It’s that point of the 12 months for the prognosticators to make their forecasts of what the markets might be like subsequent 12 months and maybe for the adventurous few to challenge out the following ten to thirty years. “Do I’ve sufficient saved to retire if the inventory and bond markets don’t sustain with inflation for twenty years?” It isn’t a rhetorical query to ask ourselves.

I don’t wish to be the Grinch who steals Christmas, however I hope for the most effective and put together for decrease long-term returns. Get pleasure from your favourite vacation meals, particularly the desserts.

After reviewing the ten-year investing panorama, I imagine the chance of one other secular bear market beginning throughout this decade is excessive. On this article, I evaluation the explanations for this perception and what Constancy, Vanguard, and the Monetary Elders see on the horizon. The ultimate part displays a number of the small changes that I’m making to my plans.

This text is split into the next sections:

OVERVIEW OF SECULAR MARKETS

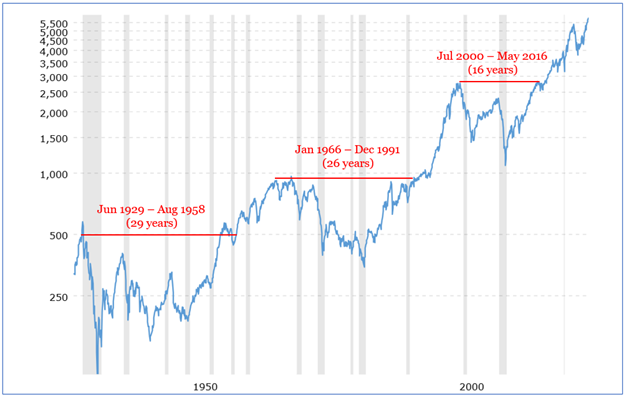

Determine #1 reveals the S&P 500 for the previous hundred years adjusted for inflation. A greenback in 2007 would have 31% extra buying energy than a greenback in 2024 attributable to inflation. The chart doesn’t embrace the advantages of dividends. Dividends have largely been changed by inventory buybacks for the reason that mid-2000s and have been additional lowered by straightforward financial coverage. The DQYDJ calculator can be utilized to estimate the return of the S&P 500 with dividends and adjusted for inflation for the twenty-six-year interval from January 1966 to December 1991 to be 3.8% and for the sixteen years from July 2000 to Might 2016 to be just below 2.0%.

Determine #1: S&P 500 Adjusted for Inflation

Supply: Creator utilizing S&P 500 Index – 90 Yr Historic Chart | MacroTrends

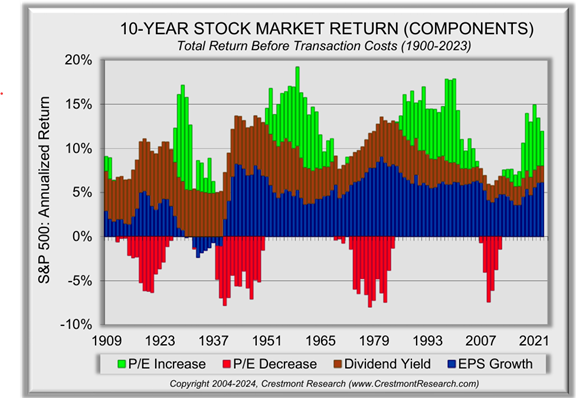

Ed Easterling is the founding father of Crestmont Analysis and creator of Surprising Returns: Understanding Secular Inventory Market Cycles and Possible Outcomes: Secular Inventory Market Insights. These books and his web site shaped the inspiration of my retirement planning. Mr. Easterling reveals the Parts of Inventory Market 1o-Yr Rolling Returns in Determine #2. Modifications in valuation are the important thing driver of inventory market returns throughout secular markets. Word that valuations are at present excessive which suggests below-average returns within the coming decade(s). As well as, lengthy durations of excessive inflation are often related to falling valuations. Mr. Easterling describes secular bull markets as a time for crusing, and secular bear markets as a time for “rowing” which means energetic funding administration.

Determine #2: Parts of Rolling 10-Yr Inventory Market Returns

CAPITAL MARKETS IN THE COMING DECADE

The inventory market rose following Donald Trump’s election victory as inventory buyers relished tax cuts whereas bond yields rose as bond buyers anticipated charges to stay greater for longer to pay for greater deficits together with the expectation of upper inflation.

