Coming into April, UnitedHealth was the second greatest inventory within the Dow behind Goldman Sachs.1

The inventory was performing nicely even throughout the Tariff Tantrum. Whereas the inventory market was down 15% on the yr, UnitedHealth was up as a lot as 18% in mid-April.

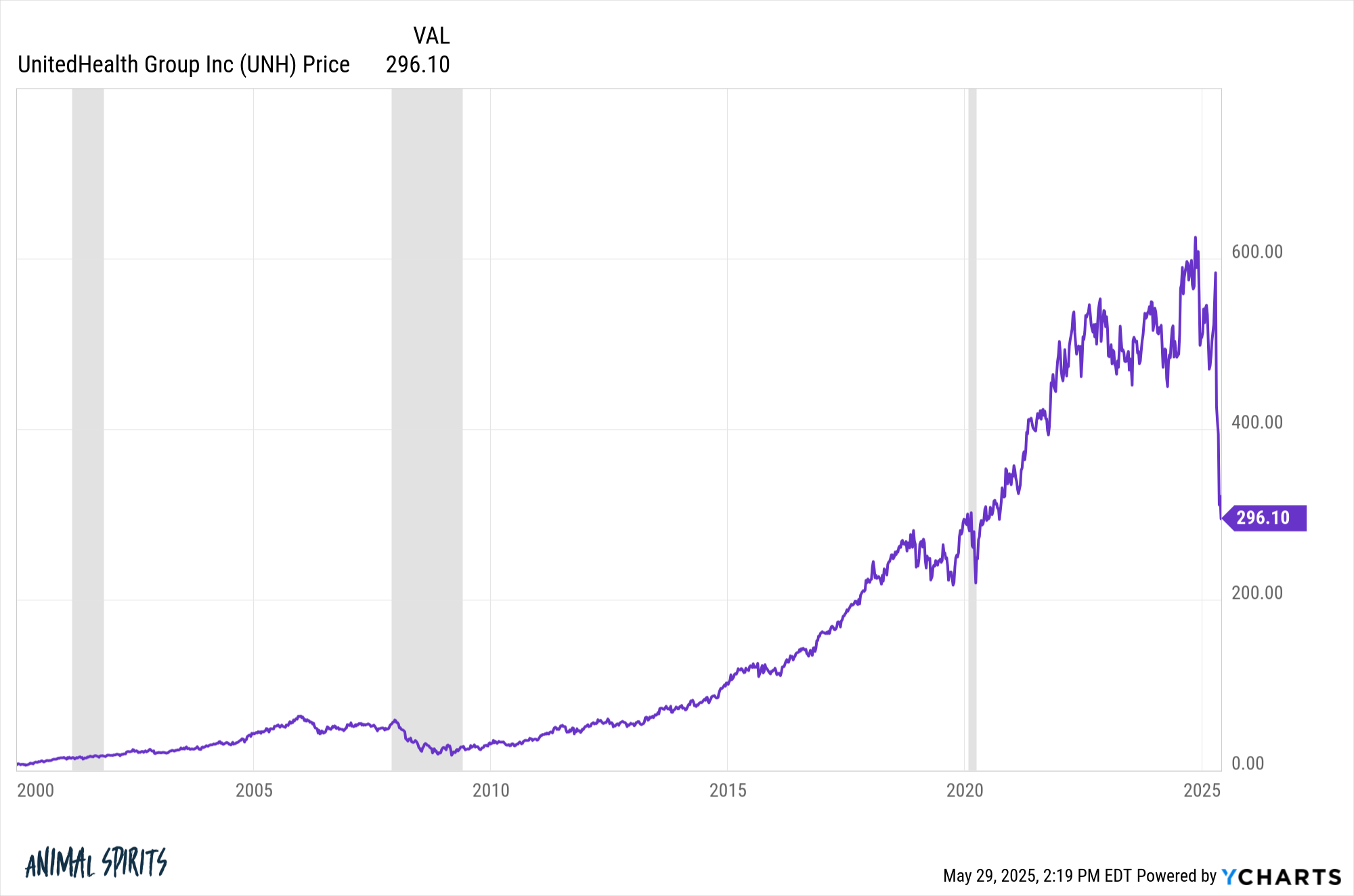

Then it fell off a cliff, Wile E. Coyote-style. This long-term chart appears to be like like a fat-finger mistake on a spreadsheet:

The inventory is down a little bit greater than 50% in a month, a large crash in such a brief time period for a corporation that was price practically $600 billion.

