I purchased Bitcoin for the primary time in 2017.

I attempted my darnedest to know it however my conventional finance mind couldn’t get there.1

As an alternative of repeatedly banging my head in opposition to the wall and combating the rising crypto faith, I purchased some. It was a hedge in opposition to being left behind.

My timing was by no means nice however I averaged in quite a lot of occasions through the years.

That first ramp-up to $20k or so round Thanksgiving 2017 was enjoyable. The every day swings had been wild. Then got here the crash and a crypto winter. Throughout the pandemic in March 2020, Bitcoin misplaced half of its worth in simply two days.

Then we had one other growth that kind of ended proper when Coinbase went public within the spring of 2021.

There have been some darkish days throughout that crypto winter following the Sam Bankman Fried fiasco. There was one other ~80% crash.

Once I first purchased Bitcoin, I advised myself it was a buy-and-hold without end asset. There’s no good technique to worth it. There are not any money flows. I’ve come to purchase the digital gold story, however it nonetheless appears like a bunch of techies have kind of created trillions of {dollars} out of skinny air.

I don’t say that as a slight both. It’s spectacular.

I got here near promoting some over the past growth occasions in 2021. I used to be ready for Bitcoin to hit $75,000 and I used to be going to loosen up. It by no means fairly obtained there. The following crash was brutal however I stayed invested similar to I had within the earlier bloodbath.

This time round I made a decision to implement some promote self-discipline.

I’m not providing funding recommendation to anybody else right here however thought it might be useful to share my causes for promoting a few of my Bitcoin place.

Right here’s goes:

I’m rebalancing. This one place is now almost 10% of my whole portfolio. Exterior of my complete inventory market index funds, Bitcoin is my largest single holding.

It’s time to trim and produce that place again to a extra affordable 5% or so of my portfolio.

Promoting is an inexact science. I do know there may be nothing particular a few massive spherical quantity like $100,000 however the time appeared proper to rebalance and right-size this place.

Common rebalancing is likely one of the finest methods to make the most of an ultra-volatile asset.

Have a look at it this manner — crypto has graduated from a speculative asset to one thing I’m utilizing in a extra conventional portfolio administration assemble.

There’s more cash at stake. I first began shopping for Bitcoin when it was round $4,000 however it was comparatively small quantities of cash. From my common price foundation, the place is up roughly 5-6x.

There’s far more cash at stake now than through the earlier booms.

A large crash could be way more painful from a greenback perspective as a result of the stakes are larger.

I assume I’m not a diamond arms particular person. Oh properly.

