Since I started specializing in crypto in 2016, there have been a handful of shifts in overt U.S. digital asset coverage, and the importance of the latest shift can’t be overstated. The bipartisan passing of the GENIUS Act, signed into legislation on July 18, alerts a transparent 180-degree reversal. The overarching narrative has shifted. The place blockchain was as soon as seen as a instrument to assist digital currencies supplant the US greenback, it’s now being acknowledged as an inevitable know-how that may serve to solidify the greenback’s standing as the worldwide reserve foreign money.

There’s a important profit to the USA in controlling the worldwide reserve foreign money. When there’s a constant international bid for U.S. {dollars}, the price of capital is reasonable, and new debt can persistently be issued to assist fund home development and entitlements. No matter one’s political opinions on the position that the federal government ought to play, controlling the worldwide printing press with a comparatively low value of debt service is unequivocally a superb factor. Consequently, it’s not a shock that the U.S. has lengthy centered on defending this dynamic from exterior competitors, be it sovereign (Renminbi) or decentralized (Bitcoin).

Stablecoins: The Killer Crypto App

Whereas the approval of the Bitcoin ETF in January 2024 served because the catalyst to reverse the earlier crypto winter, and the favored institutional TradFi narratives have lengthy centered on tokenization, stablecoins are the true killer utility of crypto.

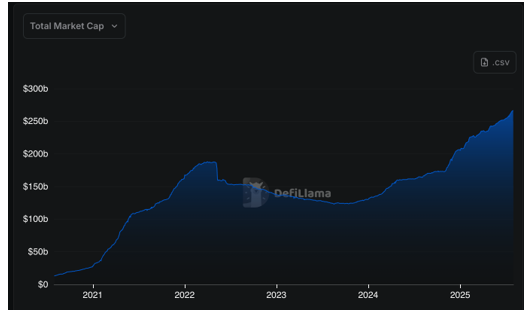

With an combination Stablecoin market cap of practically $267 billion, up from $13.4 billion lower than 5 years in the past, the proof is overwhelming.

As could be seen from the above chart, along with the staggering five-year development, the quantity of U.S. {dollars} settled on-chain has practically doubled year-over-year. Over 60% of the market is captured by Tether’s USDT, although this market share might proceed to compress over time on account of competitors from present gamers similar to Circle’s USDC, in addition to rising participation from conventional monetary heavyweights similar to Blackrock, PayPal and Franklin Templeton.

Stablecoins: What, How and Why?

Stablecoins have discovered product-market match, however it is likely to be useful to take a step again. What are Stablecoins, and the way do they work? Let’s begin with why they had been created within the first place.

Whereas blockchain as a settlement layer has a stronger probability than ever to offer the rails of our international monetary infrastructure, this was not all the time the case. Given the friction inherent within the interplay between crypto and our legacy monetary framework, stablecoins initially represented a manner for crypto market members to extra simply commerce, and to derisk with out having to exit the ecosystem. Contemplating every part from Bitcoin to PEPE is quoted in greenback phrases, it appears apparent to have a crypto native token that serves as a digital clone of a US greenback. Additional, the 24/7 and permissionless transaction dynamics make stablecoins merely a greater mousetrap as each a cross-border and a peer-to-peer funds choice.

Primarily based on that, one would possibly ask how the $1 per unit worth is maintained over time? In spite of everything, these will not be FDIC-insured financial institution deposits, nor are they Rule 2a-7-regulated cash market funds. It’s an excellent query, and admittedly there’s nothing that inherently forces a stablecoin to commerce at $1. Nevertheless, the mechanics of the create/redeem course of are not any completely different from a cash market fund or financial institution deposit. So whereas slight near-term dislocations can definitely occur, equilibrium at par will win out in the long term. For example, under is a one-year chart of Tether (USDT).

With a $164 billion market cap, and over $116 billion in 24-hour buying and selling quantity as of August 1, 2025, USDT is an extremely environment friendly and liquid instrument.

In an effort to simplify the use case and mechanics, right here’s how a sequence of transactions throughout the lifecycle of USDT could happen:

-

Entity A deposits $1 million with Tether and receives 1 million USDT tokens to their Ethereum pockets.

