You might suppose having a $1M portfolio is a dream, however the reality is, that is extra achievable than most individuals count on.

Equally, once I first began investing, I didn’t think about I’d arrive at 2025 with $1 million in my funding portfolio – however that’s precisely how life panned out. By budgeting, rising my revenue and investing often, I managed to realize a breakthrough that my youthful self by no means imagined potential.

All that, whereas changing into pregnant twice and elevating two younger youngsters.

So even in case you’re busy juggling work and life – with no time to check or monitor the markets – I counsel that you would be able to look into utilizing passive investing methods like dollar-cost averaging (DCA) or organising a daily financial savings plan (RSP) that will help you construct your wealth.

Disclosure: This publish is delivered to you in collaboration with Nikko Asset Administration. All analysis and opinions are that of my very own, and shouldn't be taken as monetary recommendation in your particular scenario(s) as I do know nothing about your particular person monetary circumstances, danger tolerance or funding goals. I extremely advocate that you just use this as a place to begin to grasp extra in regards to the varied ETFs supplied by NikkoAM, after which click on into the respective hyperlinks above to retrieve the fund prospectus and efficiency in order that will help you resolve whether or not it suits into your funding goals

The true secret to hitting $1 million

Most individuals suppose it’s essential be tremendous good or have distinctive investing abilities with a view to obtain a $1 million portfolio, however that’s not needed.

Within the phrases of Warren Buffett, “The inventory market is designed to switch cash from the Lively to the Affected person. Investing isn’t a recreation the place the man with the 160 IQ beats the man with the 130 IQ.”

In my view, the true secret to reaching the $1 million milestone is to remain invested (this requires self-discipline) and never let your feelings dictate your purchase/promote choices.

Consistency and self-discipline.

It’s not about luck, or how effectively you’ll be able to time the markets.

So long as you make investments often, let compounding do its magic and keep away from emotional buying and selling, I belief that you just’ll finally get there.

The sooner you begin, the simpler it’s.

Concentrate on incomes extra and investing passively. As a substitute of attempting to outsmart the market, let a easy technique be just right for you whilst you deal with rising your revenue.

Don’t underestimate the ability of investing often

Most individuals have a tendency to speculate throughout market highs and keep out when the markets are down. However I at all times believed that purchasing throughout instances of greed and promoting throughout instances of worry is the fallacious strategy to make investments – you’re actually shopping for excessive and promoting low!

Definitely, not everybody has the time to select shares or analyze market traits. In the event you’re centered on constructing your profession, operating a enterprise, or elevating a household, you is perhaps tempted to place off investing in your future and let it take a backseat.

However what if I informed you that you might nonetheless develop a million-dollar portfolio with out spending hours on analysis?

Even in case you do not need a variety of time to watch the markets, utilizing passive investing methods can assist you keep on observe.

With dollar-cost averaging (DCA), as an illustration, it takes the guesswork out of investing. You make investments a hard and fast quantity at common intervals (e.g. month-to-month) no matter market situations. When costs are excessive, your funding buys you much less shares or items. When costs fall, you get extra for a similar quantity. This helps smoothen out market volatility and removes the stress of you attempting to time the market.

Greenback Value Averaging - If an index ETF is buying and selling close to S$4.00 per unit, an funding of S$1,000 would purchase 250 items for that month. Nonetheless, if the value falls to S$2.00, the identical S$1,000 would purchase 500 items, whereas a acquire to S$8.00 would see simply 125 items purchased with the identical S$1,000. This method sees the investor accumulate extra items when costs are decrease, serving to traders to keep away from the remorse of poor timing choices, keep disciplined and keep away from overtrading market actions.

A straightforward strategy to apply this technique could be to arrange a Common Financial savings Plan (RSP). These are automated funding plans that you would be able to create with nearly any financial institution or brokerage in Singapore right this moment, which then invests in your behalf into your chosen ETFs, unit trusts, or blue-chip shares every month.

At the beginning of final 12 months, I taught a free learners investing class to 300 of my readers and did an experiment the place I arrange a RSP on the spot for them to see how simple it could possibly be. It took me quarter-hour and I specified a hard and fast quantity to be withdrawn from my account to speculate on my behalf each month.

The returns on my RSP has made me greater than what the same sum sitting in my high-yield financial savings checking account has gotten.

Not too unhealthy for simply quarter-hour of labor and set-up.

