by Hope

That is my tentative funds for after the home sells.

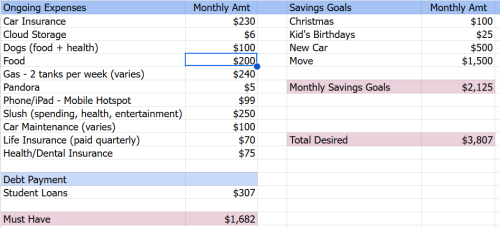

The gadgets on the left hand column are “required”, those on the fitting are “targets”. The overall wanted to reside comfortably $3,807. Eliminating my bank card debt and housing prices might be an enormous weight off my shoulders. What am I lacking or forgetting on this funds?

One factor to notice, is that this funds was created with the thought of touring and automobile tenting in thoughts (see all of the fuel,) however for the majority of the summer time, I might be stationary. The plan throughout the months I’m with my mother and father might be to place all monies not spent into financial savings.

Once more, the 2 yr objective is to save lots of sufficient to have the ability to purchase land for a tiny home. Thus, the $1,500 per 30 days for Transfer. After 2 years, that might be $36,000.

I might be posting my “what is going to I do with the home cash plan” within the subsequent few days. It’s a very smooth plan as I’m undecided how a lot cash I’ll stroll with. The present guesstimate is round $50K, however once more, that’s a very unfastened estimate.

Home Replace

The home is presently below contract…once more. Since that is the third time, I’ve discovered to not rely my chickens earlier than they hatch. So we wait…

It did go below contract to considered one of my “exclusions” with the realtor. A household who had seen the home a few occasions earlier than I signed the contract with him. In reality, they didn’t make a suggestion till the day the skilled footage got here again and it was going to be listed on MLS. So I’m saving 3.5% in realtor charges if this one closes. I’m paying the consumers’ agent 2.5%.

They’d 3 contingency intervals, the primary has expired. They’ve put down $1,000 in earnest cash. And the inspection occurred this week. The second contingency interval ends Sunday. If we get by means of that, I really feel like it would probably shut.

However once more…simply ready and specializing in work.

Hope is a resourceful and solutions-driven enterprise supervisor who has spent almost 20 years serving to shoppers streamline their operations and develop their companies by means of mission administration, digital advertising and marketing, and tech experience. Not too long ago transitioning from her function as a single mother of 5 foster/adoptive youngsters to an empty nester, Hope is navigating the emotional and sensible challenges of redefining her life whereas sustaining her willpower to regain monetary management and get rid of debt.

Residing in a comfortable small city in northeast Georgia together with her three canines, Hope cherishes the serenity of the mountains over the bustle of the seaside. Although her youngsters are actually discovering their footing on this planet—pursuing training, careers, and independence—she stays deeply dedicated to supporting them on this subsequent chapter, at the same time as she faces the bittersweet tug of letting go.

Since becoming a member of the Running a blog Away Debt group in 2015, Hope has candidly shared her journey of economic ups and downs. Now, with a renewed focus and a transparent path forward, she’s able to sort out her funds with the identical ardour and perseverance that she’s delivered to her life and profession. Via her writing, she continues to encourage others to confront their very own monetary challenges and attempt for a brighter future.