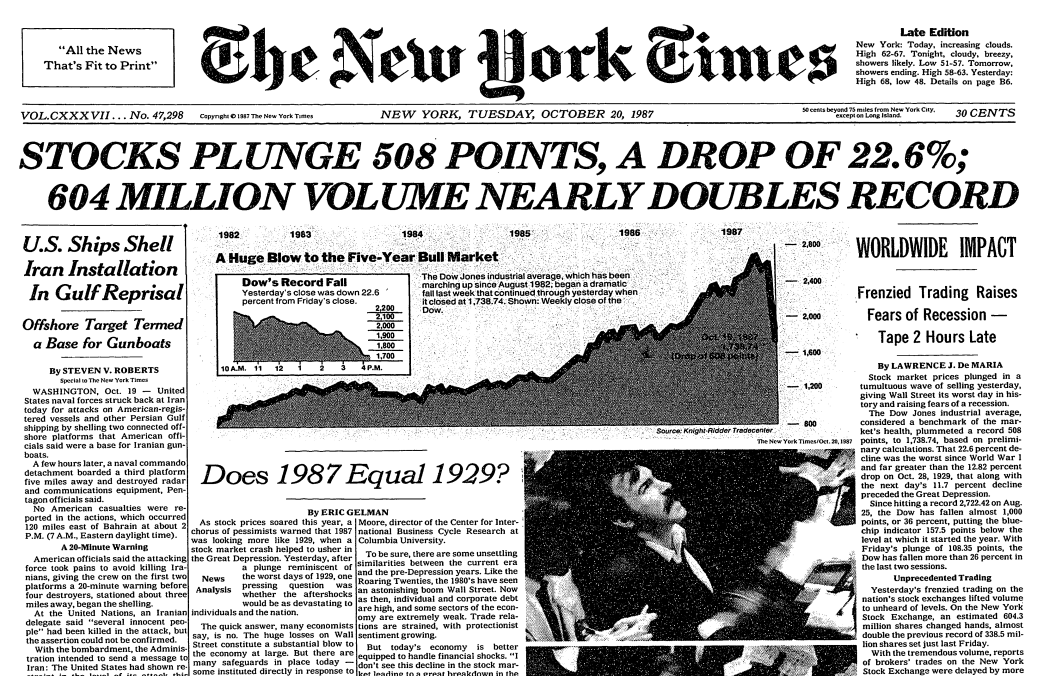

The 1987 Black Monday crash was so swift and extreme that some had been questioning whether or not it was the sign of an oncoming melancholy:

Most individuals didn’t really assume 1987 equaled 1929 however the crash was painful sufficient to trigger pundits to not less than contemplate the likelihood that an financial calamity was on the horizon.

The inventory market fell greater than 20% in a single day and almost 35% over the course of every week however the financial affect was…nil.

The subsequent recession within the U.S. didn’t hit till the summer time of 1990. The inventory market completed the 12 months with a achieve of round 5% in 1987 and was off to the races following the crash.

The inventory market wasn’t large and highly effective sufficient to trigger an financial downturn. That’s primarily as a result of not that many individuals owned shares again then. In 1987, round 25% of U.S. households owned shares in any kind — particular person shares, mutual funds, and so forth.

