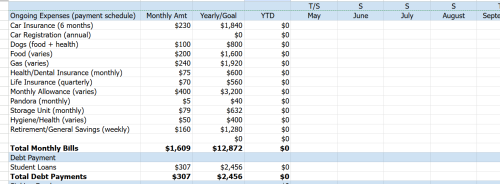

I respect all of the suggestions on my submit sale price range. I’ve revised it so as to add extra classes.

This covers the time interval of Could 15-the finish of 2025 (eight months). And I believed that monitoring whether or not it was a journey month, stationary month, or combine would make sense once I look again on this as that issue alone will drastically have an effect on a number of the categorial spending.

What classes have I missed? I need to get this nailed down earlier than the sale closes so I’ve a transparent plan on methods to proceed.

Notes:

- I noticed a number of suggestions for revisiting life insurance coverage. I’ve added it to my to do listing as soon as I arrive in Texas mid to late Could.

- I’ll need to switch my automotive insurance coverage and registration no later than the top of the yr, I don’t understand how a lot that can run in Texas so leaving insurance coverage as it’s now, and can revisit automotive registration when it comes time. My present tag expires in December so I’ve a short while.

- Clearly the gasoline, meals, allowance classes will fluctuate primarily based on it being a journey or stationary month. Once I’m stationary, they may simply construct up.

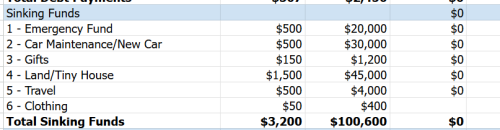

Sinking Funds

I must have financial savings objectives. However I did transfer them to sinking funds and gave myself both a long run objective or month-to-month objective. And I’ll observe by month how a lot I contribute to every class.

I put them so as and set a month-to-month objective. My thought is that this:

Once I hit the month-to-month objective for that class, I’ll begin on the subsequent precedence merchandise for that month. For instance, let’s say I make sufficient to contribute $500 to my EF in June, I might then begin on the $500 towards the month-to-month automotive upkeep objective and so forth. And I begin over at no 1 every month UNTIL, I hit the annual/total objective. So once I get $20K in a EF, then each month I might begin on quantity 2… and so forth.

Does that make sense?

Revenue

I do know you need to see my earnings. However it fluctuates drastically. With this price range, I’ve to usher in roughly $2K monthly after taxes and overhead to keep up, any greater than that goes to the sinking funds. I feel that’s simply achievable.

Some months I barely make $2K, however then with one challenge that jumps as much as $8K. So I can’t actually predict my month-to-month earnings. However I can let you know that I’m laser targeted on not solely daily work, however I’m engaged on two totally different passive earnings methods and have been for six months now. Work in progress.

I’m additionally planning to seek for an element time, in individual job in Texas simply to get me out of the home a bit. Perhaps 1-2 evenings every week when a sibling can cowl my mother and father. Most likely extra of a psychological well being factor, however will present some earnings.

What do I must make clear? What have I missed? (Earlier than you ask, debt numbers are simply across the nook.)

The submit Publish Sale – Finances – Take 2 appeared first on Running a blog Away Debt.