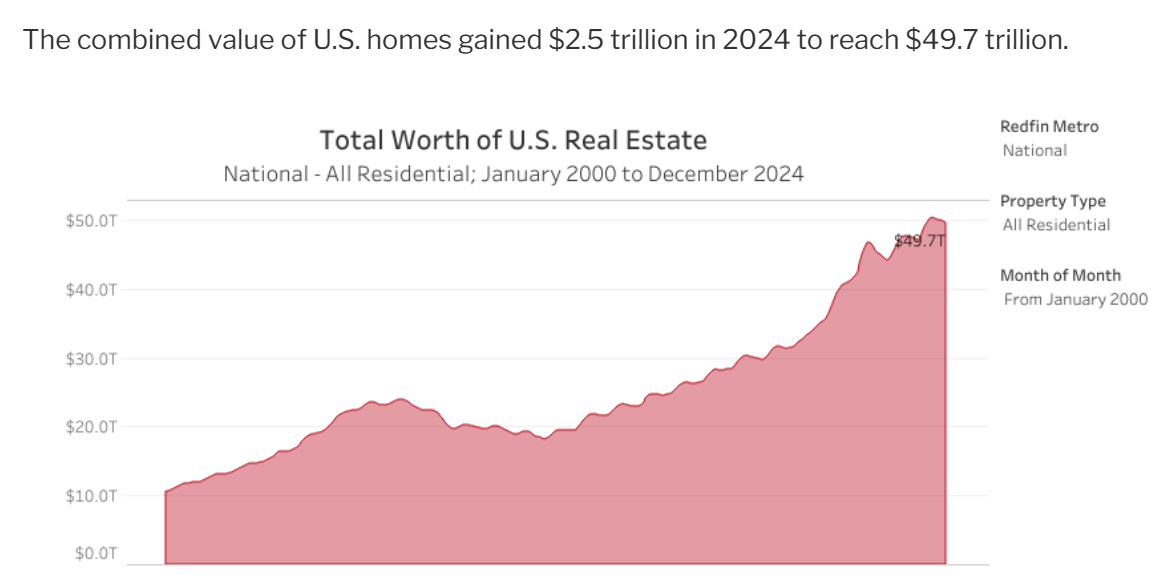

In keeping with Redfin, the U.S. housing market is now value a stone’s throw from $50 trillion:

Depedning on the day, that places the housing market roughly on par with the entire worth of the U.S. inventory market. Prior to now decade alone the entire worth of the housing market has greater than doubled (from $23 trillion in 2014).

Contemplating mortgage charges averaged almost 7% in 2024, it’s laborious to consider housing costs have been up one other 5% in 2024. That achieve follows annual housing returns of +19%, +6%, +6% and +4% from 2021-2024.

