The American Specific® Gold Card is one among our prime picks relating to incomes bonus factors on eating and groceries. Nonetheless, offsetting its excessive $325 annual price (see charges and costs) by maximizing as much as $424 in annual assertion credit takes a good bit of effort — particularly while you’re overseas.

I’ve spent the previous three months touring via South America and have discovered some methods to get worth from the cardboard’s credit. So, whether or not you are overseas quickly or long run, listed below are my recommendations on how you can get probably the most out of the Amex Gold’s 4 assertion credit.

Reload your Dunkin’ stability

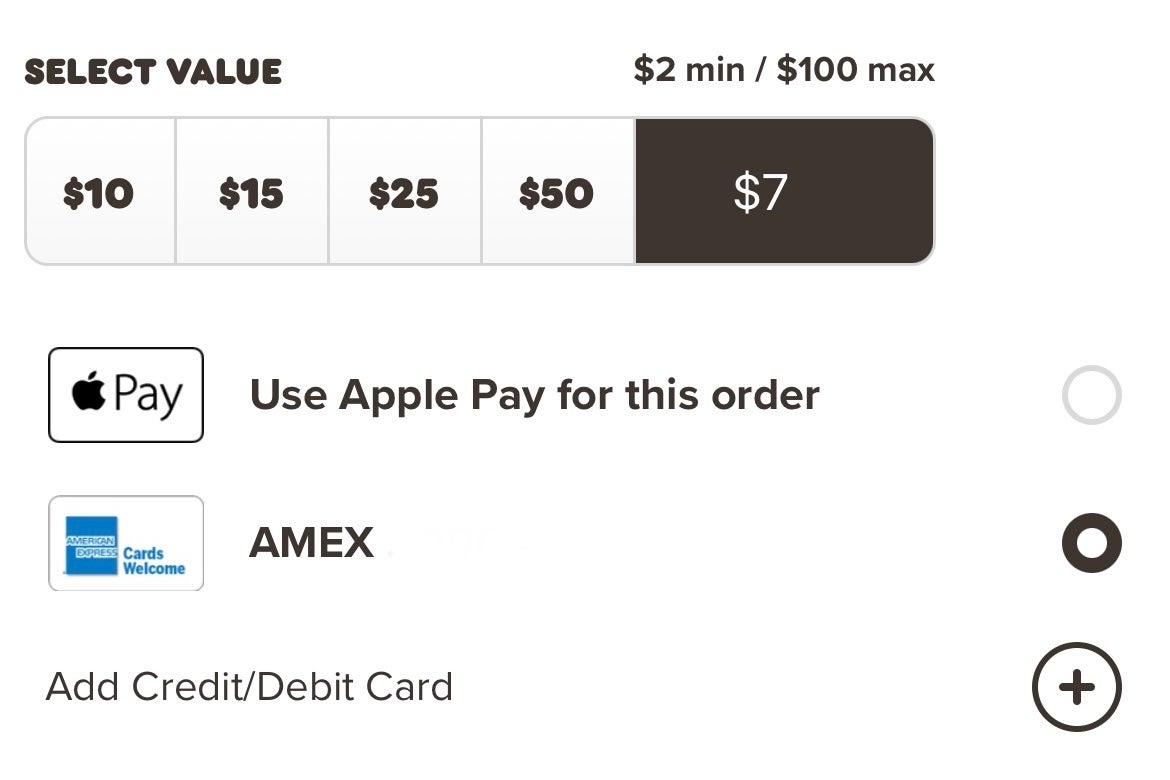

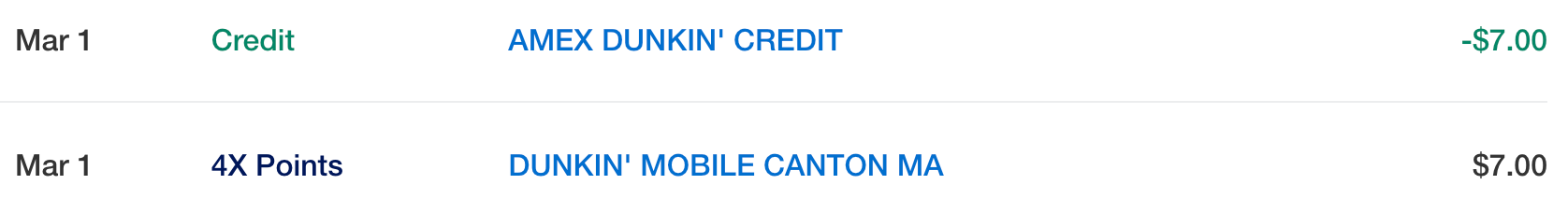

That is a simple one. Whereas I am overseas, I am unable to use the credit score because it’s solely legitimate within the U.S., however I can nonetheless reload my stability for future use. Obtain the Dunkin’ cellular app, go to the “Scan / Pay” tab and use your Amex Gold to reload your stability with $7 each month (enrollment required).

