I’m a giant proponent of simplicity, primarily as a result of I’ve witnessed the ill-effects of complexity within the finance world.

Recommendation doesn’t must be difficult to be efficient.

The 2 most vital medical breakthroughs of the trendy period are probably penicillin and washing your fingers to cease the unfold of an infection in hospitals.

Life expectations are rising as a result of individuals give up smoking, put on seatbelts and apply sunscreen.

There are in fact different components at play right here however more often than not the easy explanations get you a lot of the manner there.

Inventory market pundits, analysts and portfolio managers spend loads of time and vitality analyzing financial and monetary information — financial development, inflation, rates of interest, company earnings, monetary statements, authorities insurance policies, and many others.

Many alternative variables impression particular person shares and the inventory market as a complete so it pays to solid a large web when attempting to know the drivers.

I additionally suppose there are some easy explanations within the markets that individuals don’t pay sufficient consideration to.

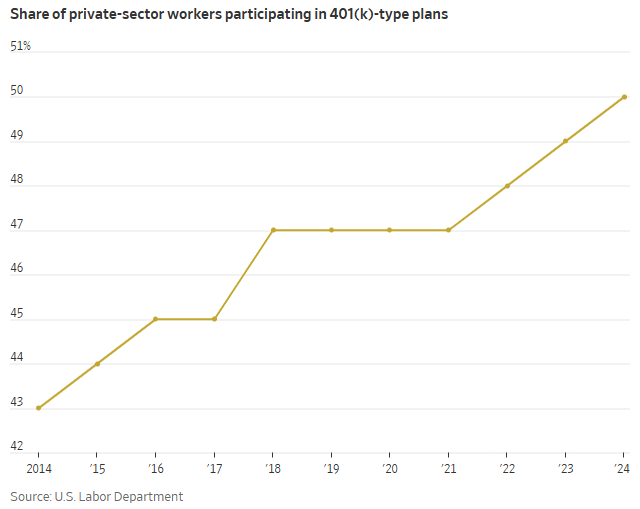

The Wall Avenue Journal talks in regards to the development in outlined contribution retirement plans:

It took practically 50 years, however half of private-sector staff are saving in 401(ok)s for the primary time.

Lengthy after workplaces began utilizing these retirement plans instead of conventional pensions, they’re lastly reaching a tipping level. Round 70% of private-sector staff within the U.S. now have entry to a 401(ok)-style retirement plan. A decade earlier, 60% had entry and 43% contributed, in accordance with the U.S. Labor Division.

That is excellent news.

The chart says loads:

There may be loads of short-term speculative conduct occurring within the markets as of late however tax-deferred retirement plans encourage good long-term conduct — opt-out sign-ups, automated contributions, targetdate funds, automated rebalancing, escalated financial savings charges, and many others.

Persons are shopping for shares at common intervals. The variety of individuals doing so will increase each single 12 months.

Worth is pushed by provide and demand. Extra individuals shopping for shares, whatever the market atmosphere, has to have an effect.

Demographics will even be one of many less complicated explanations for a lot of financial developments over the following 20-30 years.

