Blue Star Ltd – Constructed on Belief

Integrated in 1943 and headquartered in Mumbai, Blue Star Ltd. is India’s main Heating, Air flow, Air Conditioning and Business Refrigeration (HVAC&R) firm. It’s also a serious participant within the Mechanical, Electrical, Plumbing, and Firefighting (MEP) house providing turnkey options for buildings, factories, information facilities, infrastructure, heavy trade and water distribution tasks. At present Blue Star exports its merchandise to 18 nations within the Center East, Africa, SAARC, and ASEAN areas. As of 31 March 2024, the corporate has 7 state-of-the-art manufacturing services throughout Himachal Pradesh, Dadra, Ahmedabad, and Wada, together with the corporate’s 100% subsidiary Blue Star Climatech Restricted’s Sri Metropolis facility.

Merchandise and Companies

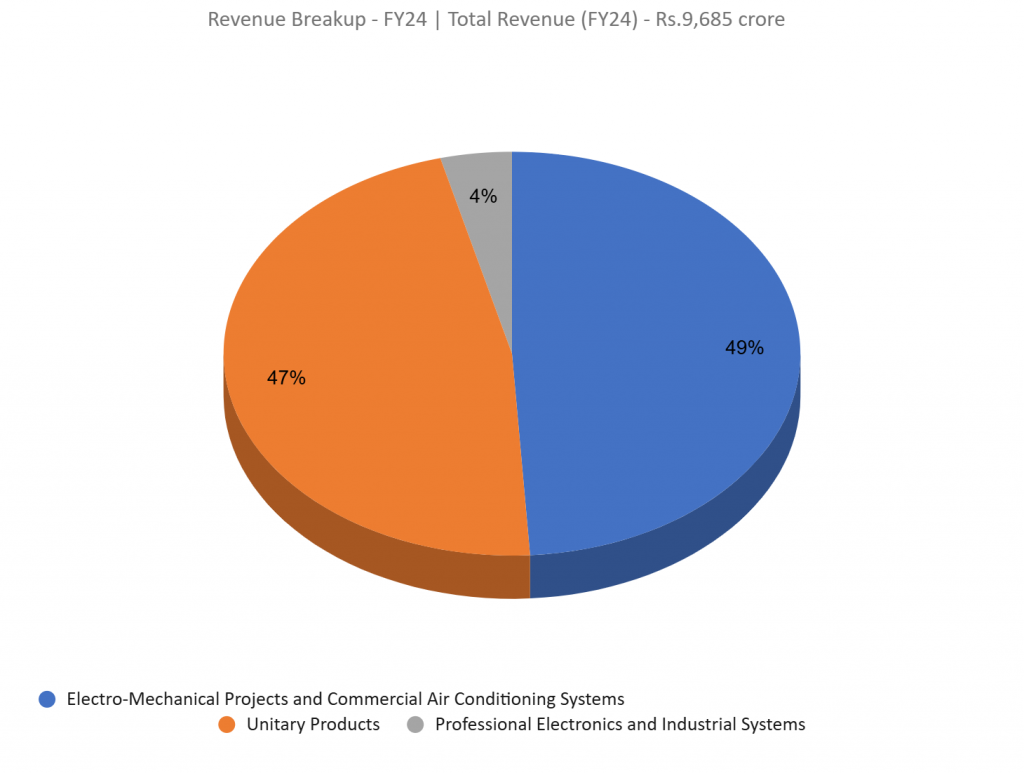

The corporate provides wide selection of merchandise equivalent to inverter break up AC, window AC, air and water coolers, air purifiers, transportable AC, water purifiers, VRF V plus system, warmth pumps, business refrigeration, chilly storage, screw & scroll chiller, bottled water dispenser, ice lined fridge, freezers, chilly rooms and many others. The corporate operates majorly in 3 enterprise segments – Electro-Mechanical Tasks and Business Air Conditioning Methods (Section 1), Unitary Merchandise (Section 2) & Skilled Electronics and Industrial Methods (Section 3).

Subsidiaries: As of FY24, the corporate has 10 subsidiaries and a pair of joint ventures.