As a result of the acquisition codes as “Dunkin’ Cellular,” it earns the 4 factors per greenback Amex Gold awards at eating places worldwide on the primary $50,000 spent every calendar yr (1 level per greenback thereafter).

I’ve accomplished this every month because the assertion credit score was added in July 2024 and the credit score has been backdated to the identical day each time.

Purchase a Goldbelly (or Wine.com) present card

The Amex Gold provides cardmembers as much as $120 per calendar yr in assertion credit — as much as $10 per 30 days — for eating purchases from choose retailers (enrollment required).

Out of the 5 eligible eating assertion credit score retailers, my prime advice is to purchase a Goldbelly e-gift card. Goldbelly “delivers meals and meals items from iconic eating places and meals makers throughout america” — albeit at a premium worth.

I’ve bought a $10 e-gift card from Goldbelly twice and the credit score has posted inside three and 9 days, respectively. You possibly can then mix a number of present playing cards when inserting an order, both for your self while you’re again within the U.S. or as a present for a liked one. This stuff provide free transport.

Shopping for an e-gift card from Wine.com additionally triggers the credit score, which TPG bank cards author Chris Nelson acquired inside three days. Nonetheless, there are two drawbacks:

Each day E-newsletter

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

- The minimal present card buy is $25

- You possibly can solely use as much as two present playing cards per buy

So, it is a good methodology if you wish to purchase a $30 bottle of wine each two months. You’d pay $50 complete for 2 present playing cards and Amex would provide you with $20 in assertion credit. Successfully, the Amex credit cowl the $19.99 transport price, that means you are shopping for a $30 bottle of wine for $30 — with “free” transport, courtesy of Amex.

As for the opposite three listed retailers, we examined shopping for e-gift playing cards from Grubhub and The Cheesecake Manufacturing unit — and neither triggered the credit score. And 5 Guys solely affords present playing cards in particular person at one among their areas.

