A reader asks:

I used to be studying your publish “3% Market Returns For The Subsequent Decade” and it obtained me serious about one thing you wrote about a couple of years in the past — the John Bogle Anticipated Return Formulation. I don’t keep in mind the way you had been in a position to get the numbers to calculate the formulation, however I’d like to see an replace about what the formulation says at present.

I got here throughout the Bogle Anticipated Returns Formulation in his ebook Don’t Depend On It.

Bogle regarded again on the historical past of inventory market efficiency going again to 1900 by breaking down returns into three principal elements:

1. Dividend yield

2. Earnings progress

3. The speculative return or change in valuations

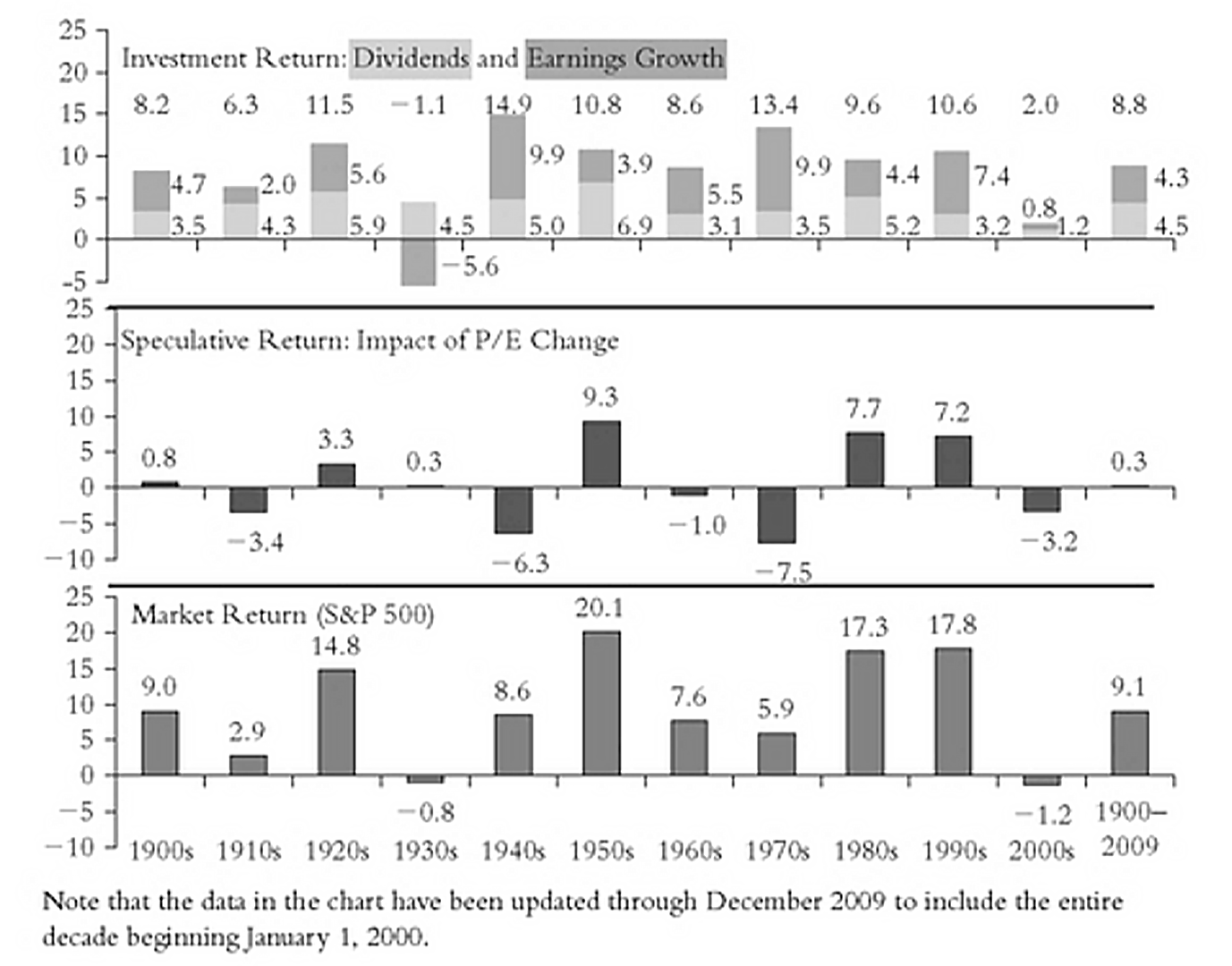

Bogle broke out these return variables by decade to point out the place inventory market efficiency comes from:

The 9.1% return from 1900-2009 was made up of principally dividends (4.3%) and earnings progress (4.5%) with little change within the speculative ingredient (0.3%). However the person a long time are in every single place.

There have been a long time with common fundamentals however extremely speculative returns (Nineteen Fifties), poor fundamentals with little change within the speculative return (Nineteen Thirties) and good fundamentals with poor valuations (Seventies).

Clearly, there are causes for every atmosphere. Context issues.

