Pricey associates,

Welcome to Might, historically, the month by which to promote in!

These first few weeks of Might are an odd time on campus. My seniors are scrambling for jobs (or antidepressants), the juniors are teeing up internships, and the kids are … nicely, largely questioning what simply occurred to them?

It’s a time of 12 months that brings out the very best, and the worst, and the oddest of them. On Might 7, a whole lot of our college students collect to current their work to a campus and neighborhood viewers. Not classwork, simply work. Stuff they’re obsessed with. Certainly one of my college students, Adele, presents “Minimalism, Which means, and Machines: Einstein on the Seaside and the Artwork of Processing Technological Innovation,” which appears on the Philip Glass opera (you did realize it was a well-known opera, proper?) utilizing, partially, the problems we mentioned in Communication and Rising Applied sciences about technological determinism and the worry of latest expertise. A bunch of shows will construct off the work college students did final summer season with the College of Texas M.D. Anderson Most cancers Heart and Baylor Faculty of Drugs, “Generally Used Measures of Most cancers Impression: What are we measuring?” for instance. Quilting in Appalachia, The Gods in Racine (no, not Racine, Wisconsin, Racine the French playwright who can also be the main target of Sado-Masochism within the Works of Racine, which is okay as a result of it’s the French division and the French are … very French typically). We cancel all our lessons for the day to interact in The Celebration of Studying.

And on the identical time, I bought a stunning be aware from Zoe that stated, “Hey, Snowball, only a heads up. I’m not coming to class in the present day. I’ve three weeks left in my time in school, and in the present day is just too stunning to spend inside.” Glanced on the report to verify what I already knew (she may skip the remainder of the semester with out noticeably decreasing her likelihood for an “A”) and nodded.

Professors as soon as gave lip service to the argument that “studying takes place in all places, not simply within the classroom.” I’ve all the time been delighted that Augustana typically acts like they actually imagine it.

On this concern of the Observer …

Lynn Bolin has adopted a fairly cautious “danger off” stance amid financial uncertainty. Tariffs and their potential impacts emerge as a central concern, with Lynn drawing parallels to Nineteen Seventies stagflation. These considerations tie collectively each of his essays this month.

In “My Funding Technique For 2025,” Lynn outlines his funding strategy amid excessive market volatility and uncertainty. He maintains a standard 60/40 inventory/bond portfolio (starting from 55-65% in shares) with small quarterly changes based mostly on volatility-adjusted momentum. His funding mannequin, which contains 30 years of fund knowledge, recommends a “danger off” stance since mid-2022. Regardless of the S&P 500’s current positive factors, he identifies regarding tendencies in client well being, company efficiency, and fairness valuations. With parallels to Nineteen Seventies stagflation, he’s growing allocations to short-term investment-grade and inflation-protected bond funds whereas sustaining stability for withdrawals.

In a market topic to moderately sudden reverses, Lynn additionally addresses “Trending Funds YTD 2025.” He opinions top-performing funds throughout bonds, combined property, and equities utilizing his proprietary rating system based mostly on MFO Premium knowledge. Bond rankings present power in short-term investments and inflation-protected securities, and he’s contemplating changing high-yield funds exhibiting detrimental YTD returns. In combined property, different world macro funds like Eaton Vance International Macro Absolute Returns stand out as potential “Threat Off” diversifiers. Fairness rankings show worldwide and world funds considerably outperforming home choices. As tariff impacts turn out to be clearer by June, Lynn is specializing in dependable fastened revenue for the following 5-10 years whereas contemplating tax-efficient worldwide fairness funds.

