Each week our inbox at The Compound is filled with questions from our YouTube viewers, podcast listeners and weblog readers.

I needed to share a handful of the questions we obtained this week with some ideas on every:

I’ve an ongoing private finance idenity disaster. I inform my youngsters we’re poor, I inform my spouse we’re middle-class. I inform myself, we’re doing higher than others. Reality is: I wish to purchase a Porsche 911-well, a used one and never one of many restricted version REALLY costly ones. Your 3 posts within the final couple of months tie very nicely to this query. (Under) Having been a “automobile man” for years however in any other case your traditional “millionaire subsequent door”, I wrestle with losing cash on depreciating property. I store for garments (and all the pieces else) at Costco. I drive unassuming automobiles. I’ve owned decrease priced toy vehicles that are enjoyable to drive however in any other case serve no specific goal. I don’t personal a ship, airplane or second dwelling. Nevertheless, spending round six figures for a mid-life thrill looks as if a large waste of cash and invitation for future complications on account of upkeep, insurance coverage and different automobile prices as I battle the traditional logic vs emotional buy. I notice you’ll be able to’t take it with you and that is removed from an impulse buy however one thing I’ve needed to do for years. How do you give your self permission to splurge after a lifetime of saving?

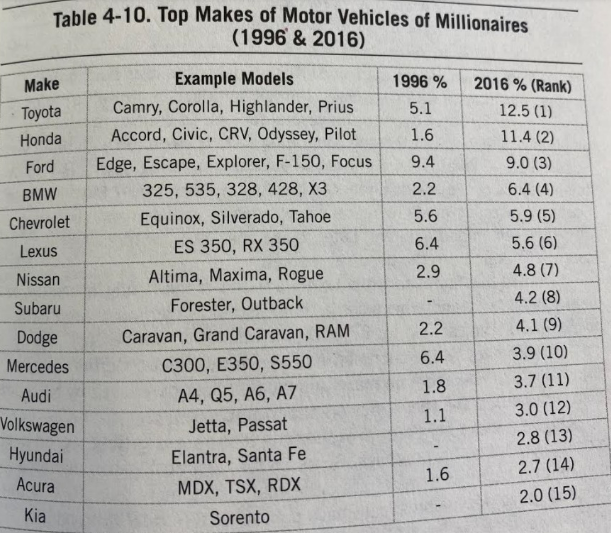

The Millionaire Subsequent Door sorts drive pretty regular automobiles and types:

There aren’t quite a lot of uber-luxury manufacturers.

In terms of growing good monetary habits — budgeting, saving, investing, and so forth. — it takes time and you need to work at it.

The identical factor applies to splurging and having fun with your cash. You don’t go from the sofa to operating a marathon so why would you ever go from being overly frugal to freely spending cash?

You’ll be able to’t change who you’re in a single day.

Give your self 1-2 classes the place you’ll go nuts to see the way it feels.

Perhaps you fly first-class on each flight that’s extra 2-3 hours.

Perhaps it’s some type of self-care like a weekly therapeutic massage.

Perhaps it’s a pleasant bottle of wine each time you exit for dinner.

Perhaps you store for produce at Entire Meals as a substitute of Aldi for some time and don’t obsess over the price.

It’s a must to work out the stuff that’s necessary to you. Simply decide a few classes, objects or companies and check out it out.

You can additionally hire a Porsche for every week to see the way it feels. It’s potential the novelty wears off, however you may fall in love and resolve it’s well worth the splurge.

Simply discuss to your loved ones in regards to the areas they wish to splurge as nicely. It’s extra enjoyable if everybody has their very own spending priorities.

I at all times inform my youngsters they’ll get any e-book they need at any time when they need. That’s one in every of our splurge classes.

The entire level of delayed gratification is that you simply enable your self to really feel gratification at a later time. You’ll be able to nonetheless be selectively low-cost in some areas whereas splurging in others.

