It’s raining new fund affords.

Two new fund affords, nevertheless, caught my consideration.

- Mirae Asset Nifty 200 Alpha 30 Index Fund of Fund

- Edelweiss Enterprise Cycle Fund

The curious factor about these 2 funds is their deal with one thing referred to as ‘elements’.

Issue primarily based investing or sensible beta portfolios have picked investor’s fancy in India not too long ago.

You do bear in mind the Nifty 200 Momentum 30 Index which has had a dream run of types. UTI MF has an older fund there, HDFC MF too launched its personal in early 2024.

Can issue primarily based investing or sensible beta portfolios make a distinction to your portfolio? Let’s discover out.

What are “elements”?

Elements are like elements that blend, of which might make the meals tastier or more healthy.

A film has elements just like the script, solid, manufacturing high quality and enhancing that may decide its success or failure.

In investing too, the function of things is being recognised to find out a technique’s success or failure.

Various factors for various outcomes

There are a number of elements that may be recognized in a portfolio however let me spotlight a number of on your reference.

a) Low Volatility – Shares whose costs have lesser extremes or technically, low commonplace deviation.

b) High quality – Shares which have proven higher capital administration, decrease dangers, debt and better return on capital.

c) Worth – Shares which can be undervalued with respect to the Worth to Earnings, Worth to E-book and Dividend Yields.

d) Momentum – Trending shares which have delivered higher returns during the last 3, 6 or 12 months.

e) Alpha – Sometimes measured as extra return over a predefined benchmark.

f) Equal Weight – Instance, having equal weight to Nifty 50 or Nifty 100 shares will take away any dimension bias and permit every inventory to contribute equally.

How issue primarily based investing has began to develop into fashionable is mirrored within the variety of indices which can be on the market. Each the index suppliers affiliated to NSE and BSE are on a spree.

A few of these indices use standalone elements and others a combo of a number of elements.

Listed here are some examples:

- Nifty 200 Momentum 30 Fund

- Nifty 100 Low Volatility 30 Fund

- Nifty 200 High quality 30 Fund

- Nifty 200 Worth 30 Fund

- Nifty 200 ALpha 30 Fund

- Nifty Alpha Low Volatility 30 Fund

- Nifty High quality Low Volatility 30 Fund

and plenty of extra. See a complete checklist right here

Quiz: Which one of many above checklist is a multi issue index?

Does issue primarily based investing work?

Nicely, previous research and backtests present that there’s a distinction in outcomes when issue primarily based portfolios are used compared to commonplace benchmarks from which these portfolios are created.

To start with, as talked about earlier, an element primarily based method is prone to provide a special portfolio than the common index. How completely different? We’ll examine portfolios primarily based on the 4 huge elements.