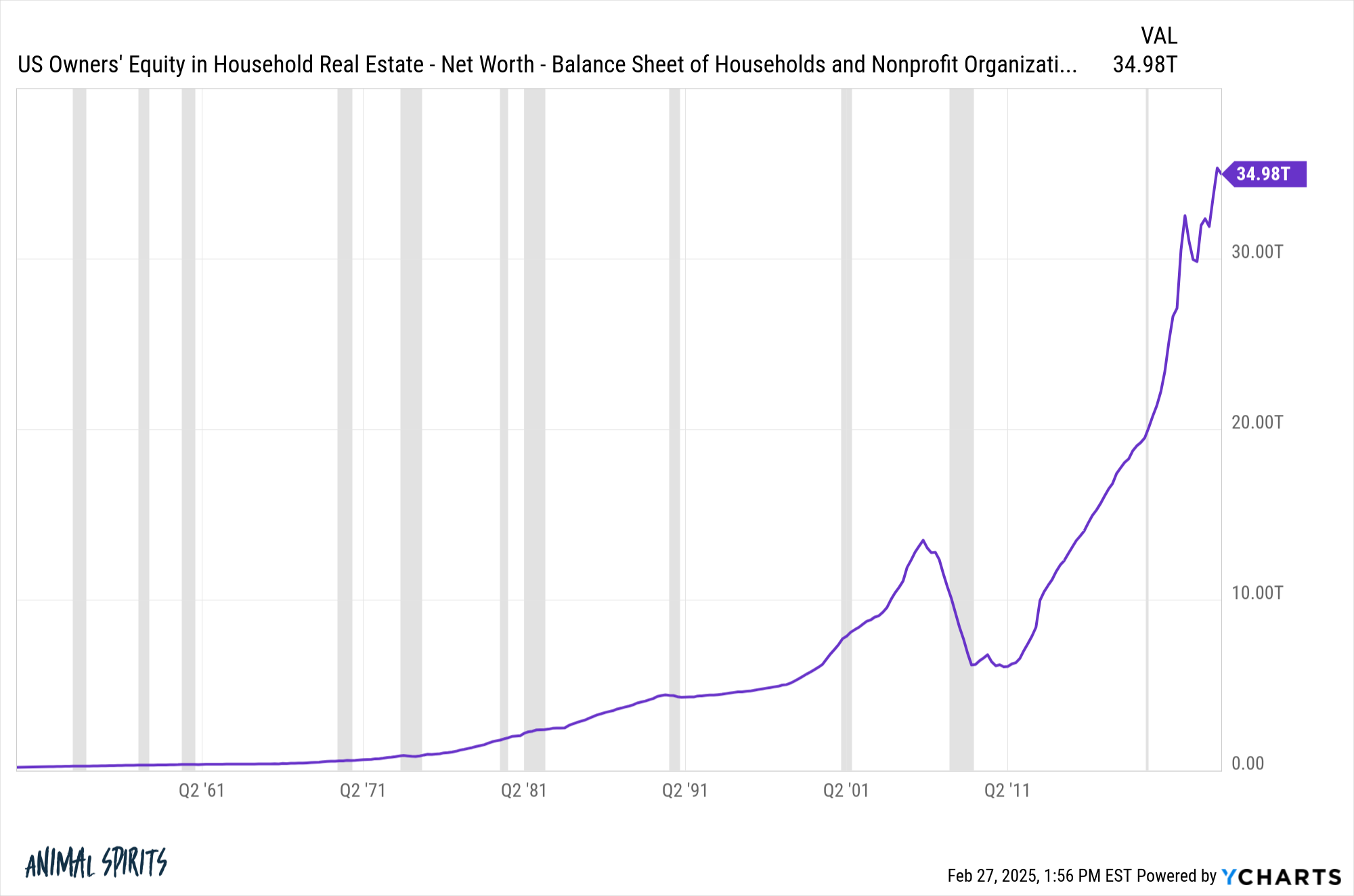

Whenever you throw in the truth that 70% of that $50 trillion is fairness, Individuals are sitting on some wholesome housing good points.1

Regardless of all of that house fairness simply sitting there, customers aren’t tapping it simply but (through Sonu Varghese):

My guess is quite a lot of this has to do with the truth that house fairness loans are within the 7-8% vary proper now. One would think about extra folks will likely be tapping that fairness if charges ever come down. We will see.