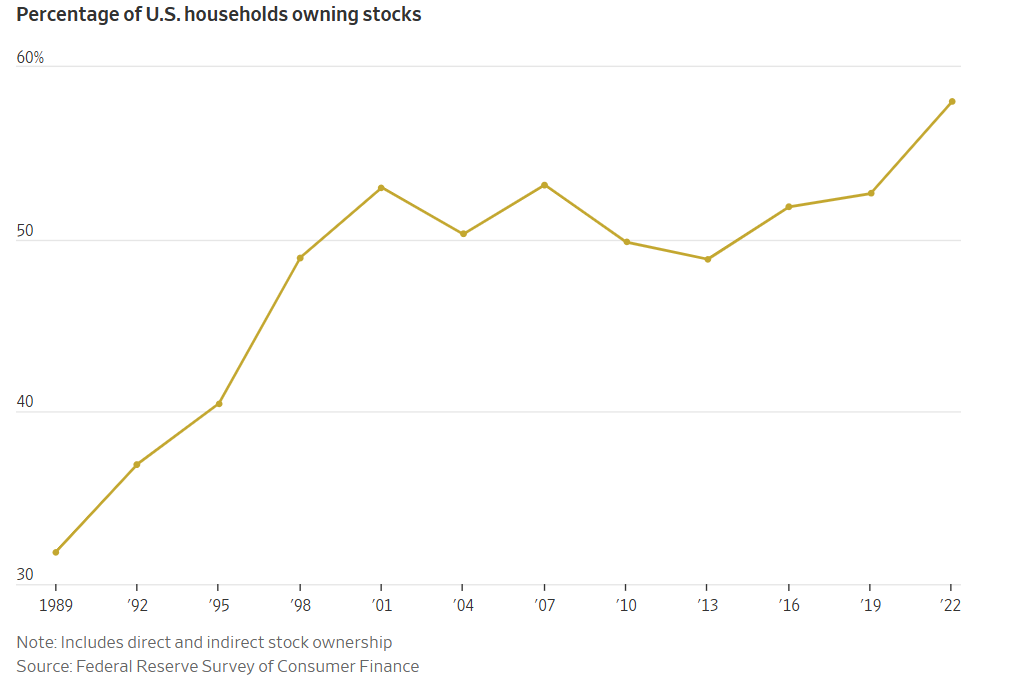

You possibly can see that inventory market possession didn’t actually take off in a significant manner till the Nineties:

This chart is a few years previous. In the present day the quantity is 62% of households that personal shares. This improve in possession means the inventory market is much extra essential to extra folks than it was in 1987 (duh).

