A reader asks:

I’m all the time listening to in regards to the power or weak spot of the US Greenback. Are you able to present some primary background of what this all means? What’s the weak spot in opposition to different currencies, particularly, or all currencies in a basket? Is that this good or unhealthy for my portfolio which is principally in US Shares and Bonds? What are the key advantages and downsides of a robust or weak greenback?

This can be a well timed query as a result of we’ve seen a giant transfer within the greenback this 12 months.

It’s down round 7% on the 12 months which is a moderately large transfer for the worldwide reserve forex.

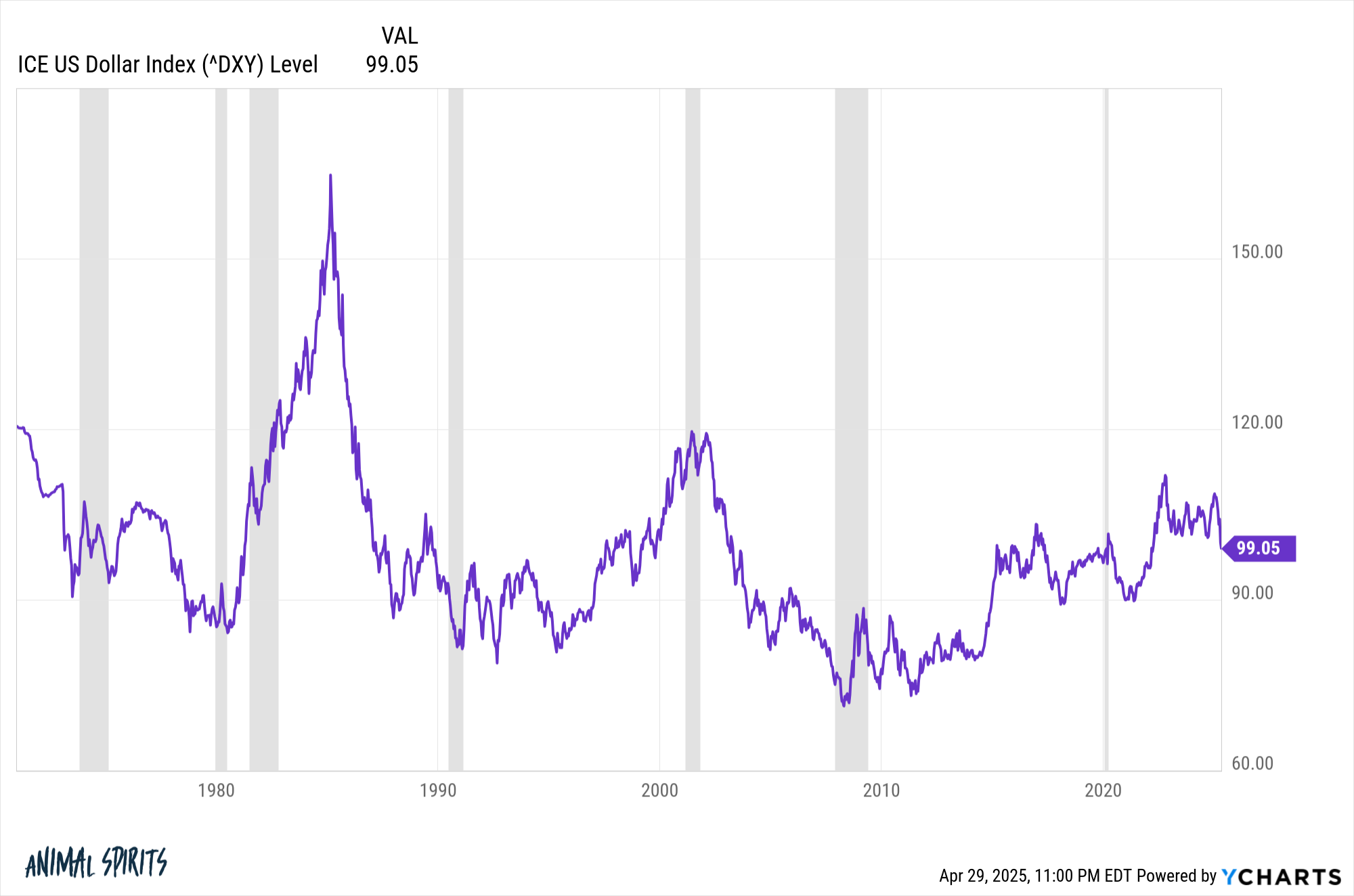

To start with let’s take a look at the greenback’s actions on a long-term foundation:

This chart reveals the greenback going again to the Seventies in opposition to a basket of foreign exchange. There have been loads of completely different regimes right here — sturdy greenback, weak greenback, sideways greenback, and so on.

However over the course of five-plus many years, the greenback has kind of gone nowhere. Like a Looney Tunes character spinning their legs with out going anyplace.

That power or weak spot may come about due to rate of interest differentials, inflation, financial development, or funding flows from overseas buyers. There are numerous variables that impression currencies. Belief and religion within the system are the unquantifiable ones.

A stronger greenback tends to result in weaker gross sales abroad and a weaker greenback tends to result in stronger gross sales abroad. When the greenback is weak you may anticipate worldwide shares to outperform U.S. equities. That’s as a result of when foreign exchange admire your investments in these nations will get extra bang for the buck when it comes to earnings and dividends.

The other is true when a greenback strengthens. Take into consideration all the folks happening holidays to Europe in recent times. The greenback has been sturdy, whereas the euro has been weak, making it cheaper for U.S. vacationers to journey abroad.

This is likely one of the many causes worldwide shares have underperformed for therefore lengthy. A robust greenback is a headwind.

These forex fluctuations are one other advantage of worldwide diversification.