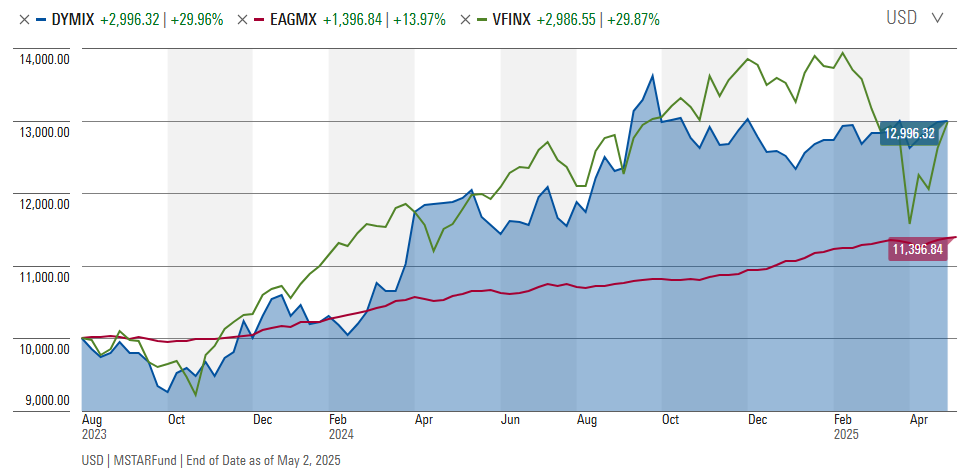

I share Lynn’s anxiousness in regards to the penalties of coverage chaos on the markets, and so profiled Dynamic Alpha Macro Fund, a youthful entrant within the world macro class. The fund matches a 50% fairness stake with a 50% macro-driven futures buying and selling technique. The outcomes have, to date, been exemplary: returns since inception that beat the S&P 500 with a negligible correlation to it. The image of the trio – Eaton Vance (pink), Dynamic Alpha (blue), and the S&P 500 (curler coaster) since Dynamic Alpha’s launch – appears like this.

There’s one clear beta story. One clear alpha story. And two funds price contemplating in the event you’re not satisfied that it’s all going to be effective and dandy any day now.

Dynamic Alpha is an element of a bigger dialogue that we’ve been pursuing, Constructing a Chaos-Resistant Portfolio. We debuted the time period in December 2024 and have pursued articles, nearly month-to-month, on the problem of managing via loopy occasions. This month, we replace on how the funds and techniques we’ve mentioned have served their buyers. (Spoiler alert: fairly nicely, all issues thought-about.) As a kind of public service, we additionally supply a sneak peek at Lewis Braham’s Barron’s essay, “The Chaos-Resistant Fund Portfolio.”

We additionally share a Launch Alert for T. Rowe Worth’s latest providing in its Capital Appreciation suite for funds and ETFS: T. Rowe Worth Capital Appreciation Premium Earnings ETF. It gives revenue, some development, and distinctive stability.

Our colleague Charles Boccadoro updates people on new fund circulation evaluation, which is able to now supply day by day updates via the FLOW instrument. (At $120/12 months, his website actually is probably the most radically underpriced – albeit quirky – fund and ETF knowledge website in existence. In contrast to Morningstar’s on-line instruments, Charles has provided side-by-side, metric-by-metric analyses of funds, ETFs, and closed-end funds since Day One. The information and analytics are extremely wealthy.)

And The Shadow wraps issues up in Briefly Famous, noting briefly, as is his wont, an enormous sequence of fund-to-ETF conversions which appear to be eclipsing the impulse to liquidate funds.

Issues that make me pause

“Requirements” don’t imply fairly the identical factor to all of us. Credit score Karma surveyed 2,000 American adults in April 2025, looking for to find out how they could reply to a world with increased bills and extra constrained revenue. Throughout the board, 80-90% of all age teams allowed that they’d “strongly contemplate” reducing again on nonessential spending.

The distinction, by technology, is what’s “important.”

Fifty-six % of Gen Z and 59 % of Millennials stated spending on hobbies and pursuits is a necessity, not a luxurious. And almost half of younger customers (51 % of Millennials and 45 % of Gen Z) stated they’d moderately scale back long-term financial savings than quit sure way of life experiences together with going out to eat, journey and health memberships. (Alexandre Pastore, “Gen Z and Millennials Are Redefining What Gadgets Are ‘Requirements’ Amidst Financial Uncertainty,” 5/5/2025)

A Lending Tree survey reported in Fortune notes that one-quarter of People are actually shopping for their groceries on credit score (paid entry, sorry, 4/28/2025). One finances transfer has been to finish psychological remedy appointments; the most well-liked use for AI chatbots in 2025 is now “remedy and companionship.”

