Most of us already know by now the significance of outsourcing our greatest monetary dangers in life i.e. to an insurer. Nevertheless, the dilemma as to what to purchase and from who nonetheless stays a puzzle, particularly when the knowledge stays largely opaque, and the advantages and phrases of insurance policies preserve altering over time.

The scenario immediately

All people understands the significance of insurance coverage, however most individuals simply don’t just like the shopping for course of due to worry of being oversold, pressured, or misled. We now have additionally gotten used to acquaintances calling us up out of the blue within the guise of eager to “catch up”, just for the session to be a gross sales pitch to attempt to get us to purchase insurance coverage from them.

These are very actual ache factors of customers immediately, typically arising from the conflicts of curiosity as a result of fee mannequin of the business. Until an agent sells one thing to you, they don’t earn something, so there’s all the time an incentive to get you to decide to a coverage, particularly those who pay a better fee of fee.

Since 2014, I’ve lengthy advocated on this weblog that one ought to use insurance coverage primarily for defense, fairly than for financial savings or funding. What’s extra, we ideally need to pay the bottom premiums potential whereas securing as a lot protection as potential.

Nevertheless, the issue is that not each insurance coverage salesperson immediately shares these identical beliefs. Not everybody joins the insurance coverage business wanting to guard lives and assist individuals; some are in it for the cash, whereas others are drawn by the incentives as seen on social media – assume lavish existence, often within the type of a abroad journeys for the adviser and their accomplice, enterprise class flights or a brand new, shiny automotive.

As a substitute, brokers who promote insurance policies producing essentially the most income for the corporate are those get rewarded and clinching MDRT, COT and even TOT titles*. Is it any surprise that entire life insurance policies, endowment financial savings and investment-linked plans are repeatedly offered 12 months after 12 months to ignorant clients? The business’s present enterprise mannequin rewards those that promote essentially the most, however that may rapidly line the agent’s pockets to allow them to give their households a greater life, this could typically come on the expense of the buyer.

MDRT = million greenback roundtable; COT = court docket of the desk (3x MDRT); TOT = prime of the desk (6x MDRT).

Many customers don’t realise that regardless that they get “free” monetary recommendation, the “recommendation” given to them is usually swayed by commissions and layers of gross sales incentives that they don’t seem to be aware of (learn this put up to know). The result is that unbeknownst to them, the overwhelming majority of customers find yourself paying excessive charges over the following few many years on their subpar insurance policies (due to the hidden and embedded commissions)…whereas nonetheless ending up with an inferior plan that doesn’t totally cowl their safety wants.

Lately, paying an upfront price for monetary recommendation (i.e. the fee-paying mannequin) has began to achieve traction abroad. International locations just like the UK and Australia now have numerous fee-paying advisors, and over within the US, my buddy Jeremy just lately launched his insure-tech agency Nectarine, the place you pay a median of $150 – $250 per hour to guide licensed monetary planners in the US to get recommendation, notably on insurance coverage and investing.

Nevertheless, in Singapore, the fee-paying mannequin has but to take off, and there is just one agency that practices this mannequin: Providend.

Sadly, Singaporeans have gotten so used to getting “free” recommendation from insurance coverage brokers (who now go by the title “monetary advisors”) that we’re in all probability a couple of many years away earlier than the commissions-model declines and fee-paying fashions turn into mainstream. Sadly, the “free” recommendation you get will not be actually free, as a result of the salesperson is getting paid by the insurer, the dealer, or the fund home benefiting from the coverage; this fee is taken out from the cash that YOU pay.

For so long as this mannequin doesn’t change, then we customers want a greater means to have the ability to distinguish between the black sheep and the great brokers. I’ve written right here about some starter inquiries to ask your insurance coverage agent, however even then, that’s hardly sufficient.

Is Havend the answer for higher, unbiased insurance coverage recommendation?

After my current article the place I revealed how insurance coverage commissions can affect the “recommendation” that you simply’re getting out of your agent, the parents over at Havend reached out to me for a chat and shared about their enterprise mannequin and philosophy.

