For those who’ve completed making these New Yr objectives, you’d certainly wish to kick begin the 12 months with a recent monetary plan. Listed here are the highest monetary tricks to start the New Yr. Educate your self with these monetary steps that may take you nearer to your monetary objectives for the 12 months.

Monetary objectives could be slightly overwhelming, which is why most of us are usually not capable of maintain them. Study to make sensible and particular objectives as a substitute of simply normal ones like ‘saving extra money’ or ‘spending much less’. For example, make it particular, like I’ll save an addition $2000 each month and put it in the direction of an emergency fund.

Listed here are Some Cash Suggestions for Lengthy-Time period Objectives That You Can Verify Out to Flip Your Monetary Objectives right into a Actuality

#1. Educate Your self concerning the Inventory Market

For those who’re a first-time investor, you’re justifiably cautious of frauds within the inventory market. Educate your self first. Choose up a duplicate of One Up on Wall Avenue or The Clever Investor and study valuing investments and creating your portfolio from the perfect monetary advisors.

Commit your self from the primary 12 months of the New Yr to be taught extra about cash and investments and also you’re nicely set in your method to creating long run monetary safety and prosperity for your self and your loved ones.

There are various books in addition to on-line programs from the perfect monetary planners. These can be found that will help you perceive funding within the inventory market. You possibly can develop into an funding genius inside no time in any respect.

Begin by making conservative investments. Take a look at tutorial websites like The Mint to study alternative ways to speculate, dangers, rewards and many others.

Tip: Strive taking part in free buying and selling video games on-line on the Digital Inventory Alternate, to check methods and get follow managing your portfolio.

#2. Suggestions for Automobile Insurance coverage

- As part of cash saving ideas, earlier than you go for automotive/car insurance coverage, make a cautious comparability of assorted quotes.

- Take a look at the options. See whether or not there’s a no declare bonus supplied. Attempt to get insurance coverage for people who find themselves within the automotive with you as nicely.

- Take a look at the high-quality print.

- Know the worth of your automotive, as it is going to enable you to with saving on premiums. Calculate its current worth, so that you could negotiate with the corporate and scale back the premium of the insurance coverage coverage.

- Go for greater deductibles, to cut back the premiums.

#3. Well being Care Financial savings

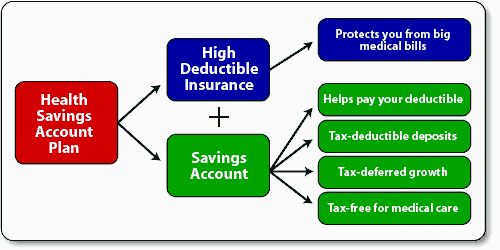

Supply

You’re in all probability into the retirement financial savings plan, so it is smart to hitch the HSA or well being financial savings account as a part of important monetary planning ideas. You get tax benefits and you’ll reap a very good harvest to your retired life. These financial savings can be utilized primarily for health-related expenditure, however they will also be used as normal retirement funds.

Should Learn – Wholesome Habits of Rich Those who Can Make You Wealthy Too

Strive to not make any withdrawals, and you could possibly simply earn even 1,000,000 {dollars} if you happen to maintain contributing for, say, 40 years, with a 7.5% return charge. It’s a strategic side of retirement monetary planning and will enable you to obtain your New Years decision.

Open an HSA, and contribute a minimum of $3000 a 12 months or double the quantity together with your partner, as a part of strong retirement monetary planning ideas. You possibly can even go for a mutual fund’s funding together with your HSA quantity.

#4. Sensible Financial savings Objective/Automated Financial savings

If you wish to obtain your monetary objectives of household finance this 12 months, the best approach is to automate financial savings. A greenback saved is a greenback earned.

Have a monetary objective. What are you planning on doing with the cash? Set a time-frame for reaching these objectives. Arrange automated direct deposits straight out of your paycheck right into a separate saving account. Out of sight is out of thoughts, so you’ll not really feel the pinch.

Attempt to save the identical share of your earnings every month. Even strive creating a number of financial savings accounts for various objectives, say holidays, residence renovation, retirement fund and so forth.

#5. Retirement Suggestions – Strategic submitting of your Social Safety

For many retired individuals, Social safety continues to be the principle supply of revenue. Use these methods to get the utmost profit from social safety.

Associated – High 10 Pleasures of Early Retirement

- Whereas contemplating the perfect time to retire, just remember to work for at least 35 years to get the utmost advantages.

- If doable, wait until 70 years and delay retirement credit, particularly if you happen to’re wholesome. You can begin at 62 years and delay it until 70, and with yearly of delay, the advantages improve by 8%.

- How you can be productive? In order for you a much bigger social safety examine, strive getting extra certifications and transfer to higher paying jobs.

#6. Emergency Funds

Whereas establishing private monetary objectives, you have to have emergency funds equal to a minimal of 6 months of your common residing bills.

Arrange a fund this 12 months for assembly sudden monetary crises conditions. Take care that you simply by no means spend it on needs like a trip, a tv and so forth. The fund must be used primarily for:

- Home repairs like a leaky roof

- Surprising journey bills, like a demise in your loved ones, final minute flight tickets and so forth.

#7. Use Apps/Monitor Spending

I agree it may be tedious to maintain monitor of all of your expenditure. But, this behavior may prevent loads of cash. You get a greater concept of the place the cash is being spent and you’ll keep away from overspending the subsequent month.

Additionally Learn – How you can Use a Credit score Card Responsibly – Suggestions and Recommendation

Go the old school approach and use a small pocket book. Or you could possibly simply use your smartphone and create notes for all expenditures. There are additionally loads of free spending tracker apps that do the be just right for you. Save all receipts, take a look at your on-line banking particulars, ATM receipts, bank card statements and many others.

#8. Sensible Purchasing Methods

Make sensible buying selections.

- For example, if you wish to buy that new tv, cost it to a bank card with a rewards program. You may even get money again for some purchases for eligible purchases.

- Take a look at on-line boards and or use the Ebates app to make simple cash and get extra info on offers and flash gross sales. Take a look at critiques earlier than getting in for a deal.

- Groceries can take an enormous chunk out of your paycheck. Plan forward, take a look at the stock, have a look at offers after which plan your meals round them. Use substitutes for costly gadgets.

Final Phrase

The New Yr is a good time to be overhauling your monetary habits and make some strong resolutions that can enable you to obtain your objectives for the 12 months. Set your objectives and work in the direction of them.

If you wish to actually achieve your New Yr decision this 12 months, make sure that to set an achievable variety of objectives primarily based on these monetary ideas. Commit your self to the objective and monitor your progress usually. Take a look at your investments and overview your funding portfolio. Ensure that to plan for emergencies.

You Might Like – 5 Massive Cash Errors to Keep away from in Your 20’s

A New Yr decision doesn’t at all times need to be centered on giving up alcohol, smoking or start exercising, although they’re all nice resolutions as nicely.

Take management over your monetary place, set new objectives, and contemplate investing in inventory markets. Make a high monetary decision for the New Yr and, extra importantly, make it stick.