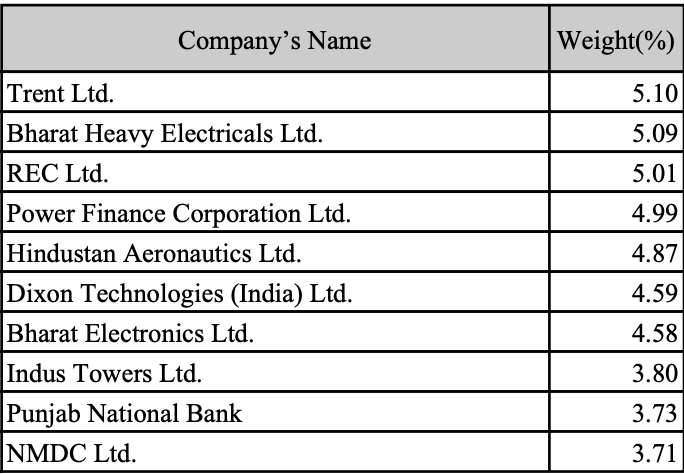

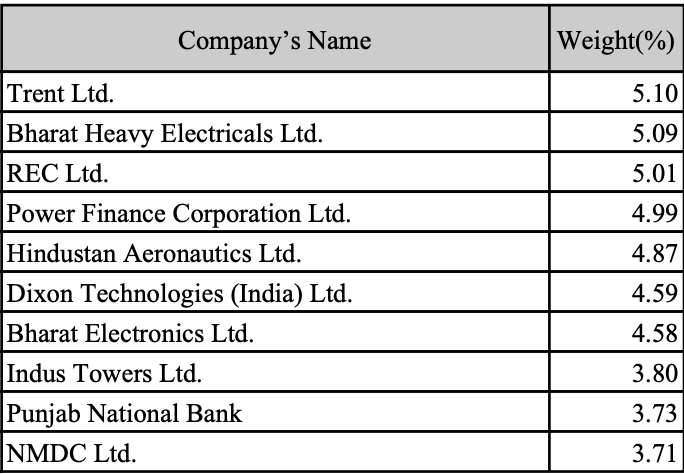

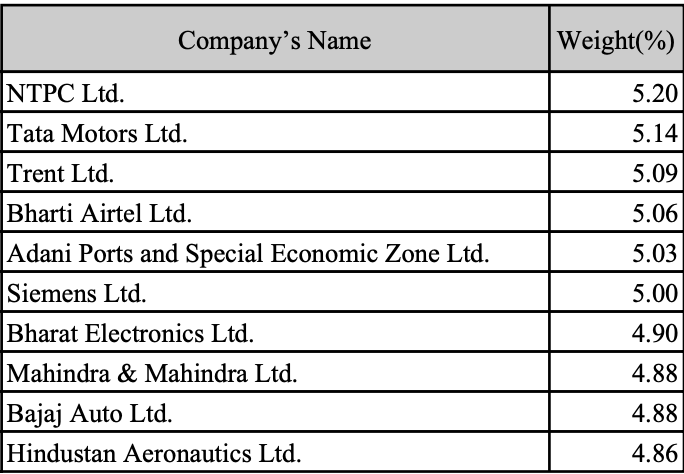

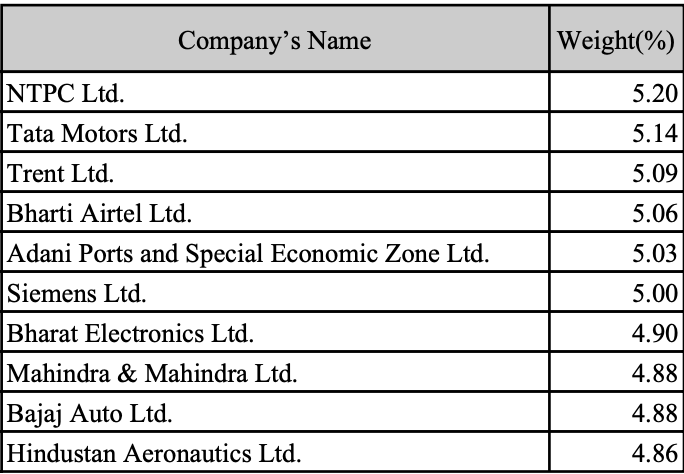

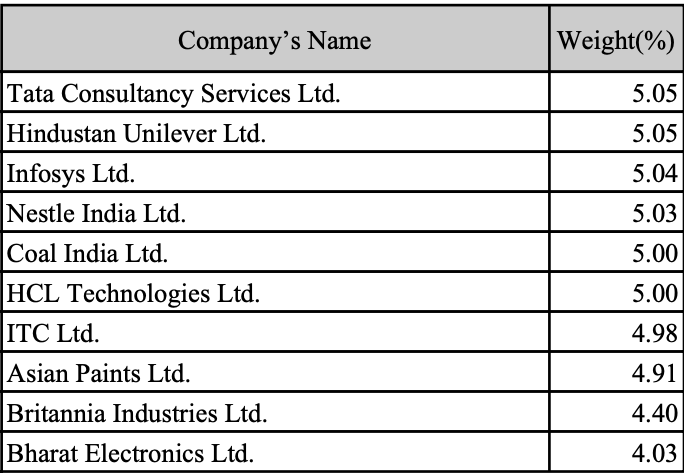

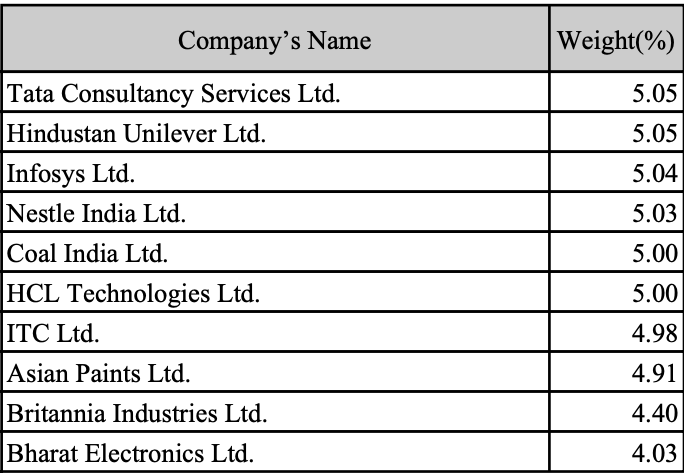

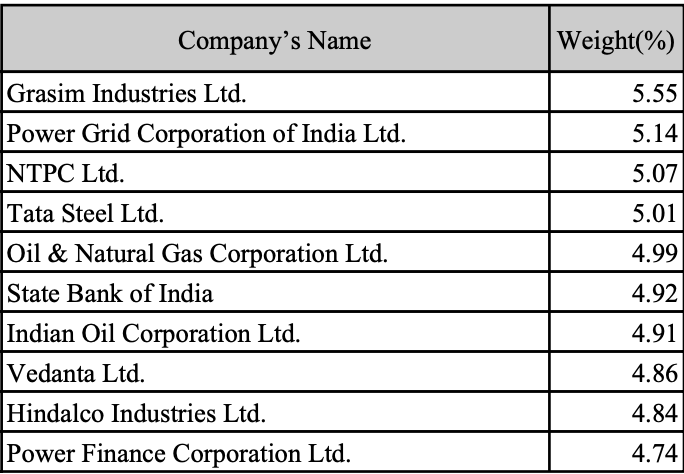

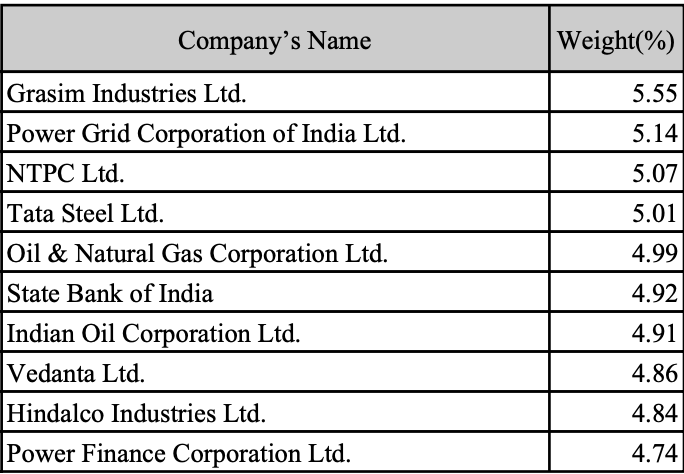

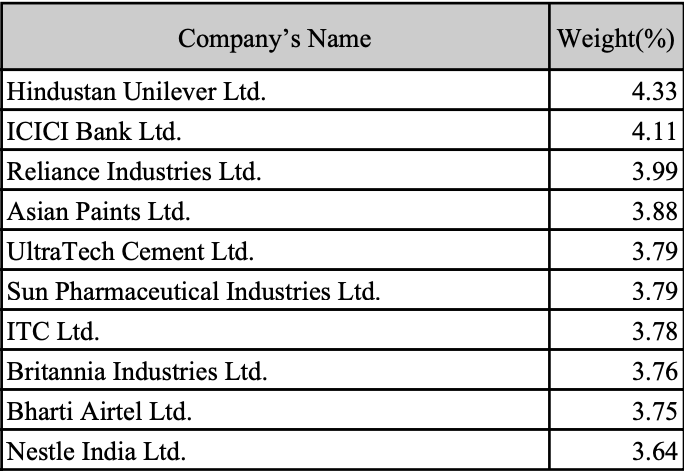

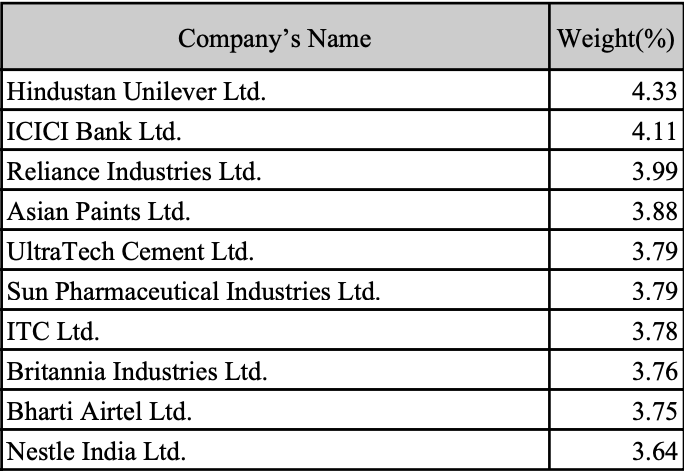

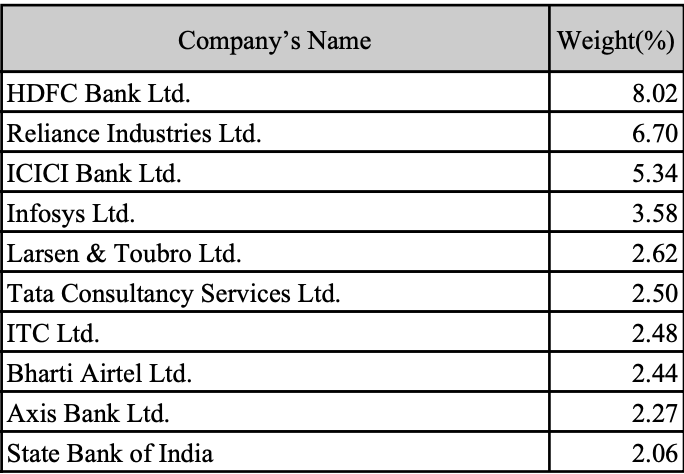

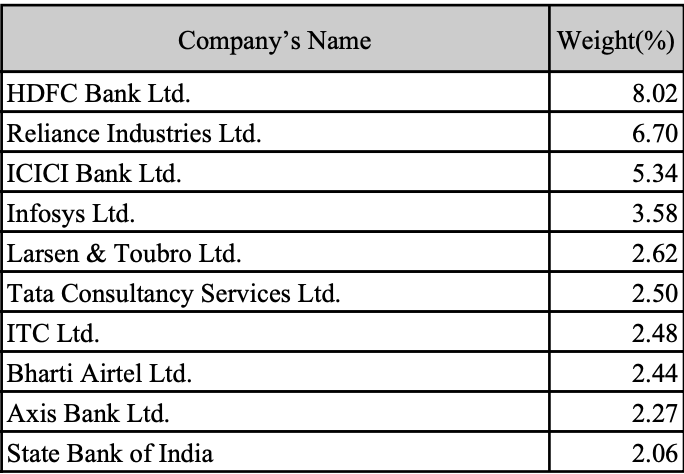

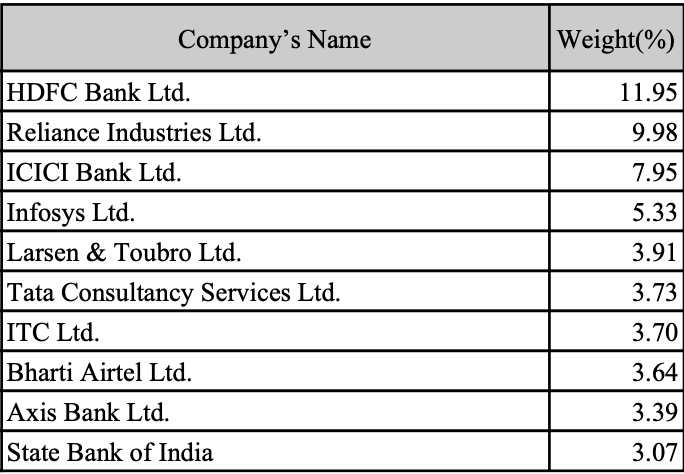

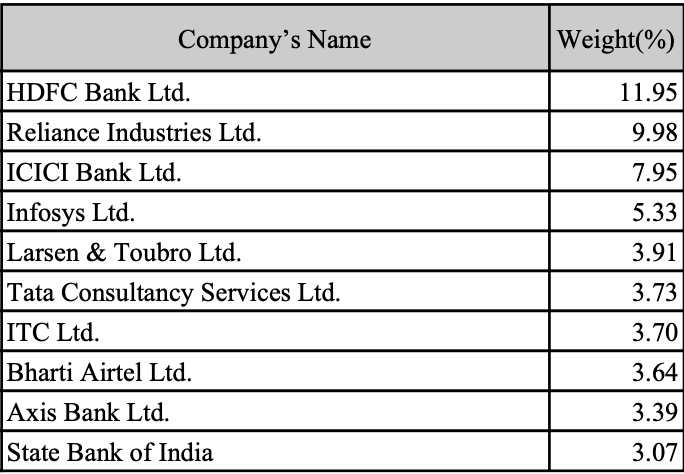

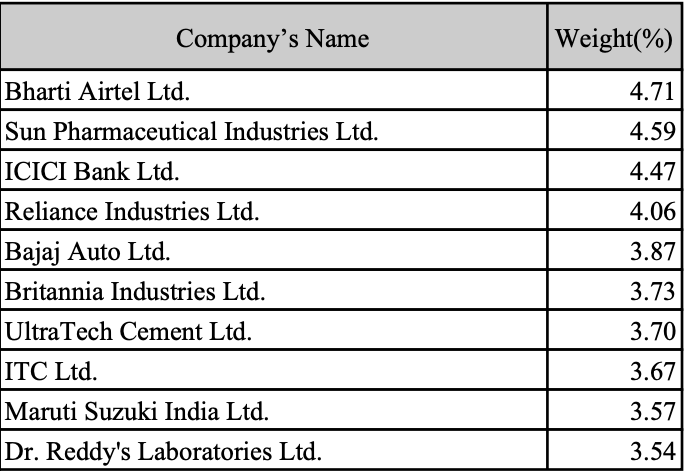

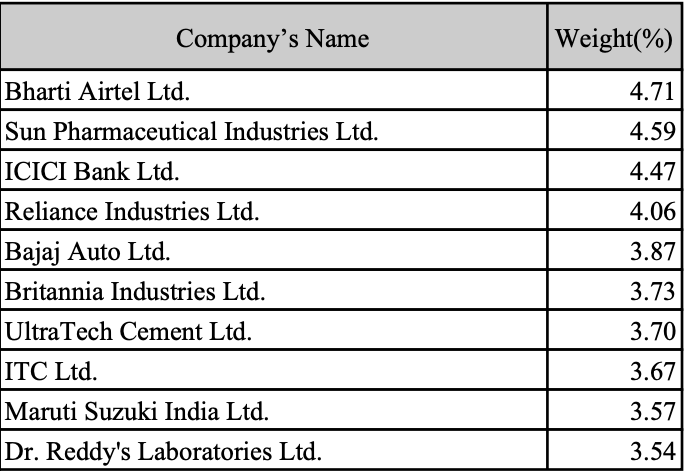

Prime Holdings in numerous issue technique indices as of June 28, 2024

Nifty 2oo Alpha 30 Index

Nifty 2oo Momentum 30 Index

Nifty 2oo High quality 30 Index

Nifty 2oo Worth 30 Index

Nifty 1oo Low Volatility 30 Index

Nifty 2oo Index

Nifty 50 Index

