My focus is break up – scholar loans and financial savings. I simply up to date you on my debt load after funds made this month. Now it’s time for a financial savings replace.

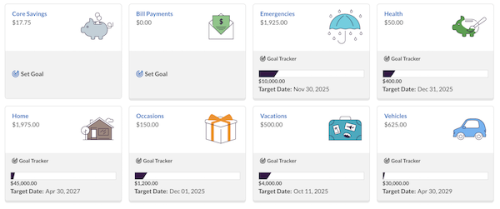

I at present have a complete of $6,249 in my private financial savings accounts. $807 is in my lengthy standing private financial savings account. And the remaining is in my new Ally financial savings account assigned to all my financial savings buckets that I created after I created my funds. There was unique (publish home sale $4,000 extra in financial savings. I’ll clarify use after I get a Could finance replace collectively.)

*Word: earlier than you come for me, this picture solely reveals $6,049 as there’s a $200 switch pending.

How do you want Ally?

I’m so grateful to the individual in my remark a couple of excessive yield financial savings account who really useful Ally. I LOVE, LOVE, LOVE the buckets and associated purpose and date characteristic. After which seeing cumulative complete may be very motivating.

It’s been really easy to arrange and use. And feels “far-off” so I’m under no circumstances tempted to have a look at it usually not to mention contact the cash there.

My solely criticism is that transfers take wherever from 3-4 enterprise days. Whereas they take the cash out of my account on day 1, they take 3-4 days to deposit it into my account. (Even when they listed it as Not Obtainable). They do present the switch as pending, however looks as if a stretch to take that lengthy to even file in my account.

I solely have the one financial savings account. And I’ve already earned simply over $17 in curiosity. And that’s in simply over a month. Woot, woot!

Very motivating.

Future Plan

The plan stays the identical, with a small hiccup of this unplanned keep in GA whereas Magnificence and fiance get well from 4 wheeler accident.

I’ll proceed to dwell with my mother and father, serving to look after my mother (and pa as wanted) till I’m not wanted. Issues are working effectively with dad. I maintain day time care – feeding, bathing, and modifications. After which cook dinner a number of occasions per week for dad and I, consuming leftovers in between. Dad handles night care and is free to get out of the home throughout the day. We’re each fairly pleased with this schedule.

And I’m capable of work round mother’s schedule, and vice versa. I begin at 4:30am every day. And we make it work. I’m diligently saving and paying some further to my scholar loans each month. However I feel I’m leaning barely extra to saving.

My siblings have stepped again in whereas I’m right here in GA.

The publish Financial savings to Date – Ally Overview appeared first on Running a blog Away Debt.