Endurance Applied sciences Ltd – Increasing Horizons

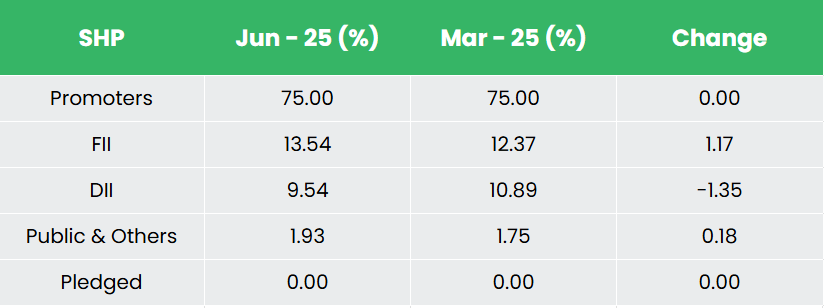

Integrated in 1985 and headquartered in Aurangabad, Endurance Applied sciences Ltd. is a number one automotive element provider, providing a various vary of technology-driven merchandise throughout its operations in India and Europe (Italy and Germany). The corporate serves key automotive verticals reminiscent of die-casting, suspension, braking, transmission, embedded electronics and aluminium forging, adopted by a big presence in aftermarket enterprise. The corporate has additionally expanded into the electrical mobility sector via its wholly owned subsidiary, Maxwell Power Programs Pvt. Ltd., specializing in superior Battery Administration Programs (BMS) for electrical autos and power storage purposes. The corporate’s clientele contains of main manufacturers reminiscent of Volkswagen, Stellantis, Bajaj Auto, HeroMotocorp, Ather, TVS, Valeo, Yazaki and so on. As of 31 March 2025, it has 19 manufacturing vegetation in India and 14 in Europe.

Merchandise and Companies

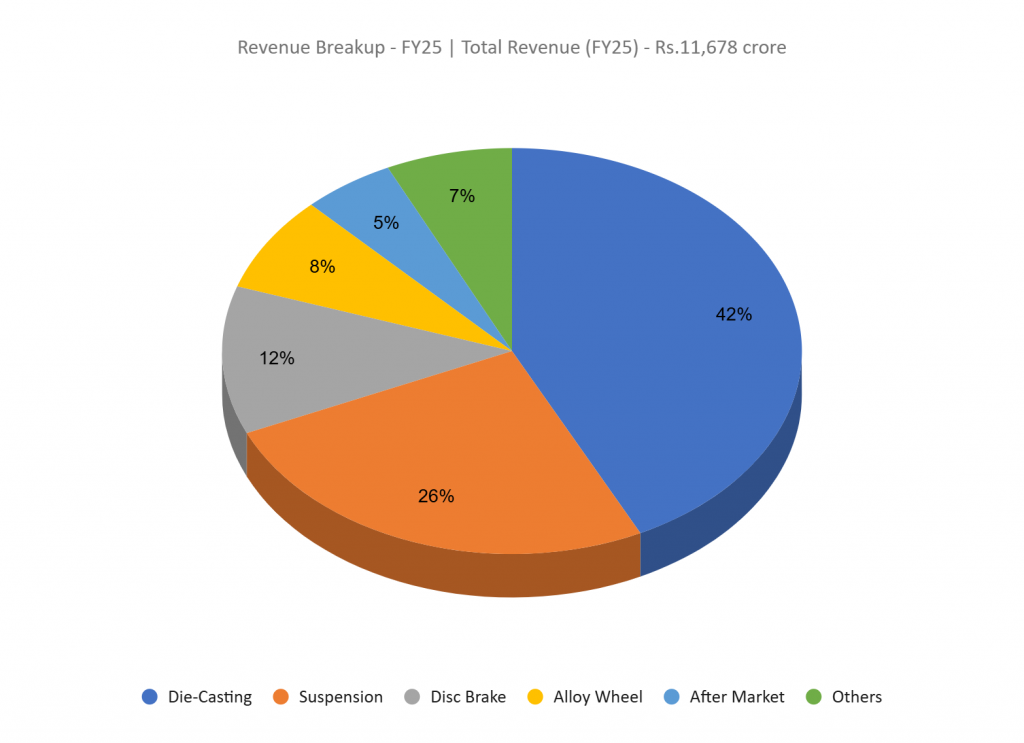

The corporate offers a variety of services as follows:

- Aluminium die casting – Built-in face cowl, swing arm, crank circumstances, alloy wheels, EV mission case and so on.

