We get lots of questions on folks’s EPF claims rejected. On this article, now we have mentioned a few of the widespread explanation why EPF claims are rejected and how one can repair these.

Govt Discover with E-mail particulars for EPF

In view of the current spike within the variety of Covid-19 instances, all Subscribers/Pensioners/PF members are requested to utilize on-line companies to investigate about their Provident Fund declare associated issues. PF Members and Employers coming below the jurisdiction of Regional Workplace, Chennai (North) can ship e-mails to [email protected] whereas these throughout the jurisdiction of Regional Workplace, Chennai (South) are requested to ship emails to [email protected]. The landline numbers 044-28139200, 201, 202 and 044-28139310 are additionally accessible on working days for elevating grievances. Furthermore queries can be communicated to whatsapp quantity 09345750916 for matter regarding Regional Workplace, Chennai (North). Subscribers working in institutions below jurisdiction of Regional Workplace, Chennai (South) can ship queries to the whatsapp quantity 06380366729.

It’s appealed to the PF members to utilize the on line services conserving in view the prevailing pandemic scenario.

That is said in a press launch issued by Shri. Rituraj Medhi, Regional Provident Fund Fee-I, Regional Workplace, Chennai North & Chennai South.

Frequent The explanation why EPF claims are Rejected and Options

I labored in 2 corporations and after leaving the second firm I withdrew my EPF. Not when I attempt to switch my 1sr firm EPF my declare is rejected. The rejected cause is the declare already settled what to do now?

To withdraw from the primary employer you would need to method the primary employer and do it offline. This turns into time-consuming.

One has to switch the previous PF account to the brand new account. Solely then will you be capable of withdraw from each accounts on-line. Linking of PF account with UAN will not be ample

When you don’t switch your PF account from the previous to the brand new employer?

- Then you definately would have two separate EPF accounts.

- When you go away 2nd group and withdraw then it is possible for you to to withdraw from solely the final employer.

- To withdraw from the primary employer you would need to method the primary employer and do it offline. This turns into time-consuming.

- The previous EPF account will likely be thought of inactive. It’ll earn curiosity however you’ll have to pay tax on it. It’ll additionally present in Kind 26AS.

Our article Why ought to one switch an previous EPF account to the brand new employer? explains it intimately.

Identify not Printed/Completely different in Cheque

As per the brand new strategy of PF withdrawal, it’s essential to add a replica of the cheque or passbook throughout your PF withdrawal. That is finished to cross-check whether or not your submitted financial institution particulars match the small print of your checking account or not. If it doesn’t match then the PF declare is rejected.

Answer: You need to add cheque/passbook that has your identify printed because the account holder. Whenever you go to the financial institution and get the chequebook, the identify will not be printed on the cheque ebook. To get cheque ebook with identify within the order cheque ebook on-line/SMS.

EPF Declare rejected as Your identify in UAN account differs from financial institution report

Your PF declare can get rejected due to the distinction of your identify within the checking account and in UAN.

Answer 1: Guarantee that your first identify, center identify, and final identify match in each the UAN and checking account. Submit an software to Financial institution to replace your identify. They could require to submit the one and identical particular person affidavit. When you full the financial institution formalities, order a brand new cheque ebook or passbook. Add your appropriate passbook/financial institution particulars adopted by the approval of the identical out of your employer

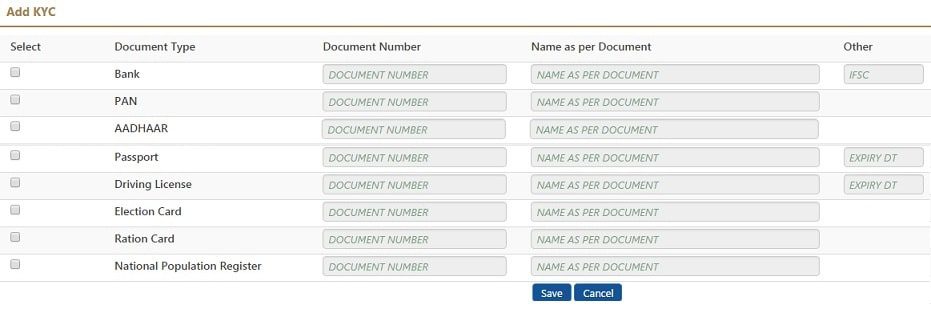

Answer 2: Change your checking account in UAN. It’s essential add new checking account particulars in KYC of UAN. You employer has to approve it. Defined intimately in our article UAN KYC : Add Particulars PAN,Aadhaar, Financial institution Account

Identify in UAN account differs from Aadhaar

Answer: It’s essential fill the Joint Declaration Kind. Together with that, it’s essential to write an software stating that your Aadhaar is already linked however nonetheless your identify is totally different. It could be as a result of you will have already linked it prior to now.

