When you perceive the fundamentals, you’ll discover that Credit score Playing cards are extremely helpful. They might help you save time, earn rewards, and get you in your option to constructing good credit score.

By getting your first Credit score Card, you’ve achieved a significant milestone!

A handy monetary product, Credit score Playing cards include a number of advantages, like the choice to pay for purchases over time, rewards and cashback for all spends, the flexibility to construct and enhance your Credit score Rating, and a lot extra!

Able to get began? Right here’s a newbie’s information to Credit score Playing cards.

What’s a Credit score Card?

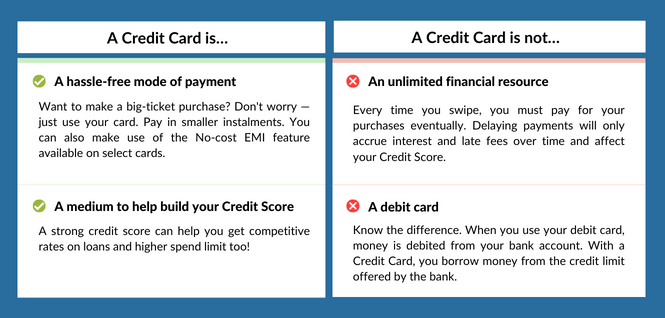

A Credit score Card is a monetary instrument that permits you to make hassle-free purchases for items or companies. It’s charged to your line of credit score with the invoice fee made at a later date. It offers you extra time to pay and gives the choice to separate big-ticket purchases into smaller instalments. Though it’s simple to get carried away, the significance of accountable Credit score Card utilization can’t be careworn sufficient.

Merely put,

Is there a spend restrict?

Each card issuer (sometimes a financial institution) gives you a credit score restrict primarily based in your profile. You’re allowed to spend as a lot as your credit score restrict, nonetheless, it’s endorsed that you utilise solely 30% of your credit score.

Extra Studying: Can You Use Your Credit score Card Past Your Credit score Restrict?

Is there an interest-free interval?

Each card issuer permits a set interval throughout which curiosity just isn’t charged, sometimes as much as 55 days. Submit which, if full fee just isn’t made, curiosity might be accrued.

Extra Studying: How The Curiosity-Free Interval Is Calculated On Your Credit score Card

When does the Credit score Card assertion get generated?

Your Credit score Card assertion might be generated each month on a pre-set date. Your billing cycle might be sometimes each 25-31 days. Your assertion accommodates the next particulars:

- Quantity spent (since your final assertion)

- Curiosity and late fee fees (if any)

- Minimal quantity due

- Due date for invoice fee

As a regular observe, test your assertion fastidiously each month to make sure all the data is correct.

Extra Studying: Reversal Of Credit score Card Transactions

How to decide on the appropriate Credit score Card?

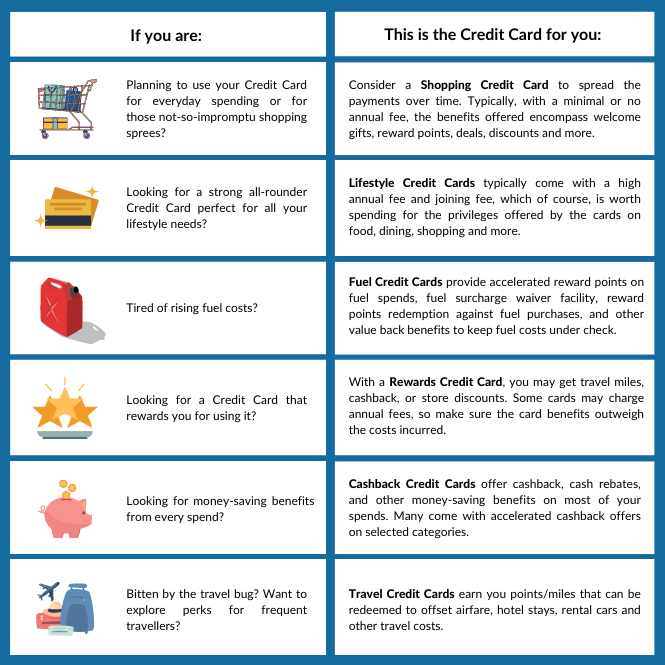

With an in depth vary of Credit score Playing cards to select from, choosing the appropriate Credit score Card for you might be fairly daunting. It normally is determined by why you desire a Credit score Card and the way you need to use it.

Let’s enable you to perceive the various classes of Credit score Playing cards to select from.

Forms of Credit score Playing cards:

Simply placing somewhat thought into the aim of your Credit score Card utilization, you may leverage the advantages to your benefit. Now that you’re well-versed with the fundamentals, decide one which fits you finest.

A one-stop store for all of your monetary wants, discover Credit score Playing cards on BankBazaar.

Copyright reserved © 2025 A & A Dukaan Monetary Providers Pvt. Ltd. All rights reserved.