- Suspension system – Shock absorbers, entrance forks, and so on.

- Transmission – Clutch assemblies, driveshafts, and so on.

- Braking system – Disc and drum brake assemblies, ABS modulators, and so on.

- Aftermarkets – Alternative elements for suspension, transmission, braking methods.

Subsidiaries: As of FY25, the corporate has 10 subsidiaries and no different affiliate corporations/joint ventures.

Funding Rationale

- Capability enlargement and new enterprise initiatives – The corporate is making a strategic foray into the fast-growing power storage phase with the institution of a brand new lithium-ion battery pack manufacturing facility in Pune, with manufacturing anticipated to start by January 2026. This initiative is geared toward tapping into alternatives throughout the electrical mobility ecosystem – together with 2W, 3W, and 4W segments – in addition to non-automotive sectors reminiscent of telecom, inverters, and stationary power storage methods. It has already secured order value Rs.3 billion from a number one 2W OEM. The corporate is aiming to leverage its in-house battery expertise alongside the BMS experience of its subsidiary, Maxwell, to ship built-in, high-performance options. Moreover, it’s establishing a 4W casting plant at AURIC Shendra, with operations set to start in H2FY26. The plant has already constructed a sturdy order pipeline, with an annual order ebook of Rs.2.75 billion from main world OEMs. These merchandise are anticipated to yield excessive margins. A 2W alloy wheel manufacturing plant can be being developed at AURIC Bidkin with an annual capability of three.6 million wheels, and manufacturing is predicted to begin in H2FY26.

- Strategic acquisitions and partnerships – The corporate has strengthened its European footprint via the acquisition of a 60% stake in Germany-based Stöferle GmbH and Stöferle Automotive GmbH. These entities carry superior capabilities in automated machining of advanced aluminium die-cast elements and in-house CNC machine manufacturing, enabling sturdy vertical integration and operational effectivity. The acquisition is predicted to be earnings accretive, supported by the entities’ constant top-line and bottom-line progress. The corporate has additionally entered a strategic technical partnership with a number one Korean suspension producer, which has delivered over 10 crore shock absorbers globally. This collaboration marks the corporate’s entry into the underpenetrated four-wheeler suspension phase in India, an area with restricted competitors however rising OEM curiosity. To seize this chance, the corporate is establishing a devoted greenfield manufacturing facility, with three key packages underneath energetic growth and estimated timelines of 8–12 months. This initiative is additional supported by a brand new suspension R&D heart in Waluj, centered on 2W, 3W, 4W, and non-automotive purposes, positioning the corporate for long-term progress in a high-potential vertical.

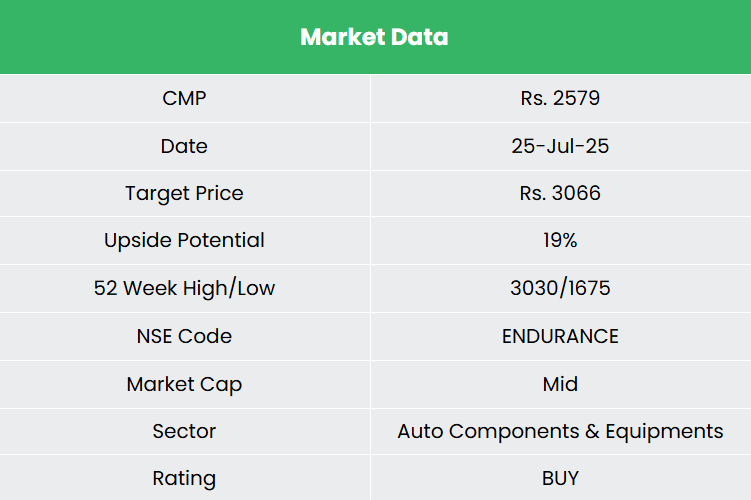

- Q4FY25 – Throughout the quarter, the corporate generated income of Rs.2,998 crore, a rise of 11% in comparison with the Rs.2,711 crore of Q4FY24. Working revenue elevated from Rs.416 crore of Q4FY24 to Rs.457 crore of Q4FY25, a progress of 10%. The corporate reported internet revenue of Rs.245 crore, a rise by 17% YoY in comparison with Rs.210 crore of the corresponding interval of the earlier 12 months.

