Any individual’s paying the tariffs. Seems to be prefer it’s you. Supply: OptimistiCallie

You in all probability missed V.O.S. Picks, Inc. v. Trump, a little-noticed case that’s working its manner by the courts.

Most buyers are usually not listening to this. Possibly they need to.

The underlying thesis? Congress, not the President, is the one entity empowered to implement tariffs. As per the U.S. Structure, Article I, Part 8, Clause 1:

“The Congress shall have Energy To put and accumulate Taxes, Duties, Imposts and Excises, to pay the Money owed and supply for the widespread Defence and normal Welfare of the US; however all Duties, Imposts and Excises shall be uniform all through the US…”

Recall the April 2nd White Home announcement threatening world reciprocal tariffs of 100%. That shocked the fairness, fastened revenue, and forex markets. It additionally stunned quite a few authorized students, who have been assured of their beliefs that the precise to tax and spend — and that features tariffs — lay solely with the Legislative and never the Government department of presidency. Congress, not the White Home, is the entity the Structure empowers.

Following these bulletins, a lawsuit was filed on April 14th, difficult the Administration’s authority to declare an financial emergency and impose across-the-board tariffs beneath the Worldwide Emergency Financial Powers Act (IEEPA).1

The litigation argued it was an unconstitutional violation of the separation of powers as a result of solely Congress has the authority to levy tariffs. The plaintiffs have been profitable in entrance of a three-judge panel of the U.S. Courtroom of Worldwide Commerce. They concluded beneath the IEEPA, neither the President nor the Government Department might impose tariffs as a manner to answer longstanding commerce deficits.

The ruling was stayed pending attraction. That appellate listening to was held at this time, in entrance of the U.S. Courtroom of Appeals for the Federal Circuit in Washington, D.C. The 11 jurists seemed to be skeptical of the federal government’s arguments that declaring a state of emergency was merely an choice to bypass the structure.

The constitutional energy to tax was given completely to Congress, and these tariffs more and more resemble a tax on shoppers. Reuters reported “Tariffs are beginning to construct into a major income supply for the federal authorities, with customs duties in June quadrupling to about $27 billion, a file, and thru June have topped $100 billion for the present fiscal 12 months.”

The nonpartisan Tax Basis has reached related conclusions. The tariffs imposed by President Trump’s present administration represent “the biggest tax enhance on American households since 1993.” Based on their evaluation, the tariffs scheduled and imposed for a full 12 months would enhance federal tax revenues by $167.7 billion, or 0.55% of GDP. This makes them the biggest single-year tax hike since 1993

Neal Katyal, former Principal Deputy Solicitor Common within the U.S. Division of Justice, is main the staff of attorneys arguing on behalf of a number of small companies.

Katyal mentioned the case lately on TV lately; I discovered his arguments so compelling, I jotted some down:

“No president in 200 years has ever been capable of unilaterally impose tariffs. This separation of powers goes all the best way again to the Revolutionary Struggle…”

“Congress gave President Lincoln all types of powers – together with the ability to blockade and ban all merchandise from the South – however the one factor they didn’t do was grant him was the tariff energy.”

“The structure was very clear in saying there’s one department that has the ability to tariff and it isn’t the president and it isn’t the courts – it’s the Congress of the US.”

“should you’re elevating income, you’ve acquired to originate that invoice within the Home of Representatives… The president tried to try this in his first time period and that laws failed…”

“What’s occurred right here — and the best way we’ve at all times traditionally accomplished issues — when presidents need to have commerce authority or negotiate a deal or threaten tariffs, they go to Congress upfront and get that approval. They will’t go off on their very own and say “Hey, I do know what’s greatest and blow off Congress.”

All the new tariffs are scheduled to enter impact tomorrow, August 1st.

I don’t get to play lawyer fairly often as of late, however from time to time I get a reminder that I didn’t fully waste three years in regulation faculty. This case is a main instance.

