In on a regular basis language, we use “chaos” to imply full dysfunction or randomness – like a toddler’s playroom after a protracted afternoon or a desk buried below scattered papers. This sort of chaos implies there’s no underlying order or sample in any respect. It suggests a brief state of disarray that may be resolved or introduced again to order.

There’s, nonetheless, a second use of the time period. In chaos concept, “chaos” has a exact and fairly completely different which means. It describes methods that seem random on the floor. These methods are unpredictable intimately however nonetheless have an underlying order and produce recognizable patterns. This sort of chaos is a everlasting state, intrinsic to the system’s nature, the place small adjustments in preliminary situations can result in vastly completely different outcomes.

An awesome instance is my rubber duck. If I wander right down to the banks of the Mississippi River and fling my duck into the water, I might be fully unable to reply the query “The place will your duck be in a single minute or one hour?” past “someplace within the river, probably.” However if you happen to had been to ask “The place will your duck be two months from now?” I may have extra confidence in say “visiting New Orleans.” I can’t say precisely the place or precisely when, however the river is a constrained system with predictable long-term tendencies.

An awesome instance is my rubber duck. If I wander right down to the banks of the Mississippi River and fling my duck into the water, I might be fully unable to reply the query “The place will your duck be in a single minute or one hour?” past “someplace within the river, probably.” However if you happen to had been to ask “The place will your duck be two months from now?” I may have extra confidence in say “visiting New Orleans.” I can’t say precisely the place or precisely when, however the river is a constrained system with predictable long-term tendencies.

2025 might even see an intersection of each types of chaos: an intrinsically chaotic market system overlaid by the prospect of coverage chaos initiated by the brand new presidential administration. Within the weeks for the reason that election, the president-elect has threatened 25% tariffs on items from Mexico and Canada, 10% tariffs on Chinese language items, and 100% tariffs on items from the BRIC nations, together with China, in the event that they undermine the US greenback. They may undermine the greenback by shifting trade insurance policies to peg costs in opposition to a basket of currencies, fairly than the greenback. That appears to replicate fears of erratic US insurance policies and burgeoning federal debt. A preliminary evaluation by the College of Pennsylvania concluded that Mr. Trump’s proposals would improve the nationwide debt by $4.1 trillion if all the things went properly and just below $6 trillion if it doesn’t. (What would possibly qualify as “going poorly”? Hostile responses from nations affected by tariffs and provide chain disruptions for US corporations depending on factories in these nations. I’m setting apart prospects of battle or local weather catastrophe.) Morningstar’s John Rekenthaler forecasts a short-term spike in inflation which might be compounded if the Federal Reserve turns into much less impartial, as Mr. Trump promised, since he favored zero rates of interest even throughout financial booms. In the meantime, crypto booms.

Mr. Rekenthaler’s evaluation of each candidates’ plans ends with the query, “What, me fear?” and a hyperlink to …

Fast recap: within the quick time period markets are extremely unpredictable (chaos concept) and more likely to be exceptionally so within the instant future (Trump). In the long run, markets have predictable dynamics and central tendencies (just like the Mississippi River does) that give us larger confidence the additional out we glance.

The query is, how do you persist by the shorter-term chaos in an effort to proceed capturing the longer-term beneficial properties?

Chaos and your portfolio

If you’re younger with a snug profession trajectory and an affordable long-term plan, do nothing. Each Warren Buffett, Ben Carlson, and John Rekenthaler affirm the identical proposition: over lengthy durations, nobody ever wins by betting in opposition to the US markets. And, over those self same lengthy durations, nobody ever loses by betting with them. In brief: if you happen to don’t want your cash for twenty-plus years make investments recurrently and cheaply in (largely) American shares, cease studying this essay now and get on with life. Your cash might be ready for you when the time comes.

Not all of us have the luxurious of that diploma of Cynical detachment from the world. 5 methods for the remainder of us to outlive chaos of each types.

-

Let different individuals fear for you. Successfully responding to sudden adjustments requires a level of obsession and entry to intensive information that common buyers don’t have. “I noticed this man on TikTok,” or “I learn Reddit,” or “I received a sense” is not an indication that you’ve both adequate information or a clue about learn it. When you don’t have the willingness to remain put, or the abilities and assets to dynamically alter place sizes based mostly on present market chaos ranges, rent somebody who does. It’s cash properly spent.

