distinction in fee. And the upfront closing prices for taking up the marginally decrease fee probably wouldn’t be recouped for a few years.

Tip: A lender credit score doesn’t rely towards your get together contributions (IPC) restrict despite the fact that the lender is technically an get together to the transaction.

So you possibly can mix vendor concessions and a lender credit score to cut back your closing prices.

Can You Ask for a Lender Credit score?

Most banks and lenders provide them, however you may be questioning get a lender credit score.

It may be so simple as asking, although one could already be included in your quote.

When comparability buying, take note of the closing prices (and APR) to see what’s lined and what isn’t.

Usually instances, any credit might be explicitly talked about. In the event that they don’t look like included, merely ask your mortgage officer or dealer if one could be added.

Word that including a credit score will probably improve your mortgage fee. So take that under consideration.

You may’t actually negotiate lender credit since they have an inclination to have a direct greenback worth related.

They solely solution to negotiate could be to buy your mortgage with a number of corporations that provide totally different pricing.

For instance, one lender could also be prepared to provide the similar mortgage fee with a bigger credit score. If each corporations are dependable, you can select the one providing the larger credit score.

Simply be certain the whole out-of-pocket price to you is decrease as soon as any credit are utilized.

The Bigger the Mortgage Quantity, the Bigger the Credit score

It ought to be famous that the bigger the mortgage quantity, the bigger the credit score. And vice versa, seeing that it’s represented as a share of the mortgage quantity.

So debtors with small loans would possibly discover {that a} credit score doesn’t go very far. Or that it takes fairly a big credit score to offset closing prices.

In the meantime, somebody with a big mortgage would possibly have the ability to remove all closing prices with a comparatively small credit score (percentage-wise).

Within the case of borrower-paid compensation, the borrower pays the mortgage originator’s fee as an alternative of the lender.

The profit right here is that the borrower can safe the bottom doable rate of interest, but it surely means they pay out-of-pocket to acquire it.

They will nonetheless offset some (or all) of their closing prices with a lender credit score, however that too will include a better rate of interest. Nonetheless, the credit score can’t be used to cowl mortgage originator compensation.

Should you go together with borrower-paid compensation and don’t need to pay for it out-of-pocket, there are alternatives.

You should utilize vendor contributions to cowl their fee (because it’s your cash) and a lender credit score for different closing prices.

[Are mortgage rates negotiable?]

Which Is the Higher Deal? Lender Credit score or Decrease Mortgage Charge?

- Examine paying closing prices out-of-pocket with a decrease rate of interest

- Versus paying much less upfront however getting saddled with a better rate of interest

- Should you take the time to buy round with totally different lenders

- You would possibly have the ability to get a low rate of interest with a lender credit score!

There are a number of prospects, so take the time to see if borrower-paid compensation will prevent some cash over lender-paid compensation, with varied credit factored in.

Typically, if you happen to plan to remain within the residence (and with the mortgage) for a protracted time frame, it’s okay to pay to your closing prices out-of-pocket. And even pay for a decrease fee by way of low cost factors.

You could possibly save a ton in curiosity long-term by going with a decrease fee if you happen to maintain onto your mortgage for many years.

However if you happen to plan to maneuver/promote or refinance in a comparatively brief time frame, a mortgage with a lender credit score could also be the most effective deal.

As an illustration, if you happen to take out an adjustable-rate mortgage and doubt you’ll hold it previous its first adjustment date, a credit score for closing prices may be an apparent winner.

You received’t must pay a lot (if something) for taking out the mortgage. And also you’ll solely be caught with a barely greater rate of interest and mortgage cost briefly.

As a rule of thumb, these seeking to aggressively pay down their mortgage won’t need to use a lender credit score, whereas those that need to hold more money readily available ought to take into account one.

There might be circumstances when a mortgage with the credit score is the higher deal, and vice versa. However if you happen to take the time to buy round, you need to have the ability to discover a aggressive fee with a lender credit score!

Lender Credit score Professionals and Cons

Now let’s briefly sum up the advantages and disadvantages of a lender credit score.

Advantages

- Can keep away from paying closing prices (each lender charges and third-party charges)

- Much less money to shut wanted (frees up money for different bills)

- Might solely improve your mortgage fee barely

- Can get monetary savings if you happen to don’t hold your mortgage very lengthy (refinance or promote quickly)

Downsides

- A lender credit score will improve your mortgage fee

- You’ll have a better month-to-month mortgage cost

- Might pay much more for the shortage of closing prices over time (by way of extra curiosity)

- Mortgage could also be much less reasonably priced/harder to qualify for at greater rate of interest

Learn extra: What mortgage fee ought to I anticipate?