The common American family has $96,371 in client debt in response to Experian. This contains round $5,221 in bank card debt and $20,987 in auto mortgage debt.

A number of years in the past once I first began my debt payoff journey, I used to be all about saving essentially the most cash in curiosity and tackling the massive balances first (ie. utilizing the avalanche methodology).

Extra not too long ago although, I’ve skilled the advantages of utilizing the debt snowball methodology to pay down a few of my bank card debt from final yr. The debt snowball methodology is a well-liked debt reimbursement technique that’s based mostly round offering you with continued motivation.

I truly imagine the debt snowball methodology might help you eliminate your debt for good and obtain monetary freedom.

Are you in search of a solution to pay down your debt sooner? Let’s study extra about learn how to use the debt snowball methodology strategically that will help you attain your targets.

What’s the Debt Snowball Methodology?

The debt snowball methodology entails paying off money owed so as of smallest stability to largest stability. You begin by first specializing in paying off the smallest stability first whereas making minimal funds on all different money owed.

As soon as the smallest stability is paid off, you then transfer on to the following smallest stability and so forth till all money owed are paid off. This methodology makes it simpler so that you can keep motivated and maintain observe of your progress. As every debt is paid off, your whole quantity owed decreases considerably.

By using this methodology, you possibly can speed up the method of paying off your debt and attain monetary freedom earlier than you’d suppose.

How Does It Work?

The thought behind this method is that by specializing in one small objective at a time, it will likely be a lot simpler so that you can keep motivated and really feel such as you’re making progress towards turning into financially free.

Because it’s simpler to remain centered whenever you’re working towards smaller targets, this methodology helps pace up your reimbursement course of. With the debt snowball methodology, you’re capable of pay extra every month and extra shortly than should you have been making an attempt to deal with your whole money owed directly.

Then, as every debt will get paid off, you’ll have more cash accessible which can be utilized in the direction of paying down bigger balances sooner.

Through the use of this technique, not solely will it assist pace up your reimbursement course of, however it’s going to additionally assist increase your credit score rating by displaying lenders that you would be able to handle a number of money owed responsibly over time.

Why Does the Debt Snowball Methodology Work?

I imagine the debt snowball methodology phrases as a result of it helps you give attention to one factor at a time. Having debt could make you are feeling overwhelmed and you might not know the place to begin relating to tackling it.

As a substitute of simply paying on totally different accounts at random occasions, the debt snowball methodology helps you slender down a core focus.

Another excuse why this works is it motivates you early on by seeing success immediately. Certain, a small $200 debt for instance isn’t a lot. However whenever you pay it off, you’ll immediately increase your motivation and be extra prone to maintain going.

Lastly, this methodology works as a result of your cost grows over time. When you repay one stability, you simply roll that cost quantity onto the following debt. When you get to the previous couple of debt accounts, you gained’t have almost as many minimal funds. This frees up extra of your earnings to make progress in your debt.

Associated: Prioritizing Your Debt-Free Technique

The best way to Get Began With the Debt Snowball Methodology

Actual Life Instance of the Debt Snowball Methodology

So, now that we all know what the debt snowball methodology is and the way it works, let’s see this play out in motion. Beneath is an instance of how you need to use this methodology to repay your bank card debt.

- Synchrony Automotive Card: $128.85

- Finest Purchase: $144.98

- IHG Rewards: $151.43

- Southwest: $307.43

- Chase Slate: $620.13

- Amazon: $680.27

- Citi: $1,103.24

As you possibly can see, I listed the balances from smallest to largest. The rate of interest or minimal cost quantity doesn’t matter. Solely the stability quantity is vital.

Now, let’s say that every of those playing cards had a minimal cost of $35. As soon as we get to the final card, we have already got extra cash move since we’re not paying $210 in minimal funds on the opposite playing cards.

You should use the debt snowball methodology for different kinds of debt too whether or not you may have private loans, a automotive mortgage, or scholar loans. Simply listing all the things out and begin tackling the debt with smallest stability first.