In case you’ve by no means heard of Havend, they’re shaped by the identical crew that introduced you DIYInsurance, which was Singapore’s first life insurance coverage comparability portal began in 2014 (even earlier than MAS launched compareFIRST). DIYInsurance gave customers the power to get the insurance coverage they wanted at a decrease value, with out having to undergo an agent, and the portal did very nicely earlier than it was acquired by MoneyOwl, in a three way partnership with NTUC Enterprise. The unique people behind DIYinsurance went again to Providend (the unique “dad or mum” firm), and has now branched out as a subsidiary generally known as Havend.

I’ve labored intently with Providend, DIYInsurance and MoneyOwl on a number of events earlier than, so I’m accustomed to their work ethics and their philosophy in the direction of insurance coverage. So when the crew at Havend invited me right down to overview their companies for myself and provides my suggestions, I stated sure.

And because it turned out, I loved my expertise a lot that I’m now happy to share I can wholeheartedly suggest you guys to go and examine them out for a overview, too.

Evaluate: My expertise with Havend

I’ve been managing our household’s insurance coverage insurance policies all this whereas, consulting with 3 trusted advisors-turned-friends each 1-2 years as I overview our family protection. Because it stands, I’m often the one proactively reaching out to them with my questions, or to ask for a overview – particularly every time we cross a brand new life milestone (reminiscent of once we turned dad and mom, or when my children had been born).

My insurance coverage brokers typically inform me I’m one in all their few purchasers who strategy them for a overview fairly than the opposite means spherical, lol. It ain’t simple to achieve Finances Babe’s belief, a lot much less her enterprise – on condition that my work exposes me to tons of of insurance coverage brokers whom I might select to work with at anytime!

Nonetheless, I used to be open to see what recommendation Havend’s insurance coverage specialists would give me on our portfolio, so I went down for a InsureWell evaluation to listen to their skilled opinion.

Previous to the session, I used to be requested to (i) undergo a Goalsmapper evaluation on-line, and (ii) replenish an Excel spreadsheet with particulars about our insurance coverage insurance policies. These had been despatched to the insurance coverage advisor(s) assigned to our case to overview earlier than giving us any suggestions or recommendation.

We opted for an in-person session, which began with an introduction to Havend’s insurance coverage philosophy – one I used to be glad to see aligned very a lot with my beliefs. Then, they went into their 3 Ps framework: Objective, and Payout vs. Premiums. I used to be requested about my Objective(s) then for selecting the plan(s) we had, whereas Havend suggested on the worth i.e. Payout vs. Premiums.

After assembly with numerous of brokers who’ve tried to speak me out of time period insurance coverage (vs entire life) and persuade me into getting an ILP (learn: why I cancelled my ILP), it was a breath of contemporary air to fulfill with Si Jin and Mike, who didn’t attempt to pull any tips on us.

As somebody who does most of my household’s insurance coverage planning myself, it was reassuring to see that even the specialists at Havend agreed with my strategy and techniques. And even once we disagreed on the 3Ps for some plans – reminiscent of how our Private Accident plans value us double of what Havend might get for us on a unique insurer – the specialists at Havend took the time to listen to us out and agreed that there was a case for paying increased premiums so long as we had been happy and getting worth out of it.

For example, whereas I’ve all the time identified that placing our household underneath AIA’s Private Accident plans value us much more than if we had caught with Sompo (which we had up until 2021), this resolution was not made flippantly – however we felt the upper premiums was value it as a result of our AIA agent is nice at what he does, and has helped us declare for a number of tons of of {dollars} yearly with out fail.Our AIA agent (Bran) takes the hassle to observe our lives on social media and is usually within the know when our kids get sick or my husband will get into a motorcycle accident. Throughout a 2-week episode final 12 months when HFMD struck each our youngsters and my husband, we had been too frenzied to even do not forget that our PA plan covers for HFMD. If not for our agent, who messaged us to remind us to ship him our medical receipts and filed the claims, we might in all probability have gone by your complete season with out getting a payout…as a result of we had been too caught as much as keep in mind our entitlements. That is why we're keen to pay (a better) premiums for our household’s PA plans, so long as it continues to be serviced by him.

