Bonds had a strong begin to 2025, with most high-quality fastened revenue sectors up low- to mid-single digits via the primary half of the yr. Whereas shares skilled a roller-coaster journey powered by coverage uncertainty, fastened revenue usually held up nicely regardless of the broader market turbulence. Will or not it’s the identical story within the second half? Let’s take a more in-depth look.

A Flock to Security

Traditionally, investment-grade bonds have benefited in instances of uncertainty, as buyers typically flock to the protection of high-quality fastened revenue when dangers rise. We definitely noticed that play out earlier this yr when shares offered off and bonds rallied. The chart beneath highlights year-to-date and one-year returns for a handful of main sectors inside fastened revenue.

12 months-to-Date and 1-12 months Whole Returns

| 12 months-to-Date | 1 12 months | |

| Bloomberg U.S. Mixture Bond Index | 2.35% | 4.61% |

| Bloomberg U.S. Company Bond Index | 2.40% | 5.13% |

| Bloomberg U.S. Company Excessive Yield Index | 3.10% | 9.26% |

| Bloomberg Municipal Bond Index | -1.02% | 0.91% |

| Bloomberg Municipal Excessive Yield Bond Index | 2.47% | 5.54% |

| Bloomberg U.S. Treasury 1-5 12 months Index | 3.44% | 6.45% |

Supply: Bloomberg, as of 6/10/2025. All indices are unmanaged, and buyers can’t really make investments immediately into an index. In contrast to investments, indices don’t incur administration charges, expenses, or bills. Previous efficiency doesn’t assure future outcomes.

Trying ahead to the second half of the yr, the probably end result for fastened revenue buyers is sustained strong beneficial properties. Nonetheless, there are dangers that must be acknowledged and monitored, together with the menace to the bond rally posed by rising considerations in regards to the nation’s deficit and long-term debt plans.

Shifting Focus to Lengthy-Time period Yields

When will the Fed begin slicing charges? Coming into the yr, that was one of many main questions for the bond market. We entered the yr with merchants pricing between one and two rate of interest cuts in 2025, with the primary lower anticipated in Might because of an anticipated financial slowdown. However this charge lower by no means materialized. The financial information confirmed the job market remained impressively resilient via the beginning of the yr, whereas inflation remained stubbornly excessive. Fed members, together with Chair Jerome Powell, have indicated the central financial institution is in no rush to regulate rates of interest and can stay data-dependent when setting charges at future conferences.

Given the shortage of Fed exercise to begin the yr and muted expectations for additional charge cuts in 2025, investor focus has shifted towards the longer finish of the yield curve. This shift turned particularly obvious after Moody’s downgrade of the U.S. financial system in Might amid the continuing congressional budgeting discussions which can be set to broaden the scale of the deficit and nationwide debt.

Lengthy-term Treasury yields fell all through the primary quarter of the yr. Within the second quarter, they rose notably, with the 30-year Treasury yield hitting a latest excessive of almost 5.10 % in late Might. Whereas long-term yields have pulled again modestly from latest highs, they nonetheless sit nicely above the degrees seen all through 2024, indicating continued investor concern. Upwards stress on long-term yields might current a headwind for fastened revenue buyers within the second half of the yr, particularly as congressional negotiations over the price range and tax insurance policies proceed.

A Take a look at Company and Municipal Bonds

Whereas Treasury yields attracted a lot of the consideration within the first half of the yr, there are compelling alternatives within the company and municipal bond markets for buyers prepared to tackle credit score threat in alternate for heightened yields.

