A podcast listener asks:

If there are not any iron legal guidelines in markets and nothing works without end as an indicator, maybe finding out the inventory market is ineffective?

There are not any if-then guidelines that apply to the inventory market that work each time.

If that had been the case, everybody would do them, and investing can be straightforward.

I stated nothing works on a regular basis, that doesn’t imply nothing ever works.

Learning inventory market historical past exhibits you that though the long run doesn’t all the time look precisely just like the previous, some common guidelines of thumb will help you be a greater investor when utilized via a constant course of.

Listed below are a few of my iron legal guidelines of the inventory market (even when they don’t work on a regular basis):

Volatility is mean-reverting. Intervals of excessive volatility are inevitably adopted by intervals of low volatility and vice versa.

The inventory market wouldn’t supply a danger premium over different asset lessons with out some volatility, however it may well’t final without end. Good results in dangerous and dangerous results in good…finally.

It must be this fashion or the inventory market would stop to exist in its present state.

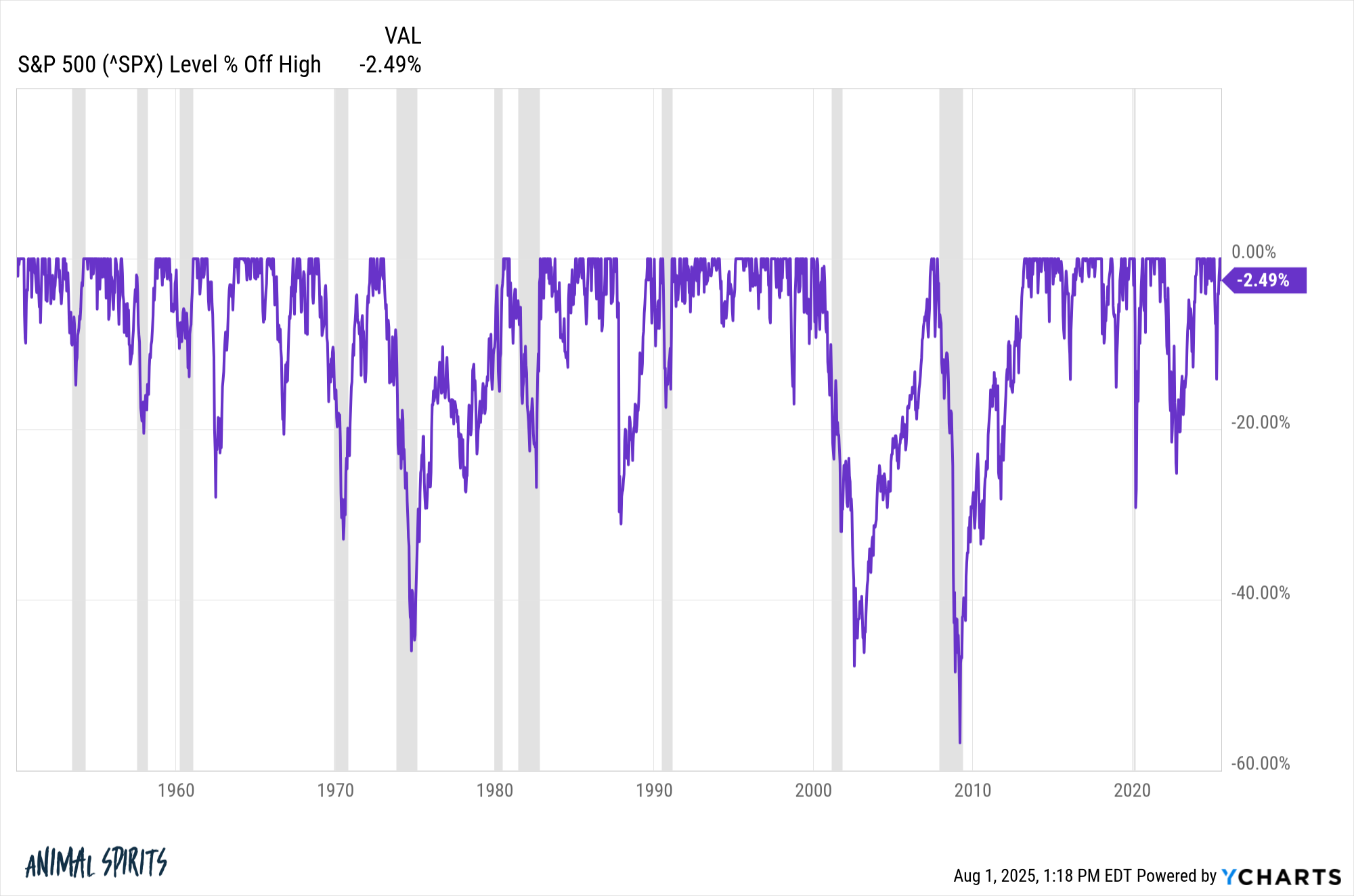

Purchase when the inventory market crashes. I really like inventory market crashes as a result of it means you get to take a position at decrease costs, decrease valutations and better dividend yields. And that normally means greater ahead returns.

Are you able to time the underside? No.

May the market crash even additional? Certain.

What if it by no means comes again? If that occurs, we’ll have a lot greater issues on our fingers.

Diversification is your greatest hedge in opposition to excessive occasions. Most shares stink. A small share of shares account for almost all of the good points in the long term.

Many shares crash and by no means come again. Some nation inventory markets have carried out terribly for many years at a time.

One of the best ways to keep away from catastrophic losses and survive the inventory market is by diversifying your holdings throughout totally different geographies, market caps, sectors and the variety of shares you personal.

Diversification doesn’t assure you unbelievable outcomes but it surely does make it easier to keep within the sport.

Your greatest edge just isn’t data-driven however behavioral. Don’t attempt to outsmart the market. Attempt to keep away from outsmarting your self.

The inventory market has to crash generally. It is a characteristic, not a bug:

No ache, no acquire.

The market is difficult to beat. It may be completed. Most individuals can’t do it. Make investments accordingly.

Danger by no means utterly goes away. There are trade-offs with each funding stance.

Should you put all your cash in shares, your anticipated returns go up, however so does your likelihood of huge losses and bone-crushing volatility.

Should you put all your cash in money, you possibly can sidestep losses and volatilty however your anticipated returns go down.

When you have a balanced portfolio, you’re all the time going to be irritated with sure methods or asset lessons once they underperform.

Danger adjustments form however is rarely extinguished.

Imply reversion and momentum are right here to remain. Some traders maintain into dropping shares in hopes they are going to come again to their unique value. Others double-down on the shares which are going up and trim the losers.

Some traders underreact to market-moving occasions whereas others overreact. Some go along with the group whereas others are perma-contrarians.

Concern, greed, overconfidence, recency, and affirmation bias can lead traders to pile into and out of successful and dropping shares abruptly.

Human nature means the pendulum swings from one set of feelings to a different relying on the worth motion.

Timber can develop to be very tall however they don’t develop to the sky so imply reversion and momentum will all the time be with us in some trend.

Extending your time horizon will increase your odds of success. The inventory market is the very best on line casino on Earth as a result of your odds of success improve the longer you keep invested.

Markets finally punish certainty. Nobody has all of it discovered. When you suppose you do the market reminds you there isn’t any such factor as straightforward cash.

Michael and I talked about how nothing works on a regular basis and a few iron legal guidelines of the inventory market on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Why Can’t the Inventory Market Develop at 15% Without end?

Now right here’s what I’ve been studying currently:

Books: