Singapore could be mentioned to be among the best locations on this planet to lift a household. Our nation is protected, the schooling system is world-class, and there are numerous advantages in place that encourage working girls like me to proceed constructing our profession whereas elevating our youngsters.

However let’s be actual – elevating youngsters in Singapore isn’t low-cost. Whereas some FIRE (Monetary Independence, Retire Early) advocates have mentioned that having youngsters will maintain you again from monetary independence, I urge to vary. As an alternative, I consider that with correct planning and sensible budgeting, we are able to nonetheless have one of the best of each worlds.

That’s additionally why yearly, I tune in to see what advantages households will get in our Authorities’s Funds Assertion. Extra importantly, I need to know the way these advantages may also help me and my family.

If you happen to’re feeling overwhelmed by the assorted advantages introduced in the course of the Funds, fret not as a result of on this article, I’ll be focusing primarily on the perks particular to households with kids.

BUDGET 2025 FOR FAMILIES

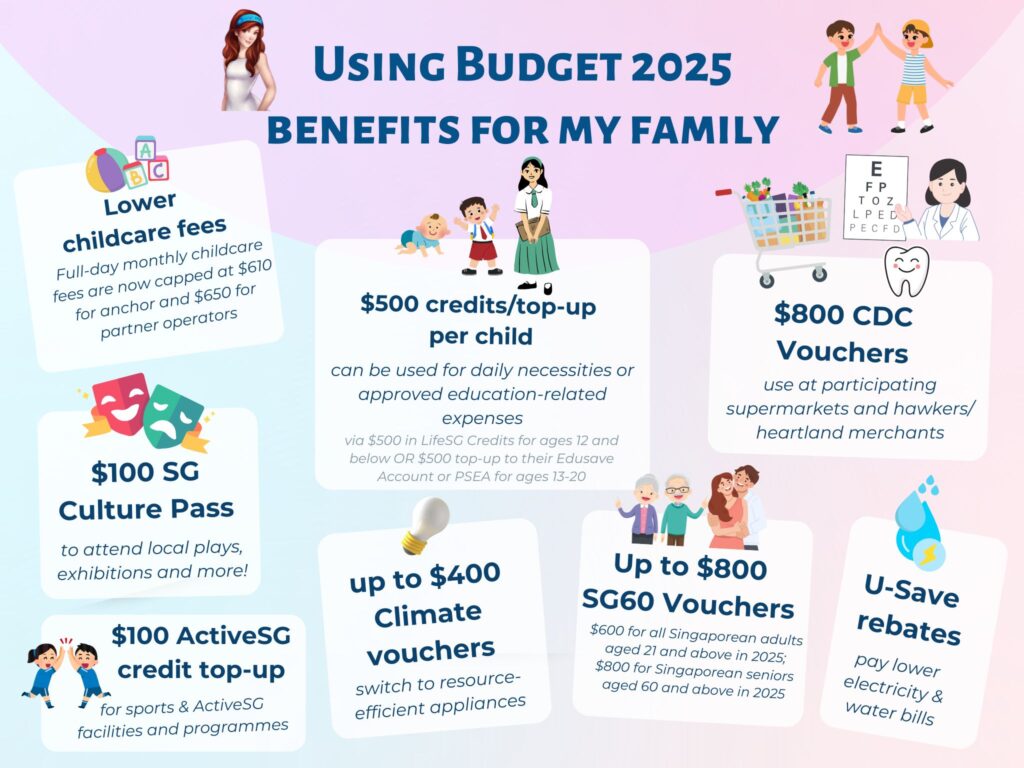

Decrease preschool charges

When you’ve got a toddler, right here’s an enormous win! The payment caps for childcare anchor operators will now be decreased to $610 per 30 days ($30 much less), and $650 per 30 days ($30 much less) for companion operators.

With this variation kicking in subsequent January, childcare will develop into extra reasonably priced, which is nice information for working mother and father like me. My youngest baby continues to be finding out at an anchor operator, so I’m trying ahead to paying much less for his childcare charges from subsequent yr onwards!

In case your baby is aged 5 or under, you too, will be capable of profit from decrease preschool charges that take impact from January 2026.

$500 LifeSG / Edusave / PSEA credit per baby

Every Singaporean baby will obtain $500 within the type of both LifeSG credit (for these aged 12 and under), or a top-up to their Edusave Account or Publish-Secondary Training Account (for these aged 13 to twenty).

Since now we have 2 youngsters under 12 years outdated, which means our family will probably be receiving a complete of $1,000 in Youngster LifeSG Credit. I intend to make use of these to pay for my youngsters’ pharmacy purchases every time they fall sick, particularly since they have an inclination to go to the physician a number of occasions a yr.

These credit could be accessed by way of the LifeSG app and can be utilized on-line or in-person at retailers that settle for PayNow UEN QR or NETS QR. Alternatively, you probably have a OCBC checking account, you can too convert them to money by utilizing the LifeSG app to switch to your PayNow-NRIC linked checking account, after which withdraw it as money from OCBC ATMs.

In case your youngsters are older, you should utilize the top-up to their Edusave / PSEA Accounts to pay for education-related bills like permitted college charges or enrichment programmes.

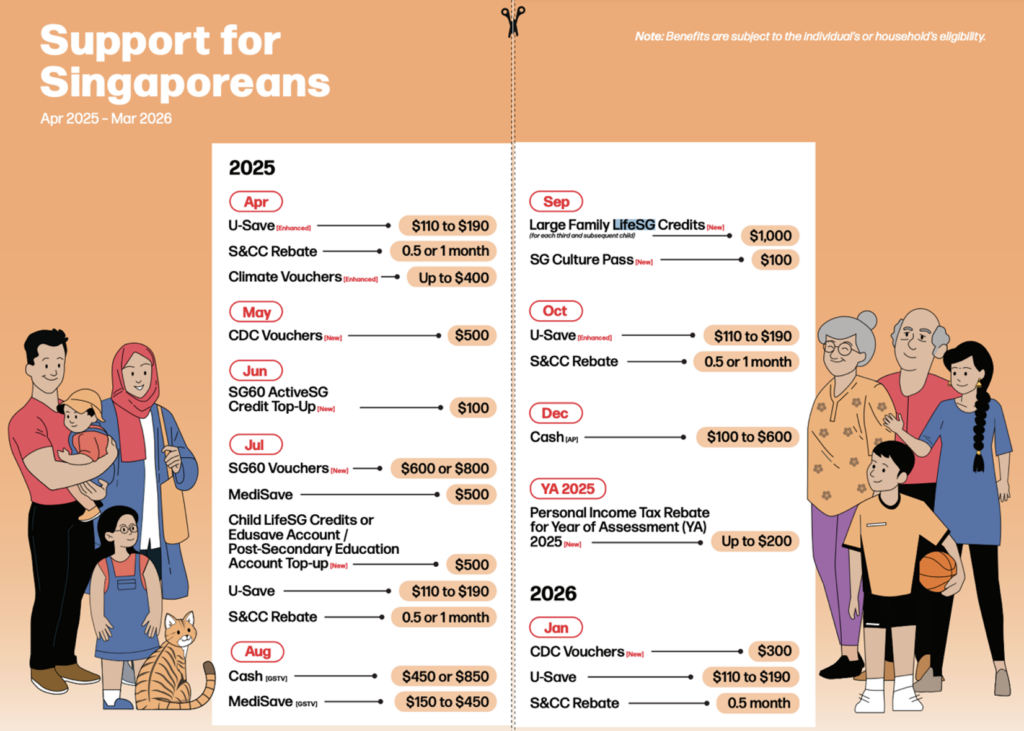

When: In July 2025

$800 CDC Vouchers

Singaporean households will obtain a complete of $800 in CDC Vouchers.

You should utilize these to your family grocery runs and create a enjoyable grocery listing along with your youngsters on what you need to get to feed the entire household! You can even pay for your loved ones’s meals at hawker centres, or alternatively, use them to pay for haircuts, eye check-ups and even dental remedies to your youngsters!

The best way to use: Log into RedeemSG by way of your Singpass and use them at collaborating supermarkets, hawker stalls, or heartland retailers that settle for CDC Vouchers.

When: $500 in Could 2025, remaining $300 in January 2026

$600 – $800 SG60 Vouchers

All Singaporean adults aged 21 and above this yr will get $600 in SG60 vouchers, whereas Singaporean seniors aged 60 and above this yr will get $800.

The SG60 Vouchers can be utilized in any respect collaborating companies underneath the CDC Voucher scheme, which implies half of the vouchers can be utilized at collaborating heartland retailers and hawkers, and the opposite half can be utilized at collaborating supermarkets.

The best way to use: Log into RedeemSG by way of your Singpass and use them at collaborating supermarkets, hawker stalls, or heartland retailers that settle for CDC Vouchers.

When: July 2025

$100 SG Tradition Go

I’ve been paying to deliver my youngsters to a number of performs and theatre experiences as I need to expose them to the humanities. Now, with the SG Tradition Go, you should utilize it to buy tickets for eligible native arts and heritage actions akin to exhibitions, experiences and performances to get pleasure from them collectively as a household!

The best way to use: Particulars to be introduced.