The session largely validated my thought course of and monetary planning strategy, and I used to be additionally capable of talk about my issues with them as as to whether we may be underinsured for crucial sickness protection regardless of shopping for a couple of further on-line insurance policies to layer our safety lately.

All in a protected area, with none strain to purchase or take a look at new insurance policies.

In truth, the suggestions had been solely despatched to my e-mail after the session.

How does Havend mitigate the conflicts of curiosity?

To be clear, conflicts of curiosity will all the time exist within the business as a result of nature of insurance coverage gross sales. Although Havend’s advisers are all salaried, paying a month-to-month wage alone can not solely get rid of conflicts if the worker’s variable pay relies on how a lot fee or annual premiums they convey in.

Therefore, Havend has put collectively 5 controls to be sure that these conflicts of curiosity are strongly mitigated:

| Drawback | Resolution |

| Advisers could also be tempted to promote costly plans to you to earn extra commissions | Deal with lives modified, not gross sales.

The adviser’s variable compensation is predicated on the variety of lives they advise, and never on the commissions they convey in. |

| Advisers could also be swayed to promote merchandise that pay further incentives along with incomes fee. | Gross sales incentives are retained by the corporate and usually are not given to Havend’s insurance coverage specialists to forestall any product bias. |

| Not figuring out if the product being really useful is appropriate or as a result of it pays numerous commissions. | Be clear sufficient to let you know how a lot commissions they are going to obtain from the plans really useful to you. |

| With no clear planning philosophy to anchor on, it’s possible you’ll find yourself shopping for insurance policies not essentially the most applicable to your wants however one which pays extra to the advisers. | A transparent insurance coverage planning philosophy: Havend publicly makes identified why it considers sure insurance coverage merchandise appropriate or unsuitable primarily based on sound rules, and never on the fee quantity the salesperson may obtain. |

| No assurance if one of the best practices in insurance coverage advisory is being carried out for you as a result of advisers have full autonomy in how they run their advisory enterprise. | Havend has institutionalized a course of the place each shopper receives the identical recommendation, which ensures each piece of recommendation given is constant to the corporate’s course of and insurance coverage philosophy, and isn’t depending on the insurance coverage specialist’s personal desire. |

On prime of that, they’re providing a Cash Again Assure; within the occasion that there’s any overselling of insurance coverage to you, Havend will provide a refund of the surplus insurance coverage premiums you’ve gotten over-paid.

Ought to I am going to Havend for insurance coverage recommendation?

Through the years, a lot of you guys have come to me looking for insurance coverage recommendation. Attributable to MAS rules, my response has all the time been the identical: I’m not a licensed monetary advisor and can’t offer you licensed recommendation.

A few of you’ve gotten requested me to hitch the business, whereas others have tried to recruit me; this can be a “no” for me as a result of I really feel that the worth of the work I do right here on my weblog impacts much more lives than I can if I turned an agent. I wouldn’t have the ability to write articles like this, this or this, as an example. My agent mates have additionally been informed by their companies or compliance groups to take away posts they made on their very own social media, together with content material round which bank card is one of the best to make use of for paying your insurance coverage premiums (my reply right here).

After having gone by a Havend advisory session myself, I can wholeheartedly say that the recommendation given by Havend is the very same that I might give to my readers.