One of many key questions is “Will enormous deficits weigh on GOP plan to slash taxes?” requested by Yuval Rosenberg and Michael Rainey at right-leaning The Fiscal Occasions. They state, “The identical dynamic performed out in 2017, when lawmakers settled on a 10-year price of $1.5 trillion for his or her tax package deal, at the same time as some pushed for a bigger quantity. However regardless of the quantity finally ends up being, it seems to be like a bigger deficit and elevated debt are doubtless this time round.” Republicans might add Trump’s proposed tariffs “even when these revenues have little likelihood of materializing”. Moody’s Rankings wrote, “Given the fiscal insurance policies Trump promised whereas campaigning, and the excessive probability of their passage due to the altering composition of Congress, the dangers to US fiscal energy have elevated.”

I wrote an in depth technical report, Sluggish Development and “Making America Nice Once more”, on Monetary Sense in February 2017 that analyzed taxes and tax avoidance, commerce, and financial progress with respect to the potential insurance policies of newly elected President Trump. I made the purpose that financial progress had slowed attributable to demographics, declining productiveness, low financial savings, low funding, erosion of the center class, devastating recessions, automation resulting in gradual job progress, and excessive debt ranges. Financial progress averaged 2.7% throughout the first three years of Trump’s presidency earlier than COVID – a lot lower than the 4% from the marketing campaign rhetoric.

Proper-leaning Cato Institute wrote The Tax Reduce and Jobs Act of 2017 stating that “the results of the [Tax Cut and Jobs Act] on financial progress and wages have been smaller than marketed.” They add that company revenue tax cuts generated substantial advantages however that the claims about these advantages are “vital exaggerations”. The precise-leaning Committee for a Accountable Federal Funds wrote in US Funds Watch 2024 that the 2017 tax cuts will improve the nationwide debt by $1.9 trillion over ten years.

The Peter G. Peterson Basis (Least Biased Media Bias/Reality Examine Ranking) writes in The Subsequent Fiscal Cliff: Huge Tax Selections to Make in 2025, “Extending all provisions from the TCJA which can be set to run out on the finish of 2025 would improve deficits by $2.7 trillion from 2024 to 2033, in accordance with CBO and JCT.” The Committee for a Accountable Federal Funds additionally estimates that President Trump’s preliminary plan will improve the nationwide debt by $7.75 trillion by way of 2035.

I wrote within the 2017 Monetary Sense article, “In 2014, 10% of importers have been multinational firms which accounted for over 76% imports. There have been over 400,000 firms importing or exporting with 20% of the businesses each importing and exporting.” Roughly 35% to 50% of complete commerce is within the type of multinational firms importing and exporting between divisions. Tariffs may have winners and losers with shoppers paying greater costs.

Federal spending has risen from 16% of GDP following WWII to 22% in 1982 and is at present at 23%. I count on there to be a shift from spending on social applications to the army. Elon Musk needs to chop $2 trillion in US spending. Can he do it? by Tom Dempsey at NewsNation describes that the $2 trillion in Federal spending cuts would come from the $6.75 trillion (or 30%) that’s at present being spent. Social Safety, Medicare, Protection, and Veterans advantages quantity to $3.5 trillion. It’s unlikely that main cuts might be made to the Federal funds with out reducing social advantages.

Shopper spending is the most important element of the financial system, and Residing Paycheck To Paycheck and the Position of Monetary Counselors within the MFO November e-newsletter reveals that almost all of People don’t have the revenue or financial savings to drive financial progress. The inventory market just isn’t the financial system! The wealthiest 10%, these with a web value of $2 million or extra, personal 93% of the inventory market as described by Matt Phillips in Axios. Slicing company taxes advantages the rich with some hoping the advantages trickle right down to the plenty.

Shares: What’s subsequent? by Jurrien Timmer, Director of World Macro for Constancy Administration & Analysis Firm factors out that earnings estimates are not advancing as they have been earlier within the 12 months and the price-to-earnings ratio is comparatively excessive. Mr. Timmer believes that the market might be extra targeted on federal spending and tax coverage.

Sluggish Development – I Don’t Assume We’re in Kansas Anymore

The U.S. Census Bureau estimates in U.S. Inhabitants Projected to Start Declining in Second Half of Century that the “low-immigration situation is projected to peak at round 346 million in 2043 and decline thereafter, dropping to 319 million in 2100.”

Investing in a Sluggish Development World by Constancy Viewpoints (September 25, 2024) describes the view of Constancy’s Asset Allocation Analysis Staff (AART) for investing over the following 20 years, “the favorable developments of previous many years could also be giving solution to a brand new setting of slower progress, growing geopolitical threat, and declining globalization during which buyers might wish to rethink the place they search alternatives. They conclude, “these buyers whose portfolios are properly diversified throughout a broad, world alternative set could also be finest positioned to benefit from future progress, slower although it could be.”