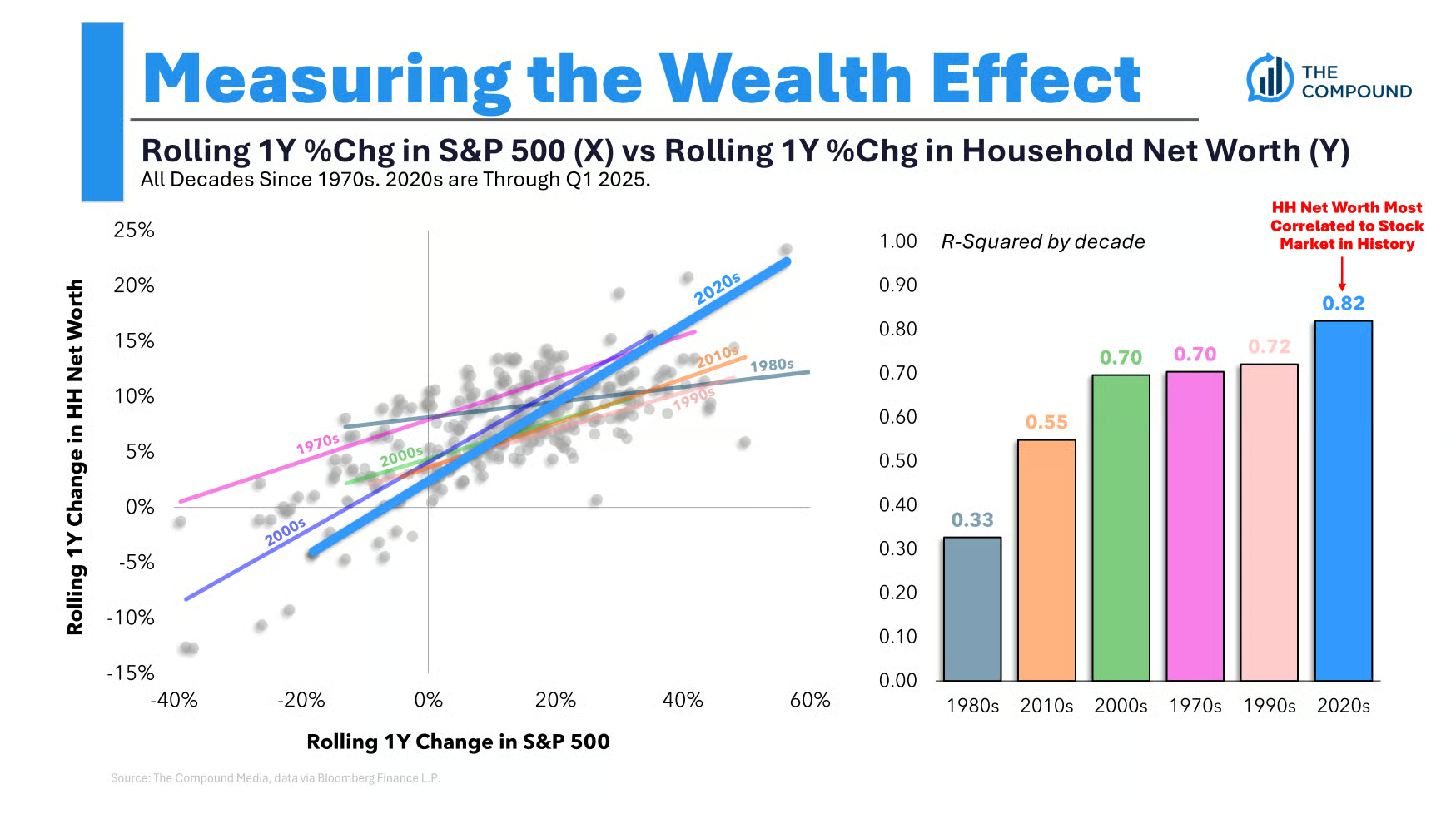

Chart Child Matt has a superb chart that reveals how web price has by no means been extra intertwined with the inventory market:

You possibly can see the large leap this relationship has taken for the reason that Nineteen Eighties.

Right here’s an excellent stat from The Wall Avenue Journal that cements this concept:

Shares as a proportion of family monetary belongings surged to 36% within the first quarter, the best stage in data going again to the Nineteen Fifties, in accordance with Ed Clissold, chief U.S. strategist at Ned Davis Analysis.

Now some folks take a look at this knowledge as a trigger for concern. A rising inventory market may very well be inflicting extra households to spend cash extra loosely.

If the market rolls over, that might trigger households to chop again on consumption. Nobody is aware of if this wealth impact will present up for positive but it surely’s actually price contemplating.

A rising inventory market can be possible driving up spending for the wealthiest subset of the inhabitants. The highest 10% personal almost 90% of the inventory market.

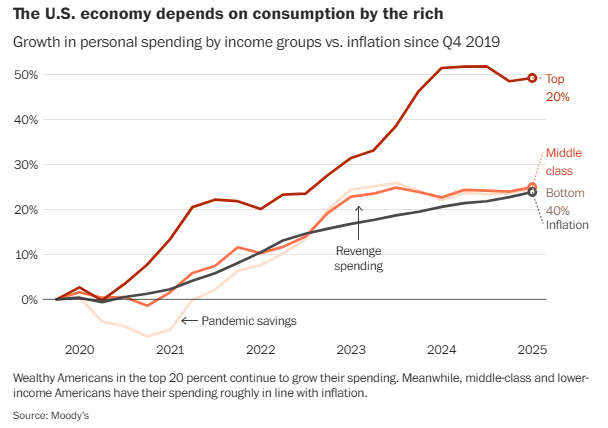

Based on The Washington Publish they’re additionally driving a lot of the spending:

“Within the close to time period, the whole lot rests on what that high 10 % decides to do or to not do. The remainder of the revenue distribution is admittedly not consequential from a macroeconomic perspective,” Mark Zandi, chief economist at Moody’s, advised me.

Zandi finds that the highest 20 % of households proceed to develop their spending, although they’ve pulled again considerably amid a lot uncertainty. In the meantime, the underside 80 % of households are principally simply conserving their spending progress according to inflation. This can be a notable shift from the “revenge spending” period from 2022 to 2024, when folks of all revenue ranges had been splurging considerably after the top of pandemic lockdowns.

This chart says so much:

This isn’t all of the inventory market after all. This group additionally makes extra money.

Basically this can be a chicken-or-the-egg challenge — will a slowing financial system trigger the inventory market to fall or will a falling inventory market trigger folks to rein of their spending?

It’s arduous to say which one comes first.

The rising significance of the inventory market on the financial system is sweet information. Having extra folks investing in shares is an indication of progress. I hope it continues.

However it will likely be fascinating to see if this rising significance ultimately has an affect on the financial system.

Can the inventory market trigger a recession?

The chance is greater at the moment than it’s ever been.

Michael and I talked concerning the rising significance of the inventory market on the financial system and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The High 10%

Now right here’s what I’ve been studying this week:

Books:

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.