by Hope

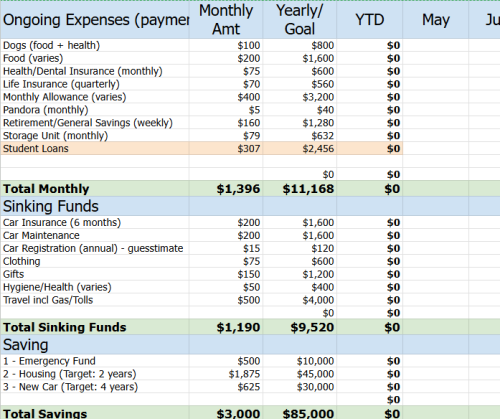

Thanks for all of the notes, definitions, constructive criticism. With out additional ado, right here’s take 3 of my publish sale finances.

Notes: Month-to-month Payments

I’ll revisit the life insurance coverage after I get settled in Texas, however for now it stays.

Sure, I’m giving myself a $400 month-to-month allowance. I’ve no clue if/what I’ll spend that on. However I’m giving myself permission to have some kind of social life and discover this space the place I’ve by no means lived earlier than. To not point out, this offers me the means to take a break from the home/caretaking each week which can be very a lot wanted for each psychological well being and since the web at my dad and mom’ house is horrible for essentially the most half.

Somebody did ask about my telephone/hotspot line merchandise which was in Model 1, however not in Model 2. I’ve moved these to my enterprise finances once more now that my enterprise is making sufficient cash to cowl these bills. I’ll share that finances at a later date.

I don’t assume there are another line objects that want any rationalization.

Notes: Sinking Funds

I believe I’ve moved all the right classes from month-to-month payments to sinking funds. Thanks to whomever outlined sinking funds so clearly within the feedback on one of many earlier finances posts. Do I’ve proper now?

These numbers are primarily based on 8 months (the rest of 2025) and invoice dates. I received’t know my auto insurance coverage renewal price till August so that is primarily based on anticipated numbers. However I’d relatively over finances than beneath finances.

I’ll have extra clothes prices this yr in order that quantity is about $200 greater than my typical annual finances. It’s because 1) marriage ceremony and a pair of) transferring to someplace VERY scorching, and I’ve misplaced over 30 kilos current with extra to lose. (Did I let you know that not solely am I the mom of the bride, however Magnificence additionally requested me to be the Matron/Maid of Honor? I really feel so honored and the notice she wrote and phrases she mentioned brough me to tears.)

As a result of my journey can be sporadic, particularly over the following 8 months, I moved gasoline/journey to a sinking fund. My guess is that for the primary 3-4 months, will probably be like GA the place one tank of gasoline lasts a month. Then come September-November, I’ll have some journey bills. So the sinking fund is sensible, proper?

Be aware: Financial savings

My financial savings objectives are extra long run relatively than 8 months. Clearly, I need to fully fund my EF as shortly as doable which can start with the home sale.

However the different two objectives: housing and new automobile are extra long run and I put a goal date to achieve these numbers there.

Automobile Financial savings

My automobile has over 100,000 miles on it and I the plan is to place a considerable variety of miles on it over the following two years. It’s in nice form, nicely maintained, and a Honda. With all these ideas in thoughts, my purpose is to have the ability to buy a more recent, new to me automobile when wanted, however hopefully no before 4 years.

Housing

My purpose is to money move land and a tiny home starting in 2 years. There have been numerous feedback about not saving for this line merchandise till I’m debt free. Right here’s the deal although. I’m about to be houseless. It’s my selection and I’m excited concerning the journey and alternative this offers me. However it’s not a long run plan.

If one thing ought to occur to my well being or my dad and mom, which can be my homebase for the following two years, I must have the means to get housing for myself. This line merchandise covers that contingency plan ought to I want it sooner relatively than later.

Alright, I’m prepared. Give me all of the notes and suggestions. I really feel like I’m getting fairly shut right here.

Hope is a resourceful and solutions-driven enterprise supervisor who has spent almost 20 years serving to purchasers streamline their operations and develop their companies by mission administration, digital advertising and marketing, and tech experience. Not too long ago transitioning from her position as a single mother of 5 foster/adoptive youngsters to an empty nester, Hope is navigating the emotional and sensible challenges of redefining her life whereas sustaining her willpower to regain monetary management and eradicate debt.

Residing in a comfortable small city in northeast Georgia together with her three canines, Hope cherishes the serenity of the mountains over the bustle of the seashore. Although her children at the moment are discovering their footing on the earth—pursuing schooling, careers, and independence—she stays deeply dedicated to supporting them on this subsequent chapter, whilst she faces the bittersweet tug of letting go.

Since becoming a member of the Running a blog Away Debt group in 2015, Hope has candidly shared her journey of economic ups and downs. Now, with a renewed focus and a transparent path forward, she’s able to sort out her funds with the identical ardour and perseverance that she’s dropped at her life and profession. By her writing, she continues to encourage others to confront their very own monetary challenges and attempt for a brighter future.