There are 3 ways of doing that. One, rent a monetary advisor who has been by it earlier than and who hasn’t surrendered to the impulse to make change for the sake of change. Two, rent a fund supervisor who has been by it earlier than and who has a file of cautious adaptation to altering situations. Think about:

-

FPA Crescent: Crescent is a reasonably aggressive allocation mutual fund that goals to generate equity-like returns over the long run whereas taking much less danger than the market and avoiding everlasting impairment of capital. The fund’s concentrate on investing in higher-quality companies with protecting moats, good returns on capital, and exemplary administration groups, mixed with its means to adapt to market situations, makes it a beautiful possibility for buyers searching for a steadiness between progress and danger administration. The fund has a 30+ 12 months file, has averaged over 10% yearly since inception with one-third much less volatility than the inventory market, is an MFO Nice Owl Fund and has excessive insider dedication.

-

Leuthold Core Funding Fund. Leuthold Core Funding is a tactical asset allocation fund that goals to attain capital appreciation and revenue whereas minimizing danger by versatile portfolio administration. With a concentrate on trade choice and the power to regulate publicity throughout numerous asset courses, the fund has demonstrated robust efficiency, outperforming its Lipper Versatile Fund friends by 1.5% yearly over the previous decade with considerably decrease volatility. The fund’s disciplined, quantitative method to asset allocation and safety choice, mixed with its long-term monitor file of capturing over 80% of the S&P 500’s annual returns whereas exposing buyers to lower than 70% of the volatility, makes it a beautiful possibility for buyers searching for a balanced method to danger administration and returns. Devotees of ETFs ought to contemplate Leuthold Core ETF (LCR).

Three, rent somebody who can recreation the marketplace for you. The place FPA and Leuthold are balanced funds that largely tilt their portfolios as situations change, some funds – each long-short fairness and managed futures – try and actively, and generally dramatically, shift course with shifting situations. Sadly, most such funds are overpriced failures, and few have lengthy monitor information. Among the many most promising choices is Standpoint Multi-Asset.

-

Standpoint Multi-Asset Fund. Standpoint seeks optimistic absolute returns by an “All-Climate technique.” The fund holds a world fairness portfolio constructed from regional fairness ETFs. The technique additionally invests, each lengthy and quick, in trade traded futures contracts from seven sectors: fairness indexes, currencies, rates of interest, metals, grains, comfortable commodities, and vitality. The managers try and take part in medium- to long-term developments in world futures markets and to supply an affordable return premium in trade for assuming danger. The argument for Standpoint is very like the outdated argument for managed futures: it may possibly present absolute optimistic returns with muted volatility even when the fairness markets appropriate, or the fixed-income markets are priced to return lower than zero within the instant future. “Our edge,” supervisor Eric Crittenden says, “is that we all know construct a superb macro program with out the standard 2 & 20 payment construction.” It’s designed to be a everlasting piece of your portfolio: easy, sturdy, and resilient. Standpoint is attempting to supply an island of predictability that buyers would possibly use to enhance and strengthen their core portfolios. With optimistic absolute returns every year since inception (15.2% YTD in 2024), they’ve earned a spot in your due diligence checklist.

-

-

Enhance publicity to high quality corporations. Mr. Buffett’s declaration, “It’s much better to purchase a beautiful firm at a good value than a good firm at a beautiful value,” is borne out by his enduring success and by quite a lot of tutorial {and professional} analysis. As we famous in “The High quality Anomaly,”

The broadest sense of a high quality firm is one which makes use of its assets prudently: high quality corporations are inclined to have little or no debt, substantial free money flows, regular and predictable earnings, and maybe excessive returns on fairness. Passive methods and plenty of energetic ones have a robust backward focus: they restrict themselves to companies which have brilliant pasts, with out actively inquiring about their future prospects.

Nonetheless, the proof is compelling that high-quality shares bought at affordable costs are in regards to the closest factor to a free lunch within the investing world. Typically, you need to pay on your lunch a technique or one other. The one rationale for purchasing crazy-volatile investments (IPOs, as an example) is the prospect of crazy-high returns. The one rationale for purchasing modest returns (three-month T-bills) is the promise of low volatility.

With high quality shares bought at an affordable value (name it QARP), that tradeoff doesn’t happen. QARP shares supply each greater long-term returns and decrease volatility than run-of-the-mill equities.

Larger high quality investments is not going to at all times lead the market, when animal spirits run wild, trash tends to dominate when it comes to pure returns. Think about:

-

GQG Companions US Choose High quality Fairness or GQG Companions US High quality Dividend Earnings. Each are managed by Rajiv Jain, whose file of excellence stretches over many years and whose agency is fully dedicated to investing in high-quality equities. GQG Companions primarily depends on elementary, fairly than quantitative, analysis to judge every enterprise based mostly on monetary energy, sustainability of earnings progress, and high quality of administration. The funding technique is high quality first; from the pool of companies that meet its high quality requirements, it goes on the lookout for undervalued corporations with substantial dividends. GQG is extra sometimes a worth than a progress investor. We have now beforehand profiled GQG International High quality Dividend, now named High quality Dividend Earnings. The identical self-discipline applies throughout all GQG funds. For you, the important thing query is whether or not you need direct worldwide publicity in your portfolio at a time when tit-for-tat commerce wars are discouragingly doable (and disruptive).

-

GMO US High quality ETF. The GMO ETF emulates the technique within the five-star GMO High quality Fund. Two variations: the ETF focuses solely on the US slice of the universe, and it doesn’t require a $750 million minimal preliminary funding (as High quality IV does). High quality has constantly been a high 10% performer. The ETF expenses 50 foundation factors.

-

-

Think about a short-term excessive yield fund. These funds sometimes spend money on fixed-income securities whose returns are uncorrelated to the gyrations of the Fed. Brief-term high-yield bonds have offered comparable returns to the broader high-yield market however with considerably decrease volatility. That is partly because of the “pull-to-par” phenomenon, the place bond costs converge in direction of their par worth as they method maturity, decreasing sensitivity to financial situations.

Over the course of a full market cycle, such funds are inclined to return about 4% per 12 months. Over the cycle that adopted the dot-com crash, 4.1%. International monetary disaster: 4.6%. Covid period: 4.3%. The 2 most compelling choices, based mostly on each Morningstar’s metrics and ours, are:

-

RiverPark Brief Time period Excessive Yield. Brief-Time period Excessive Yield invests in, properly, short-term, high-yield debt securities. Its technique focuses on figuring out alternatives the place the credit score rankings might not absolutely replicate an organization’s means to satisfy its short-term obligations. The fund targets investments in corporations present process or anticipated to bear company occasions, akin to reorganizations or funding adjustments, which may improve their capability to repay debt. About to have a good time its 15th anniversary, the fund, the fund has the very best Sharpe ratio (over 5.0 since inception) in existence. That’s, it gives a greater risk-return tradeoff than any different fund or ETF. You would possibly anticipate returns of 3-5% with negligible draw back.

-

Intrepid Earnings. Intrepid Earnings Fund is a set revenue fund that primarily invests in U.S. company bonds, aiming to generate robust risk-adjusted returns and excessive present revenue whereas defending and rising capital. With a concentrate on draw back safety and danger management, the fund sometimes invests in smaller bond problems with lower than $500 million, focusing on companies with low leverage ratios and constant money flows1. The fund’s technique has demonstrated resilience whereas sustaining a comparatively concentrated portfolio of 15 to 70 high-yield securities. You would possibly anticipate returns of 4-5%.

-

-

Keep away from any investment that everybody is speaking about. They’re dumb in good instances and disastrous in fraught ones. There are three issues with such investments.

-

They’re overpriced. Everybody will get excited, then they get silly which ends up in a “purchase first, remorse later” impulse that pushes the value of magical investments skyward. That results in volatility and decrease returns. Morningstar’s Jeff Ptak, in reviewing the most recent “Thoughts the Hole” examine, warns:

Slim funds are often extra risky by their very nature, and our findings recommend a hyperlink between greater volatility and wider investor return gaps. However volatility apart, these methods are often greater upkeep, forcing buyers to make purchase or promote choices at what might be fraught instances.

