The Inflationistas are an eclectic mixture of subgroups, beliefs, and ideologies. They rely the bond vigilantes, arduous cash advocates, Milton Friedmanites, Fed haters, goldbugs and crypto bros amongst their numbers.

Their unifying thread: Printers go Brrrrr.

As a bunch, they consider that cash printing is the rationale for all value will increase and, subsequently, should be opposed. By no means thoughts that the last decade following the GFC was about DE-flation, not IN-flation…

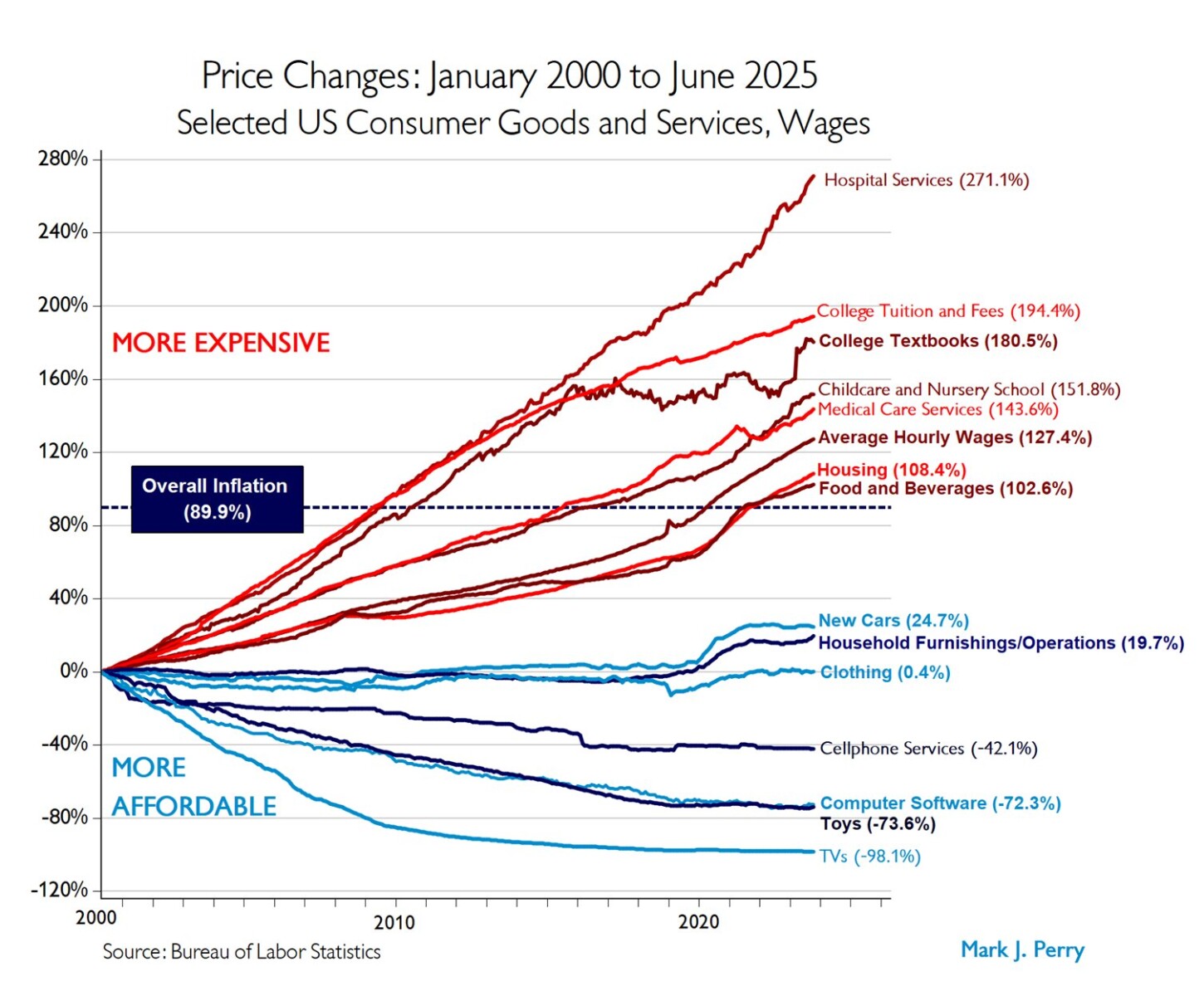

Take a look on the chart (through Mark Perry) above. It breaks down varied sectors, displaying what’s above- and below-average inflation. It’s noteworthy that a lot of the objects within the above part are companies; a lot of the objects beneath common are bodily items.

this on a sector-by-sector foundation, we will see that lots of the greatest contributors to general value will increase have very particular drivers, none of which have something by any means to do with the central financial institution.

