For a lot of traders, the phrase “different minimal tax” tends to lift eyebrows or set off confusion, if not concern. Nonetheless, throughout the municipal bond market, AMT-designated bonds are quietly providing one of the crucial enticing alternatives in immediately’s investment-grade sector. And because of latest tax laws, a main threat that will have as soon as deterred traders from these devices has, in our opinion, considerably diminished.

Understanding AMT and Its Affect on Bonds

The person different minimal tax is a part of a parallel tax system that requires some taxpayers to calculate their tax legal responsibility twice—as soon as utilizing the usual guidelines and once more utilizing AMT guidelines. The AMT calculation consists of sure deductions and extra changes. Taxpayers should pay the greater legal responsibility from the 2 calculations.

Some municipal bonds—typically these issued in sectors the place non-public entities could profit, equivalent to airports or stable waste amenities—are designated as AMT. Though curiosity from these bonds is technically tax-exempt, it might be included in an investor’s AMT calculation, decreasing the general tax benefit. AMT bonds are typically issued at greater yields than comparable non-AMT bonds to offset this threat.

How Market Circumstances Created Alternative

The 2017 Tax Cuts and Jobs Act considerably lowered the variety of people topic to the AMT. In accordance with the Tax Coverage Heart, AMT filings fell from over 5 million in 2017 to simply 200,000 in 2018. For many particular person traders, AMT ceased to be an element.

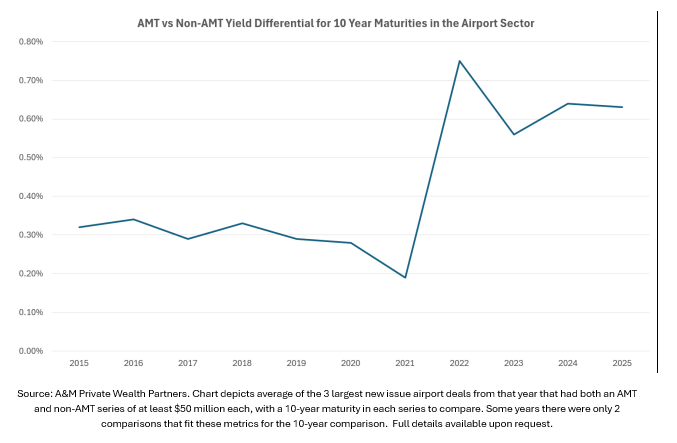

Nonetheless, the extra yield for AMT bonds continued, and in 2022, it was amplified by market volatility, rising charges, and widespread outflows from municipal bond funds. These situations precipitated municipal bond yields to extend, particularly amongst lower-rated bonds and people with AMT standing.

But whereas spreads for lower-quality bonds have narrowed, AMT spreads stay elevated. We consider traders can nonetheless entry robust earnings ranges with out sacrificing credit score high quality.

Take into account the 2021 issuance from the Atlanta Division of Aviation, benefiting Hartsfield-Jackson Atlanta Worldwide Airport. On the time, the 10-year AMT bonds supplied simply 0.20% greater than the non-AMT equal. As of July 2025, that unfold has widened to 0.72%—an distinctive relative worth in immediately’s market (Supply: Bloomberg, as of July 1, 2025).

The Case for AMT Bonds Right now

In June 2025, the Metropolitan Washington Airports Authority issued bonds that illustrate the potential of this market. A 2036 AMT bond from that providing carried a yield of 4.37%. For an investor within the prime federal tax bracket, that equates to a taxable equal yield of seven.38%, utilizing a 40.8% tax price (37% prime tax bracket price and three.8% funding earnings tax). The bond was rated Aa3 by Moody’s and AA- by S&P.

On that very same day, an index of 10-year income bonds with comparable credit score high quality yielded simply 3.63% (Supply: Bloomberg US Income AA- Muni BVAL Yield Curve 10 12 months). The AMT bond supplied a considerable yield premium with out added credit score threat, highlighting the worth on this nook of the market.

What Modified: One Huge Lovely Invoice Act

A lot of the hesitation round AMT bonds stemmed from uncertainty. The 2017 tax cuts included a sundown clause that may have reinstated the pre-2018 AMT guidelines on the finish of 2025. That chance made many traders reluctant to embrace AMT bonds.

Now, uncertainty appears to have largely been resolved. The One Huge Lovely Invoice Act, a brand new reconciliation invoice just lately handed into legislation, prolonged most of the 2017 tax reforms with no sundown clause hooked up. This consists of the lowered scope of the AMT. Whereas minor changes to the code could enhance the variety of AMT filers barely, the general footprint stays far beneath pre-2018 ranges.

In sensible phrases, the tax concern has largely light for a lot of traders, however market pricing has not but totally adjusted. We consider this presents a window of alternative for these keen to rethink AMT publicity after verifying their tax scenario with an professional.

The place to Focus: The Center of the Curve

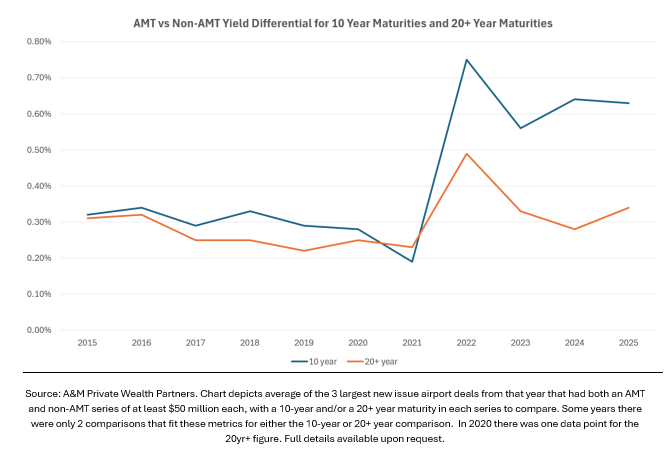

At the moment, we see probably the most compelling worth in AMT bonds to lie within the ten-year maturity vary. Longer maturities have largely reverted to historic norms, however intermediate AMT bonds proceed to supply greater yields in comparison with comparable non-AMT bonds.

Within the airport sector, for example, the yield unfold between AMT and non-AMT bonds within the ten-year vary stays nicely above the common seen earlier than 2022. For maturities of twenty years or extra, spreads have tightened and now not supply the identical stage of relative worth.

Including AMT bonds, notably these with 10-year maturities, can profit traders twofold: first, the yield benefit is clear, as excessive ranges of earnings will be achieved with out having to enterprise into lower-quality bonds. Second, these bonds can also expertise significant value appreciation relative to the broader market if AMT bond valuations converge to their longer-term averages, as proven within the earlier charts.

Conclusion

For years, AMT bonds have been ignored as a result of tax issues that have been as soon as legitimate however now seem largely outdated. Right now, these bonds supply a uncommon mixture of robust yields, excessive credit score high quality and favorable tax remedy for a lot of particular person traders.

With clearer legislative panorama and the market mispricing the related threat, AMT bonds deserve a recent look, particularly within the ten-year maturity vary. For traders looking for tax-aware earnings options, this can be one of many extra underappreciated segments within the municipal market.