I’m certain it’s not information to the BAD group that the American public training system (possibly personal too) is failing our subsequent generations by not instructing monetary literacy in our colleges. Whereas I consider the unique mindset was that it will be taught at house, it’s positively not, and it’s a failure we should always right.

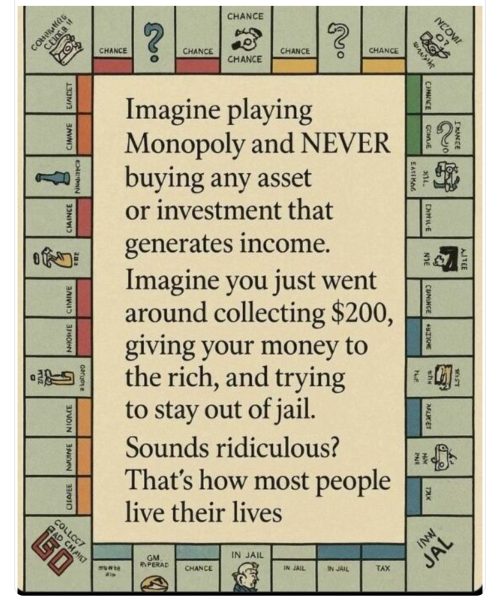

This was delivered to thoughts once I noticed this graphic on-line, and was like “Sure!” And sadly, that is the story of my life. Sure, I do know, I do know.

Senior 12 months Win

I’m undecided I’ve shared this story earlier than. It’s in regards to the evolution of Princess training and the way she ended up with a Bachelor’s of Finance. Sure, I do know this has nothing to do with my debt journey, however I might say that my youngsters had a fairly strong training on what to not do financially from me. Coupled with an training in regards to the nuances of private finance – funds, forecasting, credit score rating – as I realized about them.

However it was her senior 12 months of highschool when she ended up in a highschool economics class that her imaginative and prescient of funds actually broadened and have become actual world. I’m fairly certain it was a required course. Final semester of her senior 12 months.

I don’t know who the instructor was, however I’m so grateful for her. She had the children “purchase” shares and observe them and report on them and analysis them and talk about them. Princess fell in love.

She had already been accepted to school as an engineering main. However earlier than the semester was over (highschool), she had contacted the faculty to vary her desired main to economics.

Freshman 12 months Change

We had already deliberate her school route. Get the fundamentals out of the best way, after which deal with the main courses on the finish. However sophomore 12 months, she was in gen ed cash associated class. And that professor altered her path after assembly together with her throughout workplace hours a number of instances. He recognized her aptitude, inquisitiveness, and primary monetary competence, and really helpful she be part of the faculty membership affectionately known as SMIF, Pupil Managed Funding Fund.

Via that have, she as soon as once more modified her main from economics to finance and the remainder is historical past. Via SMIF, she was in a position to journey to New York a number of instances for competitions, was uncovered a company world that each challenged and embraced her, and constructed her confidence in presenting, researching, and development in methods I by no means might have imagined.

What’s subsequent for her…

I’m so grateful that she is already a lot additional forward than me in her data of finance. And I’m particularly grateful that one in all my brothers can be within the company finance world so she’s had somebody we belief to information her, perceive what she’s speaking about, and I can’t wait to see what’s subsequent. She’s now accomplished her onboarding coaching within the business banking world as an analyst, and is loving her job.

The put up Monetary Schooling Failure appeared first on Running a blog Away Debt.