This may very well be a major litigation. It is a case buyers shouldn’t ignore…

See additionally:

US appeals courtroom scrutinizes Trump’s use of tariffs as commerce deadline looms (Reuters, July 31, 2025)

Trump Tariffs: Monitoring the Financial Influence of the Trump Commerce Struggle (Tax Basis, July 29, 2025)

U.S. Courtroom of Appeals holds oral arguments in VOS Picks Inc v. Trump (7/31/25)

Beforehand:

Its the Regulation, Bitches! (July 19, 2010)

10 Issues You Don’t Know (or have been misinformed) In regards to the GS Case (April 23, 2010)

UPDATE: July 31, 2025

From Bloomberg:

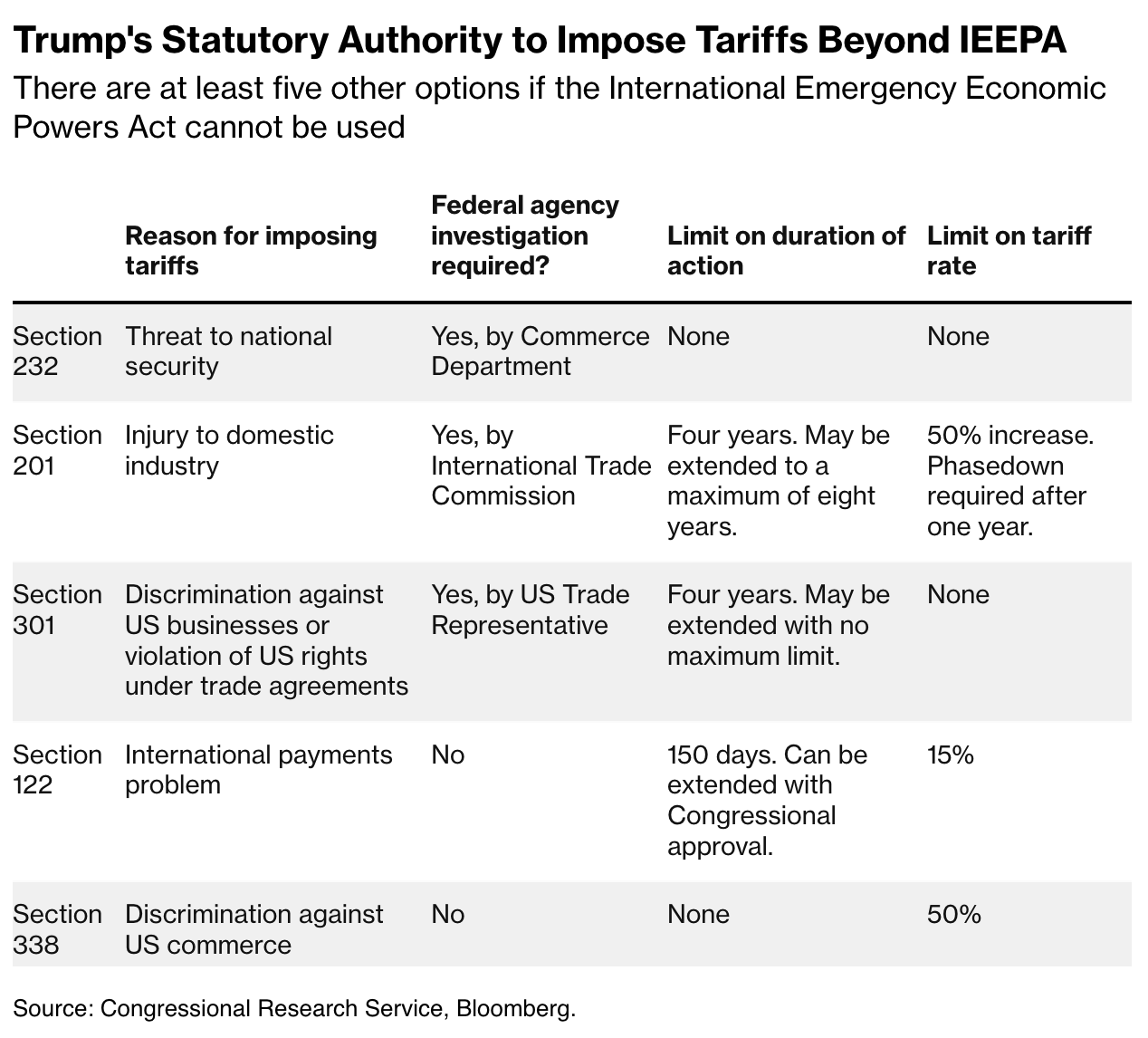

What Are Trump’s Choices If His Tariffs Are Dominated Illegal?

___________

1. From Provide Chain Dive:

“On April 23, 12 states filed a parallel lawsuit, primarily making the identical arguments. So, the USCIT consolidated the 2 instances, and a three-judge panel dominated on Might 28 that the president had no authority to impose across-the-board tariffs beneath the IEEPA. Because of the findings, the USCIT issued a everlasting injunction in opposition to future tariffs.”