The large query for buyers who wish to keep away from catching a falling knife is that this: Will it come again?

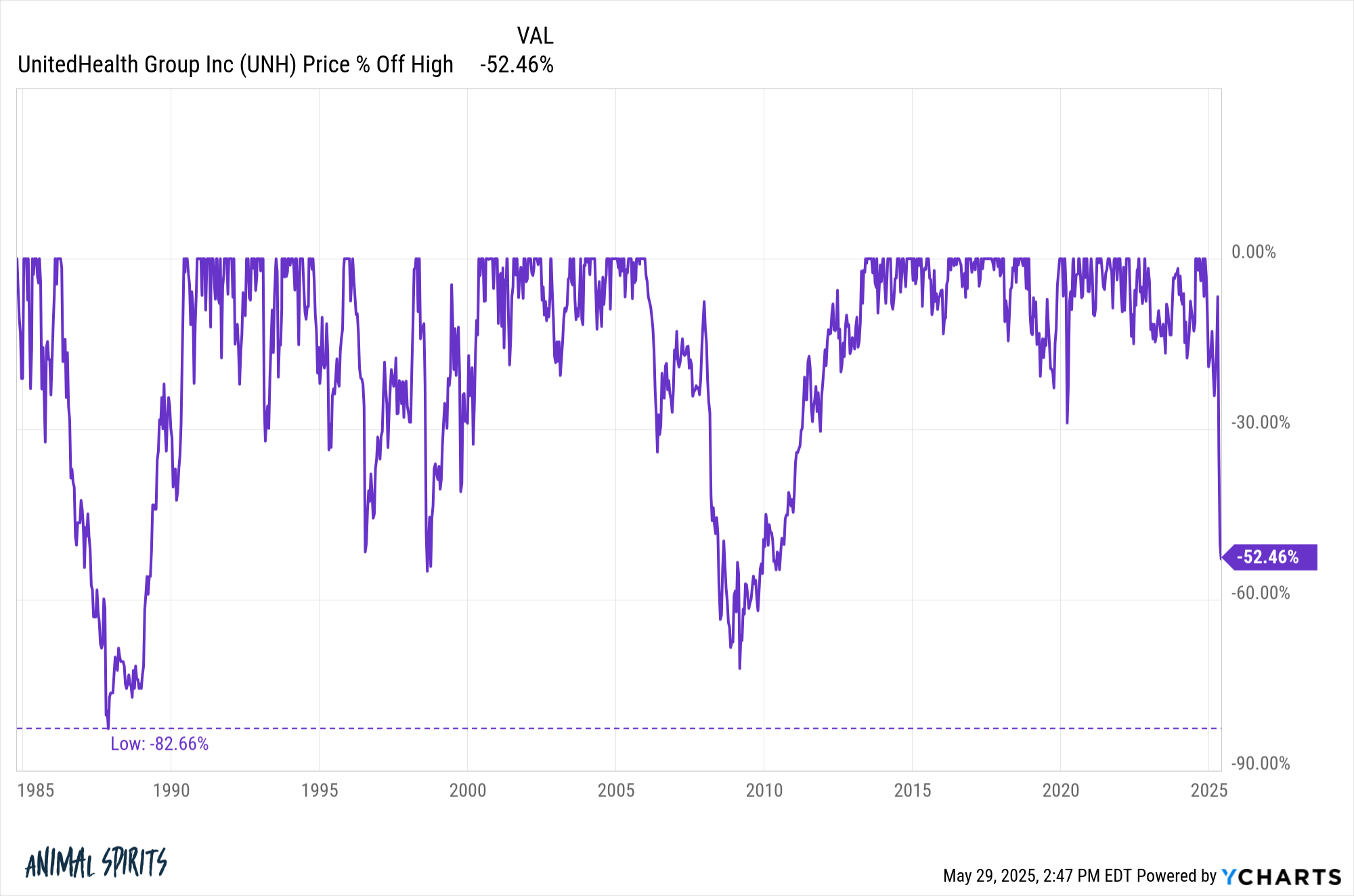

In its historical past the inventory has skilled larger drawdowns on three separate events:

It fell greater than 80% within the Eighties, practically 55% within the late-Nineties and 72% throughout the Nice Monetary Disaster. Every time it got here again.

