by Hope

Phew, it looks as if endlessly since I’ve felt good about giving a debt replace. However I’m over the moon as I write this!

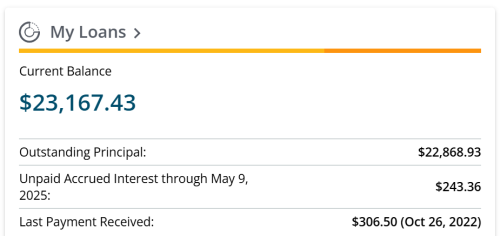

This woman’s solely debt, solely debt…are my pupil loans. And I did make an additional fee to them, together with my now often required month-to-month fee of $307. For these which might be new, my pupil loans have been in deferment for a really very long time. However no extra!

Previous to this month’s fee, that is the place my pupil loans stood.

You may see, it has been a LONG time since I made a fee towards them.

However right here we’re as we speak…

| Debt Description | October, 2023 Whole | Curiosity Fee | Minimal Cost | Present Whole | Payoff Date (Est) |

|---|---|---|---|---|---|

| Scholar Loans | $22,121 | 2.875% | $307 | $21,811 | |

| CC – Apple** | $500 | Paid off each month | $0 | ||

| CC – Frontier | $3,857 | 29.99% | $0 | $0 | Could, 2025 |

| Dad – New Furnace | $2,600 | 0% | $0 | $0 | Could, 2025 |

| CC – USAA | $5,000 | 19.15% | $0 | $0 | Could, 2025 |

| CC – Sam’s Membership | $0 | Could, 2025 (once more) | |||

| CC – Amazon | $0 | Could, 2025 (once more) | |||

| CC – Southwest | $0 | Could, 2025 | |||

| Painter | $0 | Could, 2025 | |||

| CC – AMEX | $894 | 29.24% | $0 | $0 | Mar, 2024 – Closed |

| CC – Sams | $1,106 | 29.99% | $0 | $0 | April, 2024 |

| Private Mortgage #1 | $2,500 | 0% | $0 | $0 | July, 2024 |

| Private Mortgage #2 | $2,500 | 0% | $0 | $0 | August, 2024 |

| CC – Wander | $1,630 | 29.24% | $0 | $0 | August, 2024 – Closed |

| CC – Amazon | $1,497 | 29.99% | $0 | $0 | September, 2024 |

| Whole | $44,206 | $265 | $32,131 |

Getting Acclimated & Making Plans

As of yesterday, I’ve been at my guardian’s in Texas for one week. Dad and I are slowly adjusting to a brand new regular and getting right into a routine. And I’m nonetheless feeling out the realm and retaining an eye fixed out for issues to become involved in.

My primary precedence is to be accessible to assist look after my mother. What that appears like now’s giving Dad the liberty to get out and a few bit with out being concerned about inconveniencing anybody. We’ve set two days every week that he is aware of that I will probably be right here, ie not make any plans that may take me away from the home, and he doesn’t should “ask” for protection. He’s nonetheless battling that. (I don’t depart the home typically in any case, however this common schedule offers him extra freedom than he’s had in years as mother’s fixed companion and first caregiver. My siblings have been unbelievable about serving to. However dad struggles with asking and feeling like a burden. I’m hoping this alleviates that weight on his shoulders a bit.)

On the flip facet, I’m on the lookout for methods to construct group. A kind of self care that I would like. I visited a brand new church with Gymnast on Sunday. And I’ve attain out a few locations to test on volunteer alternatives. Now I’m pondering of making a flyer to print and drop off at native companies to promote my companies.

I truly went to a chiropractor and in discussions about what I do, he employed me to assist along with his web site and advertising. I simply have to get extra daring with placing it on the market.

Hope is a resourceful and solutions-driven enterprise supervisor who has spent almost 20 years serving to purchasers streamline their operations and develop their companies by way of challenge administration, digital advertising, and tech experience. Just lately transitioning from her function as a single mother of 5 foster/adoptive kids to an empty nester, Hope is navigating the emotional and sensible challenges of redefining her life whereas sustaining her dedication to regain monetary management and remove debt.

Dwelling in a comfortable small city in northeast Georgia along with her three canine, Hope cherishes the serenity of the mountains over the bustle of the seashore. Although her youngsters are actually discovering their footing on the earth—pursuing training, careers, and independence—she stays deeply dedicated to supporting them on this subsequent chapter, whilst she faces the bittersweet tug of letting go.

Since becoming a member of the Running a blog Away Debt group in 2015, Hope has candidly shared her journey of economic ups and downs. Now, with a renewed focus and a transparent path forward, she’s able to deal with her funds with the identical ardour and perseverance that she’s delivered to her life and profession. By her writing, she continues to encourage others to confront their very own monetary challenges and attempt for a brighter future.