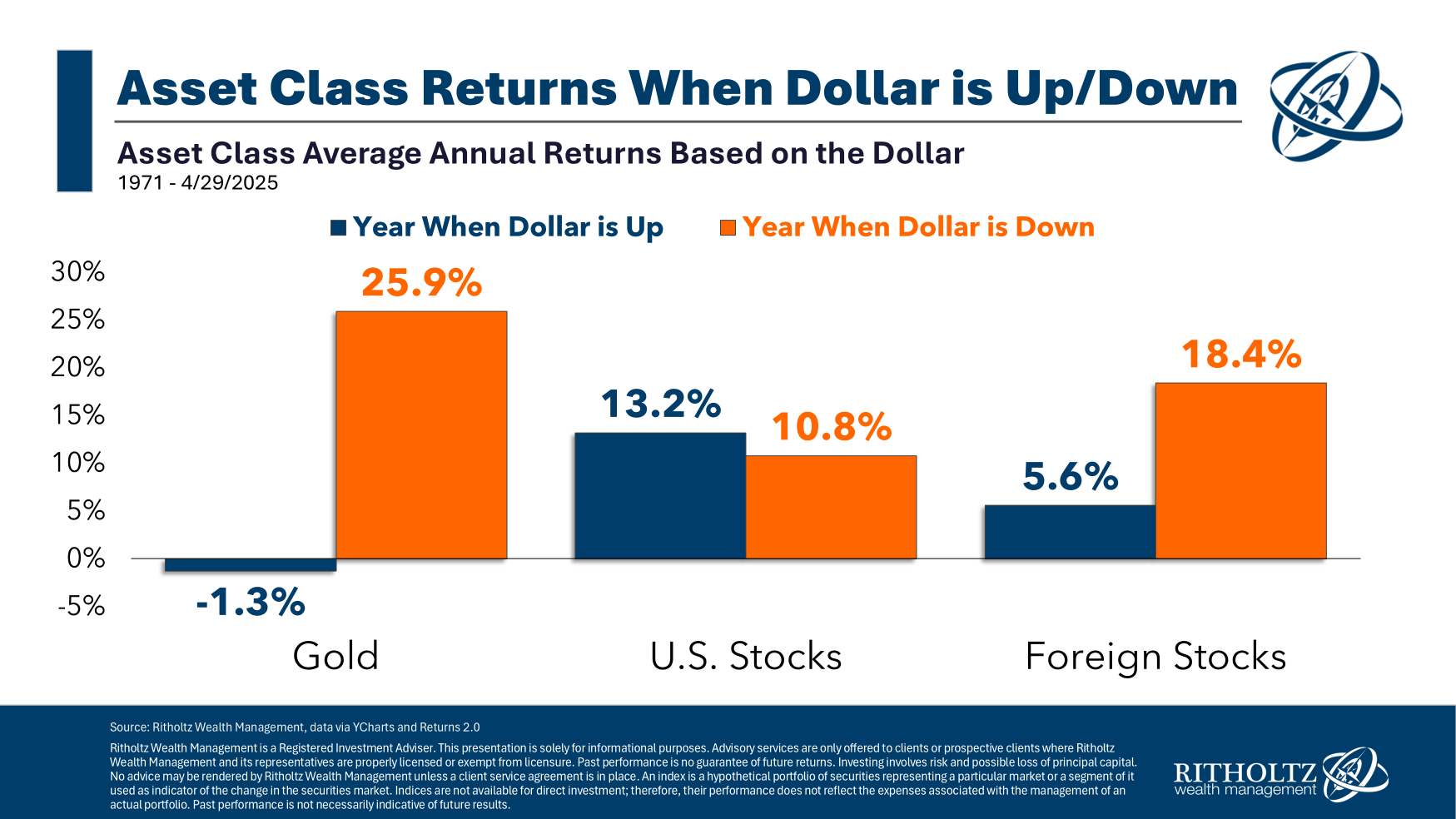

Let’s take a look at the historic numbers for inventory market efficiency in periods of a robust and weak greenback:

There’s a clear sample right here.

In sturdy greenback regimes, U.S. shares outperform and in weak greenback regimes, overseas shares outperform.

No market relationships are written in stone so who is aware of if this development will proceed however it is going to all the time be true {that a} weaker greenback will likely be higher to your overseas investments and a robust greenback will make them worse off (from a forex perspective).

For the overseas viewers, it’s the other. These overseas buyers who’ve been investing in U.S. shares in recent times have earned wonderful returns plus a pleasant enhance from a rising greenback. A weak greenback will make U.S. shares much less engaging to overseas buyers.

Now let’s take a look at the greenback’s impression on a shorter-term foundation for U.S. shares, worldwide shares and gold:

This chart reveals what occurs in years when the greenback is up or down from one 12 months to the subsequent.

The impression on U.S. shares is negligible however take a look at how significantly better gold and worldwide shares have performed when the greenback is weakening.

Once more, I can’t promise these relationships will maintain however this is smart in idea too. Gold is priced in {dollars} globally. When the greenback weakens, it takes extra of them to purchase the identical ounce of gold. Nonetheless, internationally, now you can buy extra of it in yen, euros or different currencies.

So far as bonds go, the usual reply is you wish to spend money on fastened revenue in your house forex as a result of that’s what you’re spending with. You additionally don’t wish to see the yield in your bonds swamped by forex fluctuations.

I talked about this query in additional element on this week’s Ask the Compound:

We additionally lined questions in regards to the loopy strikes within the inventory market, bonds vs. excessive yield financial savings accounts, the way to plan for a layoff and what to show highschool youngsters about private finance.

Additional Studying:

Is Worldwide Diversification Lastly Working?

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.