The 19 richest American households bought richer, $1,000,000,000 richer in 2024. One trillion {dollars} richer throughout Mr. Biden’s final 12 months in workplace, which could elevate questions on why so a lot of them have been so upset with him. The 19 households embody some acquainted names, corresponding to Elon Musk, Mark Zuckerberg, Jeff Bezos, Stephen Schwarzman, and Warren Buffett. The Wall Avenue Journal framed it this fashion:

The wealthiest have gotten richer, and management a report share of America’s wealth. New knowledge counsel $1 trillion of wealth was created for the 19 richest American households alone in 2024. That’s greater than the worth of Switzerland’s complete economic system. (“$1 Trillion of Wealth Was Created for the 19 Richest U.S. Households Final Yr,” WSJ, 4/23/2025)

Wealthy buyers providing forecasts must be approached cautiously. Their statements replicate skilled experience, private bias, and the inevitable urge to “speak their e book.” That stated, moderately quite a few top-tier buyers have shared storm warnings. Paul Tudor Jones stated that even when Trump walks again his tariffs, markets are headed “to new lows.” (“A billionaire hedge fund supervisor has a chilling inventory market warning,” Quartz, 5/6/2025). Ray Dalio argues that we face “one thing worse than a recession” (Shannon Carroll, “Ray Dalio is nervous about ‘one thing worse than a recession’,” Quartz, 4/14/2025)

Deutsche Financial institution argues that the fragility of the US markets is heightened by “the top of American exceptionalism.” Historically, the US has provided the world’s most secure investments – the US {dollars}, Treasuries – as a result of America had an unprecedented popularity for accepting its position because the grown-up within the room. As we glance extra like post-war Italy, world buyers discover it simpler to think about a flight, maybe precipitous, from US investments (“3 market alerts that may very well be setting the stage for one more correction,” Enterprise Insider, 4/29/2025, additionally Pictet Asset Administration, “The dual sell-off that alerts a break with the previous,” 4/2025). Institutional voices corresponding to Moody’s Analytics, JP Morgan, and Apollo Capital place the prospect of a US recession within the 12 months forward at 50-90%. The particular downside is the macro-economy surroundings: Callie Cox, the chief market strategist at Ritholtz Wealth Administration, worries that low development and rising costs would hamstring the Fed, which buyers have counted on for a technology to avoid wasting their cookies from the hearth. (Callie Cox, “America is on the verge of stagflation,” Enterprise Insider, 4/28/2025).

Bloomberg, not a reactionary bunch, printed findings from Bespoke Capital that substantiate a “promote in Might” technique. “Investing in a fund that debuted in 1993 and tracks the S&P 500 through the Might-October interval yielded a cumulative return of 171%, in comparison with a 731% acquire for November-April,” concluding “ the dangers are skewed towards the S&P 500 struggling one other massive decline subsequent month” (Bloomberg Markets Every day, 4/30/2025).

I all the time take the parents on the Leuthold Group critically; they’re data-driven, and their knowledge typically alerts the prudence of warning even whereas the get together rolls. Their early Might analysis releases: the market’s newest bounce is according to bear market rallies, valuations have now returned to epic ranges, and cracks appear to be deepening.

I’m intensely conscious of the success of economists in precisely predicting eight of the previous three recessions. And nonetheless, more and more, I hear the voice of Sgt. Esterhaus from Hill Avenue Blues, who completed his roll name each week with the identical prescient recommendation: “Let’s watch out on the market.”

I’m intensely conscious of the success of economists in precisely predicting eight of the previous three recessions. And nonetheless, more and more, I hear the voice of Sgt. Esterhaus from Hill Avenue Blues, who completed his roll name each week with the identical prescient recommendation: “Let’s watch out on the market.”

Farewell to The Nice Males

I do know, I do know, it’s all around the information and there’s treasured little so as to add.

Pop is gone.

Pop is gone.

Gregg Charles Popovich has stepped down after 29 years as the pinnacle coach of the San Antonio Spurs, which made him the longest-tenured coach in all {of professional} sports activities. In that stretch, he received 5 league championships, over 1400 wins, and had 22 consecutive profitable seasons. He’s, by all accounts, a exceptional individual and a champion for the individuals in San Antonio. His choice to step apart as a mere stripling of 76 was occasioned by a gentle stroke in November 2024 and fainting in a restaurant in April 2025. He might be missed.

The opposite retirement information of the month, in case you’d missed it whereas following the NBA, is Warren Buffett’s retirement announcement, apparently not shared upfront together with his personal successor. The announcement got here throughout Berkshire Hathaway’s annual assembly on Might 3, 2025.

The opposite retirement information of the month, in case you’d missed it whereas following the NBA, is Warren Buffett’s retirement announcement, apparently not shared upfront together with his personal successor. The announcement got here throughout Berkshire Hathaway’s annual assembly on Might 3, 2025.