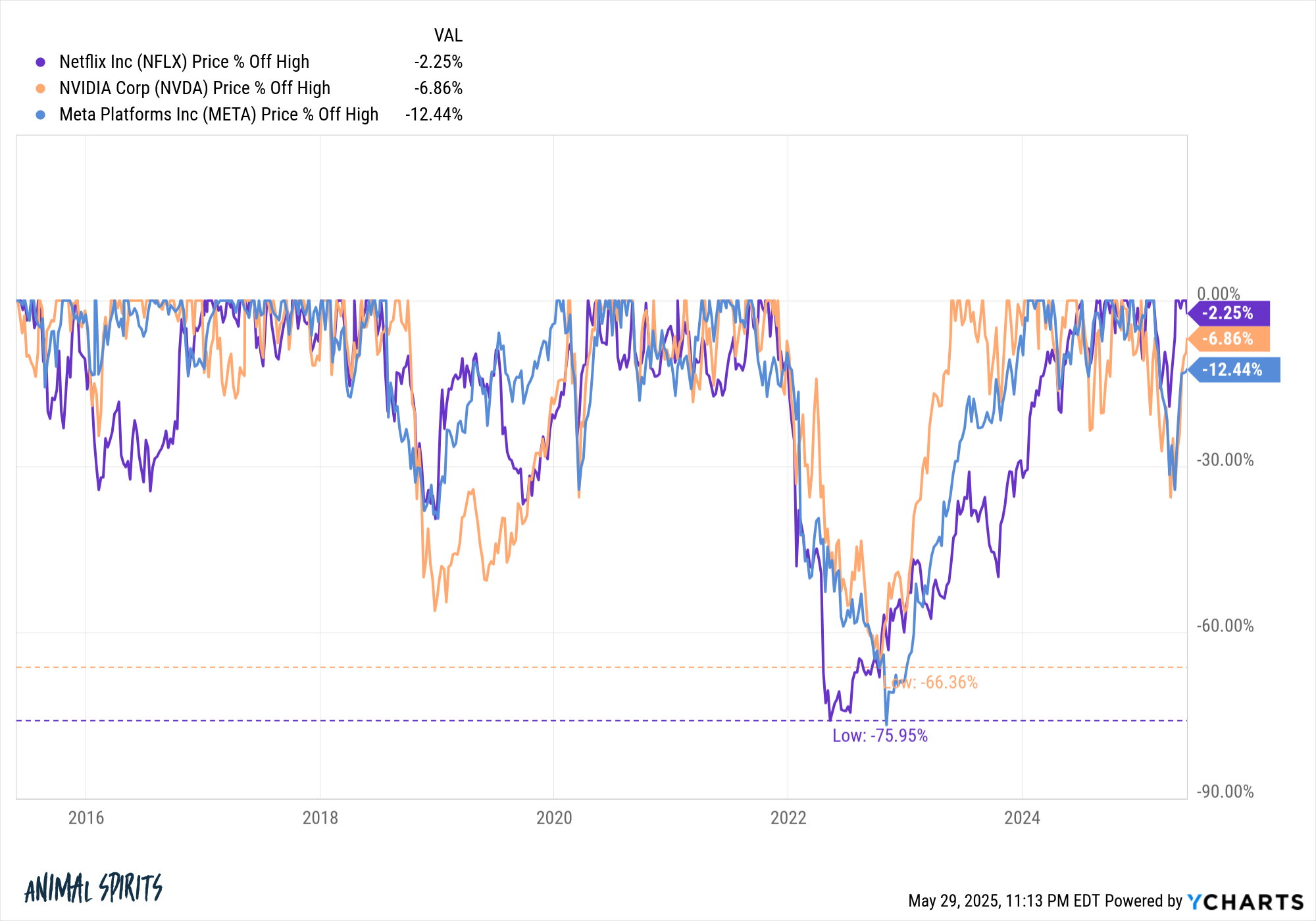

There are more moderen examples of well-known corporations going by means of gigantic drawdowns solely to come back roaring again:

Nvidia misplaced two-thirds of its worth. Fb and Netflix every fell 76% lately. These had been unbelievable shopping for alternatives in name-brand corporations.

That is the dream for stockpickers.

Nonetheless, many shares don’t come again from massive drawdowns.