Perhaps a 911 is the place you let free along with your cash.

Right here’s one other one:

After faculty, I used a few of my (very restricted!) financial savings to purchase Apple shares. This was again in 2008/2009, across the time of the crash. Clearly, they’ve gone up massively within the years since, and I’m tremendous grateful for that. I bought somewhat when my spouse and I have been youthful and we wanted money for some main bills, however for essentially the most half I’ve held onto the inventory because it went up. Now I really feel somewhat caught, even when it’s drawback to have. The Apple inventory makes up a comparatively massive share of my internet price, perhaps 25% or so, which I do know isn’t nice from a focus perspective. But I type of hate the thought of paying the 15% tax on my beneficial properties if I promote some; I’m unsure what a greater funding could be; and likewise, if I’m trustworthy, I’ve somewhat little bit of an emotional connection to the shares since they’ve completed so phenomenally nicely for me. How would you assume by way of what to do subsequent?

I’d fear extra about having “an emotional connection to the shares” than the focus threat right here.

Adam Smith wrote one in every of my favourite passages about this in his e-book The Cash Sport:

A inventory is for all sensible functions, a chunk of paper that sits in a financial institution vault. Almost definitely you’ll by no means see it. It could or could not have an Intrinsic Worth; what it’s price on any given day will depend on the confluence of patrons and sellers that day. An important factor to understand is simplistic: The inventory doesn’t know you personal it. All these marvelous issues, or these horrible issues, that you simply really feel a few inventory, or an inventory of shares, or an amount of cash represented by an inventory of shares, all of these items are unreciprocated by the inventory or the group of shares. You will be in love if you wish to, however that piece of paper doesn’t love you, and unreciprocated love can flip into masochism, narcissism, or, even worse, market losses and unreciprocated hate.

If you already know that the inventory doesn’t know you personal it, you’re forward of the sport. You might be forward as a result of you’ll be able to change your thoughts and your actions with out regard to what you probably did or thought yesterday.

You don’t have to interrupt up along with your inventory fully to detach your self from this emotional connection. Perhaps simply go on a Ross and Rachel break with a part of your allocation by trimming it again to one thing like 10-15% and see how that feels.

Paying taxes is rarely enjoyable but it surely means you gained the sport of investing and it’s significantly better than the choice.

It’s not wholesome to develop an emotional attachment to a inventory that gained’t love you again. And when Apple underperforms that’s going to make it all of the extra painful.

See the way it feels to promote some shares.

Another:

My spouse and I hit $1 million internet price final 12 months. Our annual earnings is simply over $200k/12 months. We’re having a child within the subsequent 1-2 weeks. We’re each 36 years previous and serious about planning for faculty and retirement. Purchased our dwelling 2.5 years in the past at $487k with a mortgage price of 4.85%. That is ALL to not brag. We dwell in Atlanta. We don’t know what our subsequent monetary milestone is or ought to be. What do you assume we should always do subsequent or what ought to our subsequent monetary aim be after hitting seven figures subsequent price?

That is spectacular for a family of their mid-30s.

Listed below are some concepts for what may come subsequent:

- Improve your financial savings price.

- Enable some way of life creep into your finances.

- Plan for an early retirement.

- Saving for the youngsters (529, HSA, and so forth.)

- Journey.

- Take into consideration a trip dwelling.

- House renovations.

- Charitable giving.

- Life insurance coverage.

Having a toddler can actually change the best way you consider your targets and needs too so that you may simply give your self somewhat margin of security by saving extra for an unknown future. Youngsters are costly.

It’s spectacular to be price 7-figures at such a younger age however don’t get hung up on the numbers.

The identical stuff applies at a excessive stage regardless of your internet price — defining your targets, threat profile and time horizon.

Your targets can and can change over time particularly if you develop into accountable for a brand new little individual.

I answered these questions and extra on the newest episode of Ask the Compound:

Additional Studying:

Totally different Sorts of Wealthy