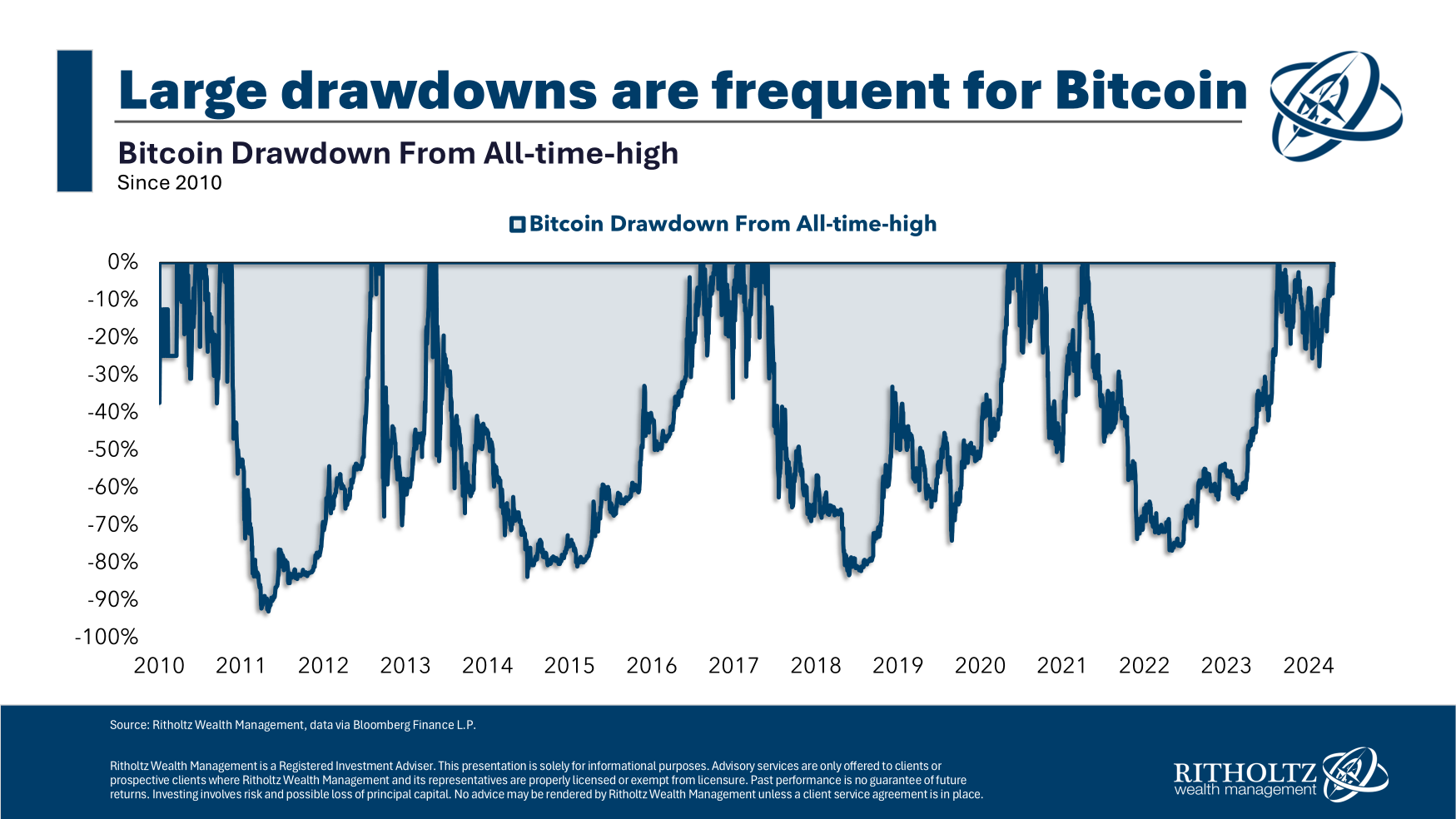

Bitcoin has painful drawdowns. Right here’s a take a look at the historic drawdown profile of Bitcoin:

That’s 4 Nice Despair-like crashes up to now 15 years!

It’s doable these gigantic crashes are a factor of the previous as a result of there may be now extra institutional cash within the house what with ETFs, advisors and institutional capital at play. Perhaps the 80% crashes each few years will go away however this asset was created to have excessive ranges of volatility.

It trades 24/7. It’s world. There are not any money flows. There’s no CEO or board. We nonetheless don’t know who Satoshi is.

You’ll be able to’t rule out the potential for crypto winters, however even when that part is finished, I’d anticipate 40-60% crashes are nonetheless on the desk.

I don’t know when it should occur however it’s a great guess in some unspecified time in the future it should get wrecked once more.

I’m practising remorse minimization. I offered 25% of my place when it hit $99,000 and alter.2 I’ve obtained one other restrict order to promote if and when it hits $110,000.

The plan is to chop my place in half.

Why do it this manner?

Name it a Grand Rapids hedge or remorse minimization. I’d really feel like an fool if I offered the whole lot and it went as much as $150k or larger. I’d additionally remorse it if I held the whole lot and noticed it crash but once more.

So I break up the distinction. A method or one other I’ll have some remorse however I’m comfy with this resolution.

If Bitcoin does crash within the months or years forward I’ll plan on shopping for extra and rebalance into the ache.

I’m merely being extra strategic about this place than I used to be up to now as a result of it grew to such an outsized piece of my portfolio (for my tastes a minimum of).

I’m certain some true believers will assume I’m an fool. It’s doable I’m promoting means too early and can really feel silly if this growth reaches new heights.

That’s one of many causes I’m nonetheless holding onto half of my place.

Probably the most bullish side of crypto to me through the years is the truth that it simply received’t die. If it didn’t die through the SBF catastrophe, it’s by no means going away. I acknowledge this truth which is why I didn’t need to promote the whole lot.

Even when Bitcoin crashes once more sooner or later it’s doable it should occur from a lot larger ranges and I received’t get the prospect to purchase again at present costs.

I’m OK with my resolution if that occurs.

Investing itself is a type of remorse minimization.

Additional Studying:

Sam Bankman Fried vs. The Match King

1Digital gold remains to be the simplest clarification however that’s not what folks had been initially promoting it as. The narrative about what crypto is has modified lots through the years. Doesn’t actually matter I assume.

2I simply didn’t have sufficient endurance to attend out the $100,000 mark.