A reader asks:

I’d like to see your tackle a concrete financial savings/internet value quantity targets by age for a snug life, with out the hand-wavey “X% of your earnings” that so many different websites give. Earnings at all times modifications a lot from 12 months to 12 months in order that response by no means feels worthwhile to me.

The share of earnings strategy to how a lot cash it’s best to have saved is sort of prevalent nowadays.

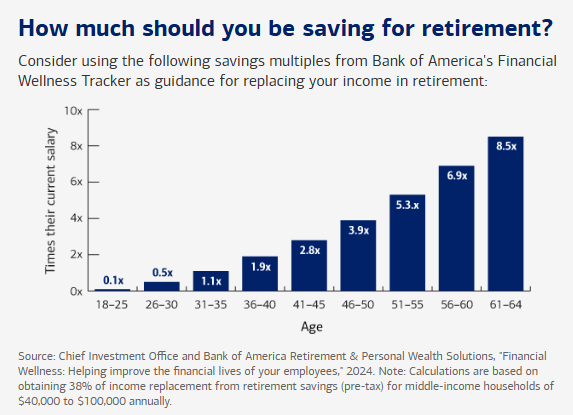

One thing like this one from Financial institution of America:

I perceive why some folks may not be comfy utilizing such a information as a benchmark.

Incomes do change from 12 months to 12 months. Some folks work on a variable earnings versus a wage. Plus, your absolute earnings degree is context-dependent. Making $250k a 12 months in Iowa is drastically totally different than making $250k a 12 months in NYC.

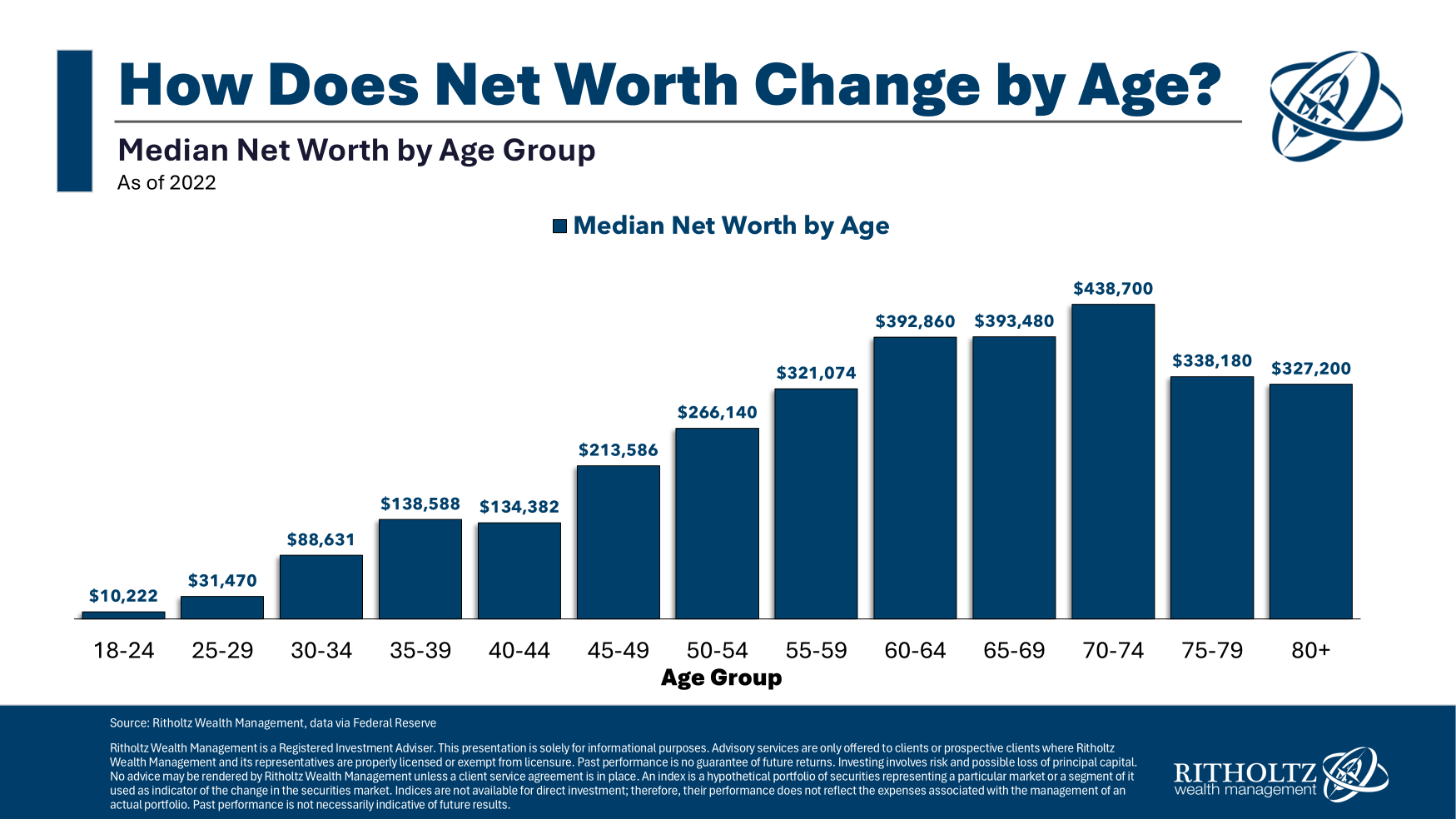

You would additionally benchmark by the precise numbers. Right here’s a take a look at median internet value ranges by varied age teams:

These are the median internet value figures from the most recent Federal Reserve Family Survey. They break them out by 5 12 months intervals. The issue right here is that there’s a big selection across the median figures.

For instance, within the 40-44 age group, the median internet value is $134k. For the underside 25%, it’s $23k. For the highest 25% it’s $436k. And for the highest 10% and 1%, it’s $1.1 million and $7.8 million, respectively.

One thing for everybody relying on who you wish to evaluate your self with.

Sadly, there actually isn’t any passable reply right here.

A “comfy” life is subjective. It’s going to be primarily based on:

- How a lot you earn.

- The place you reside.

- How a lot you spend.

- How a lot you save.

- Your objectives in life.

- Your tastes for the finer issues.

These items is and at all times can be circumstantial.

Nevertheless, you continue to should do one thing for planning functions. You may’t simply make a wild guess and hope for one of the best.

I’m a spreadsheet warrior and have been performing a easy monetary planning train since I obtained my first job out of faculty and had a detrimental internet value. Right here’s what I’ve accomplished since I entered the funding trade 20+ years in the past:

Each 3-4 years I do a list on the place we’re financially:

- What do owe?

- What will we personal?

- What will we make?

- What’s our financial savings fee?

- What’s our internet value?

Then I make some assumptions:

- Let’s say our earnings grows by X% within the coming years.

- Let’s say our financial savings fee is X% this within the coming years.

- Let’s say our investments develop by X% within the coming years.

These assumptions embrace a baseline, a conservative and an aggressive estimate.

I do know these numbers are made up however what else are you able to do? Because the previous saying goes, I might somewhat be roughly proper than exactly fallacious.

Then I map that out over the following 5-10 years.

And each few years I evaluate the precise outcomes to the estimates.

Possibly the earnings numbers are higher than anticipated, the returns had been about common, and we really saved lower than deliberate or another mixture of these items. Then I determine if any course corrections are obligatory primarily based on the now up to date numbers and present monetary state of affairs.

That may imply dialing up or down the financial savings fee, altering our asset allocation or making no modifications (which is what occurs most frequently.)

Our monetary planners at Ritholtz Wealth have a way more detailed strategy and software program applications to make the most of with purchasers however that is the final strategy they take as properly.

Monetary planning requires estimates, assumptions and updates because it’s a course of and never a one-time occasion.

I like the concept of evaluating your self to your self versus peer benchmarks or made-up goalposts.

It’s additionally value remembering that your goalposts will at all times be shifting and that’s OK. My objectives, desires and aspirations are a lot totally different now in my 40s as a household man than they had been in my 20s with no obligations.

Considered one of my anti-personal finance beliefs is that you just by no means really determine what ‘sufficient’ means to you and that’s OK too. It’s extra about discovering a spread you’re comfy and content material with in the meanwhile.

However your private goalposts are the one ones that matter really matter.

Invoice Candy joined me on Ask the Compoud this week to do a deeper dive on this query:

We additionally answered questions from viewers on an investor with an excessive amount of cash in CDs, how the brand new tax invoice will affect your taxes, the brand new $1,000 child accounts and learn how to pay no taxes.

Additional Studying:

How A lot Do People Have Saved For Retirement?