Nifty Alpha Low Volatility 30 Index

Quiz: Which inventory seems in each – Low Volatility in addition to High quality indices?

How do these portfolios translate into outcomes?

To start with let’s have a look at how numerous elements have behaved throughout calendar years.

We’ve got information from April 1, 2005 until July 16, 2024 for complete return index of every of the issue primarily based indices. We used it to calculate calendar 12 months returns as proven in picture beneath.

Calendar Yr Returns for numerous issue indices

Information Supply: www.niftyindices.com, compiled by Unovest. Please notice all the info proven beneath is again examined information on the index numbers. It doesn’t account for bills or any actual world impression prices. It’s previous efficiency and has no relation to future outcomes.

Simply to offer you an instance let’s see how altering one issue can change the behaviour of the portfolio. In case of Nifty 50 and Nifty 50 Equal Weighted, the weighting standards moved from free float market cap to equal weight. See the outcomes.

For different issue primarily based indices, the respective rating for the elements is used as a weighting standards for the inventory within the portfolio.

What are the opposite observations?

The contribution of varied elements change throughout cycles and years.

It seems that the worth issue has fairly a little bit of extremes whereas alpha and momentum elements appear evergreen.

And sure, Nifty 200 Alpha 30 appears to have delivered over plain vanilla Nifty 200.

Let’s strive a special level to level and see the way it modifications issues.

Monetary Yr Returns for numerous issue indices

Information Supply: www.niftyindices.com, compiled by Unovest

These numbers look completely different than the calendar 12 months returns.

Do your observations change?

Nicely, worth nonetheless is susceptible to extremes.