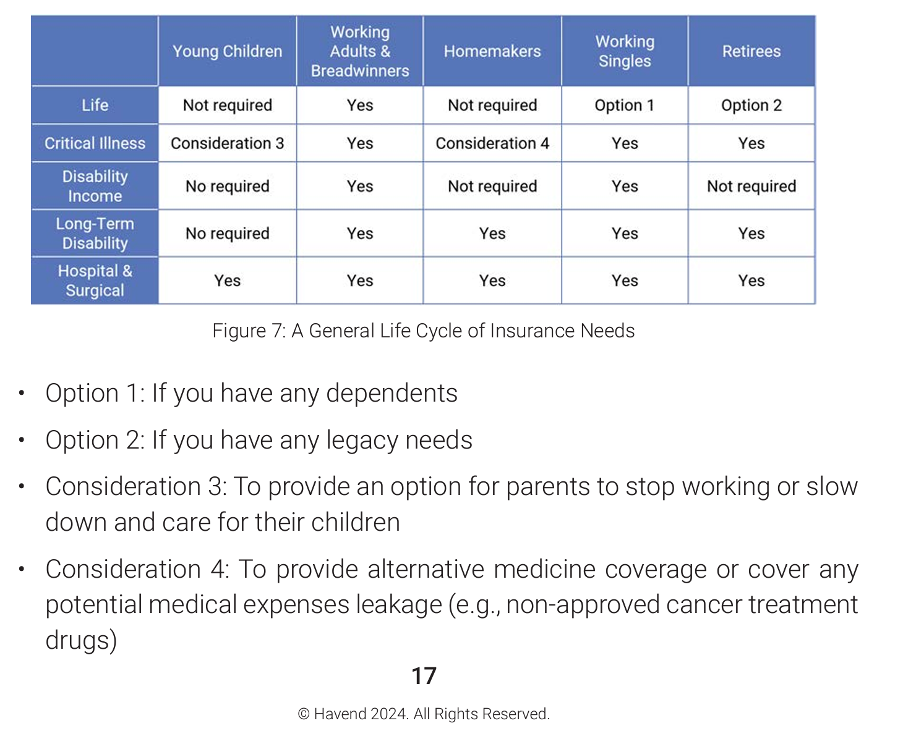

Their insurance coverage philosophy first focuses on insuring us towards 5 core areas of monetary dangers:

Adopted by a dialogue into your private circumstances, wants and price range, in order that you recognize what you need to have or whether or not some plans are pointless. This follows the institutional framework adopted by their dad or mum firm, Providend, which largely serves the wealthier teams as a trusted adviser to get a second opinion.

At this time, at Havend, the typical man on the road can now profit from the identical institutional advisory course of.

If you select Havend, you possibly can anticipate

- a reliable insurance coverage advisory expertise and belief that you simply received’t be oversold.

- Get dependable recommendation on easy methods to be adequately lined, with out having to overpay.

The second level is an enormous drawback for many customers in Singapore, and whereas many brokers are fast to level out to you about how being under-insured can rapidly result in monetary spoil ought to a life disaster strike, fewer will admit to you that you simply may be over-insured.

Being over-insured additionally comes at a worth – the premiums you pay are consuming into monies that would have in any other case been invested in your future wealth or retirement.

So when you have any of those issues, speak to the specialists at Havend to get recommendation in your monetary scenario. They may critically overview your insurance coverage insurance policies for you and offer you their unfiltered tackle whether or not it’s value it or not. And within the occasion that you simply disagree with they gave you or really feel they oversold you into any insurance policies, make use of Havend’s Cash Again Assure (and drop me an e-mail, because it determines whether or not I proceed recommending them to my readers in future).

Havend was created to make sure you and your loved ones are all the time sufficiently and suitably lined. Ought to you’ve gotten any doubts or end up not sure about your insurance coverage portfolio, I encourage you to achieve out to Havend and get a second opinion in your insurance coverage insurance policies.

In partnership with Havend, you should utilize my referral code SBBTCL01 to get a complimentary InsureWell evaluation.

You’ll additionally obtain $20 cashback for each coverage that you simply determine to bought by Havend after the evaluation.

Disclosure: This text was written in partnership with Havend, however they’d no say in influencing my opinions said right here. In full transparency, you must also know that I stand to obtain an introducer price (affiliate) from the corporate within the occasion that you simply determine to buy a coverage by Havend’s advisors.

Editor’s word: I overview and replace my suggestions infrequently. For those who go for a Havend InsureWell evaluation and for any motive, really feel that it was unsatisfactory, please e-mail me together with your suggestions – this can assist me to determine whether or not to proceed recommending them to my readers. Up to now, my expertise (and that of my mates) have been extraordinarily constructive, which is why I agreed to jot down this text and encourage you guys to examine them out for your self as nicely.