A reader asks:

I’ve seen some pundits (*cough* Chamath *cough*) now shifting their stance to “short-term ache for long-term acquire” from the entire political upheaval we’re seeing. Principally the thought is a recession will really be helpful as a result of residence costs, inventory costs and rates of interest will go down. I feel that is nuts however needed to listen to your take — are there any positives from a recession?

In only a few brief months we’ve gone from worries about an financial system that might be susceptible to overheating to worries concerning the financial system slowing dramatically. GDP estimates for Q1 have gone from practically +4% a month in the past to -2.8% in a rush:

These estimates aren’t set in stone, however financial exercise is slowing.

One factor we’ve realized these previous few years is that nobody is sweet at predicting the timing of recessions, however that doesn’t cease folks from speculating concerning the potential ramifications of an financial contraction when it lastly arrives.

Right here’s what Chamath needed to say on Twitter concerning the prospect of Trump’s no insurance policies probably throwing the nation right into a recession:

It’s a protracted one so enable me to summarize: A major proportion of the nation doesn’t personal a lot in the best way of monetary belongings like shares or a home. If we have now a recession that ought to convey inventory costs and housing costs down which might make them extra accessible to extra folks.

He’s in search of a silver lining. I get that. I’m a glass-is-half-full man too.

This sounds nice in idea.

Loads of younger folks would love extra reasonably priced residence costs and a greater entry level into the inventory market. A recession would additionally possible imply decrease borrowing prices so mortgage charges can be decrease.

What’s to not like?

Since 1950, there have been 9 bear markets. The typical drawdown in these bear markets was a lack of 35.5%, lasting 406 days from peak to trough. The flexibility to purchase shares on sale needs to be a welcomed improvement for younger folks or anybody who might be a internet saver within the years forward.

The issue is you don’t get to expertise recessions in a vacuum.

Individuals lose their jobs. Companies in the reduction of or go stomach up. Individuals spend much less cash. It’s tougher to seek out new employment or get a promotion. Wages fall. Large raises go away.

Through the 2008 monetary disaster and its aftermath there was a continuing drumbeat of:

You’re fortunate to also have a job.

You desire a increase. On this financial system?!

That lasted for years after the technical recession had ended.

Plenty of finance folks have a look at recessions via the lens of spreadsheets and charts. I’m responsible of this too. However the human toll from a recession can’t be overstated. Ronald Reagan as soon as mentioned, “A recession is when your neighbor loses their job. A despair is once you lose yours.”

Watch out what you want for.

JP Morgan as soon as mentioned, “In bear markets, shares return to their rightful house owners.”

Some interpret that as a behavioral lesson the place solely these buyers with sufficient intestinal fortitude to lean into the ache will purchase when shares are on sale. There may be some fact to that.

Nonetheless, these “asset-light” people will wrestle to pay their payments or preserve their jobs throughout a recession as a result of they haven’t any assist from monetary belongings. Who do you assume goes to lean into the ache and purchase? The individuals who purchase would be the ones who have already got the cash.

The highest 10% of households by wealth personal practically 90% of the shares in the USA. They’re those who can preserve shopping for in a downturn. Proper or fallacious, these are the rightful house owners JP Morgan was referring to.