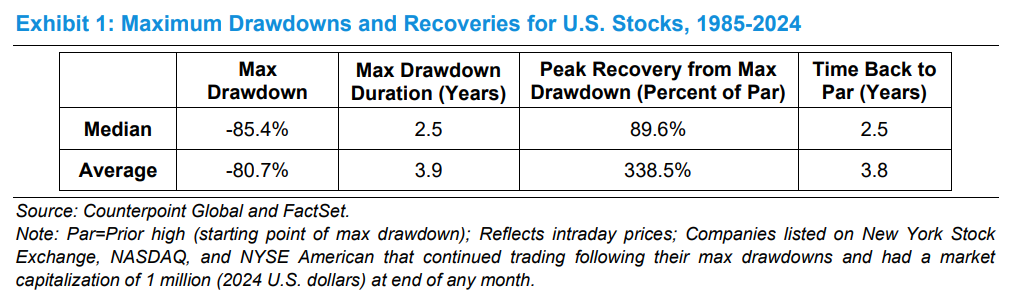

Michael Mauboussin has a brand new analysis piece in regards to the drawdowns and recoveries of particular person shares. He checked out 6,500 shares in a 40 yr interval from 1985-2024 and found the median drawdown was an astounding 85%:

54% of those shares by no means managed to get better their earlier peak. The rationale the typical restoration achieve is a lot larger than the median is as a result of a handful of shares skew the numbers larger. The chances aren’t in your favor.

Well-known corporations like Citigroup:

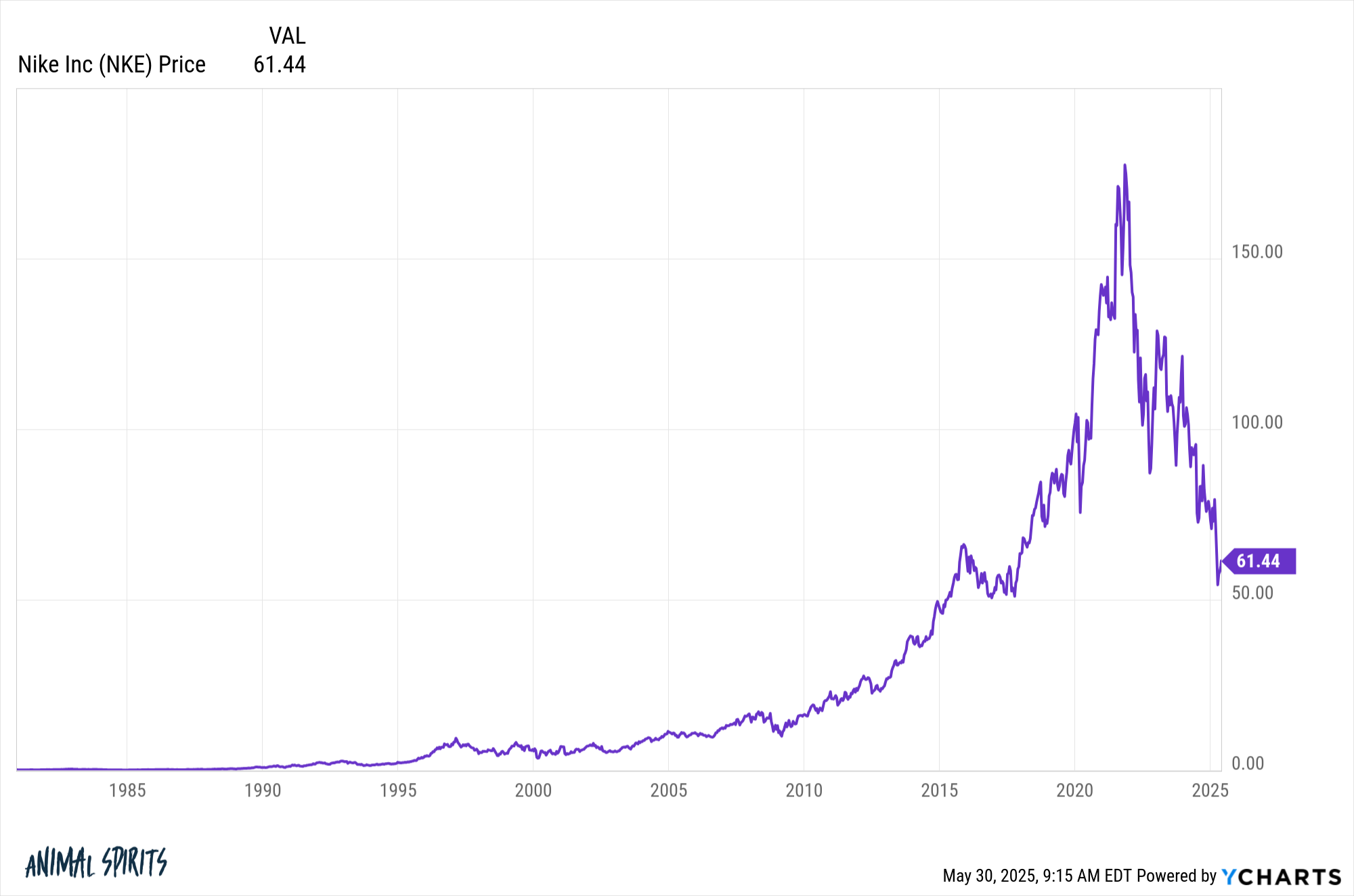

Nike:

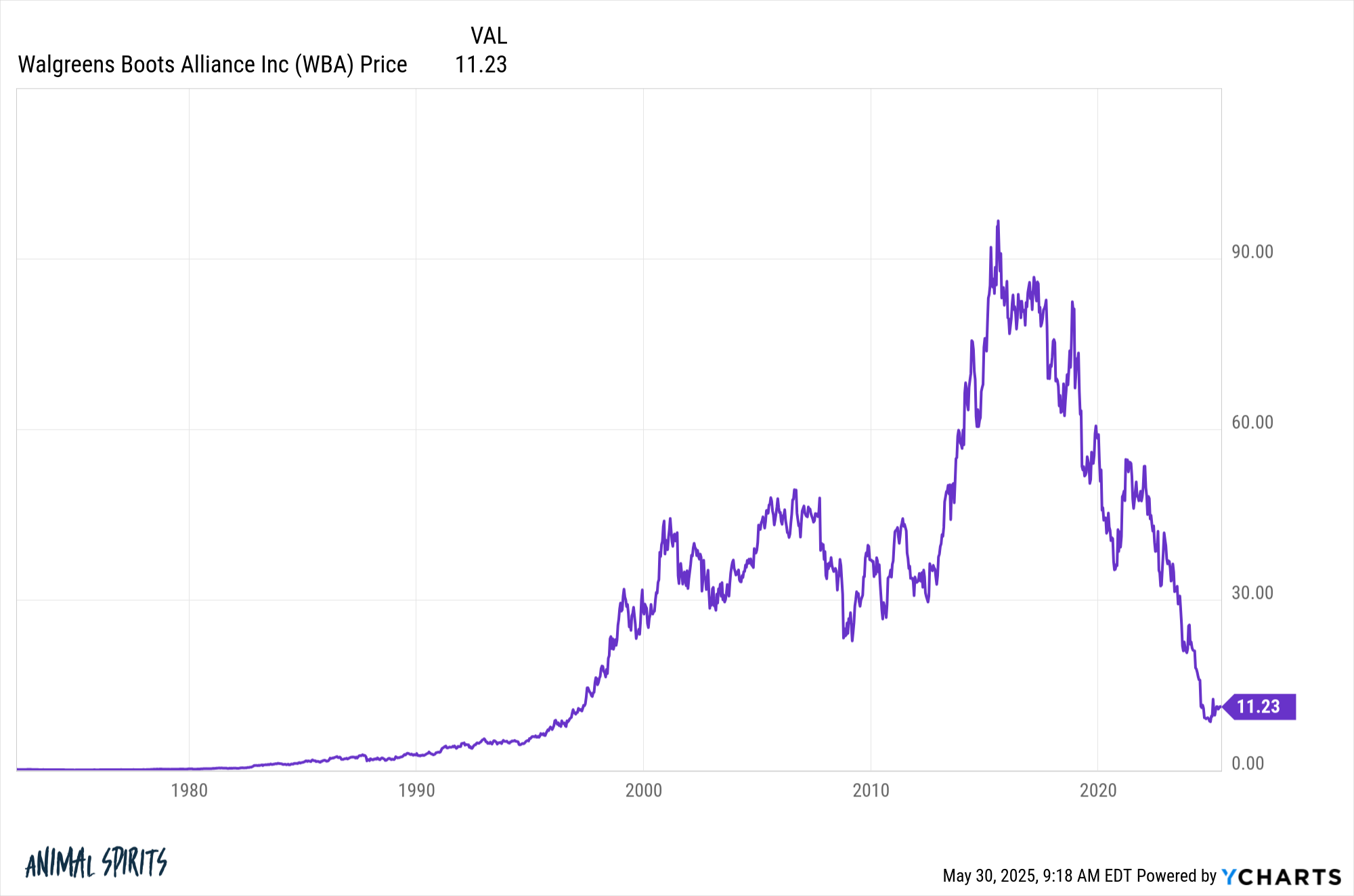

Walgreens:

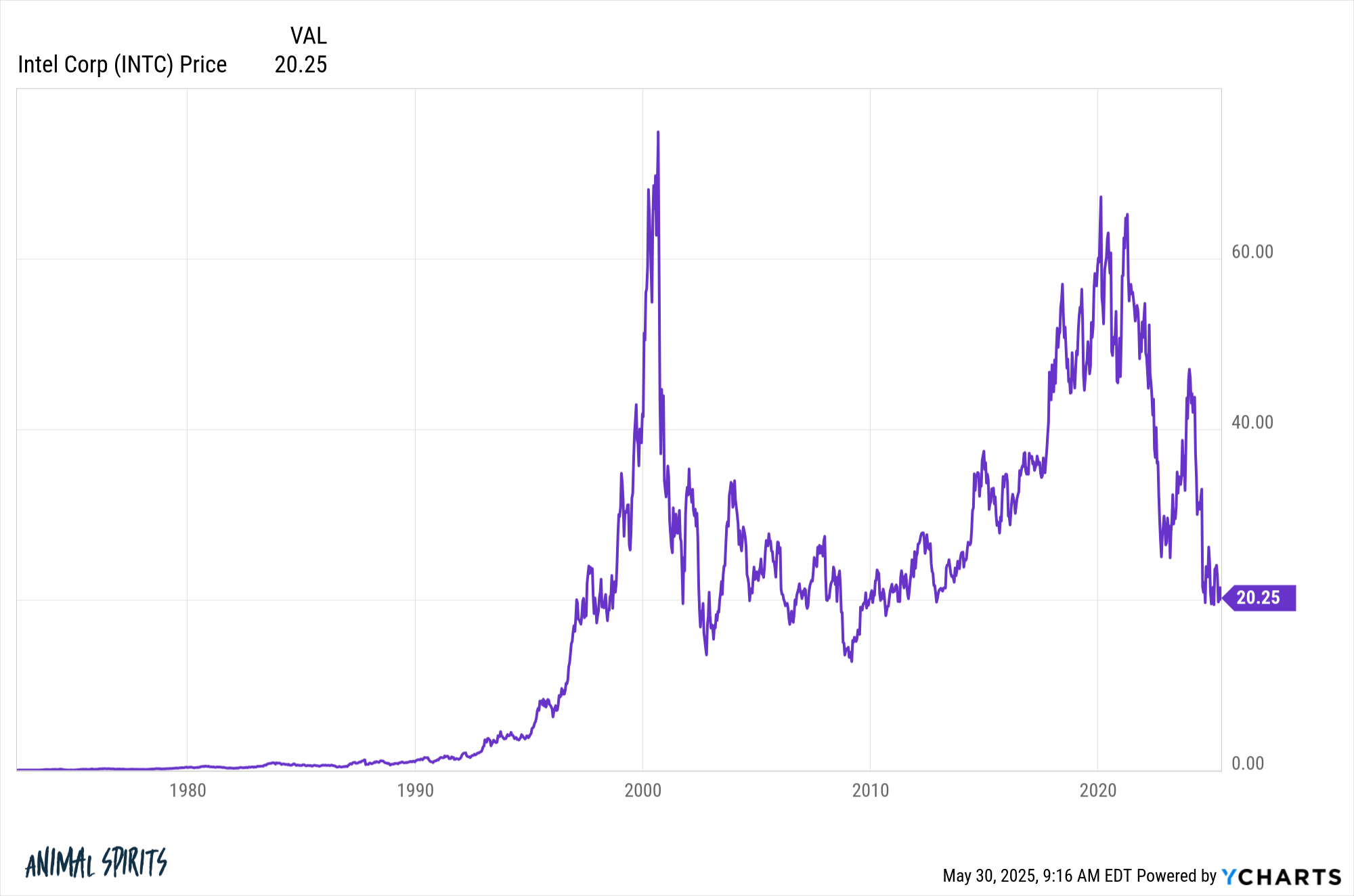

Intel:

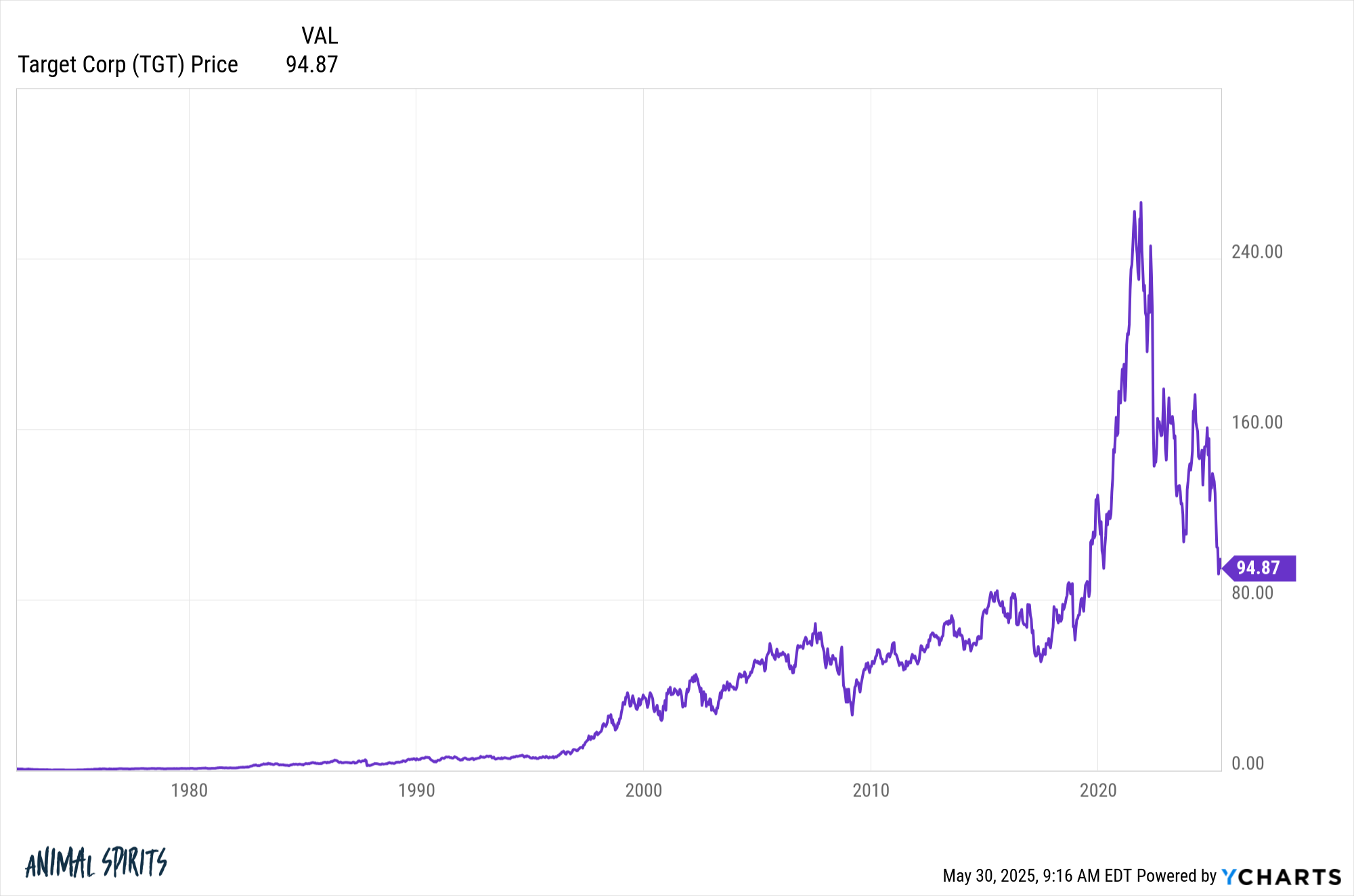

Goal:

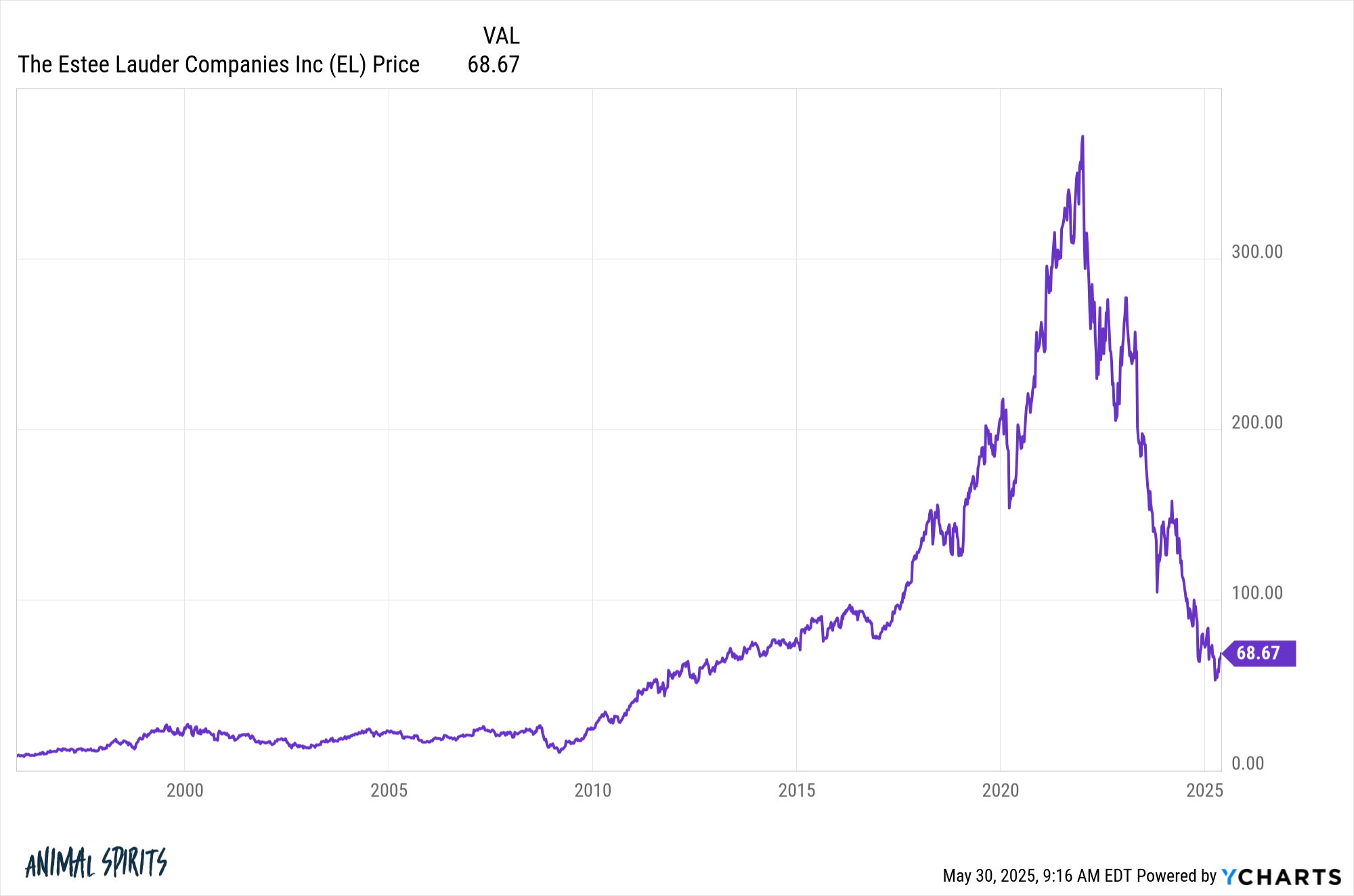

And Estee Lauder:

These corporations are sitting on drawdowns of -87%, -65%, -88%, -73%, -64% and -82%, respectively.

Some have been in drawdowns from all-time highs for years. For some it’s been many years.

Being a contrarian generally is a worthwhile technique however there are some concerns if you happen to plan on wading into the brand new lows listing:

- You might want to be affected person.

- You want a plan past shopping for what’s gone down in value. Worth issues too.

- You want a disciplined course of that you’re keen and in a position to observe it doesn’t matter what the end result is, since you’re by no means going to have the ability to time these items completely.

- Being a contrarian investor might be lonely and painful.

- Keep away from anchoring to previous value factors. Shares don’t need to commerce again as much as their earlier highs simply because they had been there earlier than. That previous value stage is meaningless if the basics of the corporate or sector have modified.

- It’s simple to seek out issues which can be down in value however rather more tough to know if or when they’ll flip round.

- Developments can final for much longer — in each instructions — than most buyers assume is feasible. Feelings may cause costs to detach from fundamentals in a rush and keep that manner for a very long time.

Clearly, nobody truly buys on the high or the underside. That’s a pipe dream. And you may nonetheless earn a living on shares in an enormous drawdown even when they don’t hit prior peak ranges. That is simply one thing to think about if you happen to’re holding onto a inventory that’s fallen drastically and ready for it to interrupt even.

It won’t occur.

A few of these shares won’t ever rise to these heights ever once more.

Michael and I talked about single inventory drawdowns and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Inventory Market Will Choose the Winners For You

Now right here’s what I’ve been studying currently:

Books:

1Bear in mind the Dow is a price-weighted index.

This content material, which accommodates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here can be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.