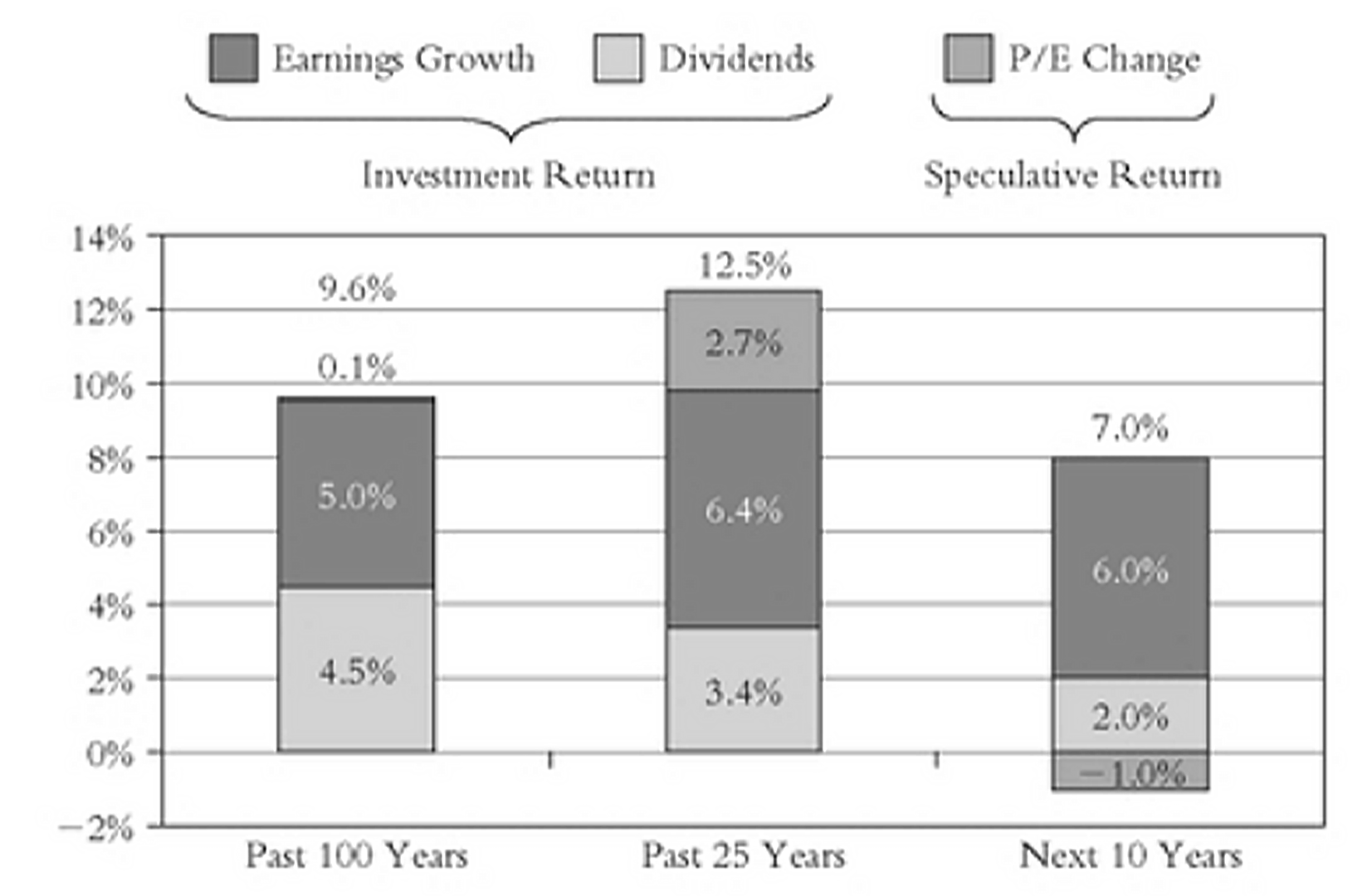

Then Bogle used that very same formulation to give you anticipated returns for the subsequent decade:

The inventory return over the approaching decade is projected at 7 %, primarily based on at present’s dividend yield of about 2 % and potential nominal earnings progress of about 6 %, with a shading for the marginally decrease price-earnings ratio that I count on a decade therefore.

Right here’s a chart from the ebook:

The below-average return forecast was the results of speculative returns being so excessive in current a long time and beginning dividend yields being so low. On the time this sounded cheap. A lot of folks had been forecasting decrease returns following the Nice Monetary Disaster.

Keep in mind the brand new regular?

This ebook was printed within the fall of 2010, so we will see how the precise returns examine to the forecast.

Over the ten years from 2011 to 2020, the Vanguard Whole Inventory Market Index Fund was up 263% in complete or 13.8% annualized, almost double Bogle’s forecast.

So the place did Bogle’s assumptions go incorrect?

I’ve up to date his formulation by 2025:

Earnings progress within the 2010s and 2020s have been a lot increased than anticipated and valuations have continued to extend.

To be truthful to Saint Jack1, nobody was predicting the tech inventory dominance that was coming. These companies turned high-margin, hyperscaler, high-growth, cash-flow-producing machines.

It’s additionally shocking that we had 13.6% annual returns within the 2010s and have matched those self same returns within the 2020s (to date).

The previous is nice and all however buyers care extra about what occurs sooner or later.