Funding Rationale

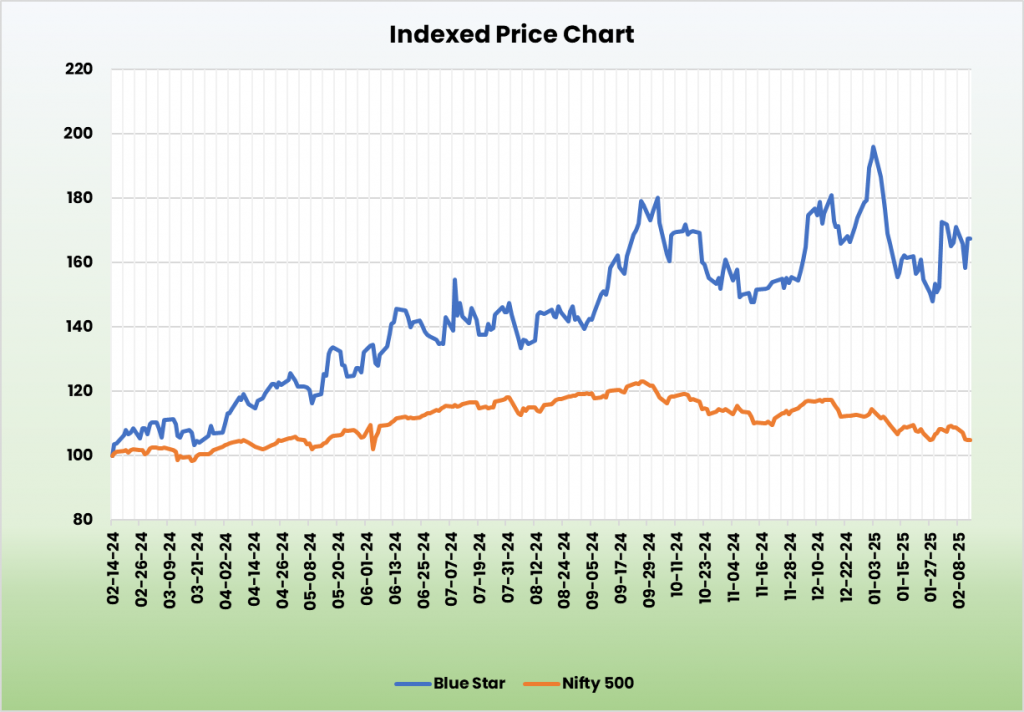

- Established place – Blue Star is a market chief in each typical and inverted ducted air-conditioning programs, and ranks among the many prime two gamers within the VRF and chiller product classes. The Unitary section has proven distinctive progress, outpacing trade efficiency within the quarter. Section income elevated by 22% in Q3FY25, supported by a 100-basis level margin growth. On the worldwide entrance, the corporate is creating new merchandise centered on decarbonization and power effectivity for key OEMs in Europe and North America. Moreover, the corporate is within the second part of growth at its Sri Metropolis plant, aiming to spice up its capability from the present 300,000 items to 600,000 items, with additional plans to broaden the capability to 16,00,000 items in a phased method.

- Development methods – The corporate continues to broaden its portfolio with new merchandise and variants in FY24. Within the room AC section, the corporate launched 3 new variants within the inverter break up ACs. The corporate has additionally launched tremendous power environment friendly & heavy responsibility ACs and new vary of window and light-weight business ACs. It additionally launched new value-added merchandise equivalent to sensible ACs with wi-fi and voice command applied sciences, scorching & chilly in addition to anti-virus ACs. Within the business air con division, the corporate has developed the sixth-generation prime discharge VRF programs. It additionally launched new vary of packaged air conditioners and centrifugal chillers. The corporate has additionally expanded its choices in deep freezers to supply a complete vary from 300L to 600L to smaller capability fashions within the vary of 60L to 200L.

- Q3FY25 – Income for the quarter was Rs.2,807 crore in comparison with Rs.2,241 crore throughout Q3FY24, representing a progress of 25%. EBITDA was at Rs.209 crore a rise of 35% in comparison with the Rs.155 crore of Q3FY24. The corporate reported internet revenue of Rs.132 crore marking a rise of 32% in comparison with the Rs.100 crore of the corresponding quarter within the earlier 12 months. Benefitting from the sturdy festive demand, the room AC enterprise continued its sturdy progress trajectory. The carry ahead order guide stood at a document Rs.6,802 crore, a 13% YoY progress.

- FY24 – The corporate generated income of Rs.9,685 crore, a rise of 21% in comparison with FY23 income. Working revenue is at Rs.665 crore, up by 35% YoY. The corporate posted internet revenue of Rs.414 crore, a rise of three% YoY.

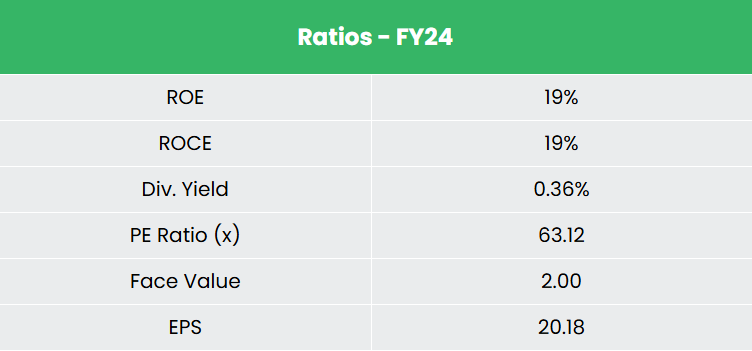

- Monetary efficiency – The corporate has generated income and PAT CAGR of 31% and 78% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 21% and 24% for FY21-24 interval. The corporate has a sturdy capital construction with a debt-to-equity ratio of 0.13.

Business

White items or client durables trade embody important family home equipment together with air conditioners, LED lights, fridges, dishwashers, freezers, coolers and many others. The market is broadly segregated into city and rural markets and is attracting entrepreneurs from the world over. Rural sector presents the subsequent important progress potential for the trade, pushed by elevated penetration. The trade is anticipated to expertise an accelerated demand with rising disposable earnings, easy accessibility to credit score, and large usability of on-line gross sales. The Indian room air conditioner market is projected to achieve Rs.50,000 crore (US$ 5.6 billion) by FY29.