Nifty Equal Weight index has proven outperformance solely publish covid.

Inside the group, the mixture of Alpha and Low Volatility seems to be a extra reliable choice.

The query I ponder over is what occurs to the plain vanilla Nifty index.

–

Now, we are able to go taking a look at every level to level information over time – however that will likely be very cumbersome.

So, let’s go a step additional and get rolling returns into the image. We’ll calculate the median throughout this each day interval rolling sequence.

Rolling Returns abstract for numerous issue indices

Rolling returns calculated with each day intervals. Information primarily based on Whole Worth Index of respective indices from April 1, 2005 to July 16, 2024. Supply: www.niftyindices.com, compiled by Unovest. For extra emphasis on the dangers, we embody drawdowns and potential losses.

This appears like an entire new body of reference. The usual indices Nifty 50 and Nifty 200 appear to have been left far behind by issue primarily based methods (single or multi).

The Alpha issue doesn’t come with out its value. It has an enormous price when it comes to anticipated drawdown (this -75.3% above really occurred throughout the monetary disaster in 2008).

Low Volatility is a stabilising issue for a portfolio or in multi issue methods.

Nicely, with a lot on the market, one is unquestionably spoiled for alpha choose decisions.

The query then is what do you wish to deal with – Extra returns or much less danger or a mixture or simply your model/issue choice?

–

Let’s circle again to the two funds we talked about earlier.

The Alpha Issue – Mirae Nifty 200 Momentum 30 Alpha Fund of Funds

Mirae’s fund proposition is to have a fund of funds construction that can feed into its current ETF (brief for Alternate Traded Fund) Mirae Nifty 200 Momentum 30 Alpha ETF..

