Widespread tariffs are a nasty concept.

How do I do know this?

Historical past exhibits they don’t work.

Let’s look again.

JP Morgan’s Michael Cembalest wrote about President McKinley’s disastrous tariffs within the late-1800s:

President William McKinley tariffs had been very fashionable on the time they had been enacted, however they induced an virtually quick inflation spike. Voters had been very sad: a number of months later, the GOP misplaced 100 seats within the 1890 midterm elections. The GOP loss in 1890 is the third largest within the historical past of the Home going again to the Civil Warfare.

Sounds nice in idea however not a lot in apply.

I first realized of tariffs from Ferris Bueller’s Day Off:

These didn’t work both.

A Splendid Alternate by William Bernstein is one of the best ebook about the advantages of free commerce.1 Right here’s a passage in regards to the Smoot-Hawley tariffs that had been enacted within the Nineteen Thirties:

All around the world, for 3 years after the passage of Smoot-Hawley in 1930, as French lace, Spanish fruit, Canadian timber, Argentine beef, Swiss watches, and American automobiles slowly disappeared from the world’s wharves. By 1933 the complete globe appeared headed for what economists name autarky–a situation wherein nations obtain self sufficiency in all merchandise, regardless of how inept they’re at producing them.

This was the result:

Between 1930 and 1933, worldwide commerce quantity fell off by one-third to one-half. Relying on how the falloff is measured, this computes to three to five % of world GDP, and these losses had been partially made up by costlier home items.

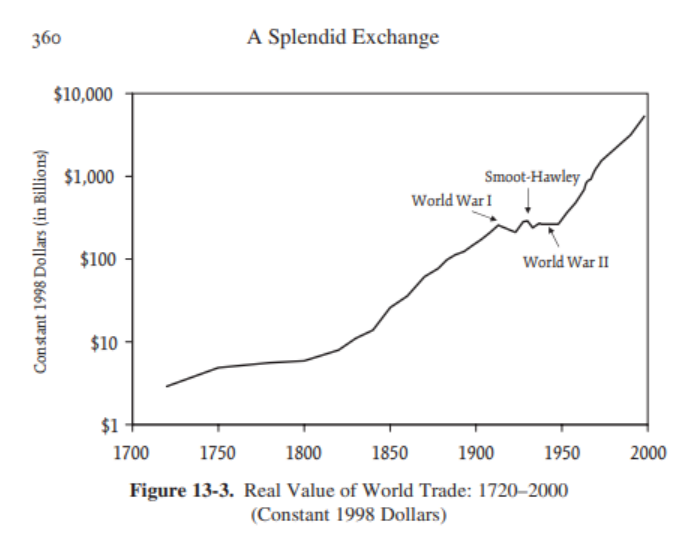

You possibly can see the autumn off in commerce throughout this era of isolation:

The Nice Despair performed an enormous position right here, too, clearly, however a commerce conflict made it worse. Isolationism and protectionism had been additionally partly in charge for World Warfare II.

Following WWII nations across the globe opened up commerce. In 1929 Individuals spent 24% of their earnings on meals. Right now it’s extra like 10%. It is a advantage of free commerce.

Clearly, the world is a distinct place now than it was in 1890 or 1929. I truly suppose some focused tariffs on a rustic like China might make sense to guard sure industries in the USA from our financial rival.

Nevertheless, common tariffs will trigger pointless financial ache for companies and customers alike.

However received’t this deliver again manufacturing and jobs to America?

No. Cullen Roche explains:

Manufacturing has fallen from 40% to 7% of US employment since 1950 and robotics will decimate the remaining 7% within the subsequent 50 years. These jobs aren’t coming again and making an attempt to show essentially the most superior technological financial system on the earth again into an rising market manufacturing financial system is backwards considering.

Individuals can have fewer decisions as a result of the federal government diminished competitors and shopper choices. It will drive UP costs. Particularly when US corporations understand they’ve extra pricing energy because of the authorities’s manipulation of the market.

A sophisticated financial system shouldn’t need to go backward. It is mindless. Joe Weisenthal explains:

A technique to consider any comparatively open buying and selling bloc is that by permitting extra specialization and focus, the financial system can construct out extra advanced market objects. If you wish to have autarky in America, you would in all probability do it, however good luck constructing out any superior, advanced business, with so many assets devoted to manufacturing kitchen mitts or microwaves.

Even should you agree with tariffs as a coverage concept the implementation right here is worse than how the Mavericks traded Luka to the Lakers. You possibly can’t probably anticipate world firms or small companies to alter their provide chain and manufacturing capabilities on the fly like this. You possibly can’t try this in a single day.

It’s financial suicide.

Primarily based on the White Home’s numbers, companies can pay upwards of 40%, 50%, or possibly 60% in tariffs. Companies will attempt to reduce prices like loopy, which implies numerous layoffs are possible coming.

This isn’t sustainable.

The hope is that there can be negotiations and that these charges will come down drastically. In the event that they don’t, a recession needs to be the baseline expectation in a commerce conflict like this.

The result right here feels binary.

Whereas not precisely the identical state of affairs, this example jogs my memory quite a lot of the story from Artwork Cashin about what he realized from a extra seasoned investor about navigating the Cuban Missile Disaster:

Professor Jack was already within the bar, and I got here bursting via the doorways as solely a 19- or 20-year-old might. And I stated, ‘Jack, Jack. The rumors are that the missiles are flying.’

And he stated, ‘Child, sit down and purchase me a drink.’

And I sat down and he stated, ‘Pay attention rigorously. While you hear the missiles are flying, you purchase them, you don’t promote them.’

And I checked out him, and I stated, ‘You purchase them, you don’t promote them?’

He stated, ‘In fact, as a result of should you’re unsuitable the commerce won’t ever clear. We’ll all be lifeless.’”

If Trump and group maintain these ridiculously excessive tariffs we’ll all be lifeless in a fashion of talking. It is going to finally nuke the financial system.

Markets are in a freefall however they are going to be superb. The inventory market has been via worse than this previously. Shares will come again sooner or later.

I’m extra apprehensive in regards to the financial ramifications. Lots of people are going to be in a world of ache if this continues.

Michael and I talked about tariffs and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Wealth Impact

Now right here’s what I’ve been studying currently:

Books:

1Right here’s a free chapter about tariffs and commerce wars that’s price studying.