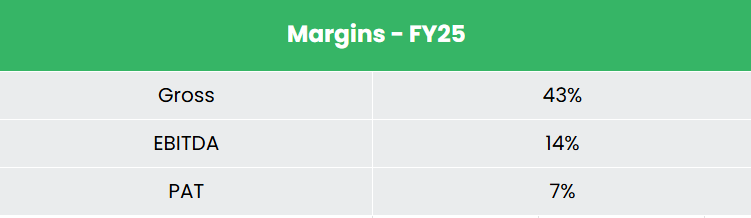

- FY25 – Throughout the FY, the corporate generated income of Rs.11,678 crore, a rise of 13% in comparison with the FY24 income. Working revenue is at Rs.1,668 crore, up by 18% YoY. The corporate reported internet revenue of Rs.836 crore, a rise of 23% YoY.

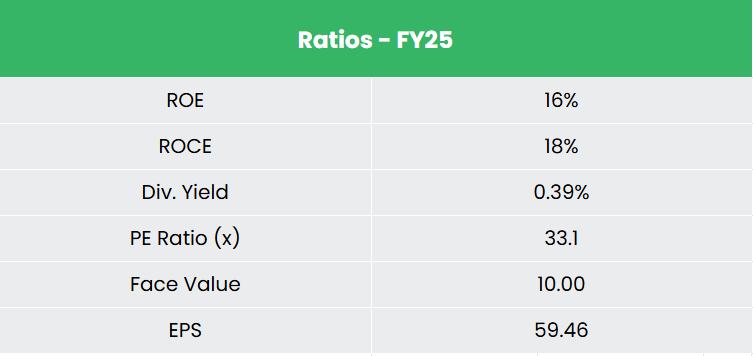

- Monetary Efficiency – The three-year income and internet revenue CAGR stands at 15% and 19% between FY23 – 25. Common 3-year ROE and ROCE is round 13% and 16% for FY23-25 interval. Debt to fairness ratio is at 0.17.

Trade

India’s auto element business is witnessing sturdy progress, pushed by a rising working inhabitants, increasing center class, and shifting world provide chains. With efforts to cut back import dependence and increase native manufacturing, home gamers are set to profit. India is turning into a world sourcing hub, aided by its proximity to key markets like ASEAN, Europe, Japan, and Korea. Rising incomes, infrastructure spending, and authorities incentives, together with help for EVs, are accelerating business enlargement. As the worldwide shift in the direction of electrical and hybrid autos good points momentum, new alternatives are rising for Indian element producers. India, the world’s third-largest automotive market, additionally leads in 3W manufacturing and ranks among the many prime two for 2W.

Progress Drivers

- 100% FDI is allowed underneath the automated route for auto elements sector.

- The discount within the tax burden within the 2025-26 Union Funds is predicted to spice up spending among the many increasing center class inhabitants.

- Allocation of ~Rs.7,400 crore (74% enhance YoY) for the EV sector within the Union Funds 2025-26.

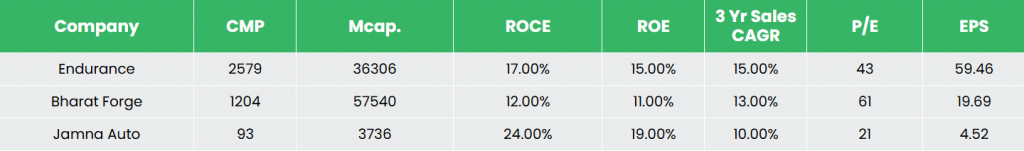

Peer Evaluation

Rivals: Bharat Forge Ltd, Jamna Auto Industries Ltd, and so on.

In comparison with its friends, Endurance Applied sciences demonstrates constant gross sales progress, reflecting stronger market penetration, whereas delivering steady returns on invested capital – highlighting its strong operational effectivity.