When: From September 2025, and legitimate to be used until 31 December 2028

$100 SG60 ActiveSG Credit score High-Up

If you’re an current ActiveSG member, you’ll obtain a $100 SG60 ActiveSG Credit score High-Up. If you happen to’re new to ActiveSG (like my youngest son, who hasn’t signed up but), you’ll get a complete of $200 in credit.

These ActiveSG credit will come in useful for bringing your youngsters to public sports activities services akin to gyms or swimming swimming pools.

$100 pays for as much as 40 ActiveSG gymnasium visits, or over 50 visits to varied swimming complexes positioned throughout Singapore!

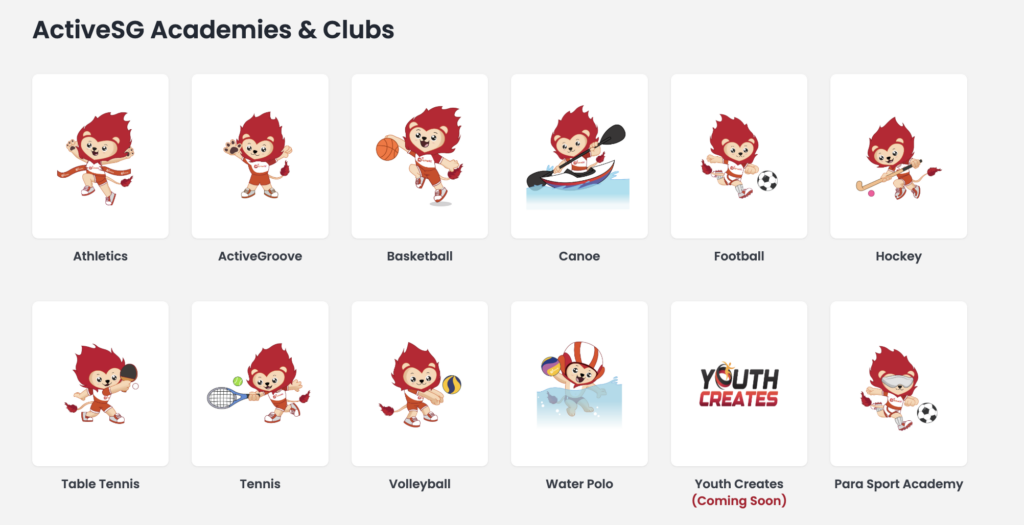

Alternatively, how about signing up for a ActiveSG academy or membership, which affords varied sports activities for kids?

When: June 2025

As much as $400 in Local weather Vouchers

Every eligible HDB family will obtain an extra $100 in Local weather Vouchers this yr, which provides on to final yr’s $300 of Local weather Vouchers. Every eligible family dwelling in a personal residential property may even be entitled to $400 in Local weather Vouchers this yr.

If you should change to extra energy- and water-efficient family home equipment or fixtures akin to fridges, LED lights or perhaps a washer – you should utilize your Local weather Vouchers to offset the price at collaborating retailers akin to Finest Denki, Courts, Achieve Metropolis, Harvey Norman and even FairPrice, Large and Chilly Storage.

Eligible households can declare their Local weather Vouchers on-line at RedeemSG by logging in with their Singpass accounts.

When: April 2025

U-Save and S&CC rebates

These are nothing new by now, however nonetheless value mentioning right here as eligible Singaporean HDB households will probably be receiving as much as $760 of U-Save to offset their utilities bills. They may even rise up to three.5 months of Service and Conservancy Prices (S&CC) rebates to defray their S&CC.

No motion is required because the U-Save rebates will probably be routinely mirrored in your utilities payments when the time comes. Your S&CC Rebate will probably be routinely credited to your family’s S&CC account managed by your respective City Council.

When: April, July, October 2025, and January 2026

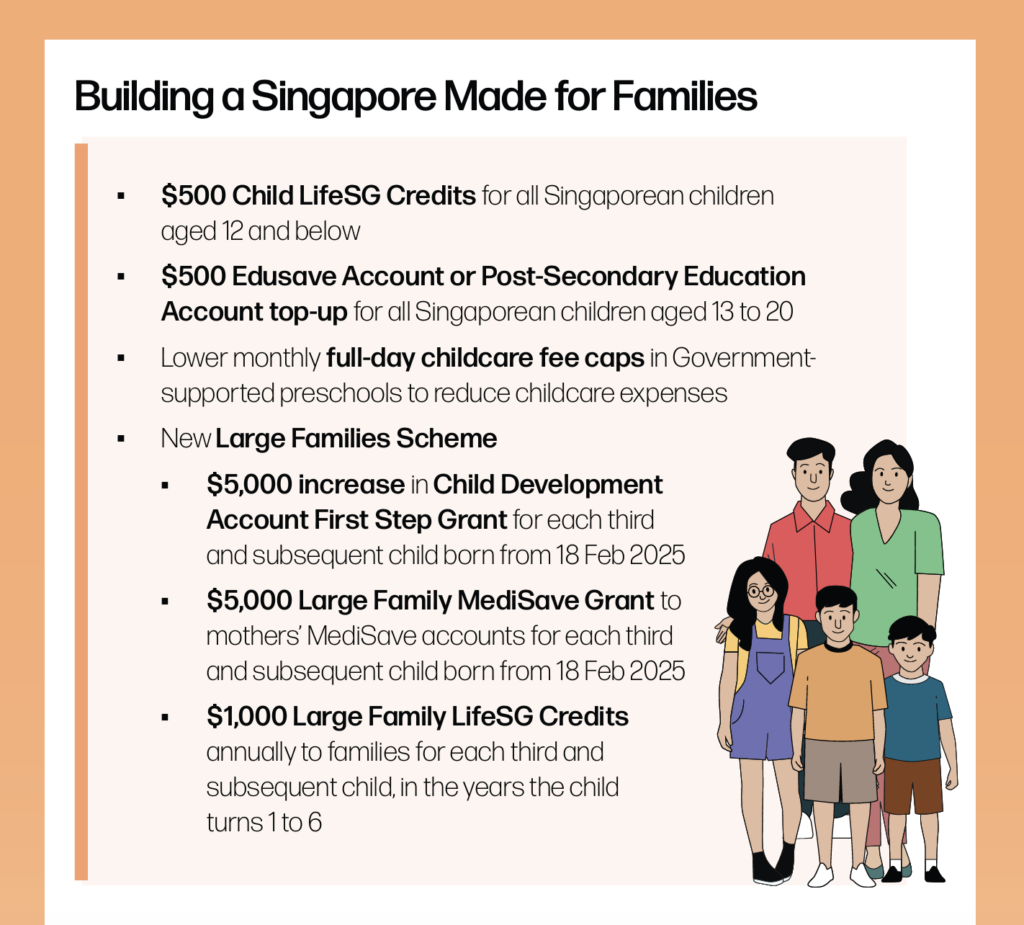

FOR LARGE FAMILIES

If you happen to intend to have (or have already got) 3 or extra kids, there are extra help measures for you in Funds 2025.

$1,000 Massive Household LifeSG Credit yearly

This profit is a game-changer. For the primary time ever, households with 3 youngsters or extra will probably be receiving $1,000 in LifeSG credit yearly from when the kid turns 1 to six to assist offset every day bills.

That’s an additional $6,000 value of credit from the third baby onwards that folks will probably be getting!

Increased CDA Grants for the third baby onwards

If the present advantages aren’t sufficient to persuade you to have extra youngsters, the Authorities additionally introduced that they’ll be growing the Youngster Improvement Account (CDA) First Step Grant by $5,000 for every 3rd and subsequent baby born from 18 Feb 2025.

CDA financial savings can be utilized to pay for childcare, medical bills and schooling, so this helps to additional offset prices.

$5,000 Massive Household MediSave Grant

What’s extra, moms will obtain an extra $5,000 of their MediSave for every third and subsequent baby.

Sure, you should utilize this to offset your supply charges when you resolve to have your third baby – and even use it to your medical check-ups or insurance coverage premium.

Funds 2025 positively brings excellent news for households, particularly you probably have a number of kids. Whereas elevating kids in Singapore isn’t low-cost, it’s good to know that the Authorities is stepping in to assist defray a few of our bills.

For me, the decrease childcare charges and annual LifeSG credit are the largest wins. What about you? Which a part of Funds 2025 helps your loved ones essentially the most? Let me know within the feedback! 😊

MY THOUGHTS

Decrease childcare charges was one thing that many mother and father have been trying ahead to, so it was nice to see additional discount in payment caps introduced on this yr’s Funds. Having paid near $1,500 per 30 days in childcare charges for my 2 kids (in an anchor operator) for the previous few years, I understand how important these charges could be for a lot of mother and father.

What’s extra, I may even be utilizing the $500 Youngster LifeSG Credit, $800 CDC Vouchers, $600 SG60 Vouchers, $100 SG60 ActiveSG Credit score High-Up and $100 SG Tradition Go credit to pay for our family requirements, entrance charges to public swimming swimming pools and catch extra native performs or exhibitions with my youngsters.

I’m heartened to see extra incentives introduced this yr to assist help households with kids of all ages and defray the prices of elevating youngsters in Singapore. As the advantages get disbursed over the following few months, I’m trying ahead to utilizing them in our every day lives.

Use the Help for You Calculator right here to estimate the quantity of advantages you’ll be getting from Funds 2025!

Disclosure: This text is dropped at you in collaboration with the Ministry of Finance. All opinions and concepts on utilization are mine.