There have been 22 buying and selling days in March of 2020.

Simply sooner or later out of these 22 noticed a transfer of lower than plus or minus 1%.

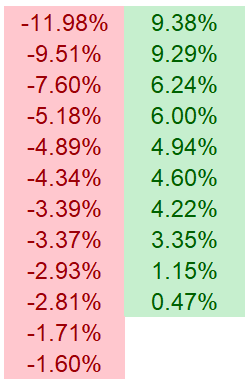

Each different day noticed a big transfer together with 8 days of down 3% or worse and eight days of up 3% or higher. These have been the day by day returns throughout that fateful month:

It felt like a 12 months’s value of volatility in a single month.1 It was probably the most unstable months in inventory market historical past, proper up there with the assassin’s row within the Thirties.2

The S&P 500 completed the month down greater than 12%. On the worst of the downturn, shares have been down 34% from the February highs simply weeks earlier than.

One of many craziest issues about this complete ordeal is that the market completed the 12 months up 18%. I don’t must recount the the reason why. It wasn’t that way back.

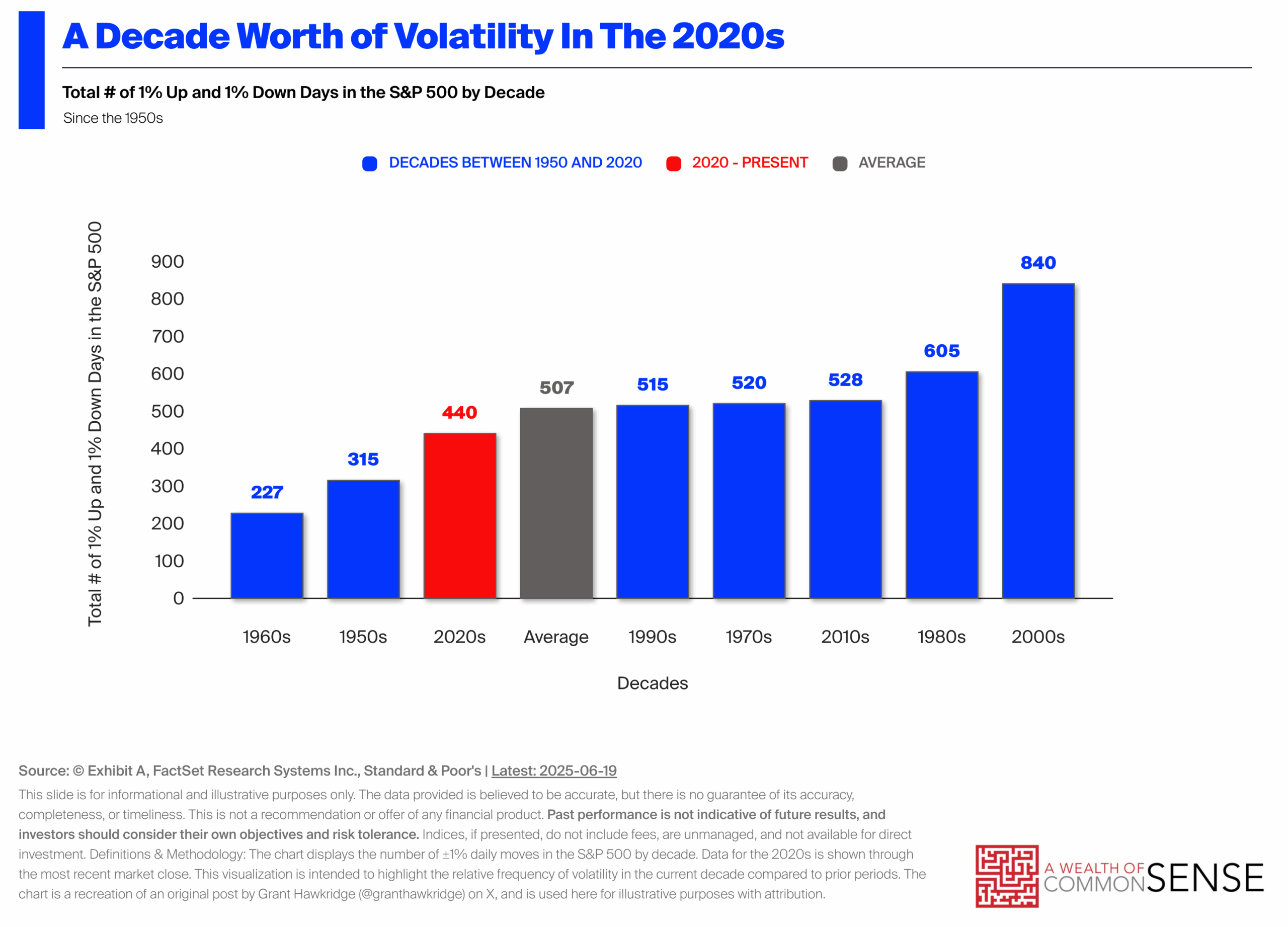

Insane volatility with great returns is the story of the 2020s. This decade is on tempo for essentially the most +/-1% days in a decade over the previous 8 a long time:

It wouldn’t shock me if we break the 2000s report.

However bear in mind, the annualized return within the first decade of the twenty first century was a lack of -1%. The volatility within the 2000s made sense within the context of poor returns, which is often what occurs.

Dangerous issues are inclined to occur throughout dangerous markets.

Though this decade has seen numerous dangerous issues occur, the S&P 500 continues to be up almost 14% on an annualized foundation for the 2020s.

It seems like we undergo some loopy state of affairs, then buyers freak out somewhat, the market nostril dives however then everybody forgets about it and strikes on like a case of monetary amnesia.

Take into consideration all of the stuff we’ve gone by way of this decade — the pandemic, the meme inventory craze, 9% inflation, the Fed jacking up charges from 0% to five% in a rush, the Silicon Valley mini banking panic, the Yen carry commerce blow out, Liberation Day and a bunch of different stuff I’m forgetting.3

The booms and busts are taking place quicker than ever but the market continues to cost larger.

Now we’ve got a state of affairs the place america simply bombed Iran.

Will this result in one other bout of volatility the place buyers fully neglect about it a month later?

Probably. We’ll see.

I simply discover it fascinating how the market is behaving this cycle.

Markets are extraordinarily unstable but they only preserve going up. Buyers care about what’s happening within the second however then transfer on instantly, like some type of highschool relationship you weren’t actually into. Within the info age it looks as if the market solely has the bandwidth to care about one occasion at a time.

This gained’t final ceaselessly.

Returns can be beneath common for a time period or we’ll have one other monetary disaster or recession or one thing to vary the psyche of buyers.

For now, volatility, booms, and amnesia reign.

One of many keys to profitable long-term investing is the flexibility to comply with your funding plan regardless of scary headlines.

This decade it’s working.

Additional Studying:

Pandemic Infants & a Bull Market in Threat

1And this was bookended by 3 down days of three% on the tailend of February together with a +2%, +7% and +3% within the first week of April. After which we have been off to the races.

2The Thirties are in a category of their very own.

3See I’ve monetary amnesia too.

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here can be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.