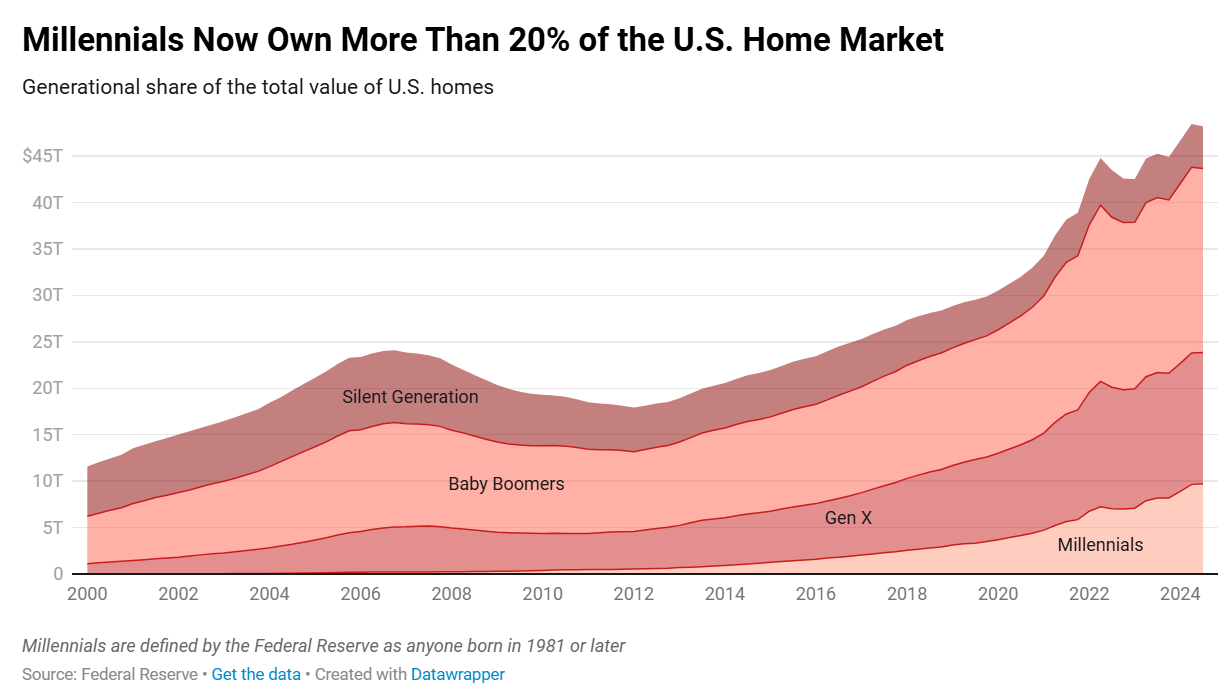

Loads of that fairness resides with child boomers, who personal 40% of the housing market. A lot of them now have homes paid off as effectively, which is smart contemplating their age. Gen X makes up almost 30% of the market however millennials are approaching sturdy:

I do know it’s laborious for a lot of younger folks to purchase a house proper now. Costs are excessive. Charges are excessive. Insurance coverage charges are excessive. Month-to-month funds are excessive.

Some younger persons are out of luck. Others are making it work with larger incomes and/or assist from their mother and father.

Millennials are the most important technology they usually would be the largest technology of householders in some unspecified time in the future within the subsequent couple of a long time. It’s simply math.

So what occurs to the housing market from right here?

Your guess is pretty much as good as mine. One of the best-case state of affairs is that worth will increase grind to a halt for just a few years so incomes can play catch-up. If housing costs do fall it’s not the top of the world as a result of there may be such an enormous margin of security.

The worst-case state of affairs for potential homebuyers is that costs preserve rising 3-5% per 12 months, and mortgage charges stay above 6% for an prolonged interval.

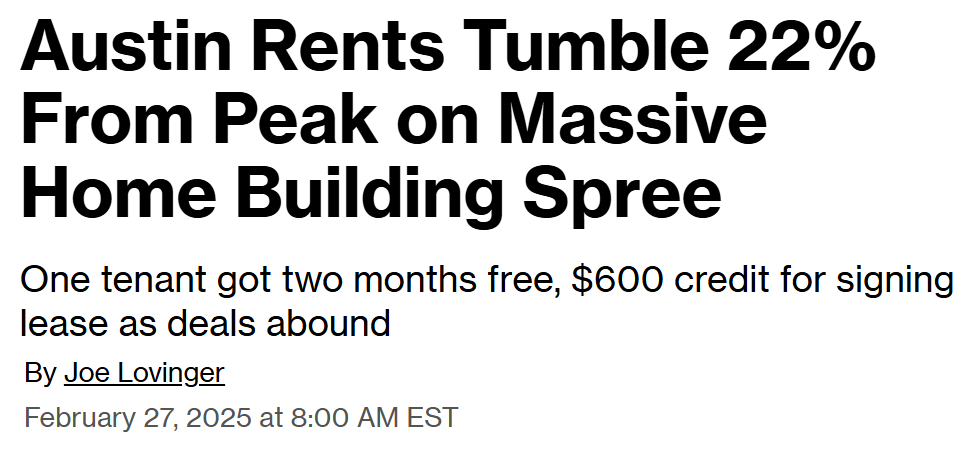

Now we have quite a lot of issues proper now that don’t have easy options. The straightforward answer to repair our housing market is to construct extra properties. It really works. Simply look what occurred to rents in Austin when builders constructed extra flats:

Possibly the homebuilders and building business aren’t capable of make this occur, however I can’t work out why our flesh pressers aren’t prioritizing it. Housing impacts everybody in some capability.

Hopefully sometime it should occur.

Michael and I talked all in regards to the housing market and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Timing the Housing Market: When Ought to You Promote?

Now right here’s what I’ve been studying recently:

Books:

1Clearly it’s not all good points. Loads of that fairness comes from folks paying down their mortgages.

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.