Berkshire’s inventory promptly fell 4%, solely barely ironic given Mr. Buffett’s lifelong devotion to investing for the long-term (actually, did anybody assume Mr. B. would really perform his menace to proceed operating Berkshire from past the grave?) and his emphasis on fundamentals moderately than personalities.

Berkshire’s unique buyers, who had held because the begin, would pocket a acquire of 5,500,000%, about 140 occasions the acquire within the S&P 500. (Not 140% of the acquire, 14,000% of the S&P’s rise). Even the latecomers who joined in 1980 would have seen a 296,000% acquire. Millennial buyers, these staggering in because the Dot.com turned the Dot.bust pocketed a 1500% rise, simply wanting triple the S&P 500’s acquire in the identical interval.

If I needed to share recommendation on how to consider Berkshire’s future based mostly on Mr. Buffett’s profession, I’d invent the next citation and attribute it to him (as a result of that’s how the web works):

The best corporations outlive even their biggest leaders; true wealth isn’t constructed by timing departures, however by proudly owning excellence via transitions.

Warren Buffett and Isoroku Yamamoto

One of many habits that distinguishes nice leaders from those that grind and trash is a bent to learn broadly, incessantly, and with an enticing curiosity. That’s true, most famously, of Invoice Gates and of Mr. Buffett’s different half, Charlie Munger.

Mr. Buffett launched what may be his last e book advice checklist at Berkshire’s Might assembly. It contained 27 titles, of which a dozen are books by or about Mr. Buffett and his agency. Right here’s what else Mr. Buffett thinks you’ll revenue from studying:

Capital Allocation: The Financials of a New England Textile Mill 1955–1985 by Jacob McDonough

The Nice Crash: 1929 by John Kenneth Galbraith

The place Are the Prospects’ Yachts? by Fred Schwed Jr.

Enterprise Adventures: Twelve Traditional Tales from the World of Wall Avenue by John Brooks

The Clever Investor by Benjamin Graham and The Clever Investor (Revised Version) by Jason Zweig

The Little Guide of Frequent Sense Investing: tenth Anniversary Version by John C. Bogle

The Ten Commandments for Enterprise Failure (“I like to check failures,” WB) by former Coca-Cola CEO Donald R. Keough

Affect: The Psychology of Persuasion and Pre-Suasion: A Revolutionary Strategy to Affect and Persuade, each by Robert Cialdini. These may be the bestselling books ever on the science of persuasion, with easy and actionable insights.

Unscripted: The Epic Battle for a Media Empire and the Redstone Household Legacy by James Stewart and Rachel Abrams

Americana: A 400-Yr Historical past of American Capitalism by Bhu Srinivasan

Getting There: A Guide of Mentors by Gillian Zoe Segal, snippets about working with nice individuals, together with Mr. Buffett

Operating with Objective: How Brooks Outpaced Goliath Rivals to Lead the Pack by Jim Weber, a management story from the CEO of Brooks Operating Firm, which Mr. Buffett purchased in 2012

Trillion Greenback Triage: How Jay Powell and the Fed Battled a President and a Pandemic—and Prevented Financial Catastrophe by Nick Timiraos, probably the most up to date e book on the roster, printed in 2022.

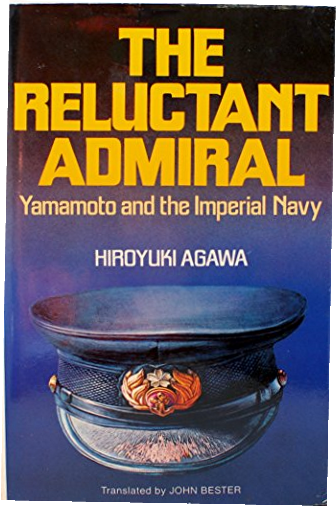

My very own studying, in management and historical past, has gone in a unique course these days. The Reluctant Admiral: Yamamoto and the Imperial Navy by Hiroyuki Agawa is broadly thought to be some of the nuanced and insightful biographies of Admiral Isoroku Yamamoto. The e book attracts closely on unique sources, together with Yamamoto’s personal letters and interviews with those that knew him, to current a portrait of a fancy, deeply conflicted chief

My very own studying, in management and historical past, has gone in a unique course these days. The Reluctant Admiral: Yamamoto and the Imperial Navy by Hiroyuki Agawa is broadly thought to be some of the nuanced and insightful biographies of Admiral Isoroku Yamamoto. The e book attracts closely on unique sources, together with Yamamoto’s personal letters and interviews with those that knew him, to current a portrait of a fancy, deeply conflicted chief

Historically, Yamamoto has been the face of Japanese aggression within the Pacific Battle, and but the image is much more complicated. As commander of the mixed fleet, Yamamoto coordinated and executed the assault on Pearl Harbor. As stories of success after success flooded in, “the workers officers couldn’t conceal their jubilation; Yamamoto alone, apparently, remained sunk in obvious melancholy.”