Order Uber Eats for a liked one

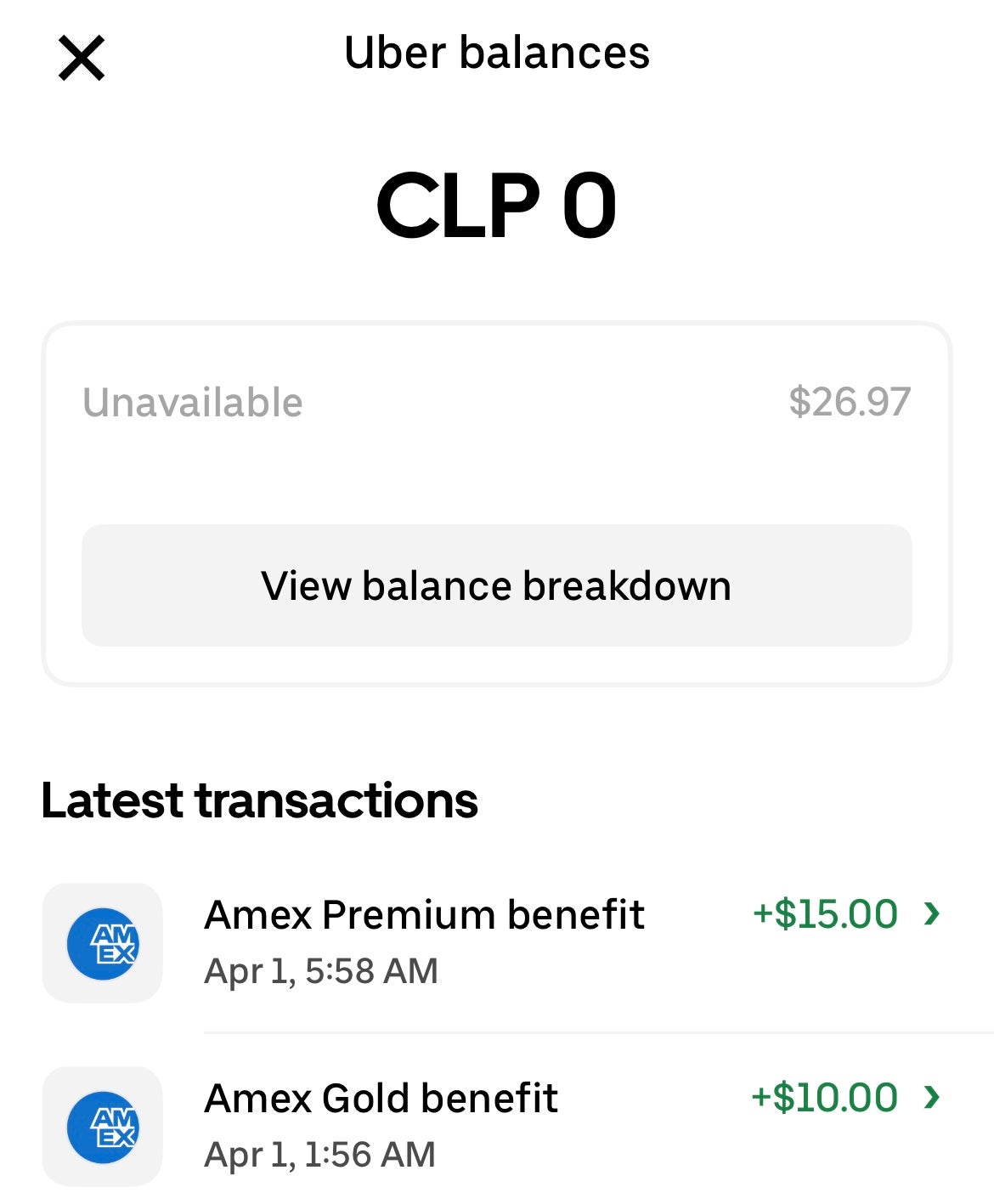

This has been the trickiest credit score to maximise.

The very best workaround I’ve discovered has been to pay for a liked one’s Uber experience or Uber Eats order again within the U.S. It does require a very good quantity of real-time coordination with that particular person to prepare the logistics of the experience or order, although.

You will obtain as much as $120 in Uber Money yearly, which comes within the type of a $10 month-to-month credit score.

Word that you need to use any Amex card as your fee methodology so as to use your Uber Money — simply make certain your Amex Gold is added to your Uber account first.

Buy a restaurant present card

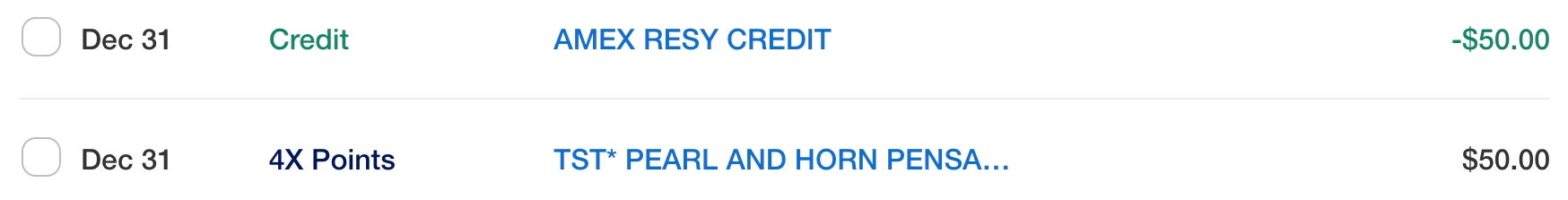

If you happen to’re within the U.S. not less than as soon as each six months, this assertion credit score is pretty simple to make use of in particular person (enrollment required). It is cut up into two components: an as much as $50 credit score from January to June and one other as much as $50 credit score from July to December.

I make it a degree to go to a Resy-affiliated restaurant — one which accepts reservations via Resy — twice a yr and pay with my Amex Gold. You need not make a reservation for the credit score to set off — you simply have to pay along with your Gold card.

Additionally, control your account to ensure the credit score posts. In my expertise, the primary time I used this credit score — I waited the total eight weeks and needed to chat with an Amex agent on-line to get the credit score utilized manually. Nonetheless, the second time I used this profit, the credit score posted the identical day.

If you cannot be within the U.S. each six months, strive buying a present card from a Resy-affiliated restaurant on-line or calling the restaurant immediately. You will doubtless earn 4 factors per greenback spent on this buy because it must be thought of a restaurant buy.

TPG e-newsletter and partnerships editor Emily Thompson acquired in on the nick of time on Dec. 31 by shopping for a present card at a Pensacola, Florida restaurant to obtain her credit score for the second half of the yr.

Word that every restaurant codes purchases in a different way, so your present card buy is not assured to set off the credit score. Be sure to select a restaurant the place you would be joyful to spend as much as $50 both method.

Backside line

It is vital to squeeze as a lot worth as potential out of your playing cards — particularly ones with a hefty annual price just like the Amex Gold. That is true whether or not you are based mostly within the U.S. or touring internationally.

In case you are an Amex Gold cardmember, my advice is to:

- Purchase a $10 Goldbelly present card each month

- Reload your Dunkin’ app stability with $7 each month

- Cowl a $10-plus Uber experience or Uber Eats order for a liked one (within the U.S.) every month

- Buy a $50 present card to your favourite Resy-affiliated restaurant each six months

Additionally, be sure you try our month-to-month and quarterly, biannual and annual credit score checklists to ensure you’re maximizing all of your card advantages.

Associated: Is the Amex Gold definitely worth the annual price?

For charges and costs of the Amex Gold Card, click on right here.