On this index, the alpha works with a particular formulation or a measure referred to as Jensen’s measure.

The measure is used to find out the shares’ extra return (alpha) and use it rank the most effective shares and assign them weightage too.

You see the place the portfolio is taking to ship a special danger / return profile towards, say, a Nifty 50.

The important thing factor to know right here is that the fund has modified its portfolio building model and is now doing the next:

- Use a extra concentrated portfolio of 30 shares towards Nifty 50’s, nicely, 50 shares.

- Change the weightage of shares and base it on the alpha rating as an alternative of market cap weight methodology utilized by commonplace indices reminiscent of Nifty 50. The per inventory weightage is proscribed to five% or thereabouts.

- The universe of shares is larger – Nifty 200 shares towards the Nifty 50

One can query as to why examine it with Nifty 50 in gross sales presentation and sure, it isn’t the proper comparability however it is advisable beat one thing.

The fund did higher in comparison with the usual index.

Don’t bear in mind? Return to the tables proven earlier.

Multi Issue magic – The Edelweiss Enterprise Cycle fund?

This fund proposes to take a multi issue method in a extra broad primarily based inventory universe of 300 shares. Its ‘proprietary mannequin’ will choose shares primarily based on a mixture of worth, progress, high quality and momentum elements and use it for sector rotation primarily based on a algorithm.

They actually had me confused about elements and sectors.

The portfolio could have about 60 shares – the quantity divided equally between massive cap and small/mid cap.

That is an actively managed fund and never a passive just like the Mirae Alpha fund.

However everyone seems to be searching for one factor – MORE.

Additionally know that many of the mutual fund schemes are designed to draw extra belongings and as they appeal to extra belongings they begin to resemble the market, for numerous causes. Over time, their outcomes is probably not so completely different from the market itself.

So, if you’re investing in a fund which is vastly fashionable or has a lot of shares, assume if it may well nonetheless do the issues which helped make it fashionable and/or a high ranker within the first place.

Do you have to spend money on issue indices / sensible beta methods?

Human nature poses an enormous downside to investing success. Everytime there’s a new choice on the horizon we wish to latch on to it within the hope that that is the one that can do the magic.

However by the point you wish to choose that issue up, it’s time is finished for then and you’re feeling dissatisfied.

I consider that among the extra fashionable issue primarily based funds at the moment will disappoint within the close to future.

Quite the opposite, in the event you have been actually focused on an element primarily based portfolio and I have been to inform you to choose a High quality and Low Volatility issue?

What I’m making an attempt to inform you is that don’t get caught up in the identical age previous circus of chasing returns.

Elements in a means are a easy approach to work along with your investor kind. If you’re a price investor, a price issue primarily based fund / portfolio, offers you the automobile to journey your conviction.

Should you assume momentum is the way in which to go for years (even with setbacks in between), there’s the issue portfolio for you.

Or, if that is an excessive amount of to ask, then allocate between elements and maintain rebalancing recurrently.

Issue / sensible beta methods could have their function however solely if you’re prepared to stay to the trail and let time do its half.

It’s important to topic your self to guidelines to maintain the monkey within the thoughts from doing silly issues.

The one alpha, in that case, is to these you pay your price and taxes to.

—

What’s your success issue going to be?

–

Frankly, you’d be an exception if you are able to do it your self. All different sensible individuals, who’ve accepted that it’s past them, are working with an advisor.

The advisor’s function is to assist stick with a path to compound your wealth which ends up in not only a fear free retirement however extra that means too. That’s an alpha value chasing.

–

Should you want to know extra about Nifty Indices and their methodology, take a look at this hyperlink

![[Factor Investing] In Search of Alpha [Factor Investing] In Search of Alpha](https://i1.wp.com/unovest.co/wp-content/uploads/2024/07/FACTOR-BASED-INVESTING.gif?w=696&resize=696,0&ssl=1)