It’s more and more trying like a soft-landing for the U.S. economic system. Whereas most individuals have been hesitant to offer the Fed credit score, I went a special course and have been singing their reward for months.

For those who’ve been following my posts, you’ll do not forget that on the finish of September and in mid-November, I dove into the info to elucidate why I felt a soft-landing appeared possible. Quick ahead to at this time and a soft-landing has arguably grow to be the market consensus thanks partly to the latest knowledge.

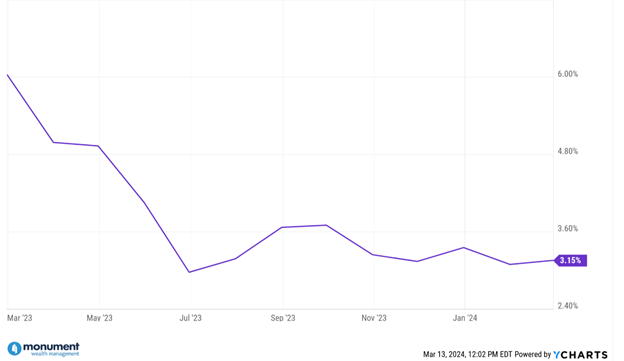

Let’s take a look at the inflation knowledge from earlier this week:

The chart beneath exhibits that the annual CPI inflation charge is now down to three.15% in February 2024 after clocking in at simply over 6% this time final yr.

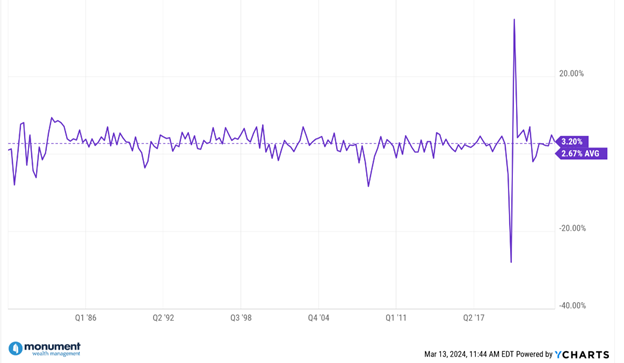

This subsequent chart beneath exhibits how the decline in inflation coincided with a 3.20% actual GDP progress charge for the U.S. in calendar yr 2023. For context, the typical GDP progress charge going again to 1980 is 2.67%, so 2023 skilled above common progress.

That is precisely what you’d anticipate to see in a soft-landing situation: robust financial progress with a falling inflation charge. A real “chef’s kiss” second for economists.

However when you consider it – this appears counterintuitive.

The Fed has been actively attempting to decelerate financial progress by aggressively climbing rates of interest, which in concept ought to result in decrease inflation. Properly, they acquired the decrease inflation they wished, however the place are the damaging financial results that usually come from larger rates of interest?

I’m assured the impacts from a restrictive Fed are being felt and elements of the economic system are certainly slowing down, however general, the U.S. GDP knowledge has remained stable. Although the newest GDP report didn’t level in the direction of an impending recession, some buyers nonetheless really feel like one is coming.

However to me it appears there are greater forces on the market contributing to our latest financial energy and our actual GDP progress – notably productiveness good points.

The Two P’s of GDP: Inhabitants and Productiveness

There are quite a few advanced inputs that go into calculating a rustic’s actual GDP, however should you’re attempting to have a look at the place its GDP is headed, I personally prefer to deal with a few key components: #1. Inhabitants and #2. Productiveness.

GDP measures the entire worth of products produced and companies supplied in a rustic, and a wholesome economic system has sustainable GDP progress. To oversimplify, if you wish to enhance your GDP, you both want extra folks doing/making extra stuff, otherwise you want your present workforce to supply stuff/do work extra effectively. Once more, for me it at all times comes again to the 2 P’s, Inhabitants and Productiveness, when attempting to rapidly assess a rustic’s potential GDP.

A Productive 2023 for the U.S.

Sturdy, above-average productiveness in 2023 appears to be a key motive why the economic system has been so resilient within the face of upper charges and a restrictive Fed.

While you take a look at the U.S.’s 2023 actual GDP report, the expansion we noticed was partly pushed by massive good points in productiveness. There’s an official productiveness measure calculated by the U.S. Bureau of Labor Statistics (BLS) that makes an attempt to measure the financial output per hour labored from a U.S. employee. You possibly can try the BLS methodology right here, however in brief, it’s finest at serving to buyers observe adjustments in employee output per hour over time and thru historical past.

The latest report got here out final week and noticed U.S. productiveness enhance by 2.6% in 2023, which was above each the latest 5-year common of round 1.8% and the historic common of round 2.1% going again to 1948.

Even with the drags from financial coverage, U.S. firms and staff had been in a position to generate extra output whereas utilizing much less sources in 2023. It’s inconceivable to pinpoint precisely the place the elevated productiveness got here from, however anecdotally I believe it’s simple to elucidate: the AI revolution has begun.

The Productiveness Advantages of AI

It’s no shock {that a} main driver of productiveness good points previously have come from new applied sciences and improvements. At this time we appear to be on the precipice of the subsequent generational know-how shift with AI. It’s possible going to take many years to really maximize the advantages of AI—so buckle up.

For all of the damaging press the AI-boom has gotten, it looks as if the advantages and efficiencies are lastly beginning to present up in the true financial knowledge, and admittedly, they’re coming at a good time. They seem like serving to offset among the damaging impacts from Fed charge hikes and are supporting the soft-landing narrative.

Trying forward I believe there’s additionally the potential for continued productiveness good points that might stay a tailwind for the U.S. particularly since we look like within the early innings of the AI-era. There appears to be limitless potentialities for much more widespread future productiveness progress as every firm and trade implements AI in their very own distinctive manner.

For instance, right here’s how AI has begun to have an effect on the insurance coverage trade. This clip is simply speaking in regards to the adjustments for a single trade, however I really feel assured in saying that is occurring all over the place. For my part, each job, firm, and nation will grow to be extra environment friendly because of AI.

When used responsibly, AI may help you be a greater problem-solver and be extremely extra productive. And, as I’ve written about earlier than , it may possibly increase collaboration between man and machine and improve creativity.

Man & Machine Working Collectively

I’ve repeatedly referred to as for the Fed to get some reward for what they’ve completed to date, however I believe it’s time to unfold the love.

AI and the efficiencies they create have helped make a soft-landing for the U.S. economic system doable by offering a big increase to employee productiveness. I hope this development continues – and I believe it may possibly.

Productiveness good points like this might be a key driver in serving to increase our financial progress into the longer term. A extra environment friendly and productive economic system is one poised for progress.