That may be defined by Yamamoto’s single most quoted prediction:

“If I’m pressured to wage conflict with the USA whatever the penalties, I’ll run wild for six months, however I’ve no confidence within the years after that,” an announcement apparently made to Prime Minister Prince Fumimaro Konoye, late 1940.

Yamamoto knew America and knew the percentages and calculated that his solely likelihood was a six-month spree of terror which may so stun the People that they’d conclude that resistance was not price the fee. If People stood agency after the six-month assault, Japan, he knew, would fall. That turned a self-fulfilling prophecy. By June 1941, when his indecision on the Battle of Halfway led to disaster, it was clear that Yamamoto had no long-term plan. Destroy as a lot as potential, as quick as potential, after which … after which? No concept. Improvise.

I ponder if People, in Might of 1941, had any concept of how brittle their apparently indestructible foe was?

In the event you’re so sensible …

“Why aren’t you wealthy?”

This acquainted problem reveals three curious truths about American tradition. First, it presumes knowledge’s pure expression is wealth—that your mind must be measurable by your funding portfolio. Second, it exposes our impoverished definition of “richness.” Whereas I nurture ideas, domesticate relationships, contact hundreds of lives, and have a tendency my backyard, none register as “wealth” with out the validation of a brokerage assertion.

Most tellingly, we by no means pose the reverse query: “In the event you’re so wealthy, why aren’t you sensible?”

This equation of wealth with knowledge is quintessentially American. Cultures worldwide ponder each riches and sagacity, but none so persistently conflates them. People uniquely generalize from nice fortune to nice perception, willingly overlooking ethical failings or mental shortcomings among the many ultra-wealthy.

Earlier this month, I printed an essay analyzing this query at LinkedIn. It has been nibbling at my mind for a very long time, highlighted by the completely, completely predictable March of the Billionaires to kneel earlier than the throne.

Validity however, it appears a bit far afield from MFO’s mission, and so we thought it higher to hyperlink to it right here (it ought to open in a brand new tab for you) moderately than republish it.

I’ll stroll via three arguments with you, adopted by a quick coda and solutions from the place you may be taught extra in the event you’re so disposed. Listed here are the arguments:

- The ultra-rich actually are totally different from the remainder of us.

- The components that permit them to turn out to be rich create an aversion to the messiness of democracy and an attract to authoritarianism.

- That by no means ends nicely, for them or for us.

- Coda: There are honorable exceptions, principled, considerate individuals who acquired (and sometimes allotted) nice wealth with out dropping their ideas.

There’s a bunch of educational analysis behind all of this. I’ve tried to not burden you with it, however can be glad to share extra sources in the event you’re curious, masochistic, or curiously masochistic.

Thanks, as ever …

To our devoted subscribers, the great people at S&F Funding Advisors, Wilson, Greg, William, William, Stephen, Brian, David, Doug, and, most just lately, Altaf. In the event you’d like to hitch them of their good work, you may click on on the “Help Us” web page.

Particular thanks this month to Anitya, Don G (I humbly and fully endorse your priorities with regards to philanthropy: serve these in misery and work to rebuild a sane future), and Thomas from Moscow (Idaho, that’s!)

And to Mr. Buffett and Mr. Munger and Mr. Popvich and all the good people who caught it out, eschewing getting wealthy fast or fast wins for lengthy careers that formed the lives of buyers and younger athletes, in highly effective methods.

And because of all of you for sharing fourteen years with us. MFO launched in Might 2011 with the promise of carrying on the mission of its predecessor, FundAlarm: to talk with a human voice, humbly and with out business strain, to assist buyers navigate a world ridden with advertising and marketing hype, monetary shenanigans, and straightforward solutions.

It’s by no means been our objective to be the supply of all of the solutions. Our objective is to assist empower the higher angels of our nature, the impulses to charity and justice, reflection, and deliberation. Our hope, on this concern and within the 168 that preceded it, is that your day is only a bit higher for the presence of 1 voice and one message: “Take a deep breath. We are able to assume this via collectively.”