The Congressional Funds Workplace produced An Replace to the Funds and Financial Outlook: 2024 to 2034 in June 2024. The CBO estimates that actual GDP (adjusted for inflation) might be 1.7% to 1.8% between 2026 to 2034. The CBO estimates the cumulative deficit for the 2025–2034 interval is projected to equal 6.2 p.c of GDP. To finance this debt, the debt to GDP will rise to 122 p.c of GDP on the finish of 2034. The rate of interest is estimated to be 3.3% to three.5% throughout this ten-year interval.

Vanguard – Shifting into Low Gear

Within the short-term, Vanguard Perspective: Energetic Fastened Revenue Views This autumn 2024: Temperature Examine states, “With sturdy progress and a proactive Fed, the chance of a U.S. recession subsequent 12 months stays low, a sentiment mirrored in market costs. We stay constructive on credit score however acutely aware of pricey valuations and doable draw back threat.” Over the long run, beginning yields have constantly been dependable indicators of fixed-income returns.

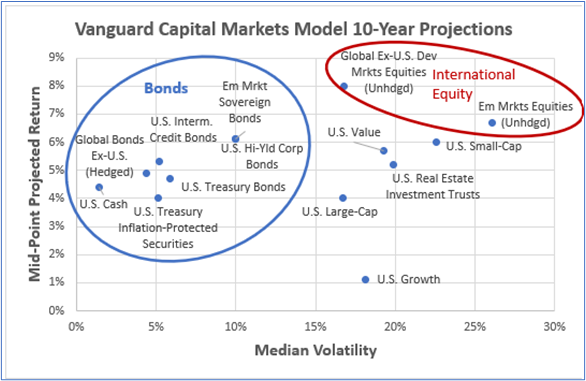

I created Determine #3 from Vanguard Perspective (October 22, 2024) to signify projected 10-year nominal return and volatility based mostly on their June 2024 working of the Vanguard Capital Markets Mannequin (VCMM). I discover riskier mounted revenue and worldwide fairness to be enticing relative to home massive firm fairness.

Determine #3: Vanguard VCMM 10-Yr Return vs Volatility Projections

Supply: Creator Utilizing Vanguard Perspective (October 22, 2024)

Valuations – Looking for Shelter

Worth investor Warren Buffett is known for the Buffett Indicator which divides the whole inventory market capitalization by gross home product. It’s at present on the highest stage since 1975. Berkshire Hathaway has been promoting inventory and in accordance with the Third Quarter Report, now has $325 billion in money, money equivalents, and short-term investments in U.S. Treasury Payments out of a portfolio of $1,147 billion (28%).

Mr. Easterling (Crestmont Analysis) makes use of the historic relationship of EPS and GDP to normalize the price-to-earnings ratio. He concludes in The P/E Abstract, “The present valuation stage of the inventory market is above common, and comparatively excessive valuations result in below-average returns.”

The Columbia Thermostat Fund is a twenty-one-year-old fund of funds that adjusts its allocation to inventory based mostly on the extent of the S&P 500 to mirror valuations. The Reality Sheet as of the tip of September reveals that it had thirty p.c allotted to shares down from fifty p.c in Might of this 12 months reflecting rising valuations.

Natalia Kniazhevich and Alexandra Semenova wrote ‘Dr. Doom’ Nouriel Roubini Warns of Trump Win Spurring Stagflation Shock. Dr. Roubini is well-known for recognizing the early indicators of the 2007 – 2009 monetary disaster. He mentioned that Trump’s coverage plans of upper tariffs, devaluing the US greenback, and hard stance on unlawful immigration threaten to decelerate the financial system and concurrently spur inflation greater. Dr. Roubini recommends holding gold, short-term length bonds, and Treasury inflation-protected securities.

1966 – 1982 SECULAR BEAR MARKET

Setting: The 1966 – 1982 secular bear market covers a part of the civil rights motion, President Lyndon Johnson’s Struggle on Poverty and Nice Society, Ladies’s Liberation Motion, the 1968 Vietnam bear market, Nixon ending the convertibility of the greenback to gold in 1971, 1973 OPEC oil embargo, easing of tensions with Russia and China, Supreme Court docket determination in Roe v. Wade, Watergate and President Richard Nixon’s resignation in August 1974, Iranian hostage disaster, and stagflation.