-

The autos that convey them to you’re designed to switch wealth out of your account to the advisor’s account. To be clear: the individuals who supply these investments to you might have zero loyalty to the investments or to their buyers. Zero. MFO has chronicled an enormous variety of ETF conversions the place, after 9 months, the House Rock Exploitation ETF instantly turns into The AI Arbitrage Impact ETF.

-

Their finest returns are previous by the point you hear of them. The investing world is dominated by (a) obsessive individuals with vastly extra assets than you and (b) passionate hucksters on TikTok whose job it’s to generate a following for themselves, not safety for you. That’s captured in The Rekenthaler Rule: “If the bozos learn about it, it doesn’t work anymore.” (I believe we’re the “bozos” in query.)

Your funding objective is just not having one thing to brag about. Your objective is to supply safety and assist meet your life objectives. Sluggish and regular is nearly at all times a surer technique.

-

-

Curb your enthusiasm: Chaotic markets can set off worry and greed. Preserve emotional self-discipline, keep on with your funding plan, and keep away from impulsive choices based mostly on short-term market actions. The 2 best methods to execute this technique:

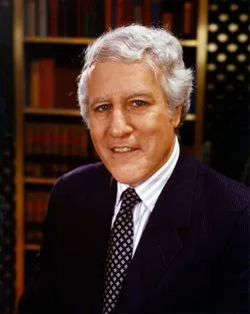

Deal with the instant, not the mediated. The worst day in market historical past was 19 October 1987 when the market fell 22.6% in at some point. Hysteria, suspicion, and fears of a continued unraveling adopted. Into the maelstrom stepped Louis Rukeyser, the person who perfected the artwork of monetary tv. Uncle Lou started his first present after the Nice Crash this manner:

Deal with the instant, not the mediated. The worst day in market historical past was 19 October 1987 when the market fell 22.6% in at some point. Hysteria, suspicion, and fears of a continued unraveling adopted. Into the maelstrom stepped Louis Rukeyser, the person who perfected the artwork of monetary tv. Uncle Lou started his first present after the Nice Crash this manner:Okay, let’s begin with what’s actually necessary tonight. It’s simply your cash, not your life. All people who actually beloved you per week in the past, nonetheless loves you tonight. And that’s a heck of much more necessary than the numbers on a brokerage assertion. The robins will sing. The crocuses will bloom. Infants will gurgle and puppies will curl up in your lap and drift off fortunately to sleep, even when the inventory market goes quickly insane.

And now that that’s all absolutely in perspective, let me say: ouch! And eek! And medic! Tonight, we’re going to attempt to make sense out of mass hysteria.

Put down your telephone. Kill the damned notifications. Steer clear of the clatter on social media. Kiss your partner. Hug your youngsters. Stroll your pup. Attempt a brand new recipe. Open the bottle of wine that you just’ve been saving – for the previous decade! – for a sufficiently big day. Day by day is particular (it’s, in spite of everything, the one one you’ll be gifted immediately), so that you’re proper to have a good time it.

Learn historical past. It’s simple to conclude “That is the worst factor ever!!” provided that … properly, you’re clueless about what else we’ve overcome. Which is to say, lots.

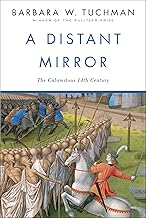

Get lost to your native used bookshop and discover a copy of Barbara Tuchman, A Distant Mirror: The Calamitous 14th Century (1978), a story woven across the household of a single French noble. William Manchester’s A World Lit Solely by Hearth (1992) examines the transition from medieval to Renaissance Europe. Whereas its scholarship has confronted some criticism, it compellingly reveals how humanity emerged from the “darkish ages” right into a interval of exceptional cultural and mental flourishing. For readers who object to the very time period “darkish ages” and assume that Manchester was too unfavorable on a half millennium of human historical past, web page by Michael Gabriele, The Vibrant Ages: A New Historical past of Medieval Europe (2021). The Heat of Different Suns (2010) by Isabel Wilkerson chronicles the Nice Migration by intimate private narratives. Like Tuchman, Wilkerson weaves particular person tales into broader historic actions, displaying how tens of millions of African People transcended systemic oppression to forge new lives.