Development Drivers

- 100% FDI allowed within the electronics hardware-manufacturing.

- The discount within the tax burden within the 2025-26 Union Funds is anticipated to spice up spending among the many increasing center class inhabitants.

- The federal government’s rural electrification efforts have improved energy provide in tier 3/4 cities and villages, enabling using electrical merchandise.

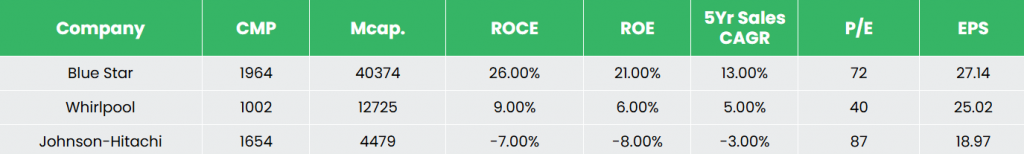

Peer Evaluation

Rivals: Whirlpool of India Ltd, Johnson Controls-Hitachi Air Situation. India Ltd, and many others.

Among the many opponents listed above, Blue Star stands out with superior return ratios and extra constant income progress, reflecting the corporate’s monetary stability and its capability to generate earnings and returns from invested capital effectively.

Outlook

The corporate goals to attain a 15% market share and preserve an 8.5% working margin. It plans to speculate Rs.750-800 crore over the subsequent 3 years in manufacturing, product improvement, and digitalization. The corporate targets a 25% progress in Section 1 and over 20% progress in Section 2 for FY25. It’s centered on increasing manufacturing capability, boosting R&D, and advancing digitalization to assist progress and profitability. Its prudent money administration helps average internet borrowing and a wholesome debt-to-equity ratio.

Valuation

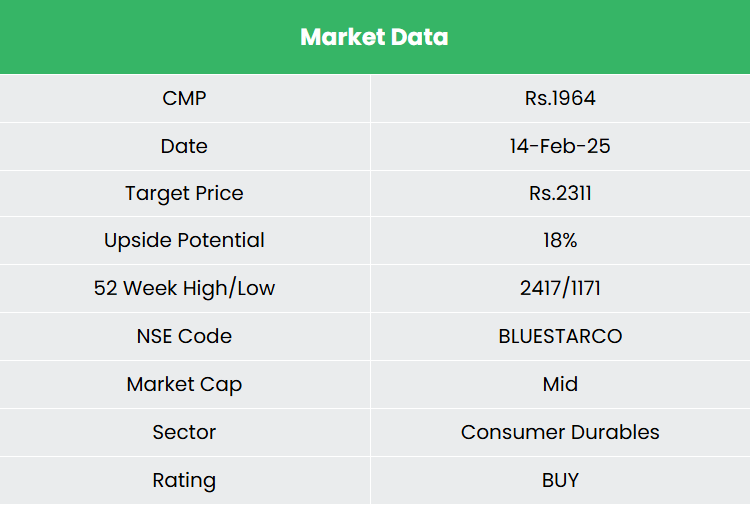

The corporate goals for important revenue progress by specializing in price administration, optimizing its product portfolio, increasing choices, and getting into new market and buyer segments. We advocate a BUY ranking within the inventory with the goal value (TP) of Rs.2,311, 65x FY26E EPS.

Threat

- Seasonality Threat – Majority of the merchandise bought by the corporate is seasonal in nature. Unexpected climate patterns equivalent to prolonged winter, nice summer season, lower than regular monsoon, extra monsoon, or any sort of disruptions in the course of the peak promoting seasons might result in both a stock-out or extra stock state of affairs and affect income progress.

- Provide chain constraints – The corporate would possibly face challenges in assembly demand, controlling prices and sustaining operational effectivity if there’s any limitation or disruption in provide chain.

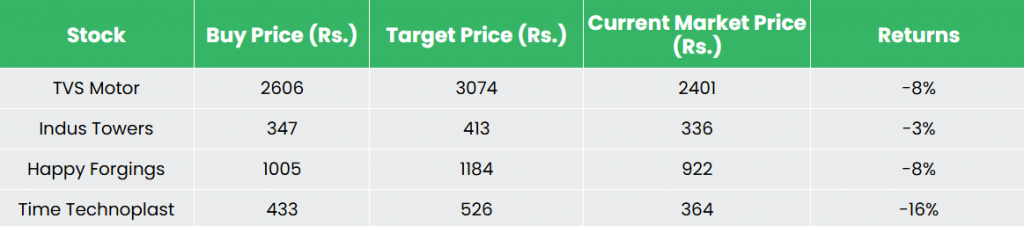

Recap of our earlier suggestions (As on 14 February 2025)

Completely satisfied Forgings Ltd

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork rigorously earlier than investing. Securities quoted listed below are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please word that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to traders.

For extra particulars, please learn the disclaimer.

Different articles it’s possible you’ll like

Put up Views:

436