Actual Property Property is likely one of the most sort-after funding choices in India. You may purchase immovable property in some ways and there might be many conditions if you want to switch your possession in a property to the one you love ones.

Essentially the most extensively used technique of transferring or buying a property is thru the execution of SALE DEED, which is also called TRANSFER DEED. However, sale deed might not all the time be a tax-efficient (or) cost-effective mode.

There could be a scenario if you want to relinquish your share within the property to your daughter or sister. In such instances, transferring the property by a Reward Deed could be a appropriate possibility.

One other scenario might be, if you need to make sure that your property is distributed to your beneficiaries in accordance with your needs, execution of WILL might be thought-about.

On this publish, allow us to perceive – What are the other ways of transferring actual property property like land, house, plot, flat and so on.,? What are the tax implications underneath every mode? What are the key variations amongst totally different sorts of Deeds like Sale Deed, Relinquishment Deed, Reward Deed and so on.,?

Other ways of buying or transferring Actual Property Property

You may purchase possession of immovable property within the following 5 common methods;

- By buying the Property

- By GIFTS

- By SETTLEMENT (Or) Partition of Properties

- By relinquishment of possession in a property (or)

- By inheritance or WILL

1 – Sale Deed

That is the preferred means of transferring the property. For those who maintain a property and also you want to promote it outright for a consideration (sale worth) then execution of SALE DEED might be thought-about.

The registration of sale deed or switch deed is necessary and as soon as the sale deed is registered in Sub-Registrar workplace, the possession will get transferred to the brand new proprietor.

- Price : Stamp obligation and registration payment should be paid to register the SALE DEED. The charges can differ from State to State. For instance, in Karnataka you need to pay 5% of the market worth of the property as Stamp Obligation and 1% as Registration Charge.

- Tax Implications :

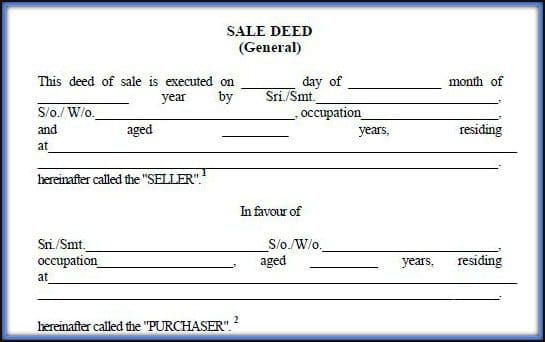

- Format : Beneath is the overall format of Sale deed. Click on on the under picture to obtain Sale Deed Template (precise templates can differ from state to state, under one is relevant for property transactions in Karnataka).

2 – Reward Deed

A present is cash or home, shares, jewelry and so on. that’s acquired with out consideration, or just an asset acquired with out making a fee in opposition to it and is a capital asset for the ‘Recipient’. It may be within the type of money / movable property / immovable property.

If you want to present the property to any of your blood relative, Reward deed can be utilized. In case of immovable property, it’s necessary to register the Reward Deed as per Part 17 of the Registration Act, 1908.

This sort of switch is irrevocable. When you present the property, it belongs to the beneficiary (receiver of present) and you can not reverse the switch and even ask for financial compensation.

It may be a value efficient means of transferring the possession in a property. (You may present the property to non-family members too however the stamp obligation or registration payment might be increased than within the case of a present to a member of the family.)

- Price : The stamp obligation is payable for registering a Reward Deed. The stamp obligation on present deed is usually lower than the stamp obligation that’s relevant for promoting the property by a Sale Deed. For instance, in Karnataka the relevant stamp obligation is Rs 1000 (mounted) and Rs 500 (mounted) as registration payment in case if the donee (receiver) is a specified Member of the family. In case of non-family member then it’s 5% & 1% respectively.

- Tax Implications on buying a Property by Reward Deed :

- For those who obtain a present (movable or immovable) from a relative then no tax might be levied. Nonetheless, for those who obtain a present (movable or immovable) from non-relative then as much as Rs 50,000 (stamp obligation worth of the immovable property or Honest market worth of movable property) is tax-exempted.

- As per the provision of taxation of items, any Reward acquired from any individual on the event of the marriage shouldn’t be liable to revenue tax.

- Presents acquired underneath a WILL or inheritance is tax-exempted.