-

Tether makes use of the $1 million it obtained to buy $1 million value of short-duration U.S. Treasury payments. As USDT will not be interest-bearing, the yield of the treasury payments is Tether’s income. (This can be a net-interest margin enterprise that pays 0% and lends to essentially the most credit-worthy borrower on the planet).

-

Entity A is fascinated about buying ETH on an change (i.e. Coinbase). Proud of the ETH quoted worth (already in USD phrases), Entity A makes use of Coinbase to swap 1 million USDT tokens for $1 million value of ETH tokens (no matter any transaction charges).

-

Entity B is lengthy ETH however wants a further $1 million U.S. {dollars} in its checking account (i.e. JPM) to fulfill upcoming obligations. Entity B additionally makes use of Coinbase to swap $1 value of ETH tokens for 1 million USDT tokens.

-

Entity B works with Tether to redeem the 1 million USDT tokens for $1 million U.S. {dollars} into its JPM account. Tether meets these obligations by way of the common operations of its stability sheet administration.

Whereas the above instance centered on stablecoins as a way for buying and selling, the 24/7 permissionless nature of blockchain rails supply extra far-reaching international advantages. Now not should one be on the mercy of banking hours, wire transfers or SWIFT to ship {dollars}. Stablecoins enable for U.S. {dollars} to be shortly and inexpensively transferred to anybody on the planet, at any time and with out the intervention of a 3rd social gathering. That is an especially highly effective dynamic. One that’s very true in components of the world which have problem accessing the steadiness of U.S. {dollars}, whether or not on account of geopolitical instability or an absence of banking infrastructure.

Stablecoins: The Trojan Horse of World Greenback Dominance

Whereas this all sounds nice, and the use circumstances are definitely clear for the forms of folks used within the earlier examples, it could stay unclear why the U.S. Authorities is rapidly behind the expansion of stablecoins. One would possibly fairly assume {that a} digital greenback instantly issued by the Treasury can be extra advantageous. And whereas a real digital greenback could assist to unravel related issues, it fails compared to stablecoins in an space of most significance to the USA: funding our debt.

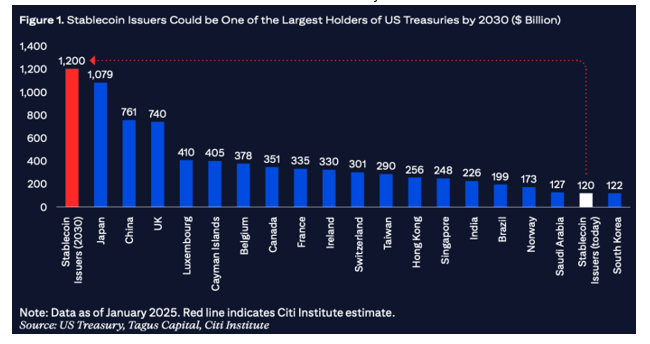

Look no additional than Tether’s independently audited reserve report as of June 30, 2025. Tether will not be the US Treasury. It may’t merely simply print extra USDT and preserve its $1/USDT worth. It must be backed by belongings, and people belongings must all the time be value a greenback. Consequently, Tether owns over $105 billion value of Treasury payments. This places Tether on par with the possession degree of countries similar to South Korea, Mexico and Germany, although nonetheless a methods off from our largest lender, Japan ($1.05 trillion of Treasury possession). That stated, primarily based on the projected development of stablecoins, a latest U.S. Treasury Advisory Council presentation projected that stablecoin points might maintain $1.2 trillion of Treasuries by 2030.

Take into consideration that. The appearance of stablecoins has already created incremental demand for U.S. Treasuries on par with main nations, and within the subsequent 5 years that incremental demand could possibly be the one largest purchaser of U.S. debt on the planet.

Value is positively correlated with demand. Bond math 101, worth goes up & yield comes down. Stablecoins enable the U.S. to not solely proceed funding its deficit, however to take action cheaper. That’s merely not one thing {that a} Treasury-issued digital greenback can supply, which is why stablecoins like USDT and Circle’s USDC are the dominant use-case propelling the way forward for crypto.