Some issues I’m occupied with concerning the housing market:

How inexpensive is housing for almost all of People? The 50/30/20 rule says that you need to spend roughly 50% of your earnings on requirements (housing, transportation, healthcare, and many others.), 30% of your earnings on needs (eating out, journey, leisure, and many others.) and 20% of your earnings on financial savings or paying off debt.

Inside the 50% necessity bucket, a superb rule of thumb says you need to spend round 30% in direction of your month-to-month housing cost. There may be clearly some nuance concerned relying on the place you reside and so forth.

Redfin has a brand new report that exhibits many households would battle to remain inside the bounds of this rule based mostly on present housing costs and mortgage charges:

A family on the median earnings would wish to spend 39% of their earnings on housing to purchase the median priced dwelling. However there’s some excellent news: That’s down from 40.5% final 12 months, seemingly as a result of incomes have risen whereas dwelling costs have barely budged (the median U.S. dwelling sale value is up simply 1% 12 months over 12 months).

Whereas solely about one-third (34.6%) of dwelling listings are inexpensive for the everyday U.S. family, that’s up barely from 33.2% a 12 months in the past.

This isn’t excellent news for potential homebuyers, however what about all the individuals who already personal a house?

In case you owned a property pre-2021 and locked in a 3% mortgage, your month-to-month housing value is probably going considerably decrease than 30%.

Take into account your self fortunate in case you locked in terribly low housing prices. These days are lengthy gone.

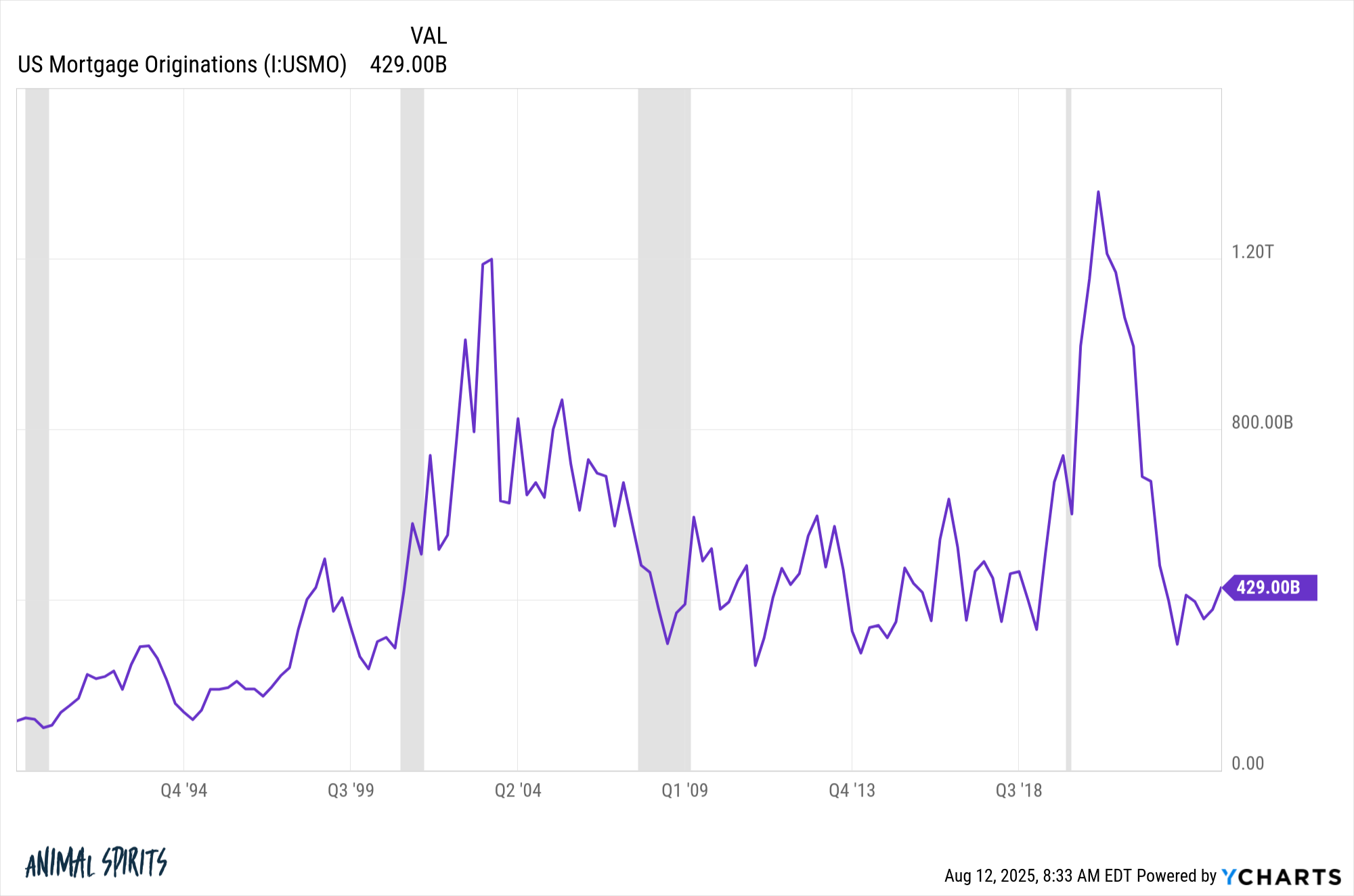

Will housing exercise growth through the subsequent recession? Housing exercise stays weak by historic requirements:

Nobody needs to refinance with charges so excessive and nobody needs to purchase a home with costs so excessive.1

We’ll get one other recession sometime. Possibly in a 12 months. Possibly in 7 years. Who is aware of?