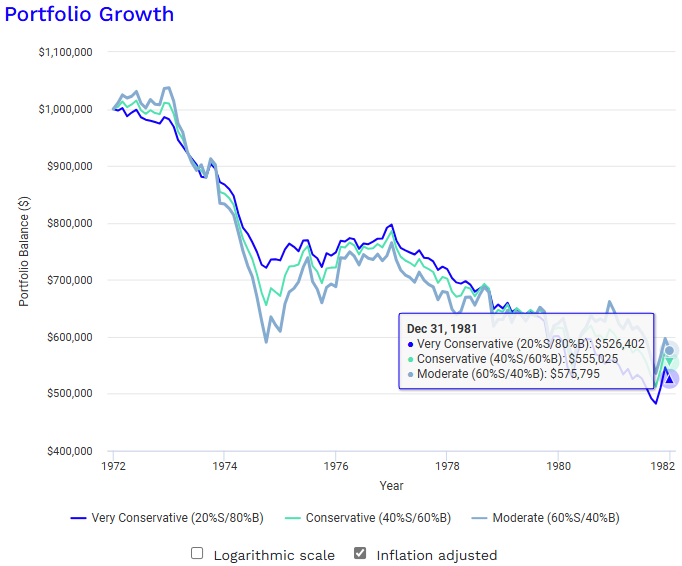

Funding information again to 1970 is restricted. I arrange Portfolio Visualizer for 3 portfolios beginning with a million {dollars} in 1972 and 4% withdrawals unfold month-to-month as proven in Determine #4. Allocations to the US Inventory Market vary from Very Conservative with 20% to Reasonable with 60%. All three mannequin portfolios ended with over $1.2 million nominal {dollars} on the finish of 1981, however with lower than $600,000 when adjusted for inflation. The buying energy of withdrawals in 1981 have been greater than 40% decrease than in 1972. Allocating 10% to gold fairness as a substitute of shares would have improved the inflation-adjusted returns over the ten years by roughly 25%.

Determine #4: Inflation Adjusted Development of Portfolios with 4% Withdrawals

Supply: Creator Utilizing Portfolio Visualizer – Backtest Asset Class Allocations

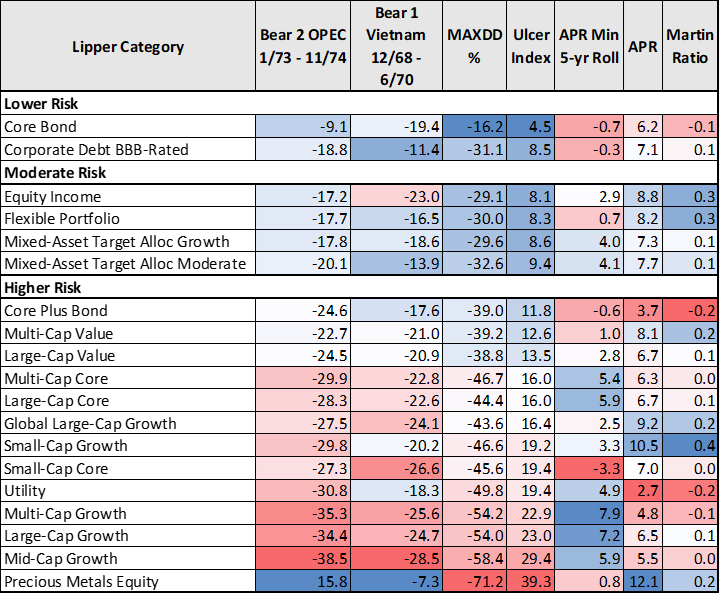

There are 96 mutual funds nonetheless in existence since 1964. The info in Desk #1 covers the October 1964 to September 1974 time interval. Fastened revenue carried out in addition to shares however with out the foremost drawdowns inflicting nervousness. Blended-asset funds that benefited from rebalancing additionally carried out properly. Treasured metals fairness did the most effective for complete return however with a lot greater volatility.

Desk #1: Lipper Class Metrics for October 1964 to September 1974

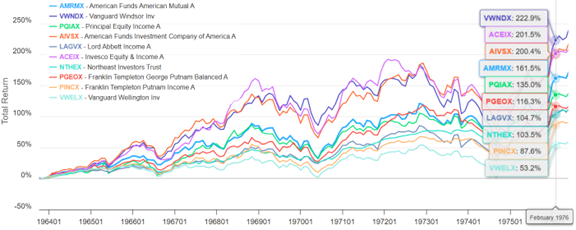

Determine #5 reveals consultant funds from the 1966 – 1982 secular bear market.