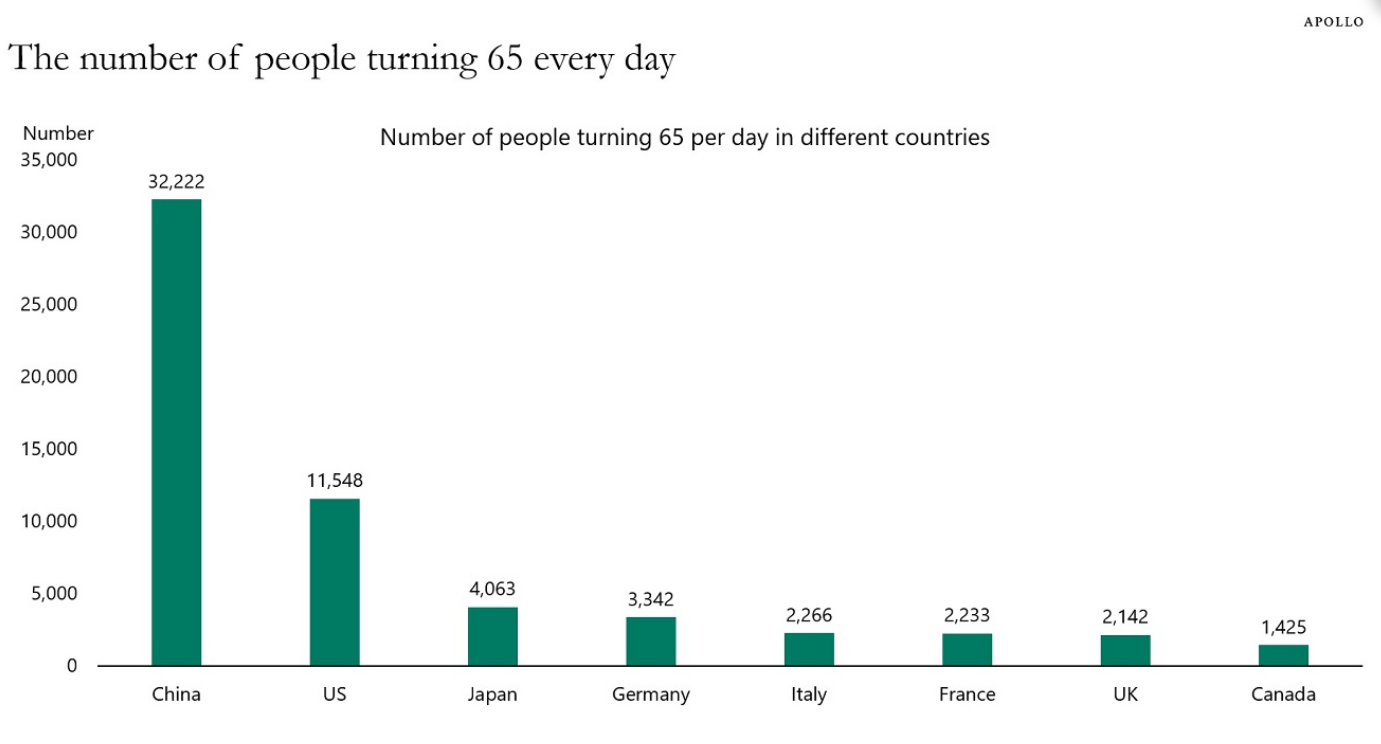

Torsten Slok exhibits the variety of individuals turning 65 on daily basis by nation:

In China, greater than 30,000 persons are hitting retirement age on daily basis. In the US, it’s greater than 11,000. This cohort controls an unlimited quantity of wealth (greater than $82 trillion within the U.S. alone).

So the place are the impacts of an ageing inhabitants with a rising pile of wealth being felt?

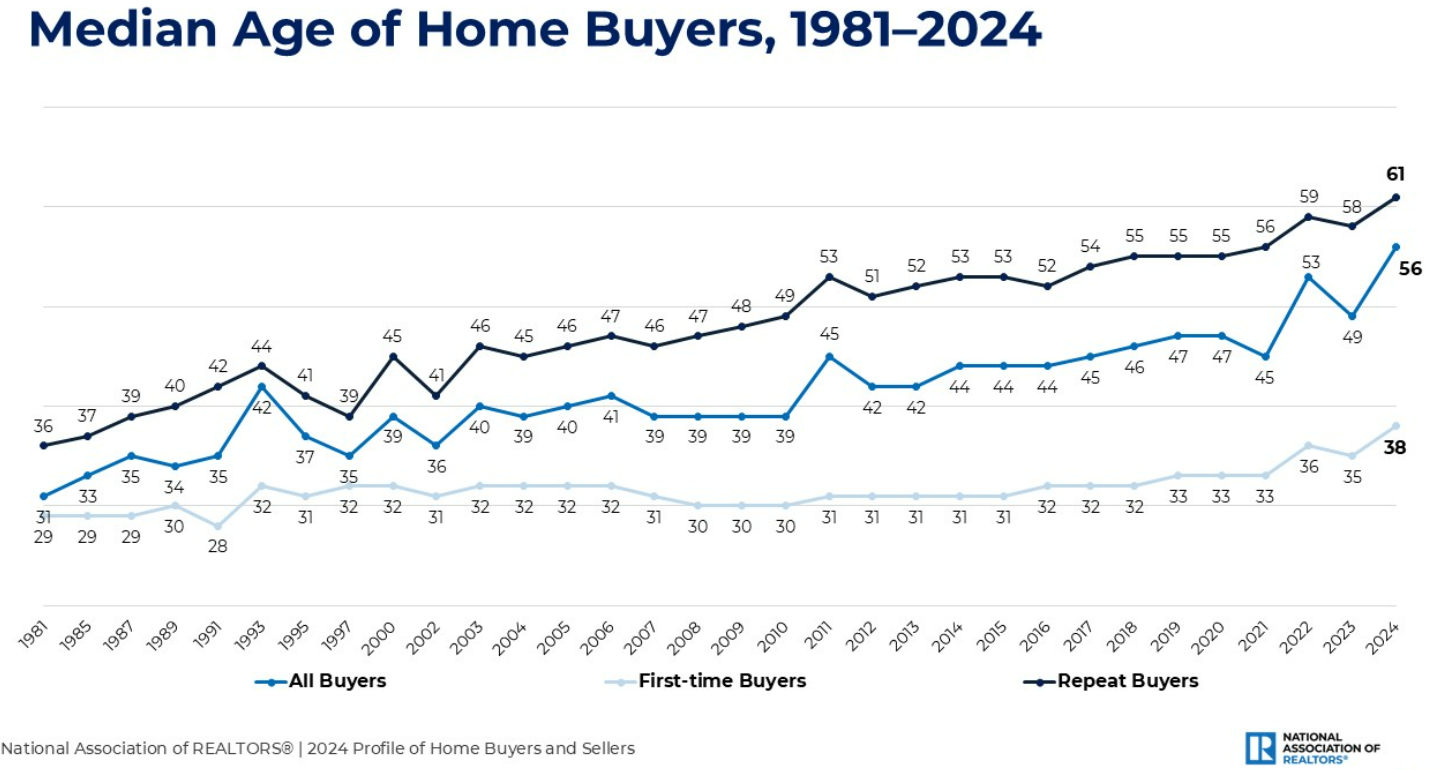

You’ll be able to clearly see it within the housing market:

The median age of first-time homebuyers has gone from 31 in 1981 to 38 now. It was 33 as just lately as 2021, which replicate how far more costly it’s to purchase a home as of late.

However have a look at the median age of repeat consumers — from 36 in 1981 to 61 in the present day!

It actually helps that many child boomers have a considerable amount of fairness of their houses. It’s additionally true that some 40% of all residential actual property is owned outright, that means no mortgage.

That makes it a lot simpler for older householders to maneuver with out having to cope with 7% mortgage charges in lots of instances.

All of that child boomer wealth goes to make an impression for the following technology attempting to purchase a home too.

The amount of cash that can be inherited within the coming years has been estimated at wherever from $84 trillion to $105 trillion. However that cash gained’t be evenly distributed. The highest 2% controls round half of that wealth.

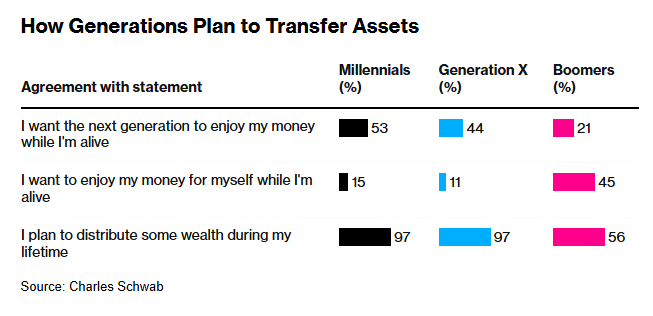

Most of the child boomer technology plans on ready to go that cash down:

If most of that cash has a time horizon that skips a technology, versus being spent down, it’s arduous to check the wealthiest technology in historical past crashing the inventory market by promoting their property in retirement.

I’m not right here to let you know the inventory market can’t or gained’t go down sooner or later. In fact it’ll. We simply had a bear market two years in the past.

However there are forces at play within the inventory market which are extending investor time horizons.

Good luck betting in opposition to these forces within the long-run.

Additional Studying:

The Computerized Investing Revolution