If that’s not adequate proof to persuade you that RSPs might be a straightforward strategy to develop your wealth, right here’s extra.

The Path to $1 Million: How A lot Ought to You Make investments?

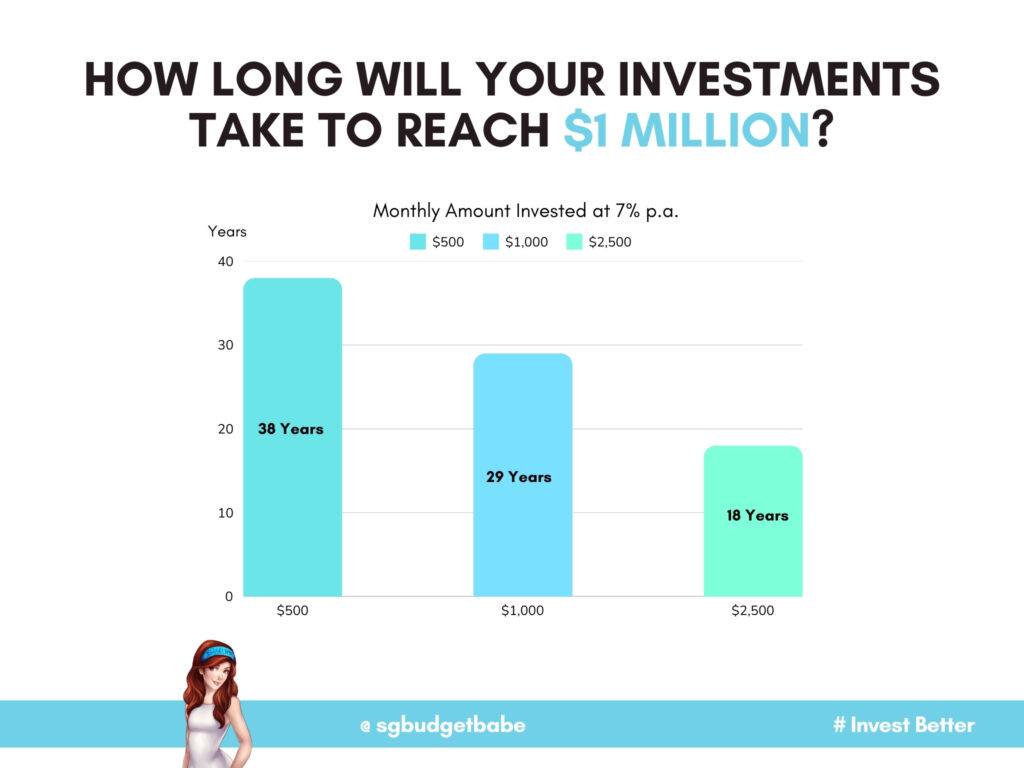

Right here’s a easy breakdown of how a lot it’s essential make investments month-to-month to hit $1 million, assuming a 7% annual return (utilizing a conservative historic common of the S&P 500):

Purely for illustration functions solely. There might be no assurance the above returns might be achieved in your scenario. A number of components together with market downturns and your individual actions can have an effect on the result which might embrace a acquire or loss in investments.

In the event you begin in your 20s or 30s, hitting $1M earlier than your retirement might be achievable – even in case you begin with a modest funding of simply $500 every month.

Once I first began investing, I used to be nonetheless incomes a take-home pay of $2,000. However I nonetheless invested each month with out fail. If I obtained any further revenue or bonuses, it went into my investments. It didn’t matter whether or not the markets have been up or down – I invested by means of the 2016 oil disaster, the 2018 extended crypto winter, the 2020 COVID crash and particularly in the course of the 2022 tech meltdown.

After 10 years of investing diligently, I crossed the $1 million milestone final 12 months in December.

RSPs: A Newbie Investor’s Greatest Buddy

Time is an investor’s largest ally. Additionally it is probably the largest issue that may have an effect on your wealth-building journey within the markets.

Most individuals actually solely have 4 a long time to speculate. Your 20s, 30s, 40s, and 50s. Yearly that you just resolve to attend is one other 12 months gone the place your cash may have grown for you.

In the event you wait too lengthy to speculate, that’s time that you’ll by no means be capable to get again.

I began investing in my 20s and crossed the $1M milestone in my 30s. You possibly can solely think about how my portfolio will appear like within the subsequent decade (psst, observe this weblog and test again right here to search out out then!)