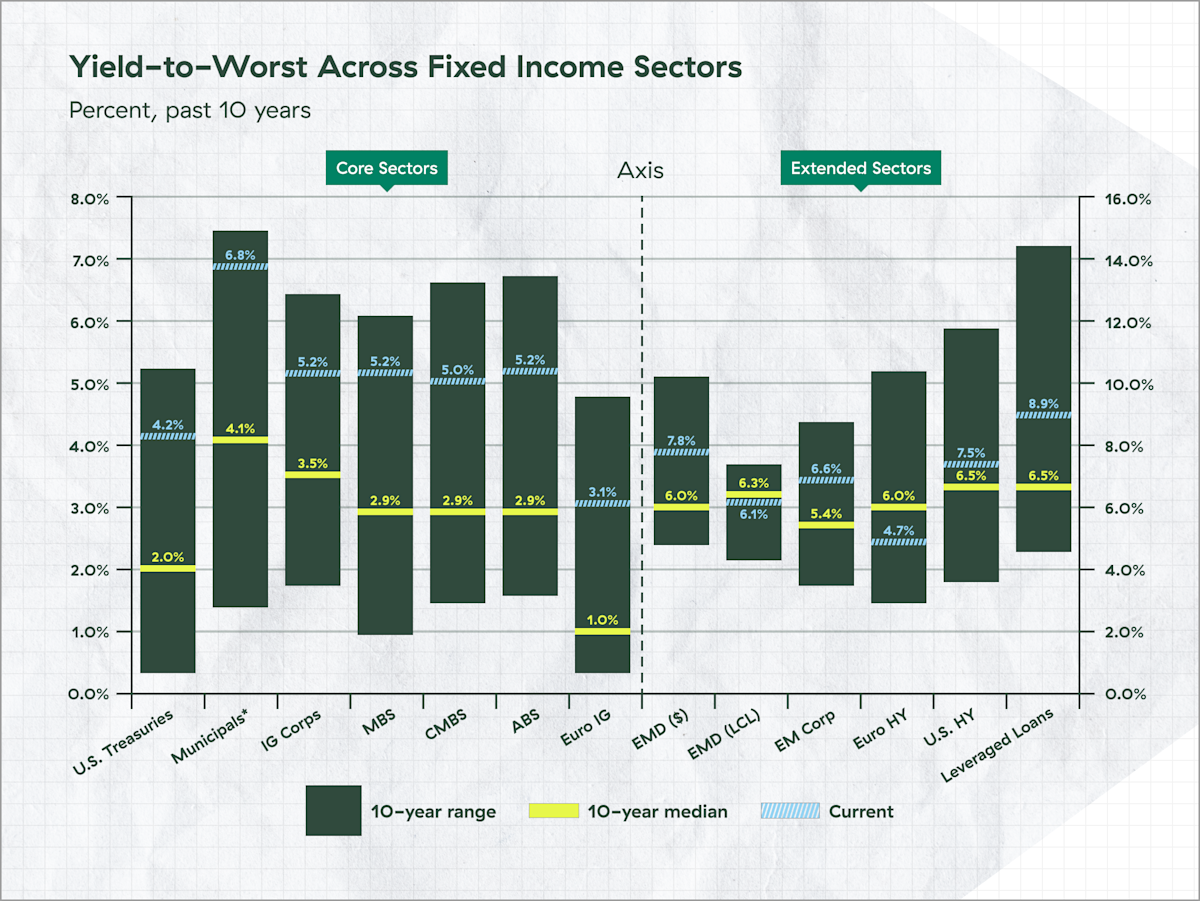

Treasury, municipal, and company bond yields are all presently above their respective 10-year median values (see chart beneath). However tax-adjusted municipal bonds and investment-grade company bonds might present extra potential yield in comparison with Treasuries.

Supply: Bloomberg, FactSet, J.P. Morgan Credit score Analysis, J.P. Morgan Asset Administration. Indices used are Bloomberg aside from ABS, rising market debt and leveraged loans: ABS: J.P. Morgan ABS Index; CMBS: Bloomberg Funding Grade CMBS Index; EMD (USD): J.P. Morgan EMIGLOBAL Diversified Index; EMD (LCL): J.P. Morgan GBI-EM International Diversified Index; EM Corp.: J.P. Morgan CEMBI Broad Diversified; Leveraged Loans: JPM Leveraged Mortgage Index; Euro IG: Bloomberg Euro Mixture Company Index; Euro HY: Bloomberg Pan-European Excessive Yield Index. Yield-to-worst is the bottom potential yield that may be acquired on a bond other than the corporate defaulting and considers components like name provisions, prepayments and different options that will have an effect on the bonds’ money flows. *All sectors proven are yield-to-worst aside from Municipals, which relies on the tax-equivalent yield-to-worst assuming a top-income tax bracket charge of 37% plus a Medicare tax charge of three.8%. Information to the Markets – U.S. Knowledge are as of Might 30, 2025.

Whereas investment-grade company bonds have moved in step with the broader market thus far this yr, investment-grade municipal bond returns lagged their friends within the first half. This underperformance was largely because of a mix of excessive issuance and uneven funding flows, together with considerations about potential tax coverage adjustments that would strip some municipal issuers of their tax-exempt standing. Trying ahead, these headwinds are anticipated to show into tailwinds for buyers, as municipal bond valuations seem comparatively enticing as a result of latest underperformance.

Bonds Performing Like Bonds

Finally, the primary half of the yr was largely constructive for fastened revenue buyers. Regardless of the ups and downs for shares, bonds held up comparatively nicely as compared. Given the coverage volatility to begin the yr, it’s encouraging to see bonds performing like bonds in instances of market uncertainty. We must always anticipate to see that conduct proceed within the second half.

That’s to not say there aren’t any dangers to this outlook. Political uncertainty stays probably the most urgent challenge for buyers. Whereas we’ve seen progress in decreasing the temperature of the continuing price range and commerce negotiations, additional surprises or disruptions might rattle markets. Mounted revenue buyers may face financial headwinds, particularly if there’s a sustained rise in inflationary stress.

Whereas high-quality bonds have traditionally carried out nicely in instances of uncertainty, latest historical past has proven durations the place bonds and shares skilled declines on the identical time. Most not too long ago, in 2022, a surge in inflation and rates of interest led to double-digit losses for each shares and bonds. Whereas it’s not anticipated presently, if we do see a significant rise in inflation, it might negatively affect markets, particularly if it prevents the Fed from decreasing charges later within the yr.

Cautious Optimism Forward

All that being stated, fastened revenue buyers must be cautiously optimistic as we enter the second half of the yr. Valuations are strong, yields are compelling, and bonds are performing like bonds once more. These components ought to contribute to a strong remainder of the yr for buyers.

Bonds are topic to availability and market situations; some have name options that will have an effect on revenue. Bond costs and yields are inversely associated: when the worth goes up, the yield goes down, and vice versa. Market threat is a consideration if offered or redeemed previous to maturity.