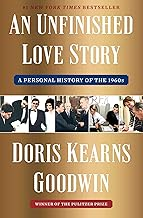

Get lost to your native used bookshop and discover a copy of Barbara Tuchman, A Distant Mirror: The Calamitous 14th Century (1978), a story woven across the household of a single French noble. William Manchester’s A World Lit Solely by Hearth (1992) examines the transition from medieval to Renaissance Europe. Whereas its scholarship has confronted some criticism, it compellingly reveals how humanity emerged from the “darkish ages” right into a interval of exceptional cultural and mental flourishing. For readers who object to the very time period “darkish ages” and assume that Manchester was too unfavorable on a half millennium of human historical past, web page by Michael Gabriele, The Vibrant Ages: A New Historical past of Medieval Europe (2021). The Heat of Different Suns (2010) by Isabel Wilkerson chronicles the Nice Migration by intimate private narratives. Like Tuchman, Wilkerson weaves particular person tales into broader historic actions, displaying how tens of millions of African People transcended systemic oppression to forge new lives. Invoice Gates, do you have to care, is presently recommending Doris Kearns Goodwin’s An Unfinished Love Story. DKG is a Pulitzer Prize-winning historian and biographer who was married to the late Dick Goodwin. Goodwin was an adviser to US presidents for many years, from shaping Johnson’s Nice Society agenda to drafting Al Gore’s 2000 concession speech. Of it, Gates writes, “It’s laborious to disclaim the similarities between the Nineteen Sixties and immediately—a time of political upheaval, generational battle, and protests on faculty campuses. Whether or not you already know lots in regards to the ’60s otherwise you’re simply dipping your toe into these waters, whether or not you need a deep dive into the artwork of political writing or a captivating story a few married couple who adored one another, you’ll get it from An Unfinished Love Story.” He describes “the teachings it gives about how leaders have tackled robust instances” as “each comforting and engaging.”

Invoice Gates, do you have to care, is presently recommending Doris Kearns Goodwin’s An Unfinished Love Story. DKG is a Pulitzer Prize-winning historian and biographer who was married to the late Dick Goodwin. Goodwin was an adviser to US presidents for many years, from shaping Johnson’s Nice Society agenda to drafting Al Gore’s 2000 concession speech. Of it, Gates writes, “It’s laborious to disclaim the similarities between the Nineteen Sixties and immediately—a time of political upheaval, generational battle, and protests on faculty campuses. Whether or not you already know lots in regards to the ’60s otherwise you’re simply dipping your toe into these waters, whether or not you need a deep dive into the artwork of political writing or a captivating story a few married couple who adored one another, you’ll get it from An Unfinished Love Story.” He describes “the teachings it gives about how leaders have tackled robust instances” as “each comforting and engaging.”I’m presently studying Kathryn Olmsted, The Newspaper Axis: Six Press Barons Who Enabled Hitler (2022). Immaculate historic scholarship and one sobering passage:

These trendy newspapers favored spectacle over substance, superstar over management, and polemics over sober debate. Essentially the most profitable publishers found they might entice readers by highlighting race, nation and empire – themes that their advertisers may additionally help. They may earn money and acquire political energy by promoting an exclusionary imaginative and prescient of their nations “us” versus “them” … [their] emphasis on people, character, energy and ethno-nationalism may assist promote authoritarian politics. (3)

Backside Line:

Neither chaos nor adversity are new. Neither is overcoming them. Overcoming them begins with a easy admission: we’re the co-authors of chaos. Systemic chaos produces nervousness. Our choices both worsen the scenario or meliorate it. Treating the short-term as if it had been the long-term. Overreacting to deliberately sensationalized tales. Specializing in the world we will’t management, and the individuals we’ll by no means meet, fairly than on what we will management and the great we do expertise.

A chaos-resistant portfolio stems from three choices on our half: (1) acknowledge the noise, (2) favor regular beneficial properties over the phantasm of spectacular ones, and (3) step away from the noisemakers. In funds, select indolent. In your actual life, select energetic. Make a distinction the place you possibly can. Converse up. Converse kindly. Suppose kindly. Pay attention to know. Volunteer. Donate. Smile on the little ones. Change into an agent of anti-chaos and prosper!