The excellent news is, you’ll be able to resolve to start out investing your cash and let compounding do the be just right for you, over time.

I began investing in my 20s and crossed the $1M milestone in my 30s. You possibly can solely think about how my portfolio will appear like within the subsequent decade (psst, observe this weblog and test again right here to search out out then!)

The excellent news is, you’ll be able to resolve to start out investing your cash and let compounding do the be just right for you, over time.

And even in case you’re too scared to select particular person shares, then RSPs may very effectively be your greatest pal that will help you make investments with no need a lot effort from you each month – no must display or analyze particular person shares, and even in case you’re busy, your investments will nonetheless run on autopilot for you. Nonetheless, like all investments, there are danger components to be thought of when investing in a sure sector or area. RSPs don’t absolve one from the necessity to conduct the private due diligence required earlier than making any funding choices. Greenback price averaging into a foul funding doesn’t make it a superb funding.

Upcoming Occasion!

As I’ve repeatedly preached over the past decade of operating this weblog, the largest mistake you might make is to wait too lengthy to start out investing.

Even in case you start with simply $100 or $200 a month, the important thing factor is to start out in order that your cash will get put to be just right for you within the monetary markets sooner fairly than later.

As an illustration, in case you favor a balanced portfolio, you’ll be able to take a look at the Nikko AM Singapore STI ETF and ABF Singapore Bond Index Fund right here for some concepts.

Or, in case you’re a fan of Actual Property Funding Trusts (REITs) for his or her dividends however don’t know which REIT to select, then the NikkoAM-StraitsTrading Asia ex Japan REIT ETF – which encompasses the highest listed REITs in not solely Singapore but in addition the remainder of Asia ex Japan – could possibly be a superb place to start out trying.

And in case you’ll prefer to find out how I crossed $1M in my very own portfolio whereas juggling my profession and household, all inside a decade, be a part of me in my upcoming session at SGX the place I’ll break all of it down.

Register right here to order your seat!

Necessary Info by Nikko Asset Administration Asia Restricted:

This doc is solely for informational functions solely for granted given to the precise funding goal, monetary scenario and specific wants of any particular particular person. It shouldn't be relied upon as monetary recommendation. Any securities talked about herein are for illustration functions solely and shouldn't be construed as a advice for funding. It is best to search recommendation from a monetary adviser earlier than making any funding. Within the occasion that you just select not to take action, you need to take into account whether or not the funding chosen is appropriate for you. Investments in funds should not deposits in, obligations of, or assured or insured by Nikko Asset Administration Asia Restricted (“Nikko AM Asia”).Previous efficiency or any prediction, projection or forecast isn't indicative of future efficiency. The Fund or any underlying fund could use or put money into monetary spinoff devices. The worth of items and revenue from them could fall or rise. Investments within the Fund are topic to funding dangers, together with the potential lack of principal quantity invested. It is best to learn the related prospectus (together with the chance warnings) and product highlights sheet of the Fund, which can be found and could also be obtained from appointed distributors of Nikko AM Asia or our web site (www.nikkoam.com.sg) earlier than deciding whether or not to put money into the Fund.

The knowledge contained herein will not be copied, reproduced or redistributed with out the categorical consent of Nikko AM Asia. Whereas affordable care has been taken to make sure the accuracy of the knowledge as on the date of publication, Nikko AM Asia doesn't give any guarantee or illustration, both categorical or implied, and expressly disclaims legal responsibility for any errors or omissions. Info could also be topic to alter with out discover. Nikko AM Asia accepts no legal responsibility for any loss, oblique or consequential damages, arising from any use of or reliance on this doc.

This commercial has not been reviewed by the Financial Authority of Singapore.

The efficiency of the ETF’s worth on the Singapore Change Securities Buying and selling Restricted (“SGX-ST”) could also be completely different from the online asset worth per unit of the ETF. The ETF may be suspended or delisted from the SGX-ST. Itemizing of the items doesn't assure a liquid marketplace for the items. Traders ought to word that the ETF differs from a typical unit belief and items could solely be created or redeemed instantly by a taking part vendor in giant creation or redemption items.The Central Provident Fund (“CPF”) Strange Account (“OA”) rate of interest is the legislated minimal 2.5% every year, or the 3-month common of main native banks' rates of interest, whichever is greater, reviewed quarterly. The rate of interest for Particular Account (“SA”) is at the moment 4% every year or the 12-month common yield of 10-year Singapore Authorities Securities plus 1%, whichever is greater, reviewed quarterly. Solely monies in extra of $20,000 in OA and $40,000 in SA might be invested beneath the CPF Funding Scheme (“CPFIS”). Please discuss with the web site of the CPF Board for additional data. Traders ought to word that the relevant rates of interest for the CPF accounts and the phrases of CPFIS could also be different by the CPF Board on occasion.