The present dividend yield of the U.S. inventory market is 1.3%. Let’s assume know-how and AI hold earnings progress above common from productiveness and effectivity features — name it 7-8%. On pure fundamentals alone, that’s fairly good, even when my earnings estimates are too excessive.

The unanswerable query is how do buyers really feel about shares? That’s all valuations are, is emotions.

Relying on the atmosphere, generally buyers are prepared to pay extra for earnings and generally much less.

Threat urge for food has been sturdy all through the 2020s. It appears like that may proceed in the meanwhile however who is aware of what the market gods will throw at us within the coming years.

This train is an efficient reminder of the issue in predicting the longer term. Your earnings forecast may very well be spot on within the years forward and you continue to most likely received’t be capable to estimate ahead returns from right here.

That’s to not say that fundamentals don’t matter. After all they do…over the long term.

I’ll give the ultimate phrase on this to Bogle:

Over the very future, it’s the economics of investing–enterprise–that has decided complete return; the evanescent feelings of investing–hypothesis–so vital over the quick run, have in the end confirmed to be just about meaningless.

Amen.

I did a deep dive on this query for this week’s Ask the Compound:

Callie Cox joined me on the present to debate viewer questions on my typical work day, how private experiences form your funding views, hedge a falling greenback, saving an excessive amount of cash and the way a lot is an excessive amount of for a single inventory place.

Additional Studying:

3% Returns For the Subsequent Decade?

1Bogle has accomplished greater than anybody in historical past to decrease prices and supply higher funding choices for the plenty.