Don’t overlook to proceed to pay the minimal on all the opposite money owed so you possibly can keep away from any late charges.

Execs and Cons of the Debt Snowball Methodology

Execs:

- Straightforward to begin utilizing ASAP (solely give attention to one factor – your stability quantity!)

- Provides a fast psychological increase whenever you see your debt disappearing

- Helps you get organized and give attention to one debt stability at a time

Cons:

- Might make it more durable to get a deal with on high-interest debt

- Because you’re solely specializing in stability quantity, your costliest debt could receives a commission off final

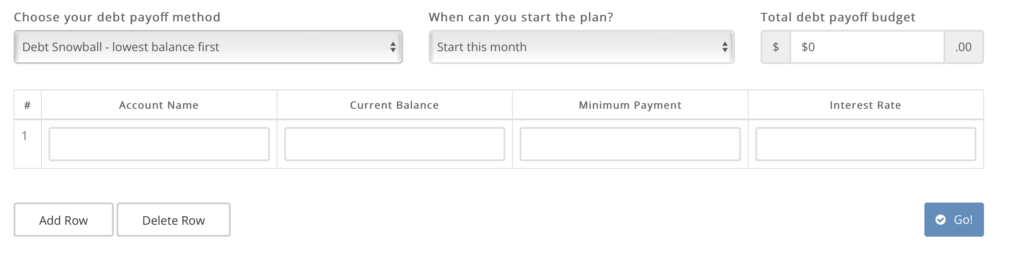

Get Began With a Debt Snowball Calculator

As I mentioned earlier, the debt snowball methodology could not prevent essentially the most cash in curiosity funds, however it’s going to enable you to repay debt regardless. To find out whether or not this debt payoff methodology can be greatest for you, I extremely suggest utilizing a debt snowball calculator.

Undebt.it has a terrific debt snowball calculator that you need to use to plug in your individual numbers. You’ll additionally see what progress you may make with different strategies such because the avalanche methodology for debt payoff.

Simply enter the title of your account, the present stability, minimal cost quantity, and rate of interest (if it).

Scale back Bills Whereas Paying Off Debt

Whilst you use the debt snowball methodology, speed up your progress by decreasing bills as properly. It’s vital to revise your price range so you may make room for minimal and further debt funds.

Calculate how a lot you’re spending and see if there’s room to chop prices anyplace. Reviewing all of your transactions (even only for the week) can appear daunting so I extremely suggest utilizing a budgeting app to assist resembling Simplifi.

Simplifi gathers all of your transactions mechanically and helps categorize them so you possibly can construct a sensible price range shortly. One other factor I like about Simplifi is that it helps you propose for upcoming payments, observe subscriptions and even watch particular retailers and purchases in areas the place you’re overspending.

Another sensible methods to cut back your spending embody:

- Utilizing a meal plan and cooking extra meals at residence.

- Procuring round for cheaper automotive insurance coverage. My husband likes to name our present insurer first to see in the event that they’ll give us any reductions.

- Switching to a extra reasonably priced cellphone plan. We now have Complete Wi-fi however Republic Wi-fi, Mint Cell, and Tello are all glorious choices.

Abstract

The debt snowball methodology gives an efficient means for shoppers to pay down their money owed sooner and attain monetary freedom sooner.

With this methodology, you possibly can simply maintain observe of your progress and keep motivated all through the reimbursement course of.

Moreover, as every debt will get paid off, more cash turns into accessible which can be utilized towards bigger balances so that customers can speed up their reimbursement even additional.

If accomplished appropriately, this technique has the potential that will help you obtain their monetary targets a lot sooner. I’d love to listen to your ideas in regards to the debt snowball methodology and should you’re ever tried it within the feedback beneath.

Cease Worrying About Cash and Regain Management

Be part of 5,000+ others to get entry to free printables that will help you handle your month-to-month payments, scale back bills, repay debt, and extra. Obtain simply two emails per thirty days with unique content material that will help you in your journey.