For these of you who’re doubters, maybe an inflation subsector evaluation could also be of curiosity:

House costs: Provide limitations

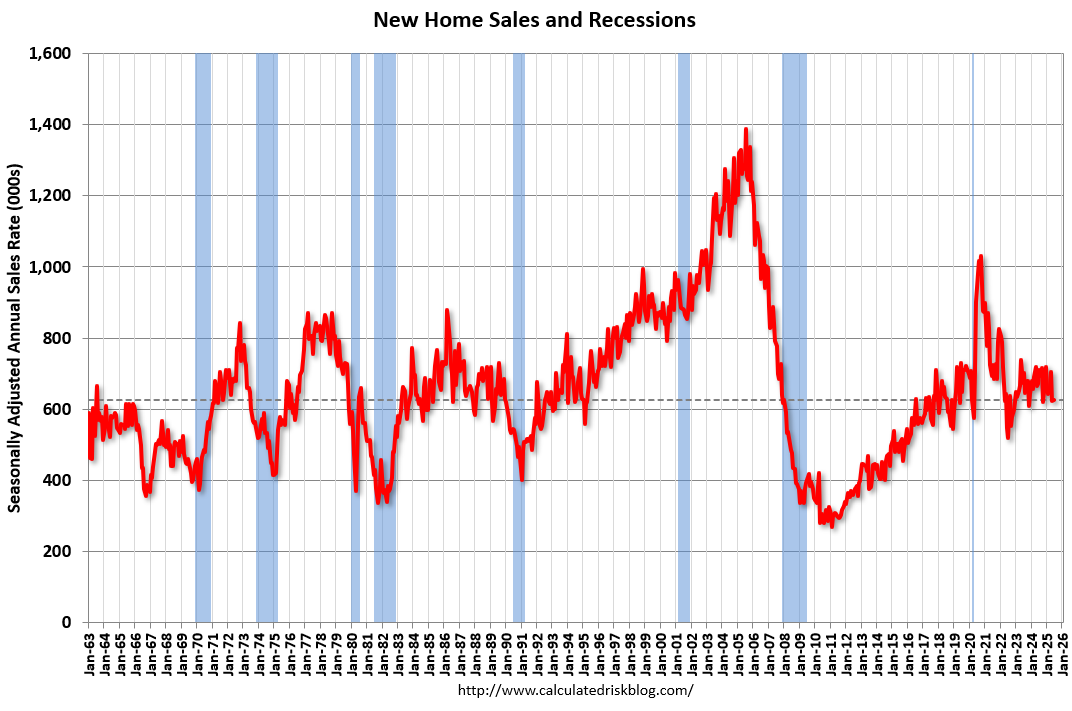

It’s arduous to disclaim that the mixture of a rising inhabitants and restricted, below-average building of single-family houses has been a poor combine (see chart). Add in NIMBY and the surge of second-home purchases through the pandemic, and it turns into clear that dwelling costs are being pushed primarily by provide points.1.

There was an overbuild of single household houses from 1999 to 2006. That was adopted by greater than a decade plus of underbuilding, even because the inhabitants within the U.S. rose (We mentioned this 4 years in the past).

At this time, the U.S. is brief 3 to five million single-family houses, and it’ll doubtless take years (a long time?) to catch up absolutely.

Cars / Auto insurance coverage: Provide/Pandemic results

Let’s mix these into one group, as a result of it has the identical fundamental drivers: Begin with the scarcity of recent vehicles from 2020-22, instantly affected by the pandemic shutdowns; add an inadequate provide of semiconductors (exasberating the issue). A 3-year manufacturing scarcity of recent vehicles means at present now we have a scarcity of used vehicles – at the least the vintages that may have been usually produced in 2020, ’21, and ’22. That additionally created a scarcity of components. This drove new and used automotive costs greater, and is making repairs for even minor accidents far more costly than they could have been in any other case.

Greatest guess: Three to 5 years for this to resolve…

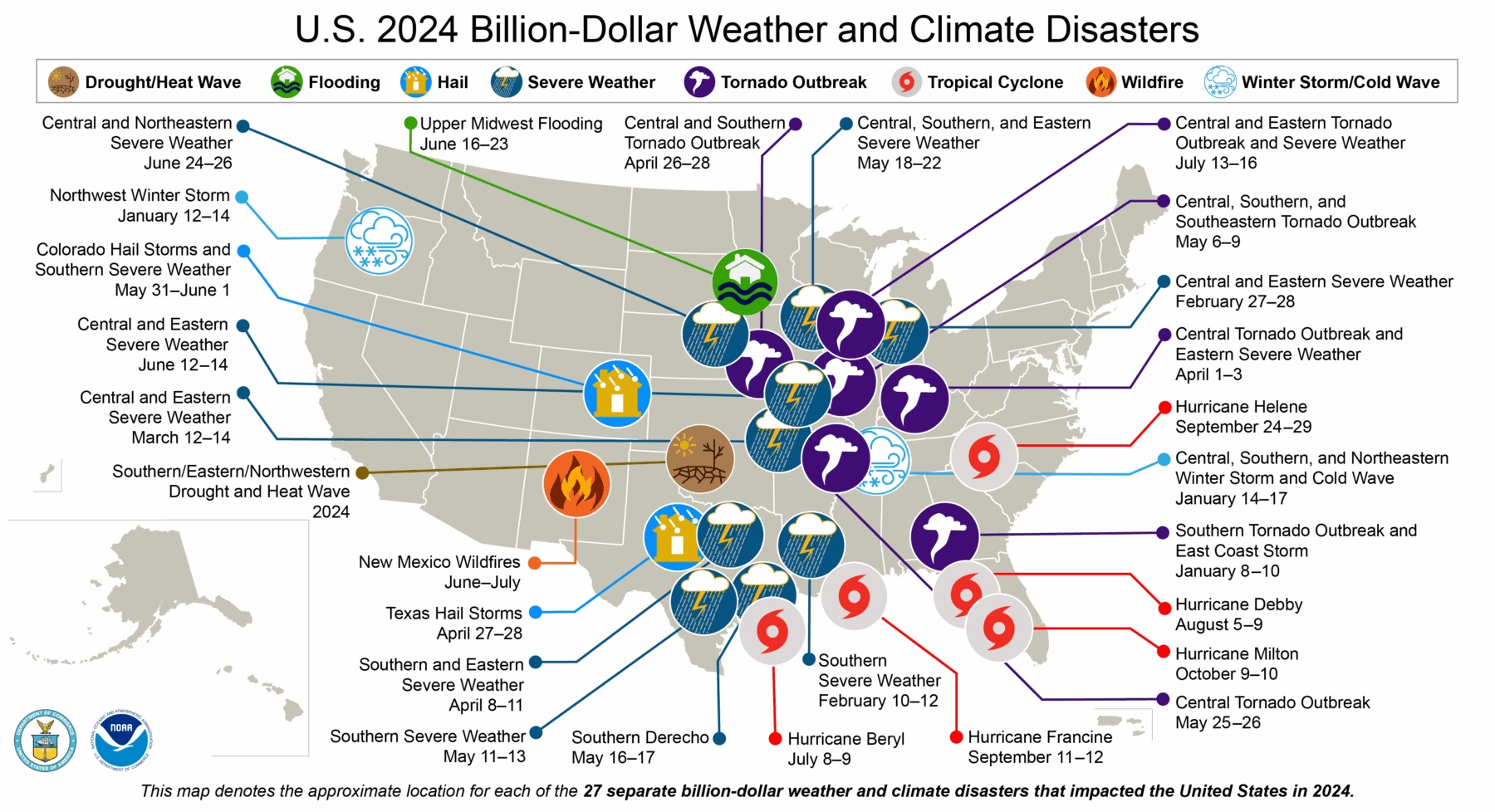

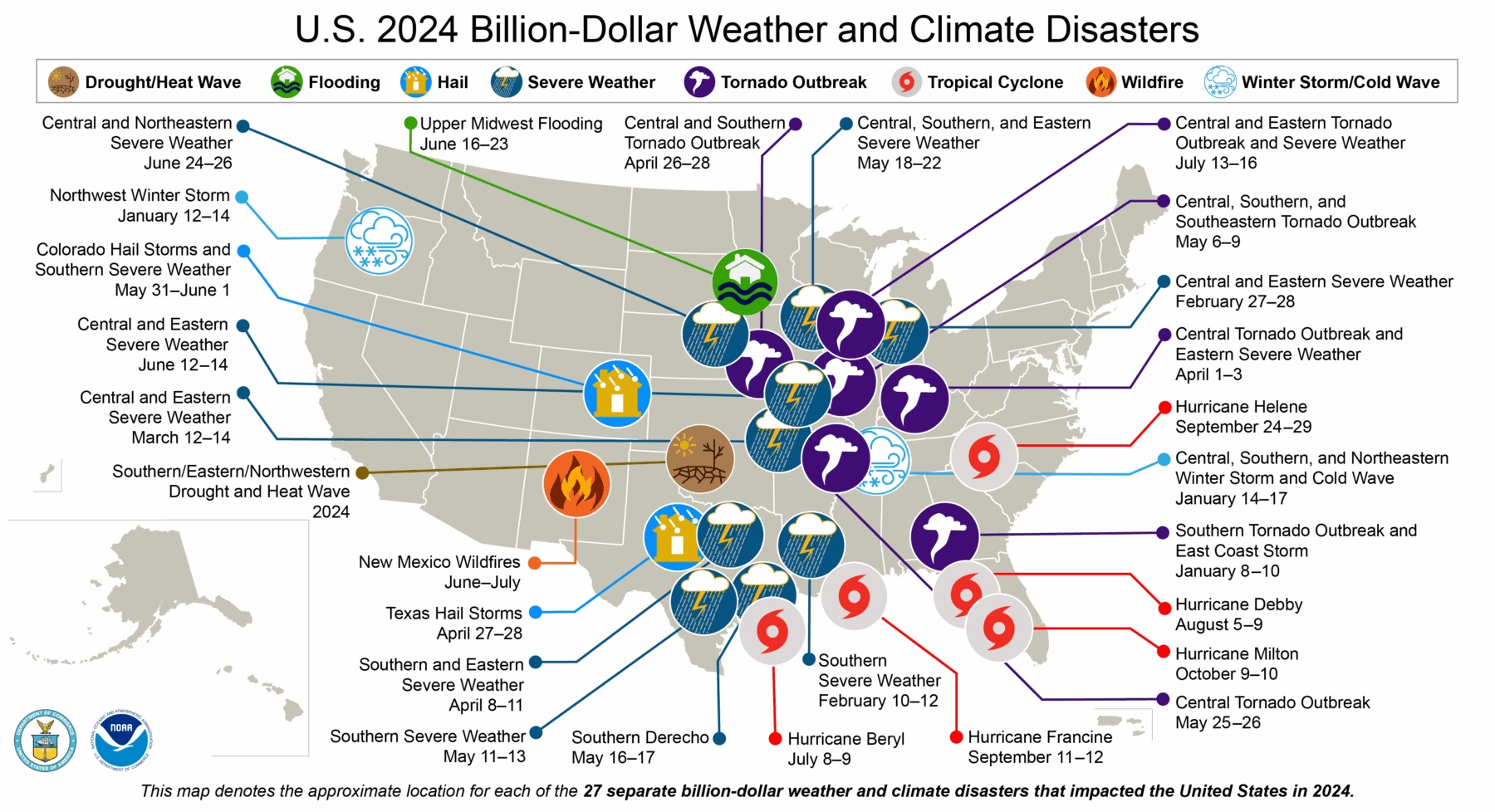

House Insurance coverage: Extreme Climate Occasions and Pure Disasters (Local weather Change)

Have you ever tried to cost dwelling insurance coverage not too long ago? Or (heaven forbid) flood insurance coverage? Checked out areas close to the ocean or a river, to say nothing of areas that endure from tornadoes, hurricanes or wildfires?

I counsel anybody who denies local weather change communicate to an insurance coverage underwriter to get a way of how unprecedented the trendy period of pure disasters is.

The wild card right here is labor, with many building employees migrants. How that’s managed impacts how briskly new houses could be constructed. (No clue as to when this will get resolved).

Chart: NOAA

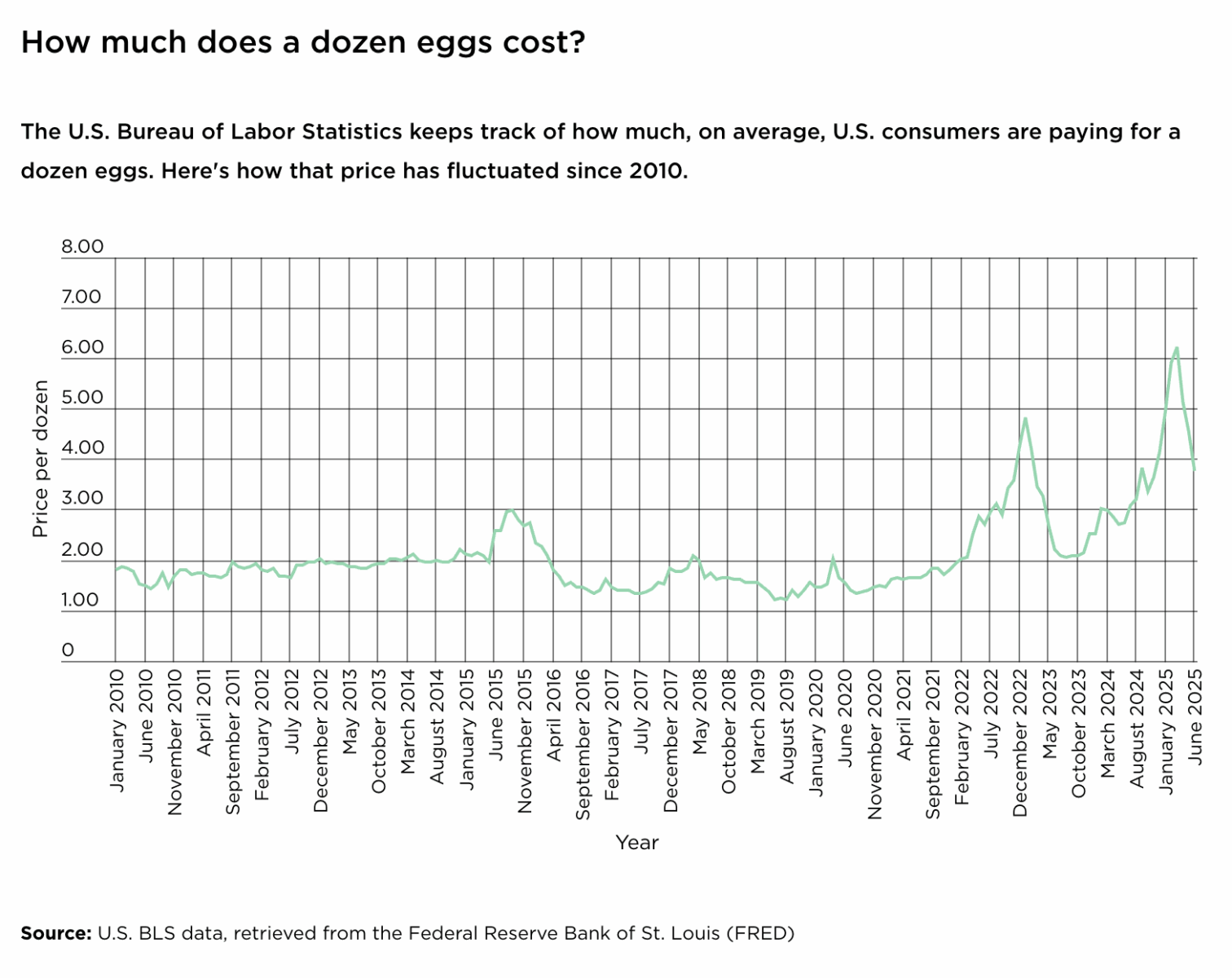

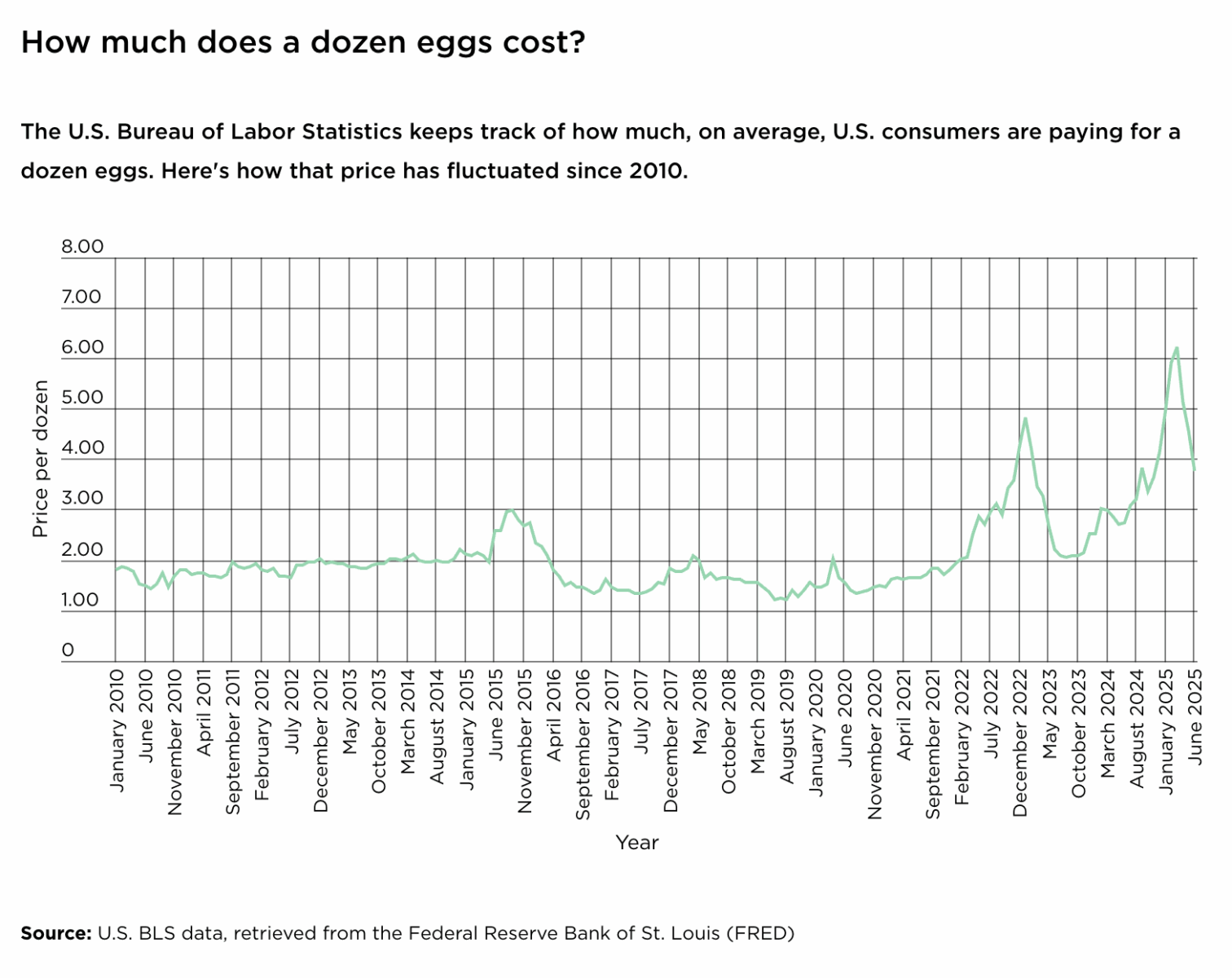

Eggs: Avian Flu

“Since early 2022, over 169 million poultry (primarily chickens) had been culled within the US on account of avian flu.” That’s over a three-year interval. Usually, ~320 million chickens are being raised in the USA, and we’re about 40-50 million beneath that stage.

Fewer hens = fewer eggs = greater costs.

Supply: NerdWallet

Beef: Drought/Local weather Change

Inflation in a single space can affect one other. Beef illustrates this nicely. Feed, labor, farmland, and rents have all elevated for the reason that pandemic. That’s earlier than Mom Nature throws droughts at ranchers, which forces them to skinny their herds – sending beef costs greater. Notice that drought has turn out to be a international downside for the meals provide.

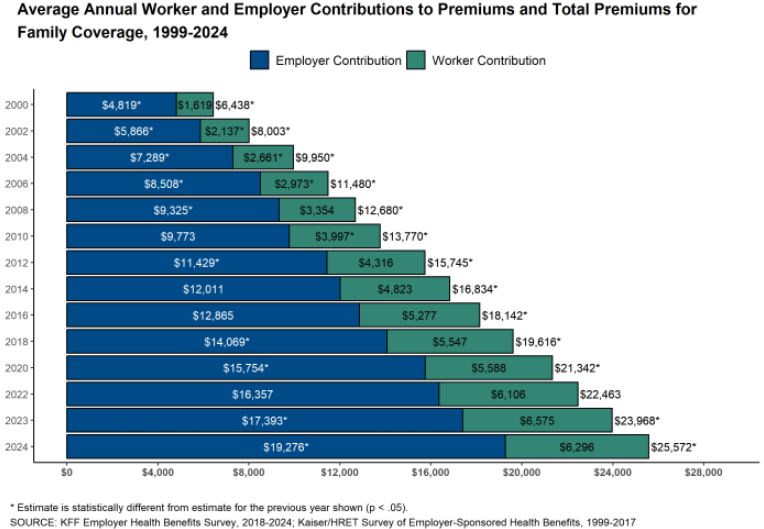

Well being Insurance coverage: Rentiers & Lobbyists

Why will we in the USA get our healthcare protection by means of our work? It’s an oddity particular to the USA, and has led to some notably poor outcomes.

It’s no secret that healthcare in the USA prices twice as a lot as in the remainder of the world, but it produces worse outcomes. Now we have allowed lobbyists and insurance coverage firms to dominate healthcare. It is among the uncommon components of the economic system the place the non-public sector does a a lot worse job than even mediocre authorities insurance coverage.

Sure, there are numerous issues with different techniques, however its arduous to endorse double the prices for worse outcomes.

Drug Costs: PBM

Well being care is a bizarre business, pushed partially by our religion in docs, an absence of competitors, and captured regulators. Need to see how bloated drug costs are in the USA? See this evaluation from the Drug Channels Institute (DCI). And so they maintain rising at double-digit charges.