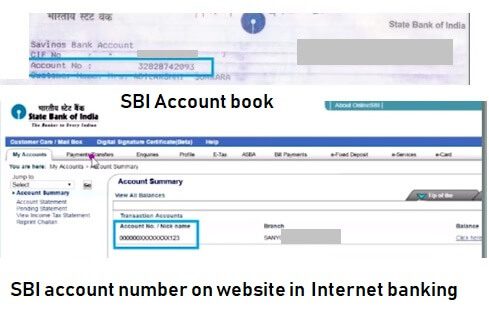

Variety of digits in Checking account quantity, esp SBI

Many account numbers begin with Zero(0) and whereas including checking account particulars many individuals ignore these. Therefore PF declare will get rejected as checking account particulars don’t match.

This difficulty is often confronted by the SBI checking account holders. SBI passbook exhibits 11-digit account quantity. However in Web Banking, you will notice a 17-digit account quantity.

Answer: It’s essential replace the financial institution particulars by giving all of the digits together with 0s. So for SBI give the 17-digit account quantity. It’s essential replace Financial institution particulars in KYC, get it permitted by your employer. Then once more declare on-line.

EPF Declare rejected as Financial institution Particulars are Incorrect

Incorrect financial institution particulars difficulty might happen as a result of change within the IFSC Code as a result of mergers of banks or it could possibly be on account of using the joint account within the PF KYC.

The PF division might settle for the checking account if the joint account is together with your partner. Nevertheless, within the instances of associates, family members, or anybody else, the PF division often rejects the declare.

Answer: You may redo the Financial institution KYC and get it permitted by your employer. Then apply for the PF declare.

EPF is Settled however returned

On this situation, the PF division initiates for the settlement of your PF declare, nevertheless, as a result of incorrect financial institution particulars or the IFSC Code, the quantity is distributed financial institution to the PF division.

Answer: To repair it, you possibly can both appropriate your KYC particulars and apply to your PF once more. Adopted by this, it’s essential to additionally add an software to the PF division that you’ve up to date your KYC particulars, please re-authorize my particulars.

Or, you may also do it by way of offline means by filling up the reauthorization kind and submitting it to your nearest PF workplace together with your appropriate financial institution particulars and a replica of your passbook and Aadhaar.

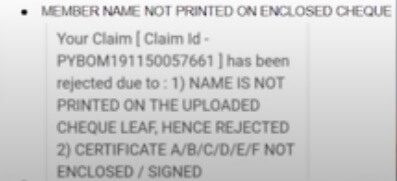

EPF Declare rejected as Certificates A/B/C/D/E/F not signed or enclosed

This is without doubt one of the widespread cause why PF declare is rejected. That is due to the EPFO officer whereas processing the declare whereas coming into the explanation for rejection chooses this. The EPFO workplace can choose 2 causes from the dropdown-others and Certificates A/B/C/D/E/F. If Epfo officer selects the ‘others’ they need to manually enters the small print. Whereas if usually they choose the primary choice from the dropdown i.e. Certificates A/B/C/D/E/F after which they don’t need to enter the small print.

Nevertheless, in some instances like for advance, the explanation could also be real. Such situations often happen within the instances of advance. Someday, you could declare your advance as a result of causes like pure calamity, manufacturing facility lockdown, strike, and many others. For such causes, it’s essential to fill the certificates and ship it to the PF division together with a replica of your passbook.

Answer: In case you are claiming advance, then we might counsel you to not use such causes. As a substitute, you need to use the sickness cause or every other real cause in order that your PF will not be rejected.

PDF not opened Re-Submit

Typically the uploaded PDF is corrupted and it doesn’t open.

Answer: Please validate the PDF file in your native pc earlier than importing it. Additionally, make it possible for the file follows the dimensions restriction.