The items of Nikko AM Singapore STI ETF should not in any approach sponsored, endorsed, offered or promoted by FTSE Worldwide Restricted ("FTSE"), the London Inventory Change Plc (the "Change"), The Monetary Occasions Restricted ("FT") SPH Knowledge Companies Pte Ltd ("SPH") or Singapore Press Holdings Ltd ("SGP") (collectively, the "Licensor Events") and not one of the Licensor Events make any guarantee or illustration in anyway, expressly or impliedly, both as to the outcomes to be obtained from using the Straits Occasions Index ("Index") and/or the determine at which the stated Index stands at any specific time on any specific day or in any other case. The Index is compiled and calculated by FTSE. Not one of the Licensor Events shall be beneath any obligation to advise any particular person of any error therein. "FTSE®", "FT-SE®" are commerce marks of the Change and the FT and are utilized by FTSE beneath license. "STI" and "Straits Occasions Index" are commerce marks of SPH and are utilized by FTSE beneath licence. All mental property rights within the ST index vest in SPH and SGP.

The items of NikkoAM-StraitsTrading Asia ex Japan REIT ETF should not in any approach sponsored, endorsed, offered or promoted by FTSE Worldwide Restricted ("FTSE''), by the London Inventory Change Group firms ("LSEG''), Euronext N.V. ("Euronext"), European Public Actual Property Affiliation ("EPRA"), or the Nationwide Affiliation of Actual Property Funding Trusts ("NAREIT") (collectively the "Licensor Events") and not one of the Licensor Events make any guarantee or illustration in anyway, expressly or impliedly, both as to the outcomes to be obtained from using the FTSE EPRA/NAREIT Asia ex Japan Internet Complete Return REIT Index (the "Index") and/or the determine at which the stated Index stands at any specific time on any specific day or in any other case. The Index is compiled and calculated by FTSE. Nonetheless, not one of the Licensor Events shall be liable (whether or not in negligence or in any other case) to any particular person for any error within the Index and not one of the Licensor Events shall be beneath any obligation to advise any particular person of any error therein. "FTSE®" is a commerce mark of LSEG, "NAREIT®" is a commerce mark of the Nationwide Affiliation of Actual Property Funding Trusts and "EPRA®" is a commerce mark of EPRA and all are utilized by FTSE beneath licence."

Neither Markit, its Associates or any third celebration knowledge supplier makes any guarantee, categorical or implied, as to the accuracy, completeness or timeliness of the info contained herewith nor as to the outcomes to be obtained by recipients of the info. Neither Markit, its Associates nor any knowledge supplier shall in any approach be liable to any recipient of the info for any inaccuracies, errors or omissions within the Markit knowledge, no matter trigger, or for any damages (whether or not direct or oblique) ensuing therefrom. Markit has no obligation to replace, modify or amend the info or to in any other case notify a recipient thereof within the occasion that any matter said herein modifications or subsequently turns into inaccurate. With out limiting the foregoing, Markit, its Associates, or any third celebration knowledge supplier shall don't have any legal responsibility in anyway to you, whether or not in contract (together with beneath an indemnity), in tort (together with negligence), beneath a guaranty, beneath statute or in any other case, in respect of any loss or injury suffered by you on account of or in reference to any opinions, suggestions, forecasts, judgments, or some other conclusions, or any plan of action decided, by you or any third celebration, whether or not or not primarily based on the content material, data or supplies contained herein. Copyright © 2024, Markit Indices Restricted.

The Markit iBoxx SGD Non-Sovereigns Giant Cap Funding Grade Index are marks of Markit Indices Lmited and have been licensed to be used by Nikko Asset Administration Asia Restricted. The Markit iBoxx SGD Non-Sovereigns Giant Cap Funding Grade Index referenced herein is the property of Markit Indices Restricted and is used beneath license. The Nikko AM SGD Funding Grade Company Bond ETF isn't sponsored, endorsed, or promoted by Markit Indices Restricted.

Nikko Asset Administration Asia Restricted. Registration Quantity 198202562H.