Just like general medical health insurance, lobbyists and corrupt politicians have pushed drug costs greater. Solely two international locations—the USA and New Zealand—enable pharmaceutical firms to run tv commercials instantly promoting pharmaceuticals to customers. It’s a signal of simply how corrupt our well being care system has turn out to be.

~~~

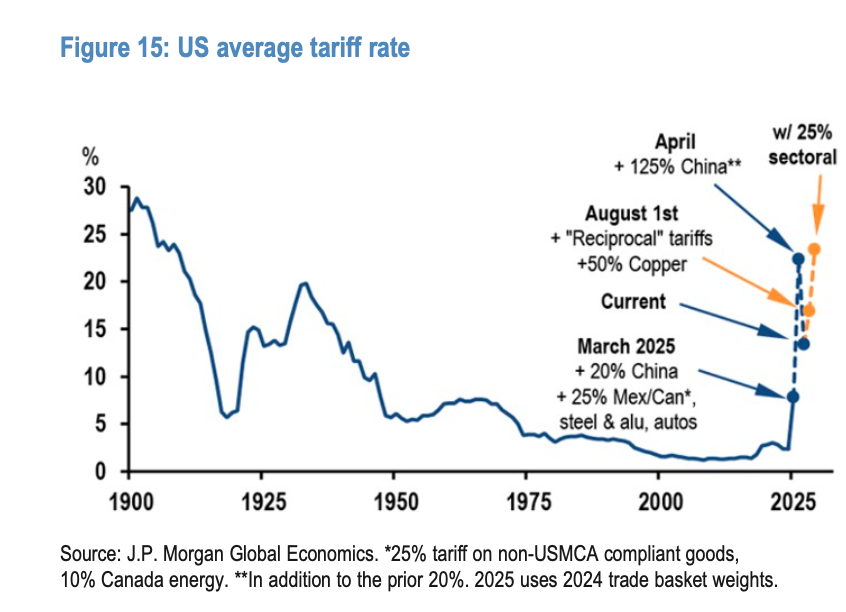

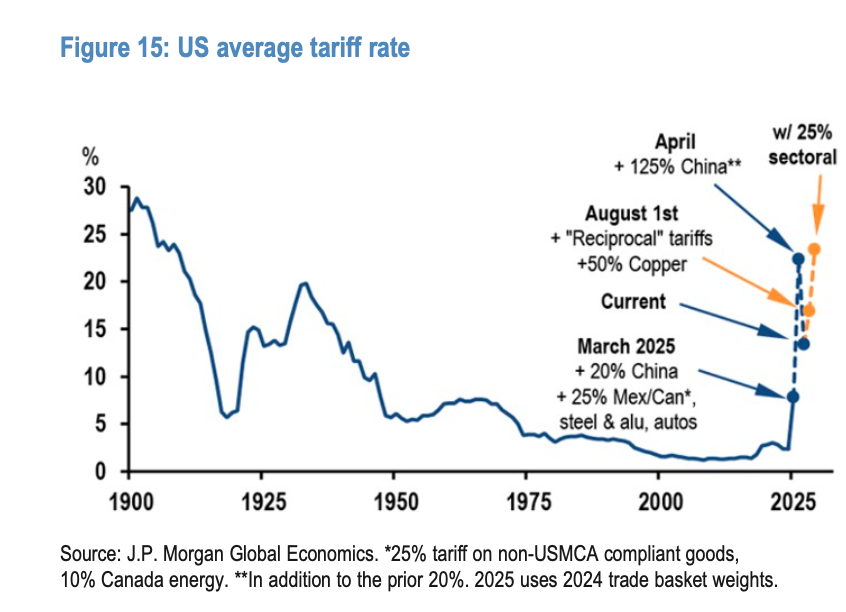

It’s into this surroundings tariffs arrive, now rising to ~15% across-the-board on most imported items arrives. This acts like a consumption VAT tax on something imported into the US.

Permit me to make clear some confusion in regards to the affect these tariffs can have on inflation.

I maintain listening to pundits repeat “Tariffs are a one-time tax;” I wince every time as a result of it’s each imprecise and incorrect. Tariffs needs to be described as a “persistent tax” on customers that results in greater costs that final so long as tariffs are in impact.2.

What I believe the speaking heads are referring to is the truth that the affect of tariffs solely seems in CPI information as a one-time value improve. Inflation metrics, such because the CPI or PCE, measure the speed of change – not absolutely the stage of costs. Items that had been priced at $100 could get tariffed to $115; the rise will solely seem in CPI as soon as, however the greater costs proceed for so long as the tariffs stay in place.

Supply: Paul Kedrosky

Beforehand:

The Muted Impression of Tariffs on Inflation So Far (July 17, 2025)

Revisiting Greedflation (November 16, 2023)

Miscalculated Housing Demand (July 29, 2021)

__________

1. June, normally the peak of the spring housing season, noticed gross sales of current houses drop from the earlier month, based on the Nationwide Affiliation of Realtors. https://www.nytimes.com/2025/07/23/realestate/home-sales-drop-prices-rise.html

2. We may see a number of the tariff prices getting absorbed by exporters and retailers, so it should present up of their revenue margins for so long as they resolve to eat a number of the prices versus passing them alongside to the buyer. However there is no such thing as a free lunch — somebody is absorbing these new prices.