Mortgage charges got here down after a softer-than-expected CPI print.

However solely somewhat bit. As a substitute of a 30-year mounted quote of seven%, you may see 6.875% as an alternative.

It’s not an enormous distinction, but it surely does present some financial savings as consumers grapple with poor affordability.

Downside is charges proceed to remain in a spread and might’t break meaningfully decrease with so many unknowns nonetheless unresolved.

Weak information is nice for charges, however can solely achieve this a lot when tariff impression is but to be seen.

CPI Cools, Pushing Mortgage Charges Again Away from 7%

The a lot anticipated CPI report got here in favorably for mortgage charges yesterday.

Costs rose simply 0.1% in Might, per the Bureau of Labor Statistics (BLS), down from 0.2% in April.

The month-to-month tally additionally beat the 0.2% forecast.

On the similar time, costs climbed 2.4% yearly, which was in step with expectations.

Core CPI, which strips out meals and power, beat expectations each by month and by yr.

That led to a little bit of a bond rally, with the 10-year yield falling about six foundation factors to 4.41%.

It was sufficient to push mortgage charges all the way down to round 6.875% from nearer to 7%.

Definitely excellent news for potential residence consumers after a sizzling jobs report final Friday.

However not sufficient to make a big impact. To your typical house owner it’s a negligible distinction in month-to-month fee.

The problem at hand is tariffs, which have but to be resolved or mirrored within the client value information.

VP Vance Requires Curiosity Fee Cuts

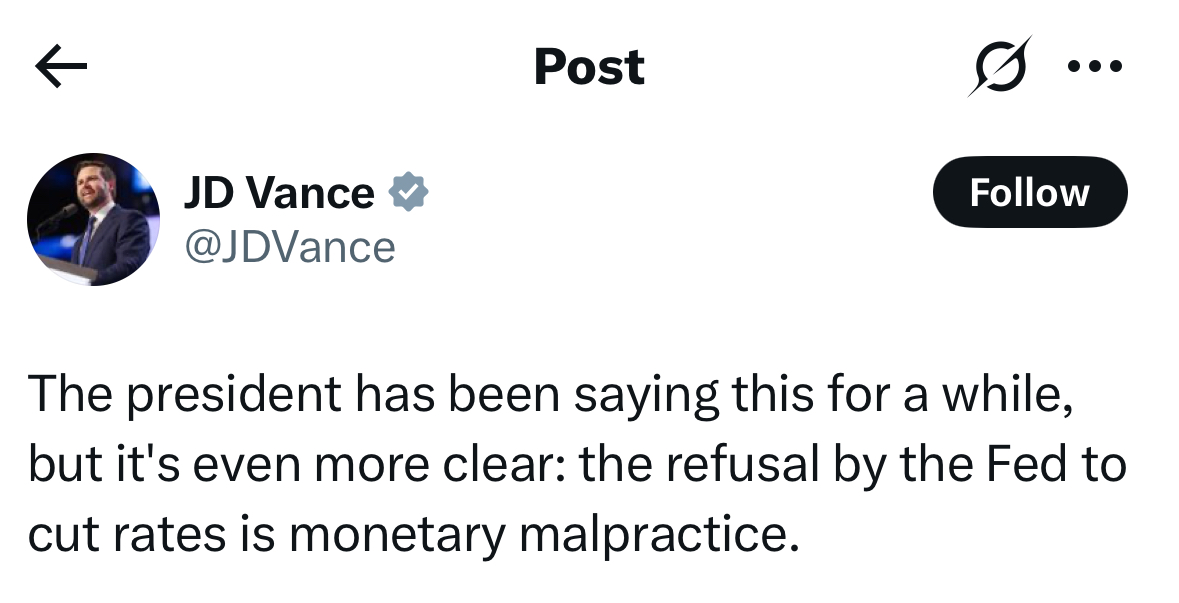

In the meantime, Vice President J.D. Vance joined Trump and others in calling for charge cuts.

On X, he stated, “The refusal by the Fed to chop charges is financial malpractice.”

Downside is, how can they with an ongoing commerce battle that has but to be resolved?

Arguably, if the tariffs have been by no means launched, the Fed could have reduce by now.

Or could be on the subsequent assembly. As a substitute, they’ve pushed again increasingly attributable to uncertainty.

What started as three charge cuts this yr is now possibly none.

And the irony in asking for charge cuts is that they wouldn’t have to ask if not for their very own coverage.

The Fed’s palms are tied as a result of even when inflation is decrease, it’d rise once more because of the tariffs.

So asking for charge cuts after probably exacerbating inflation is like saying you’re happening a weight loss plan (however doing the other) then asking for dessert.

Crude analogy, however one of the best I might give you.

Finish of the day, the Fed would decrease charges if it might, however it might probably’t due to tariff unknowns.

As well as, the Fed doesn’t even management mortgage charges, so it wouldn’t essentially assist anyway.