Determine #5: Consultant Fund Efficiency (1966 – 1982)

2000 – 2016 Secular Bear Market

Setting: The 2000 – 2016 secular bear market started with the bursting of the Dotcom Bubble, expertise superior in smartphones, social media, and the web, China and India developed into financial powers, 9/11 assault, Struggle in Afghanistan began in 2001, the euro turns into the forex of the European Union, Iraq warfare begin in 2003, Housing and Monetary Crises (2007), President Obama is elected as the primary Black President (2009), Arab Spring (2010), United States and Russia signed a treaty in Prague to scale back the stockpiles of their nuclear weapons (2010); United States, China, and Russia improve army spending; Quantitative Easing (2008-2014).

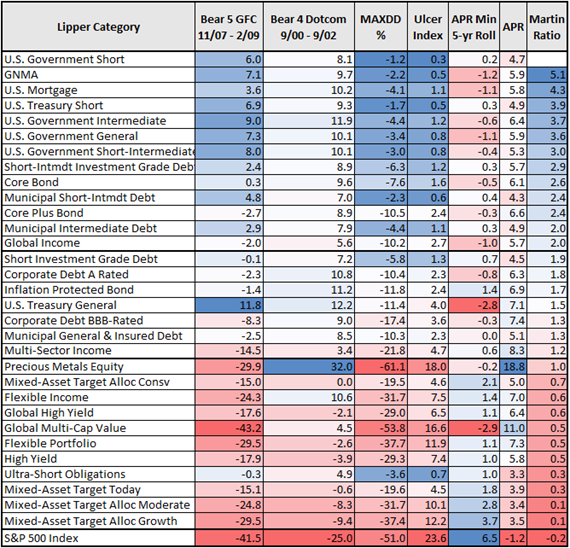

Desk #2 reveals the efficiency of Lipper Classes throughout the 2000s decade. Fastened revenue carried out properly. Treasured Metals Fairness once more carried out properly however with excessive draw back threat.

Desk #2: Lipper Class Metrics for January 2000 – December 2009

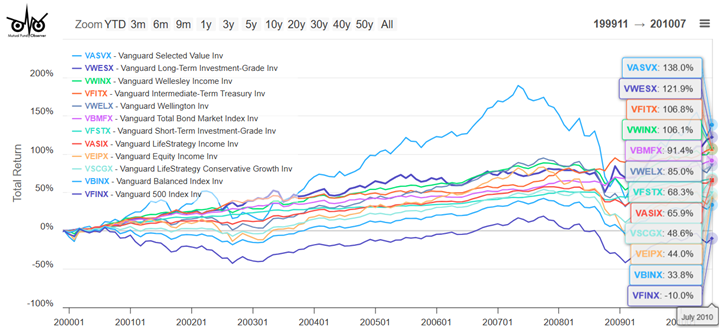

Determine #6 reveals how consultant Vanguard funds carried out. Bonds and actively managed mixed-asset funds carried out properly.

Determine #6: Chosen Vanguard Fund Efficiency (2000 – 2010)

STRATEGY FOR THE NEXT SECULAR BEAR MARKET

My outlook matches these cited on this article and I imagine the chance of a secular bear market beginning earlier than the tip of this decade is pretty excessive. I count on a “smooth touchdown” for the present charge easing, and barring any shocks, the inventory market ought to do reasonably properly subsequent 12 months or probably the following. I count on that deficits will proceed to rise and the nationwide debt to extend. Rates of interest will keep greater for longer. I advocate for individuals to work with monetary advisors to develop long-term plans based mostly on spending wants.

If a secular bear market materializes, I’ll modify my spending down and re-invest required distributions from a Conventional IRA into after-tax accounts. I arrange appointments with monetary advisors to start taking withdrawals from aggressive Conventional IRAs whereas the inventory market remains to be excessive and to scale back withdrawals from extra conservative Conventional IRAs. I comply with an accelerated withdrawal technique to keep away from excessive taxes later in retirement.

I switched from a complete return method to investing for revenue in conservative Conventional IRAs. I keep diversified bond funds in these accounts, however elevated allocations to reasonably riskier actively managed bond funds together with Vanguard World Credit score Bond (VGCIX), Vanguard Intermediate-Time period Funding-Grade (VFICX), and Vanguard Multi-Sector Revenue Bond (VMSIX). I additionally bought Constancy Advisor Strategic Revenue (FADMX/FSIAX).

Get pleasure from a protected and blissful vacation season!