- For those who get a property by a registered present deed (whereby your PAN is quoted), you possibly can present the worth of the present acquired as ‘Exempted Revenue‘ in ITR. That is to keep away from any scrutiny by revenue tax authorities sooner or later.

- It’s essential to be careful for ‘clubbing of revenue’ provisions. Kindly be aware that guidelines of clubbing of revenue comes into image for those who present a property to your partner, or minor youngsters or Son’s spouse. Any revenue earned by the recipient on the present shall be clubbed with the revenue of donor (you).

- Learn : ‘Presents & Revenue Tax implications…‘)

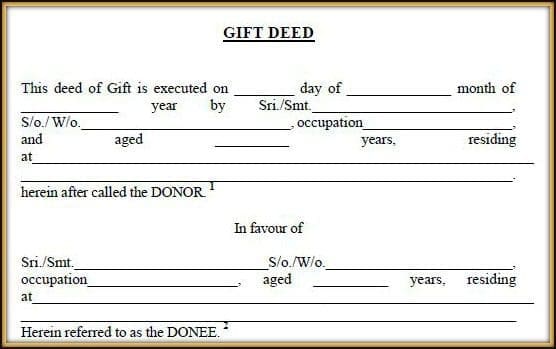

- .Format : Beneath is the overall format of Reward deed. Click on on the under picture to obtain Reward Deed Template.

3 – Relinquishment Deed / Launch Deed

If there are a number of proprietor for a property, and if one of many co-owner desires to switch his/her rights within the property to a different co-owner(s) then this may be executed by the execution of RELINQUISHMENT DEED.

The switch of property by Relinquishment deed might be for consideration or with out consideration (with none alternate of cash). Like present deed, this switch can also be irrevocable.

- Price : The Relinquishment deed needs to be registered and relevant stamp obligation needs to be paid. The stamp obligation needs to be paid solely on the portion of the property that’s being relinquished and never on the whole worth of the property. Usually the relevant payment is just like that of a Reward Deed.

- Tax Implications: The tax on capital positive factors (like in Sale Deed case) is relevant however solely on the portion of the property that you simply relinquish.

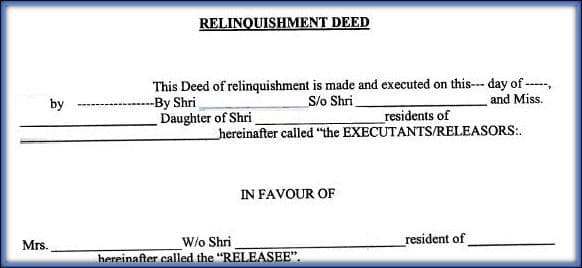

- Format : Beneath is the overall format of Relinquishment deed. Click on on the under picture to obtain Relinquishment Deed Template.

There’s a very skinny line of distinction between Relinquishment deed and Launch Deed.

Relinquishment Deed instrument is often used when an individual dies intestate (with out leaving a WILL) and his/her siblings inherit the property. For instance – If father of two children who owns an actual property property dies with out leaving a WILL then his two children inherit the property. If one of many siblings desires to relinquish his share within the property then he can execute Relinquishment deed in favor of his brother.

Whereas within the case of Launch Deed, let’s say if each companions mutually bought the property and one of many companion desires to launch his share from the property than in that case Launch Deed might be executed.

4 – Partition Deed / Settlement Deed

Partition Deed is usually executed by the co-owners of the property (collectively held property) when a court docket order or order by an native income authority needs to be applied.

In case of Settlement Deed, nevertheless, the property is owned by a 3rd individual and is settled in favour of individual’s who wouldn’t have any earlier curiosity within the stated property and the share of the beneficiary is as per the needs of the settler.

Not like WILL, Settlement is a non-testamentary doc which turns into operative instantly. Will is a testamentary doc, which turns into operative after the demise of its writer. Additionally, WILL is revocable and might be modified by the testator, whereas Settlement deed is irrevocable.

- Price : The deed of settlement attracts stamp obligation and registration of the settlement deed is obligatory. The stamp obligation payable is just like that payable on a sale deed, i.e. based mostly available on the market worth of the property. Nonetheless, concessions can be found in case of settlement made in favour of members of the family. For instance : in Karnataka the relevant stamp obligation is Rs 1000 (mounted) and Rs 500 (mounted) as registration payment in case if the donee (receiver) is a specified Member of the family. In case of non-family member then it’s 5% & 1% respectively. Partition Deed additionally needs to be registered.