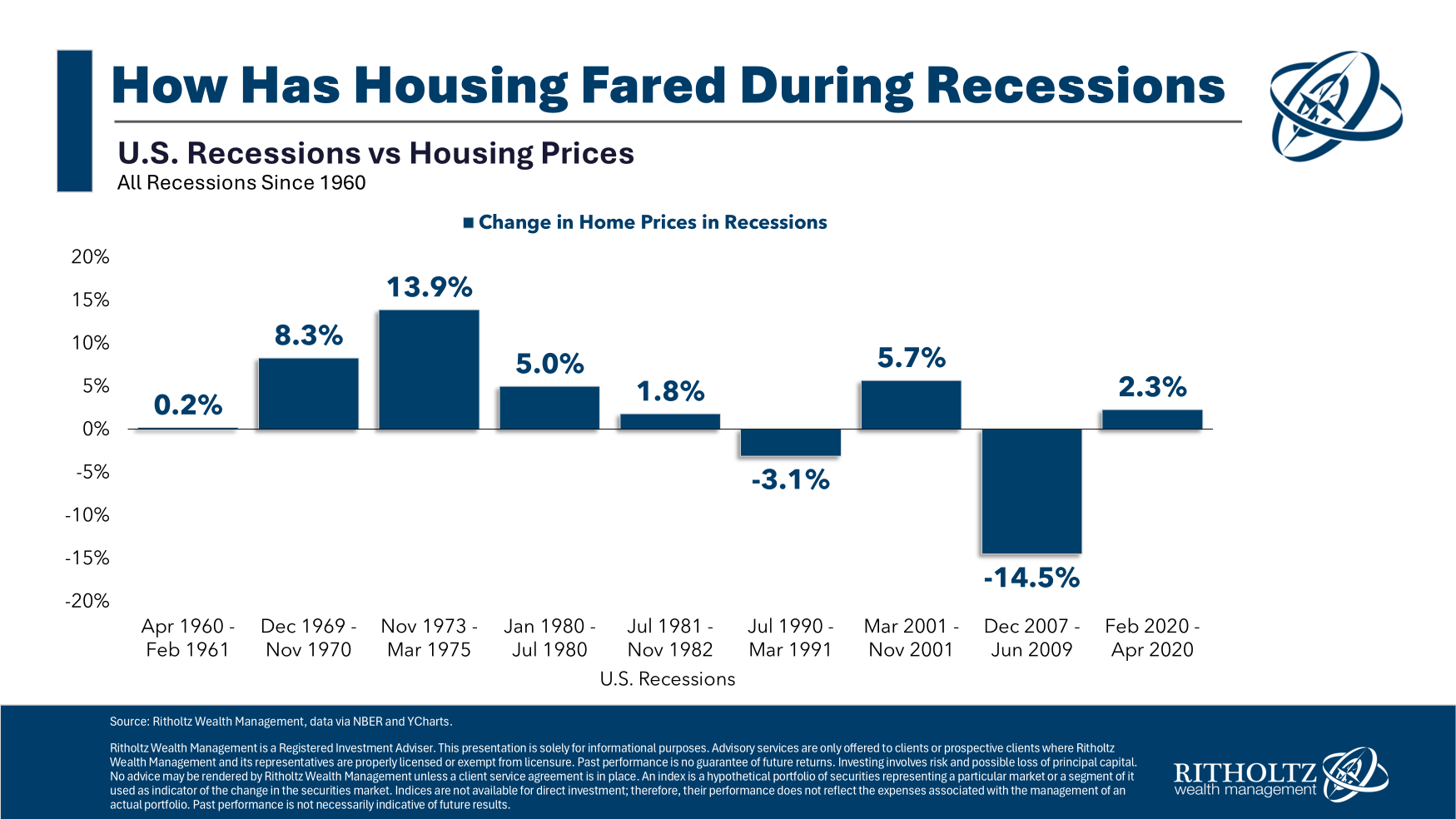

I additionally hate to be the bearer of unhealthy information to potential homebuyers however there isn’t any assure that housing costs will fall, even when we go right into a recession. That is housing value efficiency throughout each recession going again to 1960:

There was a short decline within the 1990 recession and naturally the Nice Monetary Disaster noticed housing costs get walloped. Apart from that, housing costs have been among the many finest hedges in opposition to a recession.

If the financial system contracts, we might even see some aid in mortgage charges. Nonetheless, that doesn’t essentially imply housing costs will drop. In actual fact, decrease charges might really drive extra demand for properties, particularly since exercise has been sluggish with 7% mortgage charges. Whereas elevated market exercise can be a optimistic improvement, it wouldn’t routinely result in decrease costs. It will be an excellent factor to see extra exercise within the housing market however which may really result in larger costs.

Personally, I might fairly we don’t have a recession. Job loss is painful. It may well set folks again years of their lives.

Nonetheless, you even have to acknowledge that you haven’t any management over the explanation for a recession–whether or not or not it’s a monetary disaster, pandemic, authorities coverage, inflation or one thing else.

No matter your station is in life it’s important to be ready for a nationwide or private recession sooner or later:

- Guarantee your emergency fund is nicely stocked.

- Have another monetary backstops in place.

- Create a considerate monetary plan.

- Maintain your self employable.

- Maintain saving cash.

- Construct a margin of security into your price range.

Recessions could be a good factor for sure people and companies. There have been a handful of nice companies based in periods of financial ache — Airbnb, Uber, FedEx, Microsoft and LinkedIn to call a number of.

However I’m not going to sit down right here and inform you to hope for a recession. Recessions are unhealthy and we should always keep away from them if potential.

The drawbacks far outweigh the advantages.

We coated this query on this week’s Ask the Compound:

My tax man Invoice Candy joined us on the present to debate questions on Roth 401ks, coping with uncertainty in a monetary plan, shopping for a golf membership to a premium membership and conventional vs. Roth belongings in retirement.

Additional Studying:

Market Timing a Recession