Outlook

The corporate witnessed sturdy order momentum in FY25, securing Rs.11.99 billion in orders for its India enterprise, with 37% linked to the EV phase and 34% to four-wheelers. Key clients embrace Honda, Royal Enfield, Hero MotoCorp, Ather Power, Tata Motors, Valeo, and Yazaki. It’s actively pursuing Request for Quotations (RFQ) value Rs.34 billion throughout varied product classes, together with from electrical 4W OEMs. The corporate is focusing on accelerated progress within the 4W phase via new product launches, portfolio diversification, and strategic partnerships. Within the non-automotive phase, a photo voltaic damper order from a significant Spanish agency marks a key win, with industrial manufacturing scheduled to start at considered one of its vegetation in Q2FY26.

Valuation

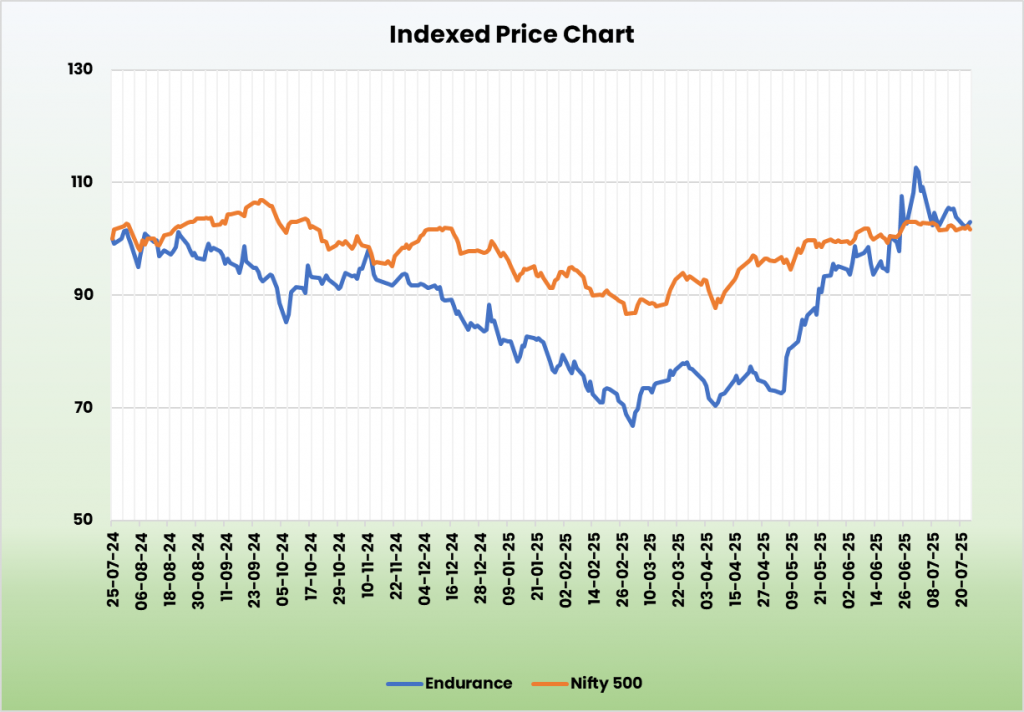

We imagine Endurance Applied sciences’ sturdy order ebook, diversified product portfolio, and strategic concentrate on EV elements place it effectively for sustainable long-term progress and worth creation. We suggest a BUY score within the inventory with the goal worth (TP) of Rs.3,066, 42x FY27E EPS.

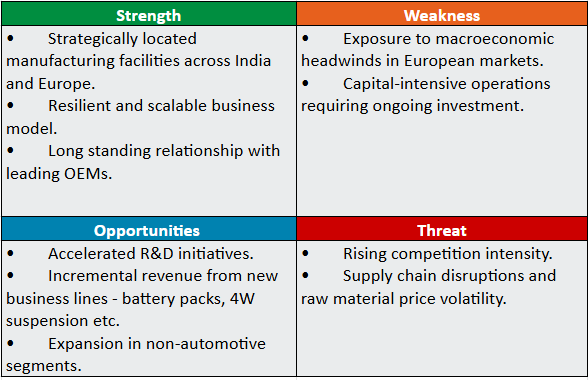

SWOT Evaluation

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM by no means assure the efficiency of the middleman or present any assurance of returns to buyers.

For extra particulars, please learn the disclaimer.

Different articles you might like

Publish Views:

511