A reader asks:

100 Years is a heartbeat by way of the dimensions of human historical past. What are the chances that capital may develop into so bountiful and technological innovation so quick that shares fall and keep underwater ceaselessly? I by no means hear mainstream (hold shopping for) advisors even entertain this risk.

This query was in response to one of many many market research I’ve executed through the years.

I get variations of this query on a regular basis — what if shares for the long term isn’t meant to final?

There’s lots to cowl right here however first a historical past lesson.

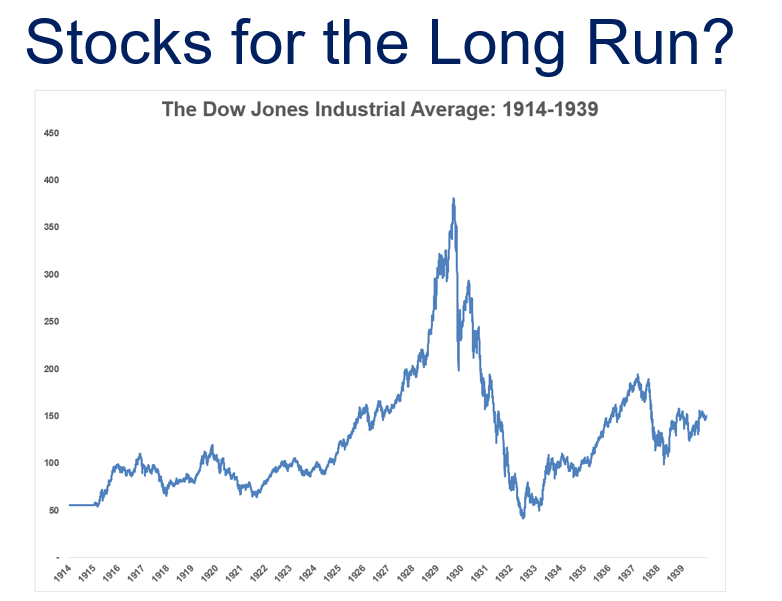

Your complete concept of shares for the long term remains to be comparatively new. Buyers actually didn’t really feel that approach within the Thirties and Forties after witnessing the inventory market fall 85% through the Nice Melancholy. Are you able to blame them?

Plus, only a few traders knew what the long-term returns in shares even have been earlier than the Nineteen Sixties.

Nobody had the info.

That’s, till a VP at Merrill Lynch named Louis Engel stepped as much as the plate. Engel was tasked with determining the long-term returns for the inventory market so he might give Merrill’s brokers some ammo when speaking to shoppers and prospects. Nobody actually had the info in a single place so Engel went to the Chicago College of Enterprise who mentioned they might carry out the historic examine if Merrill would fund the analysis.

A gaggle of professors have been capable of put collectively a dataset of NYSE-listed shares from 1926-1959. The method took practically 4 years to finish, which created what’s now generally known as the Middle for Analysis in Safety Costs (CRSP).

They now had a long-term historic file of U.S. inventory market returns, which have been a lot better than most traders assumed.

Regardless of that gargantuan crash within the melancholy, the U.S. inventory market was up greater than 2,700% in whole from 1926-1959. That’s 10.3% per 12 months.

Only for enjoyable I made a decision to have a look at the annual returns within the aftermath of that examine:

Fairly shut.

We’ve got about 100 years of fine inventory market information, however we’ve solely identified about it for 65 years. I utterly agree that it is a drop within the bucket by way of our historical past as a species. Everybody would really feel way more assured about historic market information and relationships if we have been working with 1,000 or 10,000 years of information.

Nonetheless, even when we had a for much longer historical past to check, the long run would all the time have the identical actual stage of uncertainty. There may be all the time the possibility of a paradigm shift nobody sees coming.

Historic information isn’t good however what different selection do you’ve got? The outdated saying, “I might quite be roughly proper than exactly flawed,” appears to suit right here.

I’ve had loads of individuals ask me a couple of Japan-like scenario the place shares go nowhere for many years however this query sounds extra like a Star Trek scenario. I’m not a Trekkie however my basic understanding of the sequence is that know-how solved many massive issues by abundance — poverty, illness, work, the surroundings, and so forth. — which allowed them to discover new galaxies and civilizations.

Something is feasible, though I discover it onerous to consider that the most important firms on the earth would join applied sciences that primarily put them out of enterprise.

I perceive why sure traders fear concerning the inventory market breaking. It’s a scary risk, however I don’t assume it is sensible to waste your time worrying about it.

No matter the reason being, if the inventory market doesn’t go up over the lengthy haul you’re going to have a lot larger issues than your portfolio. Your investments gained’t matter.

Additionally, let’s say you are attempting to hedge in opposition to this doomsday situation. What’s your plan? Bury your cash in your yard? Hoard bullets and gold bars?

My baseline assumption is that human beings will try to earn extra money and higher their station in life. Firms will innovate and search for methods to extend earnings. The economic system will develop. Unhealthy issues will occur however the long term will see progress.

Perhaps these baseline assumptions will show to be flawed in a dystopian future however I don’t see how you possibly can probably put together for that scenario wanting constructing a bunker beneath your home.

What’s the purpose of investing when you don’t assume the long run might be higher than the previous and current?

The one approach to make sure you’ll fail as an investor is to keep away from investing within the first place.

I did a deep dive of this query on this week’s Ask the Compound:

Invoice Candy joined me once more on the present this week to debate questions on placing your entire retirement property in a Roth IRA, the best way to make a profession shift to finance, the best way to save in your youngster’s future, tax issues when shifting out of Florida and extra.

Additional studying:

Threat Free S&P?