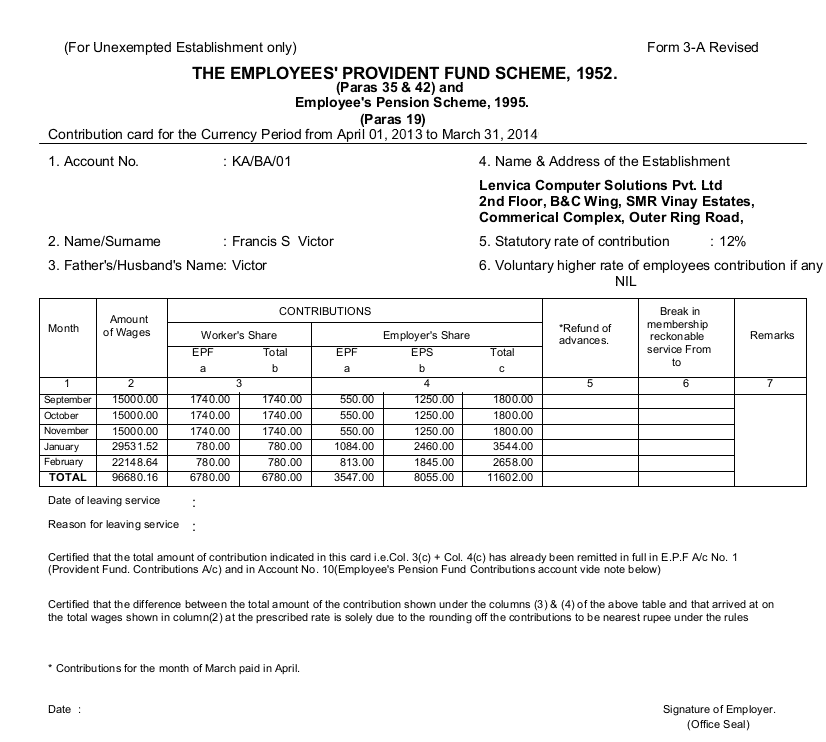

Wages lower than Rs. 15000 eligible for pension membership however institution not remitted pension contribution. Or,

Member DOJ after 01/09/2014 wages greater than Rs. 15000 Please verify if the earlier service any.

After 1st September 2014 PF Division mentioned if any particular person begins his new job with a wage greater than Rs. 15000 then his pension contribution could be nil. Typically employer not being conscious of it cuts the EPF. This was launched by way of an official notification referred to as GSR 609(E). The GSR 609(E) has nevertheless been rejected by the Supreme Courtroom and there was no replace about it since then.

Answer

The Worker must comply with up for no fault of his. Sure, it sucks however it’s essential to struggle out to get your cash. To your subsequent job make it possible for your total Employer contribution goes in direction of EPF

The answer prompt by EPFO is “You’re suggested to method the employer for rectifying the identical by submitting the revised return to the EPFO for merging the EPS contribution to EPF”

Often known as a member’s annual contribution card, Kind 3A depicts the month-wise contributions made by the subscriber/member and employer in direction of E.P.F and Pension Fund in a specific 12 months. The info is calculated for each member who is part of the scheme

Try particulars at Fundamental Wage Greater than 15000, EPS Contribution, Rejection of Switch or EPF Declare

EPF Declare rejected on account of DOJ/DOL Causes

This error might need occurred as a result of your employer might need entered your mistaken date of becoming a member of or the date of leaving. In consequence, in case your return will not be filed for a specific month, you wouldn’t be capable of course of the declare.

Answer: To repair the date of becoming a member of, it’s essential to fill a joint declaration kind together with new employer correcting the date of becoming a member of or

To repair the problem of date of leaving, it’s essential to fill a joint declaration kind together with previous employer correcting the date of leaving.

Inadequate Service

Inadequate Service rejection signifies that you haven’t served your service for a min. period of 6 months. In such situations, you’ll be capable of apply for EPF Withdrawal utilizing Kind 19 however can’t apply for EPS(pension) withdrawal utilizing Kind 10C.

Answer: Please be aware that pension withdrawal could be finished solely after 6 months of service.

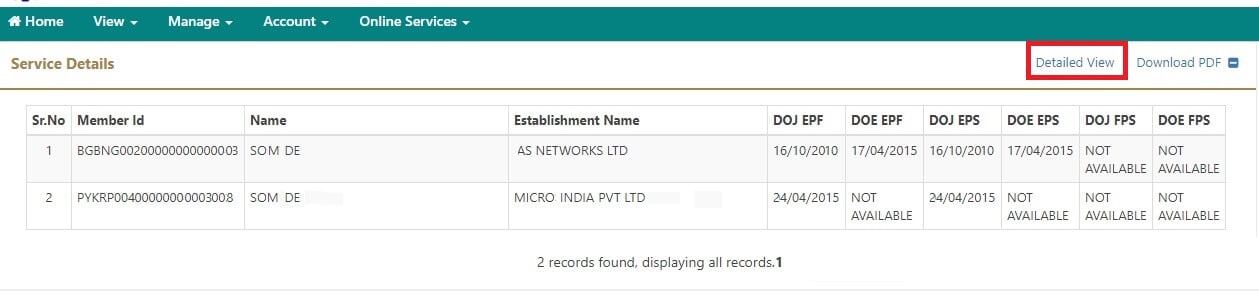

You may verify your service particulars by Logging in to UAN Portal at Member Residence and click on on View->Service Historical past and it will present particulars as proven within the picture under.

Please be aware that it is very important switch your previous EPF account if you change jobs as defined within the article Why ought to one switch previous EPF account to new employer?

Our article Learn how to verify Member Ids or PF accounts linked to UAN covers it intimately.

Submit Kind 19 and 10C each

Kind 10C is used just for Pension withdrawal whereas Kind 19 is just for the PF. Nevertheless, primarily based on the evaluations of the claimants it has been discovered that in case you are simply filling up Kind 10C then the PF division is rejecting the declare.

Answer: It’s essential fill each Kind 19 and Kind 10C to withdraw your full quantity i.e. Pension + PF.

A number of PF Numbers

You probably have made a withdrawal out of your newest PF quantity and made a switch out of your previous PF quantity then you definitely would nonetheless be having some quantity in your PF. Nevertheless, the declare is rejected and the reason being being said that your declare is already settled.

Answer: You write an software to the PF division stating that you just nonetheless have some quantity in your PF account on account of which you might be making use of for the PF declare. And ship particulars about passbook

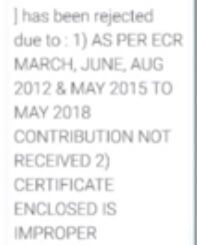

Contribution not Submitted

On this case, your employer has not made the contribution of the PF on account of which the PF division can’t course of your declare.

Answer: It’s essential to verify and replace your passbook on time to make it possible for there is no such thing as a discrepancy. When you discover any discrepancy then join together with your employer and ask them about you not getting the contribution of your PF.

Father Identify Completely different

The rejection could also be as a result of presence of the mistaken/totally different father’s identify in your PF data and financial institution passbook. Typically it occurs if you

Answer: You may add your cheque wherein your identify is written. On this situation, there could be extra probabilities of acceptance of your PF declare. Or, in case you are unable to do it then you would need to fill a joint declaration kind and proper your father’s identify by way of that.

Altering the daddy’s identify can’t be finished on-line. That is defined in our article Learn how to Appropriate EPF Particulars like Identify, Father Identify, Date of Becoming a member of

HIGH VALUE CASE CONFIRMATION MAIL NOT RECEIVED AS PER APPROVER

When you obtain this comment – It signifies that they despatched an electronic mail to your employer or payroll administration firm to confirm that this withdrawal is initiated by you.

This rejection cause is given once they don’t get a reply on that mail inside 4 – 5 days,

The employer has to answer to the e-mail.

Thanks, Parikshit for the small print.

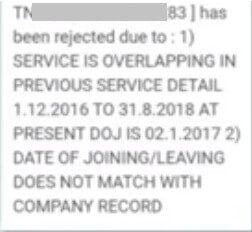

Service Overlapped

Service overlapping instances happen as a result of overlap of your service. For instance, you might need labored full time and part-time collectively in some firm. In such a scenario, you could get a PF rejection difficulty.

Answer: As per an official within the PF division, you must go to the PF workplace and get your PF merged. In such situations, it might occur that you just gained’t be capable of apply for the declare by way of on-line means and you would need to apply for the offline declare. In such a situation, you could really feel sure troubles when you apply for the declare.

Video on EPF Rejection Causes

This video explains all of the EPF Rejection Causes.

Associated Articles:

Checklist of articles for an Worker: Incomes, EPF, UAN, Examine