- Tax Implications: So long as no switch (re-sale) takes place, the events to a (household) settlement or Partition received’t be topic to capital positive factors tax in respect of the earnings derived from their share of the property.” The switch or re-sale can occur by executing Reward Deeds or Sale Deeds.

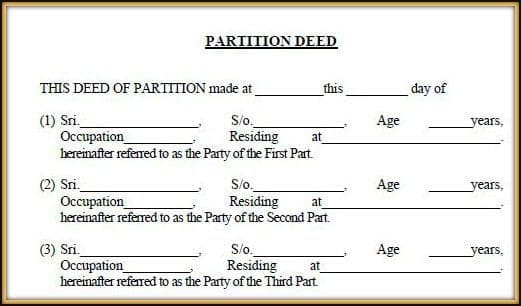

- Format : Beneath is the overall format of Partition deed. Click on on the under picture to obtain Partition Deed Template.

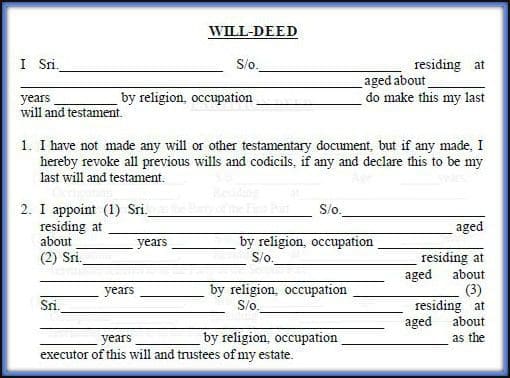

5 – Inheritance / WILL Deed

You may purchase a property by inheritance or WILL DEED. If an individual dies intestate then the properties are transferred as per the Regulation of Succession. WILL Deed might be revocable by the Testator throughout his/her life time. So, the beneficiaries of WILL get the possession rights in a property solely after the demise of the Testator.

After the demise of the testator, individual claiming by the WILL DEED or inheritance needn’t Register the property in his identify.

(Learn : ‘Significance of writing a WILL..‘)

Nonetheless he/she has to use to the involved native civil authorities with the copy of the need, Succession Certificates (Authorized-heir Certificates) and demise proof (demise certificates) for getting mutation of the property executed in his/her identify.

After the demise of proprietor of a property his heirs, equivalent to spouse, youngsters i.e. female and male, married or single might, as per respective private legislation, get the Patta/Khata transferred on manufacturing of demise certificates of the proprietor with particulars of property held by him.

(Learn : ‘What’s mutation? get Khata switch executed?’)

For instance : If property is an agricultural land – Mandal Income Officer ( underneath Andhra Pradesh Land Income Act), and if property is home or vacant land in a metropolis/village apart from agricultural land — Workplaces of Company, Municipality, Panchayat might be contacted.

- Price : Registration of WILL DEED shouldn’t be obligatory. Stamp obligation prices aren’t relevant and registration payment of Rs 200 is relevant (in Karnataka).

- Tax implications if property is acquired by inheritance or WILL : If you obtain a property by inheritance or WILL DEED, there might be no tax implications. Nonetheless, for those who re-sell the property then regular capital achieve taxation guidelines are relevant for the heir. The property which is acquired don’t value something to the heir, however for calculation of capital achieve the price to the earlier proprietor is taken into account as the price of acquisition of the Property. Additionally, the 12 months of acquisition of the earlier proprietor is taken into account for the aim of indexation of the price of acquisition.

- Format : Beneath is the overall format of WILL Deed. Click on on the under picture to obtain WILL Deed Template.

Transferring or buying a property is a BIG resolution and might be an emotional one too. We recommend you to debate the above property associated issues with your loved ones members / well-wishers and in addition take a authorized opinion, if required.

Hope you discover this publish informative and helpful. Kindly share your views and feedback. Cheers!

Proceed studying : Guidelines of Necessary Property Paperwork in India | Authorized Guidelines for Property Buy

(Submit Printed on : 30-August-2016) (Picture courtesy of fantasista at FreeDigitalPhotos.internet)