Each time an financial contraction happens, we’re prone to see decrease charges. This stuff aren’t scientific however mortgage charges have fallen by a mean of round 1-2% throughout previous recessions.

If that occurs this time round I feel you’re going to see an explosion of housing exercise from pent-up provide and demand that has been sitting on the sidelines. We might additionally see an enormous uptick in cash-out refis and HELOCs if charges are at extra affordable ranges as a result of a lot fairness is tied up in houses lately.

Individuals could be very confused by this however the housing market already went by means of a recession so it wouldn’t shock me to see it lead us out of the subsequent one.

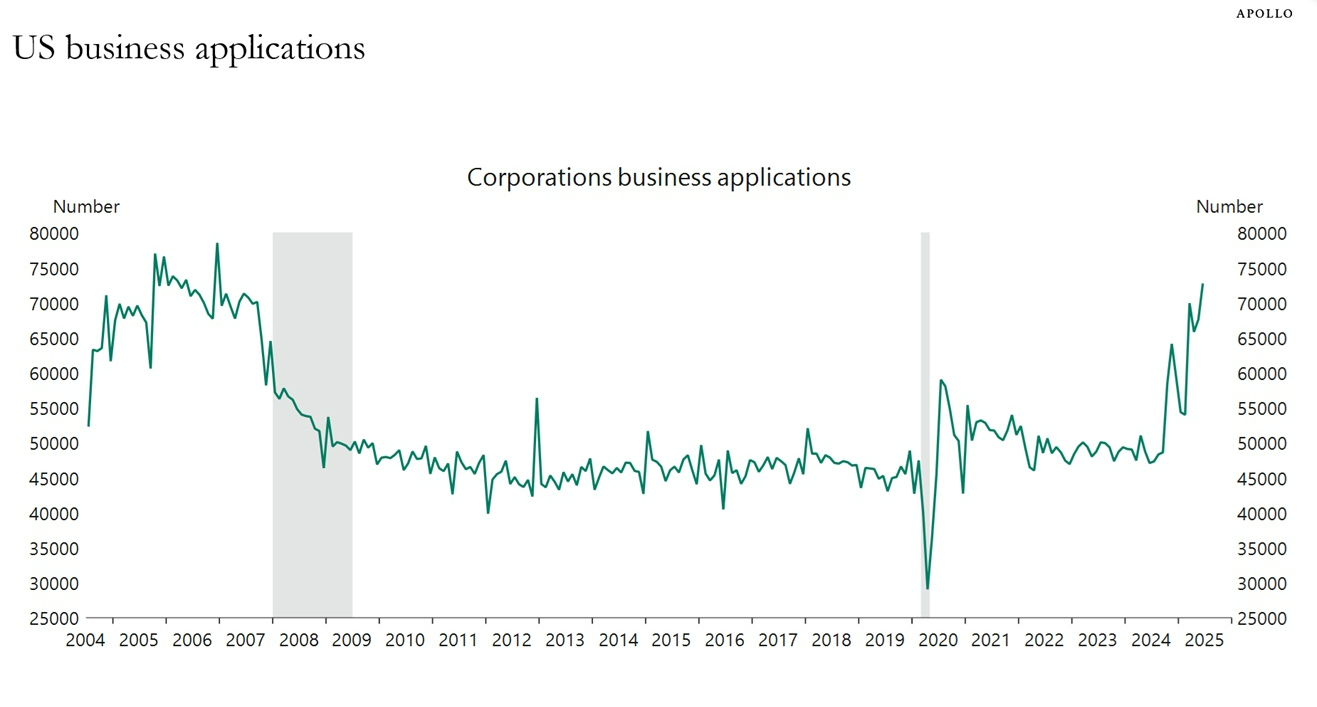

Why can we make it really easy to start out a enterprise and arduous to construct extra housing? I suppose that is extra of a rhetorical query.

Take a look at the variety of enterprise purposes in America:

The truth that we went by means of a pandemic and it led to a growth in new enterprise purposes is without doubt one of the issues that makes this nation nice. Beginning a enterprise is comparatively simple.

Constructing extra housing is a course of that’s stuffed with purple tape.

It is mindless.

Will we ever see precise coverage modifications that spur extra constructing? There are numerous causes housing has turn into unaffordable for therefore many individuals.

The only rationalization is that we don’t construct sufficient housing.

For some cause this hasn’t turn into a lot of a political problem simply but. Politicians haven’t achieved a lot to alleviate the ache of upper housing prices. That may be altering.

The ROAD to Housing Act is the primary bipartisan housing laws to be accredited by a Senate committee in over a decade.

The final concept behind this act is that we have to cut back regulation in housing growth and eliminate all of the purple tape that makes it such a ache to construct extra. It’s probably the most complete payments in years to confront the housing disaster by means of regulation reform, building innovation, and affordability initiatives.

There are loads of particulars that also should be ironed out and the Senate nonetheless must vote on this but it surely’s the primary piece of excellent information on the housing provide entrance I’ve heard of in years.2

We’re getting loads of deregulation in different areas of the monetary system proper now however housing is the place we want it essentially the most.

I hope this truly occurs and we construct extra housing.

Additional Studying:

Housing Market The Aristocracy

1There may be nonetheless some exercise occurring clearly. Over the previous 12 months there have been round 3.9 million present dwelling gross sales. That’s simply properly beneath the 5.2 million common quantity this century.

2Cardiff Garcia has an important podcast on The ROAD to Housing Act with Alex Armlovich that’s value a hear: